Miles and cashback are kind of like the Capulets and Montagues of the rewards world in that you tend to find yourself on one side or the other. That said, they’re not always mutually incompatible. DBS Live Fresh, for a while, allowed you to earn both points and cashback. FavePay allows you to stack a 4 mpd card like the DBS WWMC with whatever cashback the merchant offers.

ShopBack GO represents the latest effort to bring these two worlds together, and officially launched today after two months of closed testing. ShopBack GO’s hook is the opportunity to stack cashback with whatever rewards you normally earn on your credit card, at no additional cost to you.

Register for ShopBack GO and get a $5 bonus here

What is ShopBack GO and how does it work?

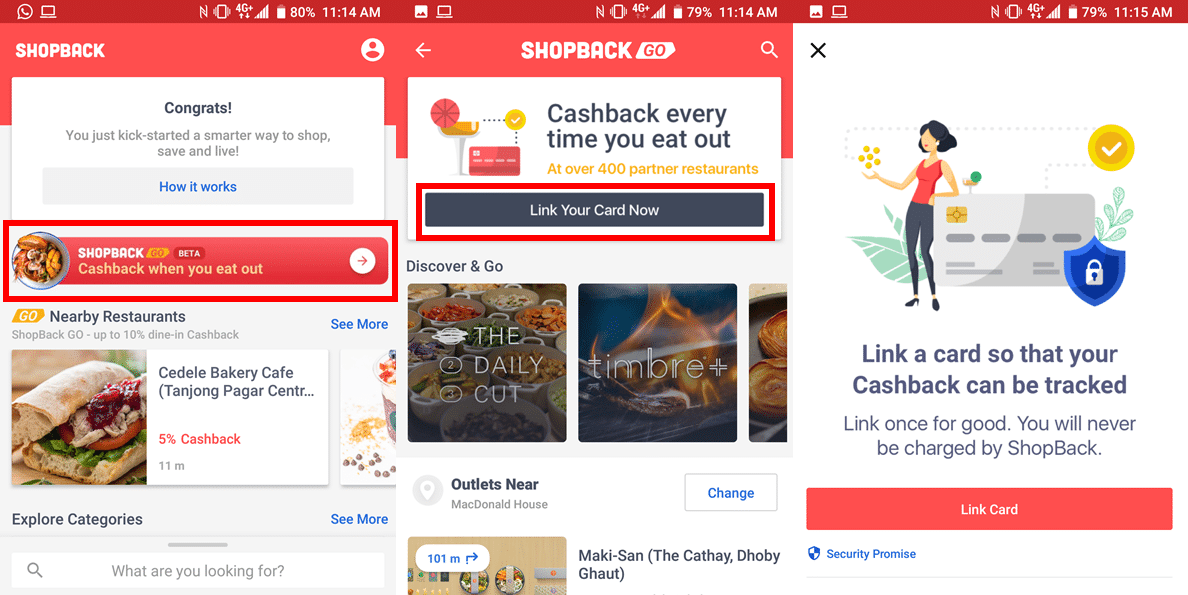

Setting up ShopBack GO is pretty straightforward. There’s no separate app to download- just open the existing ShopBack app, tap on the GO icon and link your card. ShopBack GO only supports Visa and Mastercard at the moment.

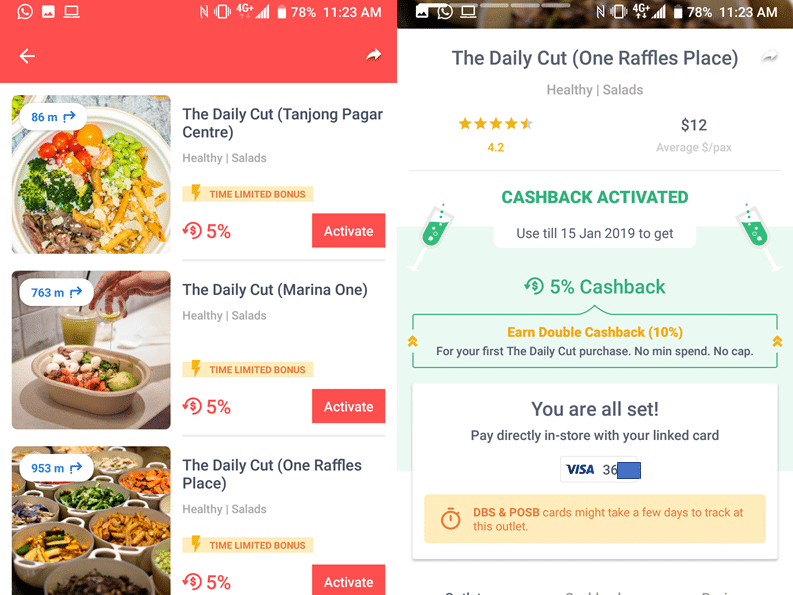

After that, you’ll be able to activate cashback at any of the ~400 offline dining merchants. Do note that you must tap the activate button at the selected merchant before you pay in order to enjoy cashback.

There’s no limit on the number of merchants you can activate cashback for, so it doesn’t hurt to just pre-emptively activate all those you think you might use. ShopBack says each activation lasts for 14 days, although the merchants I activated today (17 Dec 2018) were all valid till 15 January 2019.

Simply pay at the merchant with your registered card and you’ll see cashback appear in your account (ShopBack says they’ve partnered with Visa and Mastercard to retrieve transaction details securely).

Using ShopBack GO earns you whatever rewards you normally get on your card, including bank discounts. So if, say, UOB offers 10% off at a particular restaurant and you pay with ShopBack GO, you’ll enjoy the 10% off, plus points on your UOB card, plus ShopBack GO cashback.

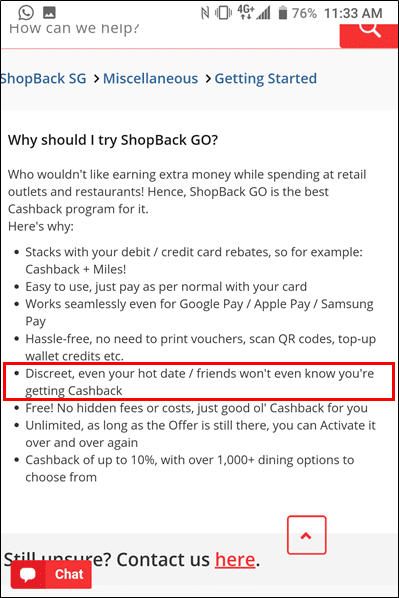

ShopBack has provided a list of other reasons to use ShopBack GO…

…and they’re spot on. If I were on a hot date I’d be disgraced to let her know I was earning cashback. Everyone knows that miles collectors are way more virile.

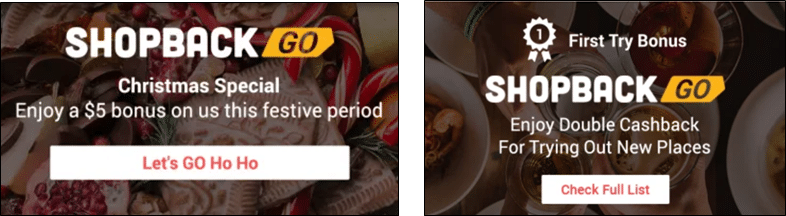

What launch offers are available?

ShopBack GO is currently offering two different launch promotions:

- Get $5 bonus cashback when you make your first ShopBack GO transaction before 31 December 2018

- Get double the cashback (i.e. 10%) with your first purchase at 14 participating brands (Cedele, Common Man Stan, Saladstop!, The Daily Cut, Sarnies, Souperstar, Teppei Syokudo, Koji Sushi Bar, Maki-san, One Man Coffee, Rookery, Texas Chicken, The Coffee Academics, Tiong Bahur Bakery)

Do note that the restriction for (2) is on brand, not outlet. That’s to say, I’ll earn 10% cashback with my first transaction at The Daily Cut (Raffles Place) but subsequently get 5% with my first transaction at The Daily Cut (Tanjong Pagar).

What’s the best card to use with ShopBack GO?

To answer this question, it’s important to understand conceptually how ShopBack GO works.

ShopBack GO doesn’t have a “special MCC” because it’s not the one processing your transaction. The merchant swipes your card as per normal, you see the merchant’s MCC on your bill and ShopBack monitors and pays out cashback accordingly. Therefore the best card to use is still whatever the best card is for dining in general. You may consider:

- UOB Preferred Platinum Visa: 4.0 mpd on dining wherever Paywave is accepted, excluding SMART$ merchants, max $1,000 per month

- Maybank Horizon Visa Signature: 3.2 mpd on dining with minimum $300 overall spend per month

- HSBC Revolution: 2.0 mpd on dining (get up to $150 cashback when you sign up via The Milelion’s SingSaver December offers)

- OCBC VOYAGE: 1.6 mpd on dining

FYI, the FAQs for ShopBack GO explicitly say that once your card is linked, you can use

- Contactless payment through Visa payWave or Mastercard PayPass

- Apple Pay

- Google Pay

- Samsung Pay

to make your payment.

Can I stack it with Mileslife/FavePay/GrabPay etc?

Short answer: no. Think about it- if you pay via Mileslife or FavePay, it’s Mileslife/FavePay who bills your account. It’s their MCC which appears on your credit card statement, not the merchant’s. Similarly, GrabPay transactions require you to have GrabPay credit, which you buy from Grab.

Moreover, from a business model point of view, I imagine that ShopBack GO is pitching this as an extra footfall deal to merchants- give a small discount and get featured on the GO platform. To the extent it brings incremental customers, everyone’s happy. That’s more or less the same pitch that Mileslife has, and another reason why allowing stacking wouldn’t make sense.

What payment option should you use for dining?

The entry of ShopBack GO throws another variable into the dining spending equation. The way I see it, you have five main options when you pay for dining:

| Credit Card | ShopBack GO | FavePay | GrabPay | Mileslife | |

| Dining Reward | 0.4-4 miles per dollar | 5% (10% on first GO transaction at 14 brands) | 3-20% | 5-10 GrabRewards points per dollar | 1-3 miles per dollar |

| Dining merchants | Unlimited | ~400 | ~600 (including non-dining) | ~6,000 (including non-dining) | ~1,000 |

| Visa/Master/ AMEX | All | Visa and Mastercard | All | All | All |

| Stack with credit card for… | N/A | 4 mpd (UOB PPV) | 4 mpd (DBS WWMC) | 4 mpd (DBS WWMC) | 6 mpd (OCBC TR until 31 Dec) |

| Potential rebate* | 0.8-8% | 13% (18% on first transaction) | 11-28% | 9-11% | 14-18% |

Mobile users, scroll left and right to see full table.

*Assumes a valuation of 2 cents per mile, and conversion of GR points into KrisFlyer miles

A few things to note about the table above:

- The FavePay potential rebate needs to be taken with a pinch of salt. First of all, there aren’t a whole lot of 20% rebate merchants. Second, the partner cashback you earn can only be utilized with the same merchant

- There’s nothing stopping you from using FavePay in conjunction with GrabPay credits, thereby allowing you to earn 4 mpd, GrabRewards points and FavePay cashback on the same transaction

- Merchant profile will differ by platform: Mileslife tends to target mid-range and high-end restaurants, while you’ll find more grab and go options partnering with GrabPay and FavePay

Conclusion

ShopBack GO isn’t an entirely new concept. QuidCo, a UK-based cashback site, offers something called QuidCo High Street which allows customers to get cashback when shopping at brick-and-mortar dining, grocery, clothing, home furnishing and other merchants. I assume that ShopBack GO will eventually expand into merchants beyond dining.

There’s a free $5 of cashback waiting for you on your first ShopBack GO transaction, so that should provide extra incentive for you to try it out once before the end of the year. If you haven’t signed up for a ShopBack account yet, signing up through any of the links in this article gets you a $5 bonus on your first transaction (I get $5 too).

on the point on what’s the best card to use with ShopBack Go, for those holding the CIMB VISA signature which offers 10% cashback on dining (provided set conditions are met), I believe that is still the best card to use since 10% cashback beats 4 MPD that the best miles card can earn (assuming no promo and that people value miles at 2 cents per mile). But pardon me if you are referring suggesting which are the best miles earning cards only.

Indeed, cimb visa signature would be very good for those who have it. And don’t mind cashback 😉

Agree with bent, hopefully there will be a small ‘cash back’ section with card updates in milelion for the cards with 8% cash back and above (more than 4mpd)