As far as miles cards come, the OCBC VOYAGE is a rather unique product in Singapore. The regular VOYAGE earns 1.2 mpd on local spending, 1.6 mpd on local dining and 2.3 mpd overseas. What’s unique about that? The VOYAGE Miles you earn can be converted to KrisFlyer at a 1:1 ratio, but can also be used to offset the cost of revenue flights at a pre-determined rate.

If you’re holding an OCBC VOYAGE card, you might want to check if you’re eligible for their Christmas spending promotion which just got announced a few days ago.

Earn 25% more miles on local spending until 31 December

From now till 31 December, regular VOYAGE cardholders will earn 1.5 mpd on local retail spending, capped at a maximum of $10,000 for the promotion period. This represents a 25% bonus from the regular 1.2 mpd. The promotion is only for holders of the regular VOYAGE card, presumably because the premier and private banking customers already earn 1.6 mpd on local spend.

There’s the usual list of exclusion categories:

- All Card fees and charges

- Card annual fees, membership fees, renewal fees

- Balance Transfer

- Charges incurred for any Balance Transfer facility

- Cash-on-Instalment facility

- Charges incurred for any Cash-on-Instalment facility

- Instalment Payment Plan

- Extended payment plan

- Income tax payment

- Interest

- Late payment charges

- Goods and services taxes

- Cash Advances

- Recurring payments for utilities and telecommunication services

- Cleaning, Maintenance and Janitorial Services

- Real Estate Agents and Managers – Rental

- Financial transactions that includes financial services such as money transfer, money order, traveller cheques and securities brokerage payments

- Charges, fees and other costs payable to any non-profit organisations which includes charitable, religious and political organisations.

- Charges, fees and other costs payable to any Government Institutions and services which includes Educational Institutions, courts including without limitation court fees and costs, fines, bail and bond payments, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here

- Any payments to Great Eastern General Insurance and NTUC Income in relation to any insurance policies

- Payment of funds to prepaid accounts and merchants who are categorised as “payment service providers” which includes and not limited to EZ-Link, NETS FlashPay, eNETS, SAM, Transit Link and AXS. OCBC Bank has the absolute discretion to determine which provider is considered a “payment service provider”.

No registration is required- if you received the SMS, you’re already included in the promotion. The bonus 0.3 mpd will post by 20 Feb 2019.

Best uses of VOYAGE Miles

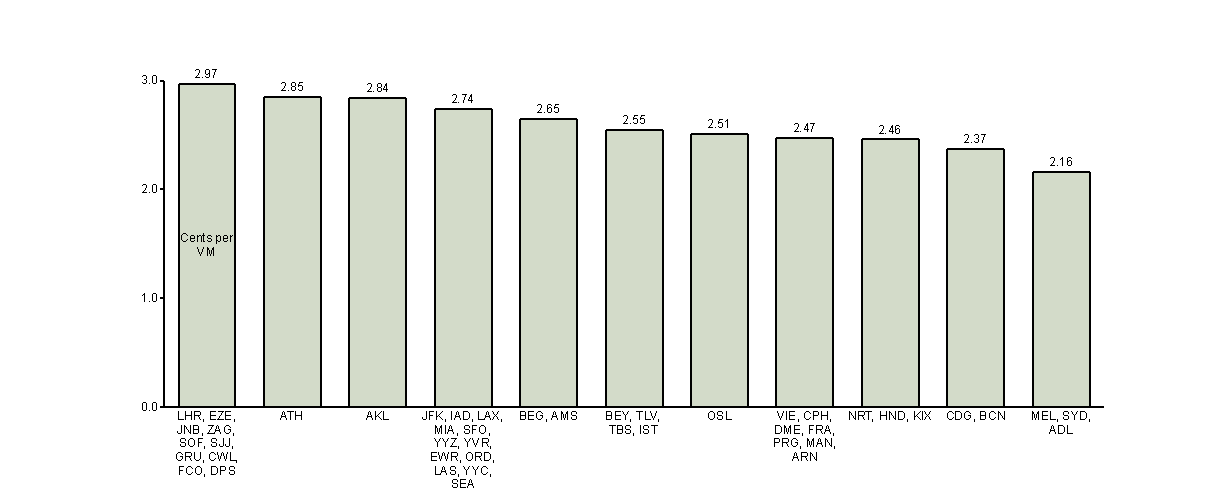

I did an extensive piece on the best use cases for VOYAGE Miles a few months ago, and what struck me as the most interesting is that the value of your VOYAGE miles depends on what destination you redeem them for. VOYAGE has its own internal “award chart” that assigns maximum value to places like selected destinations in Europe and South America, and lower value to Australia.

The chart above is not comprehensive, but it does suggest that you should play around with different airports to see if you can get more bang for your buck by flying to one airport over another.

You could convert your VOYAGE Miles into KrisFlyer miles at a 1:1 ratio, but to me that’s wasting their true potential. If your goal were out and out KrisFlyer miles earning potential, there are other cards like the BOC Elite Miles World Mastercard that would get you there faster (the card application process, unfortunately, is anything but fast).

Conclusion

1.5 mpd won’t tip the scales for most people, but it’s a nice additional bonus given how useful VOYAGE Miles can be. If you haven’t already signed up for a VOYAGE card, you can apply for one through this link to get a callback.

Be sure to check out all the various banks’ Christmas promotions in our Christmas Credit Card guide.

Thanks to Dennis for this story tip.