Singapore Airlines launched KrisPay yesterday which allows you to burn your miles at 18 local merchants. “Burn” was never a more apt word given the low valuation of 0.66 cents per mile, but in any case I doubt KrisPay is targeting the hardcore miles chaser. KrisPay seems more suited for people with orphan miles balances to cash them out.

But does anyone remember Citibank’s Pay with Points program? I wrote about it back in August last year and wasn’t impressed at all, but it’s suddenly become relevant again in light of KrisPay’s launch.

Citibank’s Pay with Points program covers all their miles and points earning cards except the Citibank PremierMiles AMEX. It’s pretty simple- after making a payment with your Citibank card, you’ll get an SMS asking if you’d like to use your miles or points to offset your bill. Clicking on the SMS link sends you to a redemption page where you can choose how many of your points or miles you want to use.

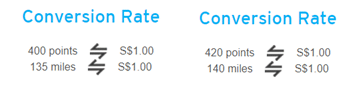

Citibank offers two different rates depending on your medium of payment. Citibank cardmembers who use Samsung Pay enjoy a special promotional rate of 400 points/135 miles to S$1, and regular card users enjoy a rate of 420 points/140 miles to S$1.

Two observations. First, given that 5 points= 2 miles, the Pay with Points program is more favorable to Citibank PremierMiles cardholders.

Second, look at those rates for Citi Miles: 135/140 miles = S$1. Remember that 1 Citi Mile can be converted into 1 mile with any of Citibank’s 12 airline partners, including Singapore Airlines.

You see where I’m going with this? Instead of trading 150 KrisFlyer miles for S$1 of value at selected merchants, I could instead trade 135/140 Citi Miles for S$1 of value at pretty much any merchant where I can pay with my Citibank credit card. Of course I’m not advocating that you should do this either, given it values 1 mile at a measly 0.74 cents. What I’m saying is that if a Citibank PremierMiles cardholder wanted to monetize his or her miles, it would make more sense to do so this way.

Sidetrack: It’s worth noting that DBS and UOB also allow you to redeem your bank points for statement rebates, but the value is really bad. 1,200 DBS points can yield 2,400 miles or a $10 statement rebate, and if you choose the latter you’re accepting a valuation of 0.42 cents per mile. Long story short- if you want to use your credit card points for cash rebates, you’d be much better off with a 1.5% unlimited cashback card like the AMEX True Cashback or Standard Chartered Unlimited Cashback.

Conclusion

Citibank’s Pay with Points program is by no means good value- but that’s the point. Even this sub-optimal way of spending miles would yield higher value than what KrisPay offers. If you transfer credit card points to KrisFlyer, I’m struggling to think of a situation where it would make sense to onwards channel them to KrisPay for everyday spend.

But like I said in the intro, I doubt that miles chasers are the real target audience for KrisPay. KrisPay seems much more suited to people who use cashback cards and end up with a small balance of KrisFlyer miles for whatever reason (eg earned from Scoot flights, now that Scoot flights earn KrisFlyer miles).

Delete repeat

UOB visa signature the exception to redeeming points for cash rebate 🙂

5% cash rebate on UOB vs quietly disappeared