[Edit: This sign up bonus has been extended until 31 March 2019]

Back in August, Citibank launched a new sign up offer for the PremierMiles Visa card which awarded customers 30,000 miles for signing up, paying the $192.60 annual fee and spending $7,500 within 3 months from approval.

The original sign up offer was supposed to expire on 31 October, but Citibank has extended it for another 3 months. You’ll be able to take advantage of this offer so long as you apply before 31 January 2019.

If you sign up through SingSaver before 30 November, you’ll get $200 of NTUC/Grab/Taka vouchers if you’re a new-to-bank customer (i.e. not held a Citibank card in the past 12 months) and $50 if you’re an existing customer. Remember to fill out this rewards form after applying so your gift can be credited to you. And yes, you’ll still be eligible for the same sign up miles bonus as someone who applies via the bank directly.

Two different sign up bonuses for new-to-bank/ existing customers

There are two different sign up offers out there. The 30,000 mile offer is available to those who have not held any Citibank card in the past 12 months.

Apply for the new-to-bank Citibank customer sign up bonus here

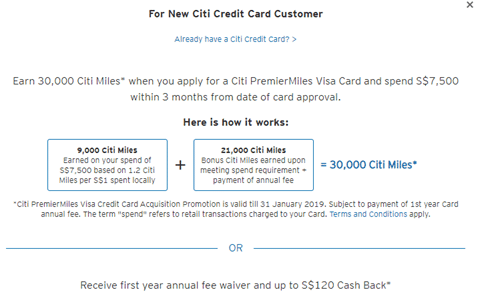

The total miles are broken down as follows:

- 9,000 base miles from spending $7,500 @ 1.2 mpd

- 10,000 miles for paying the $192.60 annual fee

- 11,000 bonus miles for meeting the spending conditions

In other words, the “real” bonus is 11,000 miles, as you could earn 19,000 miles anyway simply by making the spend and paying the annual fee.

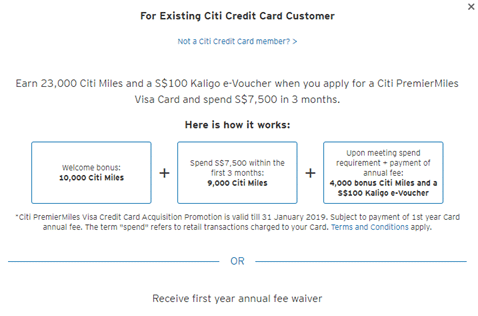

If you currently hold, or have held a Citibank card in the past 12 months, you qualify for a slightly lower offer: get 23,000 miles when you spend $7,500 within 3 months after approval. You’ll also get a $100 Kaligo e-voucher for meeting the spending requirement and paying the annual fee.

Apply for the existing Citibank customer sign up bonus here

The true bonus here is really only 4,000 miles, because you’d have been entitled to 19,000 miles under normal conditions anyway (10,000 for the annual fee, 9,000 miles for spending $7,500).

The terms and conditions of the sign up bonus for existing and new customers can be found in the links.

Why earn points with Citibank?

The Citibank PremierMiles card earns 1.2 mpd on local spend and 2.4 mpd on overseas spending. The 2.4 mpd rate is for spending done until 31 December 2018, after which the regular 2.0 mpd rate resumes. You also enjoy 3, 7 and 10 mpd on bookings made with Expedia, Agoda and Kaligo respectively.

Citibank points do not pool, which is to say that if you’ve accumulated a large chunk of points from the just concluded Citibank-Apple Pay 20X promotion on your Citi Prestige or Citi Rewards card, those points won’t be pooled with your PremierMiles.

However, Citibank has the widest selection of partner airlines available to any bank in Singapore, which includes some pretty useful FFPs like Etihad Guest, as well as British Airways Avios. Citi Miles do not expire.

How does this compare to other ongoing sign up bonuses?

You can refer to this page to see a summary of all the ongoing sign up bonuses in the market. As of today, the following cards are running a sign up bonus:

- AMEX KrisFlyer Blue: Spend $3,000, Get 15,800 miles (no annual fee)

- AMEX KrisFlyer Ascend: Spend $10,000, Get 43,000 miles (first year fee must be paid)

- DBS Altitude AMEX: Spend $6,000, Get 17,200 miles (no annual fee)

- AMEX Rewards Card: Spend $1,500, Get 13,333 miles (first year fee must be paid)

Which offer you ultimately pick depends on how you feel about paying an annual fee and how much you see yourself spending over the next 3 months.

Conclusion

If you’re a new-to-bank customer and don’t mind paying the first year’s fee (which, in a way, you’ll make back from the $200 of Grab/Taka/NTUC vouchers you get from applying via SingSaver), then this could be a good offer for you.

30,000 miles would be enough for two people to fly round-trip Economy to Bali, and although that shouldn’t be the height of your ambition in the miles and points game, it’s a decent start.

Aaron,

I tried to apply as an existing Cit customer via your link. The link didn’t direct me to anywhere. When I right clicked on the link, it shows a citibank URL, instead of Singsaver.

new customer link is to Singsaver.

Is there a problem with existing customer link please ?

thank you

Will look into that. In the meantime you can find the links here: https://www.singsaver.com.sg/credit-card/milelion-exclusives

I’ve checked both links and they both appear to be working. in the meantime you can use this link to apply if there are any issues: https://www.singsaver.com.sg/credit-card/milelion-exclusives

If you only hold a Citibank Supplementary card, does that make you an existing card holder?