Here’s your guide to all the different banks’ Spend and Redeem promotions this Christmas! Do bookmark this page as it’ll be continuously updated if/when more banks add their deals.

DBS

Period: 1 October- 31 Dec 2018

Type of spending: Online and in-app only

Qualifying spending amount: $100- $1,500, depending on customer

Combine spending across cards: Yes

Check out DBS’s Christmas Promotion here

Summary: DBS’s promotion is a bit different from the rest because it’s only based on online and in-app spending. To take part, you need to download the DBS Lifestyle app and register. Registration is limited to the first 10,000 cardmembers. Upon registration, you’ll receive a personalized spend goal.

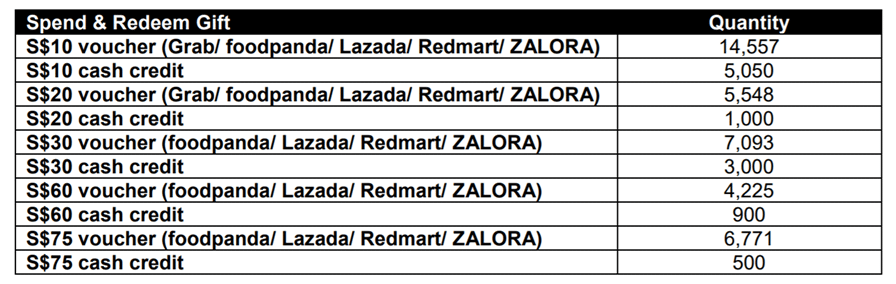

Available gifts and quantity: Gifts range from $10-75 in value, including cash credit, Grab, foodpanda, Lazada, Redmart and ZALORA vouchers.

Here’s the total number of gifts available:

The top 20 spenders in a month will receive 500,000 Air Asia BIG points each.

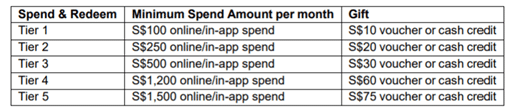

Other info: Here are the different spending tiers you might be asked to hit, based on your average monthly online spend between 1 April and 30 June 2018:

Read the full FAQ here, and the full T&C here.

UOB

Period: 19 November- 31 Dec 2018

Type of spending: Local, overseas and online transactions

Qualifying spending amount: $4,800

Combine spending across cards: Yes

Check out UOB’s Christmas Promotion here

Summary: Say what you will about UOB card promotions, but they have pretty gorgeous Christmas gifts. This year, UOB has partnered up with designer Andy Yang to create a special limited-edition band for the Fitbit Charge 3. Cardholders need to hit $4,800 of spending to qualify, be it local, overseas or online. This spending can be spread across different cards.

Available gifts and quantity : 2,500 Fitbits

Other info: Normally, supplementary cardholder spend is taken to be the spend of the principal cardholder. For the purposes of this UOB promotion, however, pooling of spend across supplementary and principal cards is not allowed.

Supplementary cardholders can participate in the promotion in their own right (i.e spending $4,800 on their own card)

Read the full FAQ here, and the full T&C here.

HSBC

Period: 1 November- 31 Dec 2018

Type of spending: Local, overseas and online transactions

Qualifying spending amount: $1,000-9,000

Combine spending across cards: No

Check out HSBC’s Christmas Promotion here

Summary: HSBC is, very confusingly, running two different, mutually exclusive Christmas promotions.

Christmas Spend & Get: Spend $6K or $9K on local/foreign/online

Christmas Travel Spend & Get: Spend $1K in foreign currency

Guys, if you want to run two different promotions, at least give them distinctly different names!

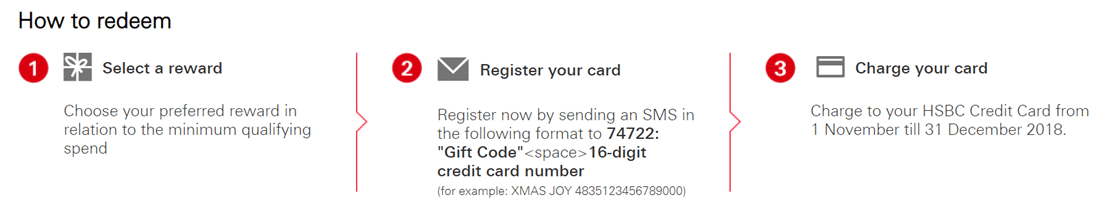

You need to pre-select an award category (i.e .$1K, 6K or 9K) and register your card. One card can only be registered for one award category, and you can’t pool spending across cards.

Available gifts and quantity:

Christmas Spend & Get:

- 800 redemptions of a staycation at the Swissotel or dining package at SKAI

- 2,000 redemptions of Aramsa package, Jaybird X4 Wireless Sport Headphones, or Regent Singapore dining package

Christmas Travel Spend & Get:

- 3,500 redemptions of $50 CapitaVouchers

Other info: Read the full FAQ and T&C here.

Standard Chartered

Period: 1 November- 31 Dec 2018

Type of spending: Local, overseas and online transactions

Qualifying spending amount: $150-15,000

Combine spending across cards: Yes

Check out SCB’s Christmas Promotion here

Summary: SCB is running two different Christmas promotions, one with a very high spending threshold, the other with a much lower one.

Spend & Be Rewarded: Spend a minimum of $15,000 on local, overseas or online retail transactions to get a sure-win gift

Snowball Challenge: Spend a minimum of $150 in a single transaction and win up to $100 cashback

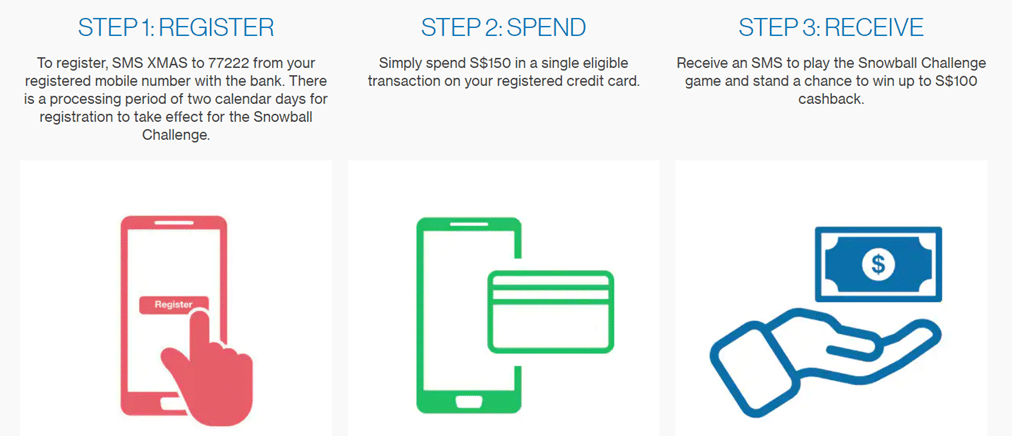

Registration is required both these promotions:

Available gifts and quantity:

Spend & Be Rewarded: Up to $20,000 cashback (10 winners), $1,000 cashback (100 winners), 1 night staycation at Marriott Tang Plaza Hotel (890 winners)

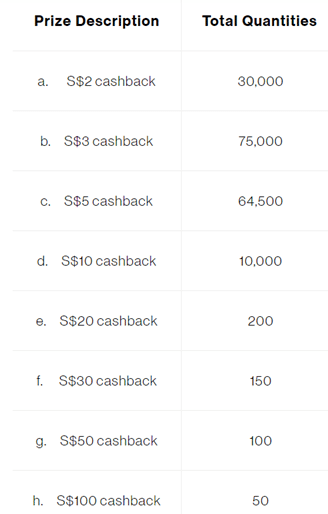

Snowball Challenge: 180,000 prizes ranging from $2 to $100 cashback.

Other info: Read the full FAQ and T&C here.

American Express

Period: 1-24 December 2018

Type of spending: ION Orchard

Qualifying spending amount: $100-5,0000

Combine spending across cards: No

Check out AMEX’s Christmas Promotion here

Summary: AMEX’s Christmas promotions are limited to Platinum Charge and Centurion cardholders who spend at ION Orchard. There is a pop up booth on the 3rd floor of ION that’s a fun visit if you’re eligible.

AMEX has three different gift periods (1-9, 10-16, 17-24 Dec) with different cumulative spending requirements. No registration is required for any of these gifts.

Available gifts and quantity: Mont Blanc Rollerball Pen (70), Chateau Peyrabon 2015 (100), French Earl Grey Tea from TWG Tea (300)

Other info: Read the full FAQ and T&C here.

Maybank

Maybank’s Christmas promotions are fully redeemed, so I’ll skip this.

OCBC

I didn’t find any spend and redeem promotions for OCBC. You can look at their Christmas deals here.

Citibank

I didn’t find any spend and redeem promotions for Citibank. Perhaps the 8 mpd Apple Pay promotion took all the Christmas joy out of them early! You can find a list of non-Christmas specific promos here.

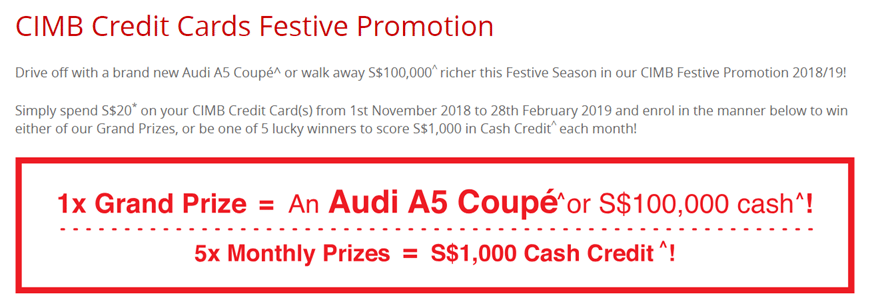

CIMB

CIMB is running more of a Christmas lucky draw than a true spend and redeem. You can win an Audi A5 or win five monthly prizes of $1,000 cash credit.

Conclusion

It’s a bit disappointing that neither Citibank nor OCBC has done anything substantive this Christmas, but hopefully you’ll be able to grab some of the other offers while they last.

If you’re thinking of applying for any cards, be sure to check out the December SingSaver gifts which offer up to $200 of vouchers/cash per successful application.

Does anyone know if downpayment for car via any of the above credit card qualifies as retail spend?

You’ll have to check with the individual card/bank… they all hVe different Ts & Cs..