When future anthropologists study our society, they’ll forever be befuddled by three things:

- Did video ever definitively kill the radio star?

- What exactly was a hollaback girl, and why were bananas in our era associated with fecal material?

- How is it that no one ever stood before The Hague for thinking up Dynamic Currency Conversion?

I’ve said it once, I’ll say it a million times: DCC is a scam, thrust upon unwitting consumers by unscrupulous merchants looking to squeeze some extra revenue out of a transaction. It’s happening right now to thousands of customers around the globe, and you should be very, very mad about it.

But what happens when you try and fight a DCC charge?

Fight the power

Back in January I wrote an article about my efforts to fight a transaction that was DCC-ed without my consent. You can read the full story in the link, but to summarize:

- I paid for a visa-on-arrival at the Amman airport. The entire process is done at the immigration counter- you tell the official your purpose of visit, scan your fingerprints and give your credit card to pay the visa fee

- I used my UOB PRVI Miles Mastercard to pay the JD40 fee. The official swiped my card, issued the visa and passed me the charge slip

- After I passed through immigration, I saw my JD40 transaction was DCC-ed without my consent to the tune of S$79.82 (or S$80.62 after UOB’s DCC fees are included). The charge slip rather laughably said that “I’ve been given a choice to pay in currency different from my local currency, I accept this choice, I’ve chosen not to use the Mastercard currency conversion process and I’ll have no recourse against Mastercard concerning the currency conversion or its disclosure”

The DCC charges were more than 6% of the total transaction amount, way above the 3.25% I’d have paid had I used the bank’s rate. To add insult to injury, the DCC “choice” meant I’d earn 1.4 mpd on the transaction instead of the 2.4 mpd awarded on FCY transactions.

Disputing the transaction

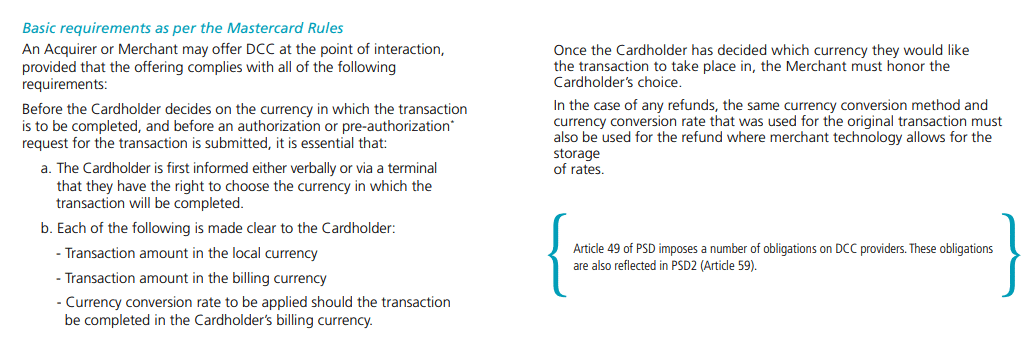

This was clearly a breach of Mastercard’s DCC compliance guide, which states that consumers must be clearly and unambiguously informed about a DCC transaction. When I contacted UOB about a chargeback, however, the customer service officer:

- Asked me to contact the merchant and get them to amend the transaction

- Asked me for a written document to prove that the transaction was supposed to be charged in Jordanian currency but ended up being charged in SGD

- Asked me if I had a voice or video recording to prove that I asked for the transaction to be done in Jordanian currency

You can see why this is so frustrating:

(1) clearly wouldn’t work. I imagine it would be some sort of nightmare to find the department within the Jordanian government who handles payments and ask them to look into my case.

(2) is just plain silly- pause for a second and think of any consumer transaction you’ve done. Do you sign a pre-agreement stating the terms of transaction?

(3) is asking the customer to put him or herself in harm’s way- especially given the context. I don’t think pulling out a camera and filming the immigration officer will end very well for you.

What annoyed me the most about the whole thing was that instead of trying to help their customer, the bank was looking for every possible way to throw the ball back to me. I know we don’t have the strongest of consumer protections in Singapore, but you’d think they could do better than repeating the line “without documentary proof we cannot open a dispute” ad infinitum.

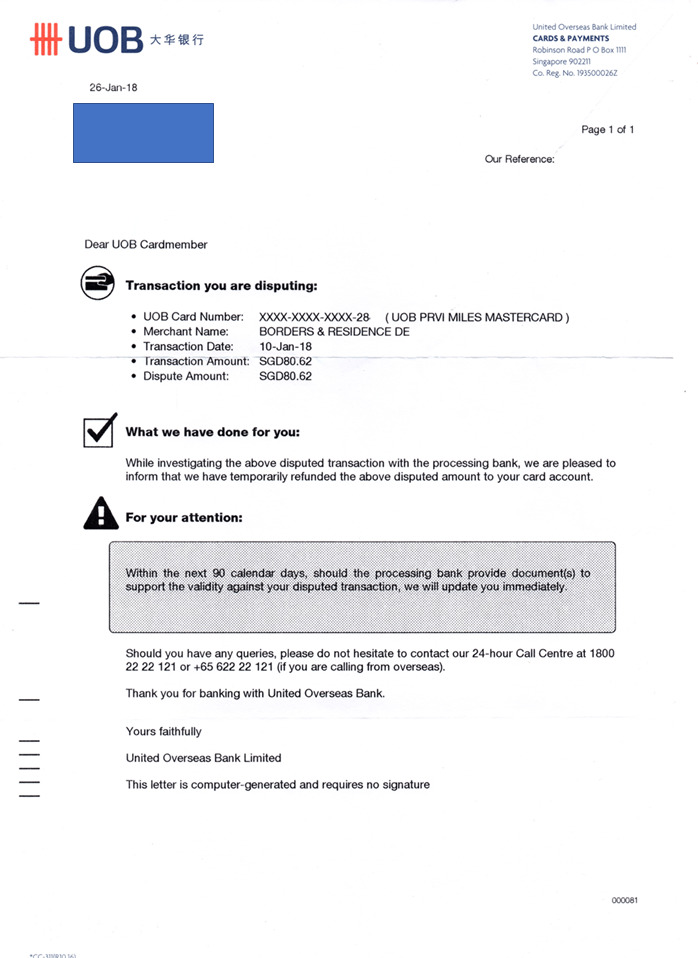

I stood my ground and refused to accept that, and a manager called me a few days later. Fortunately, he was much more reasonable and agreed to open a case after I explained the situation to him. I subsequently got this letter in the mail:

A temporary credit of S$80.62 was issued to my account, and I was told the timeline for resolving the dispute was 90 days. At least I wasn’t on the hook to pay the amount in the meantime.

So I waited, and waited, and waited. 90 days came and went. Then 180 days, then 270 days. No one ever got in touch with me, and I eventually forgot about the whole thing.

Last week, when clearing my desk, I stumbled upon the dispute letter once more. I didn’t see the transaction pop back up on any of my subsequent statements, but never actually heard back from UOB on the resolution either. So I gave the bank a call and was told that the matter had been resolved in my favor. In other words, I wouldn’t pay anything- not even the JD 40 base charge.

All’s well that ends well, but I deeply suspect what happened here was that (A) the bank had no idea who to get in touch with from the Jordanian Borders and Residence Department, or (B) they got in touch with the Department, but the Department simply didn’t bother to reply. Even if they did, I don’t really know what sort of documentary evidence they could produce to back up their claim that I’d agreed to DCC. There’s no signature on the charge slip, and it really becomes a he-said she-said situation.

Learning points

Hopefully you’ll never have to deal with a situation like this (although given how some companies like Avis opt customers in for DCC by default, it’s quite likely you one day will), but if you do, here are a few things you can do.

Be on your guard

Every time you use a Visa or Mastercard outside of Singapore, you’re always at risk of DCC. Don’t assume you’ll be asked for your choice of currency- some cashiers will autopilot through the currency choice because they don’t know what DCC is. Others will make the choice for you because they’ve been instructed by management to do so. Vigilance is your best protection. Inspect every charge slip and every terminal screen to make sure you’re not being opted in for DCC “for your convenience.”

Or maybe just use an American Express card.

Be assertive, where possible

If you’ve been hit with DCC, the first thing you’re going to want to do is ask the merchant to reverse the transaction. Sometimes it’s really an innocent mistake- the merchant will void the transaction, re-do it in local currency and you’ll be fine. Other times, it gets nasty. Some cashiers will insist that it’s “impossible” to charge you in the local currency, others will tell you “it’s the law” or make up some cock and bull story to cow you in submission.

This is why it’s so important that you do not sign the charge slip when you’ve been DCC-ed against your will. Write on the charge slip clearly “DCC refused and merchant did not offer choice“. That way, when the bank requests for copies, it’ll be hard for the merchant to claim you were a willing party. Stand up for your rights, don’t let yourself be conned and be assertive.

Note that I say “where possible”. There will obviously be some situations where your personal safety may be in danger if you try and complain. If you were in a situation like me where the merchant also happens to be some authority figure, that’s all the more so.

Should you film or record the transaction to better support your dispute? I’d like to say yes, but I know that’s not always a good idea. Nothing escalates a dispute like pointing a camera in someone’s face. If you’re sure of your surroundings and have strength in numbers, then perhaps, but otherwise I’d tend to err on the side of caution when overseas.

Be persistent

If the worst happens and you still get DCC-ed, don’t take it lying down. Call your bank as soon as you can and open a dispute. They will most likely ask you to try and sort it out with the merchant first, so you need to make it clear you already tried and they refused to cooperate.

The CSO should open a dispute for you, although they may still ask you for annoying things you can’t produce like a “document to show what currency the transaction should have been in”. Be persistent and insist on your rights- you can cite them chapter and verse from the chargeback manual if they refuse:

- Visa- Reason Code 76: Incorrect Currency or Transaction Code. Reason Code 76 is used when the transaction was processed with an incorrect transaction code, or an incorrect currency code, or one of the following:

- Cardholder was not advised that Dynamic Currency Conversion (DCC) would occur

- Cardholder was refused the choice of paying in the merchant’s local currency

- Mastercard- Reason Code 4846:

- The cardholder states that he or she was not given the opportunity to choose the desired currency in which the transactions was completed or did not agree to the currency of the transaction

Conclusion: the principle of the matter

Was filing a dispute worth all that effort and aggravation? Truth be told, the most difficult part was getting UOB to open a dispute. Once that was done I didn’t actually have to do anything but wait.

DCC is a menace, but it’s not unbeatable. Sadly, unless you’re making a big ticket purchase, most disputes are small enough that few people have the energy or inclination to fight them. But that, to me, is what is so insidious about DCC. It’s like salami slicing, with the merchants and payment processing companies lining their wallets at the expense of customers.

No one likes being cheated. And that’s what no-choice DCC does. Just to get your blood boiling once more, let me end with an excerpt from First Data’s (a payment processing company that enables DCC) marketing materials:

Detractors who are indignant (and often misinformed) about the exchange rate margin associated with each DCC transaction overlook the charges consumers pay if they had chosen another payment method…Millions of satisfied cardholders have made educated, informed decisions to use DCC because they desire the convenience of dealing in a familiar currency, plus the transparency of knowing the exact billing amount at the time of purchase. The continuing increase in consumer adoption of DCC illustrates the popularity of this service among foreign travelers, in spite of naysayers.

Very useful. Tks u

Hi

Had a similar case using my VISA in China. Stayed in Conrad, we surprise at Chekout there was no Option to be billed in CNY. The front desk was of no help said the option to pay in CNY was not available because mine was a SGD card.

Anyway was in a hurry and had no choice. I did sign on the slip but stated that I was not given a choice to pad in CNY on the slip, Front desk has no idea because they probably cant read English…

Got back and got the statement – called the bank. Explained the situation CIMB, was rather helpful and well I was not as lucky as you.. they refunded me like 5% of the txn value.

Works out to be a few dollars.. anyway like you said its the Principle …

And now I only use CUP or AMEX so no more DCC

I got a free visa out of it, yes 😉 but 5% probably covered your spread?

Any similar risks if paying by Alipay/Apple/Samsung Pay?

Alipay – No

Apple/Samsung Pay – Yes, same as credit card

Thanks for fighting and updating us. Unfortunately I’m not sure anyone is a winner, except the milelion (I recognize that’s what the title does state correctly). The problem may not even have been resolved for future generations of milecubs. UOB might have just written it off just to fob you off? They couldn’t have armtwisted this ‘merchant’ as well.

You won’t know until you try and fight it!

so how was the FCY eventually charged?

It wasn’t. I got a full refund of the entire trxn

woah! very nice. hehe

I’m going Amman soon. Whats the recommendation in payment method for getting the visa?

Can I just say something about DCC?

My understanding is that FX transactions posted by your cards are really at the whim and fancy of the exchange rate of the bank – eg you may have a transaction on 1st Jan but the bank only actually “convert” the funds for you on say 10th Jan because that’s the day they’ve pooled enough to make sense to change the money.

This is also why the SGD amount you see in your pending transactions are indicative only and may change when you see your actual statement.

Given that some currencies may be volatile, say a Turk who is shopping in Spain when TRY was crazy, it actually does make sense for him/her to use DCC and lock in the rate rather than wait a few days for the bank to lock in the rate and realize his Lira is now 10% weaker compared to b4. Of course this is not everyday occurrences but when it happens it happens in spades.

However, it is almost always in Singaporean favor since usually the local FX weakens against USD, and SGD is quite stable so most ccy in the world weakens against us hence its pretty hard to find a use case for DCC at least where Singaporeans are concerned. Even when SGD weakens we’re talking about 1% a week.

However for people coming from unstable countries? I reckon DCC is actually a life saver for them especially business owners who uses cards for large purchases. Rather lock in extra fees but have surety.

I wouldn’t say DCC is a scam and the marketing material that says there are millions of people who benefited may not be too far off the mark. We must also remember that bank fees in many less developed countries are much higher and I’ve seen it go beyond 5% myself.

Source: working in payments industry specializing in emerging markets

thanks powell! those are some very helpful insights. i think what i’m trying to get across is that dcc is a scam when it is forced upon customers without consent, which sadly happens far too often. if people make informed choices to use dcc, that’s fine. what isn’t ok is when it’s used as a cynical tactic by merchants to profit at the expense of customers.

I agree with you fully. Having the option to choose is always a good thing. More choices better than less choices.

But I’ll use the principle that you and other wisemen have espoused before, don’t attribute to malice what can be attributed to incompetence.

I’ll be willing to bet my money that most merchants don’t even know what’s happening with DCC themselves, just that it’s a “convenience” for clients and then they just roll with it. Then you just need some stupid middle manager or small business owner that insist they need to roll out to ALL THE CLIENTS because they want convenience for all clients.

Then you have businesses that think customers don’t know what’s best for them so they make the choice for them.

To be honest, I’m not sure that the merchant earns that much especially when they need to now jaga all the funny currencies which they might not even have the bank account for. Say for example, your Jordanian visa, I’m not sure if the Jordan government even have a working SGD account considering that not many Singaporeans go to Jordan and not many international banks may want to offer a nostro SGD account to such a sensitive area. MAS may even frown upon having overseas banks offering the Jordanian government SGD vostro/nostro. If it’s a problem for government, i cannot imagine smaller merchants having it easier to manage these whole myriad of FX coming in. For some other ccy like THB or MYR, the respective government don’t allow foreign accounts unlike SGD so the situation is even worst. It is physically impossible for a merchant in say Spain hold a MYR account in Spain. They can hold cash, but I doubt VISA/Mastercard will pay these merchants in cash, definitely via bank transfers.

I would imagine that Mastercard/Visa will need to then do yet another round of conversion for these merchants to their local ccy at Mastercard/Visa FX rates. So end up these merchants probably won’t get much upside.

Which leads me to the conclusion that the real assholes are Mastercard/Visa lol, and likely not merchants.

But I could be way wrong because I’ve not really read through how DCC works on the merchant end, so it could just be all hot air.

Mastercard and visa only facilitate dcc, but dcc is done by payment processors like first data, worldpay etc. Mastercard and visa seem to go through pains to emphasize that- think they must have caught heat from disgruntled consumers

Ah Worldpay…. one of my biggest nemesis.

Yeah assholes alright.

Here’s my DCC story.

Context:

Bought some stuff a couple of months back India for SGD 8000. I specifically asked to be charged in INR and not SGD. Due to inadequate training on the retailer’s part, the sales clerk quickly cycled through the multiple POS steps with the green button on the terminal and ended up charging me in SGD. Now this worked out to $400 in additional DCC charges. And to top it off, Citi charged me an additional $80 for processing the DCC. Thankfully, the CC charge slip had two additional checkboxes for SGD and INR. I checked the INR box, signed the slip and took a picture of it. Retailer reconfirmed that the charge slip was enough for the bank to process the transaction accurately. Long story short, after 2 days the transaction appeared in my online banking with DCC. $8480, 1.2 miles per dollar.

Raising the dispute – Step 1

Citi asked me to follow up with the retailer for a resolution. Given that I was still in the city, I visited the retailer and tried talking them into cancelling the previous CC transaction and charging me a new one in SGD. Given that it had already been 2 days and the transaction is already posted in their books, there was little they could do in terms of “cancelling a previous credit card transaction”. They requested for a formal letter to allow them to follow up with their bank and for 1 week time to revert with an update. 20 days in, there wasn’t any progress. I gave up on them and move to step 2.

Raising the dispute – Step 2

Reached out to Citi and raised a formal complaint. They noted my request and said Dispute Dept would reach out in 3-5 working days. They reached out after ~12 days and asked for any documentation wrt the transaction. Shared the CC slip, my formal letter to the retailer and the bill/receipt from the transaction. While they said they would revert in 10 days, it took me 8 follow up calls and them 3 more weeks to inform me that a temporary credit had been issued and that I didn’t have to pay the Charge + Citi DCC fee. And that it would take upto 90 more days for them to investigate, follow up with the retailer and close the dispute.

It’s been 2 months since, haven’t heard back. Would be surprised if the charge was taken on by Citi and waived off for me 😀

Thanks for this, you motivated me to start the same dispute, and guess what… also from Jordan…

Go for it man. Fight the power!

[…] How I fought (and won) a DCC dispute […]

Hi Aaron, i recently encountered the same in Dubai where the waiter charged me in SGD even when i requested to be charged in AED. When i saw the machine processing SGD, i confronted him but he told me that the SGD rate is only for reference. however, the charge slip showed SGD selected. All my transactions were done in AED except for this one. As i am a foreigner i did not want to argue further. Have contacted my Bank regarding this for a chargeback. May i check what exactly a charge back is? will they void the payment and charge it in AED instead?

p.s. this transaction will determine if i can get 10% cashback for foreign currency spend, that’s why i was pissed.

I had something very similar happen to me in Abu Dhabi! Man, dcc is rampant in the uae. A chargeback means they reverse the charge pending resolution of the matter. There are several possible outcomes- one of which you mentioned. The most important thing to communicate to your bank is that you were not given a choice of currencies.

i am waiting for the bank to come back to me. was told that they will get someone to call me within 3 working days. the thing is, i made 2 transactions there, the first one was done by another waiter and was done in AED. that is my argument with the bank, why would i want to pay in SGD (knowing that DCC will kick in) for my 2nd transaction (and also while all my other transactions are in AED). Hopefully they can help me resolve this.

I honestly dont mind paying this few dollars more (about SGD10) but am just very unhappy about how they do business and also dont want to lose my 10% cashback. hahaha.

Regarding Avis. I have two rentals coming in South Africa with them.

Any advices how to deal with them except taking photos of the receipt and clearly asking them to charge in ZAR?

Reading this I am really sad I had just been billed in SGD instead of CNY on my UOB Visa Signature card at a Shanghai hotel. On hind sight I really should have used my Lady’s card with travel category which will not care if it’s DCC-ed or not and will even count for ONE account.

It is impossible to go back to the hotel to reverse the transaction and I did [X] rmb on the merchant slip, also took a photo of that. if I dispute it with UOB, what are the chances that I will be billed in local currency instead?

To update the dcc story here

I actually took the risk to go back to the q hotel, the hotel said their POS terminals are programmed to charge in my home currency only! *shameless*; it was about 3 weeks from payment so the transaction already appeared in their books, I told them I will make the same payment with AMEX and they shld refund to my UOB VS card, they obliged. What I did not know is that DCC-ed transactions are refunded totally, with the additional bank processing fee refunded as well. I guess that’s the only good thing? In events of refund you don’t lose out on FX….

You may have just gotten lucky with fx movements. Most of the time you get refunded a smaller amount than what you spn

I don’t know but I am refunded the exact same amount down to the last cent. I was expecting to be refunded more because RMB actually appreciated against SGD. Anyway, next time I should try use amex/cup cards to avoid DCC

Thanks for the write up. We should not give out free money like this. It’s kinda scam.

Hi, I have a worse experience. I live in Switzerland and my bank gave me 2 cards, one in CHF and another one in EUR. Although EUR is not official currency here, they are quite common.

Now, when I travel, specially to Spain, I face frequently the DCC fraud with the Euro card. Although is a Euro card, somehow the system detects that it’s from Switzerland and freely assume that the card is in CHF, so it it offers the

DCC. And of course, because some merchants don’t know what it is (or pretend they don’t know) more than once I had to face a double conversion: DCC converts to CHF, then my bank converts back to EUR.

This is really annoying, I have to check all the time I pay, that the payment was done correctly. Recently I paid a hotel by phone and later found out the double conversion. This time I complained, lost a whole morning, talking to the manager explaining what DCC is, and the nonsense of the situation. Today I received the reimbursement of the amount, but since the reimbursed in CHF, the bank conversion back to euro still makes a difference of almost 2 euros, not compensated.

This is driving my crazy and ruining my holidays. Any advice? Maybe I should just burn the EUR cards and accept I will always lose money converting from EUR.

I maybe able to tell what actually happened once you raised that dispute. Your issuing bank would have opened a chargeback, which will go to the acquirer bank. They’ll investigate this with the merchant and if merchant could prove that the choice was given at the time of transaction and you accepted to do the DCC, then they’ll contest that chargeback. In your case, either the merchant didn’t fight the charge and effectively forfieted or the acquiring bank absorbed the charge without ever passing it to the merchant. In either case, you got your money back and truth prevailed. 🙂