| This offer has been extended till 30 Sep 2019 |

The Citi Rewards card launched all the way back in 2010, but as far as I know has never actually had a sign up bonus. Sure, they’ve offered statement rebates for new-to-bank customers who hit certain spending thresholds, but there hasn’t been an out and out spend X get Y points style offer…until now

Spend $3,000, get 27,000 bonus ThankYou points

Citibank is offering new-to-bank customers (defined as those who don’t currently hold a principal Citibank card and haven’t in the last 12 months) the chance to get 27,000 bonus ThankYou points (equivalent to 10,800 miles) when they spend $3,000 in the first 3 months after approval.

This offer is for applications submitted between now and 31 March 2019 30 Sep 2019. The full T&C can be found here.

The screenshot above shows 30,000 ThankYou points, but that’s because they’ve assumed you spend the $3,000 at 1X merchants which earns you 3,000 base ThankYou points. If you’re reading this site, I hope you’ve learned enough to know that the Citi Rewards card should only be used for 10X merchants like:

- MCC 5621: Women’s Ready to Wear Store

- MCC 5699: Miscellaneous Apparel and Accessory Shops

- MCC 5631: Women’s Accessory and Specialty Stores

- MCC 5651: Family Clothing Stores

- MCC 5611: Men’s and Boy’s Clothing and Accessories Stores

- MCC 5655: Sports and Riding Apparel Stores

- MCC 5641: Children’s and Infant’s Wear Stores

- MCC 5661: Shoe Stores

- MCC 5948: Luggage and Leather Good Stores

- MCC 5311: Department Stores

- Online shopping (examples here)

Follow that advice, and your $3,000 spend will net you 30,000 ThankYou points. This, combined with the 27,000 bonus points, yields a total of 57,000 points, or 22,800 miles. Not bad for $3,000 of spending!

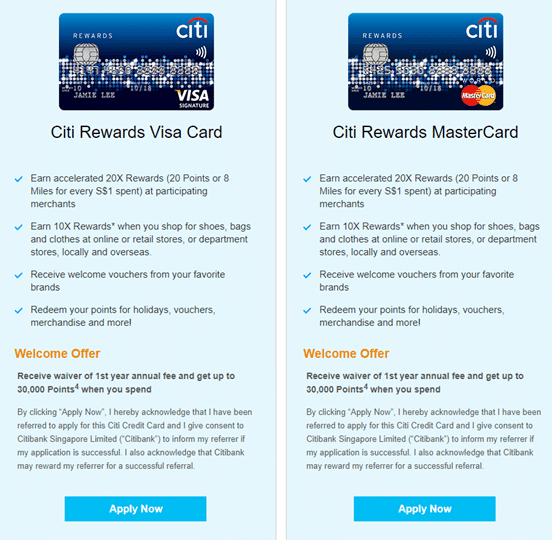

Although all the publicity materials above show the Citi Rewards Visa card, the Citi Rewards Mastercard also offers the same sign up bonus. Remember that you earn 10X points on the first $1,000 of eligible spending per month, so if you max out the spending limit on your Citi Rewards Visa, you can also apply for the Citi Rewards Mastercard to double your cap.

Citi ThankYou points are the most valuable rewards currency in Singapore

I can’t decide if I love or hate Citibank points. On the one hand, they don’t pool, which means that if you hold a Citi Prestige card, a Citi Rewards Visa and a Citi Rewards Mastercard, you’ll be paying three different conversion fees ($25 each) when you want to transfer points into miles.

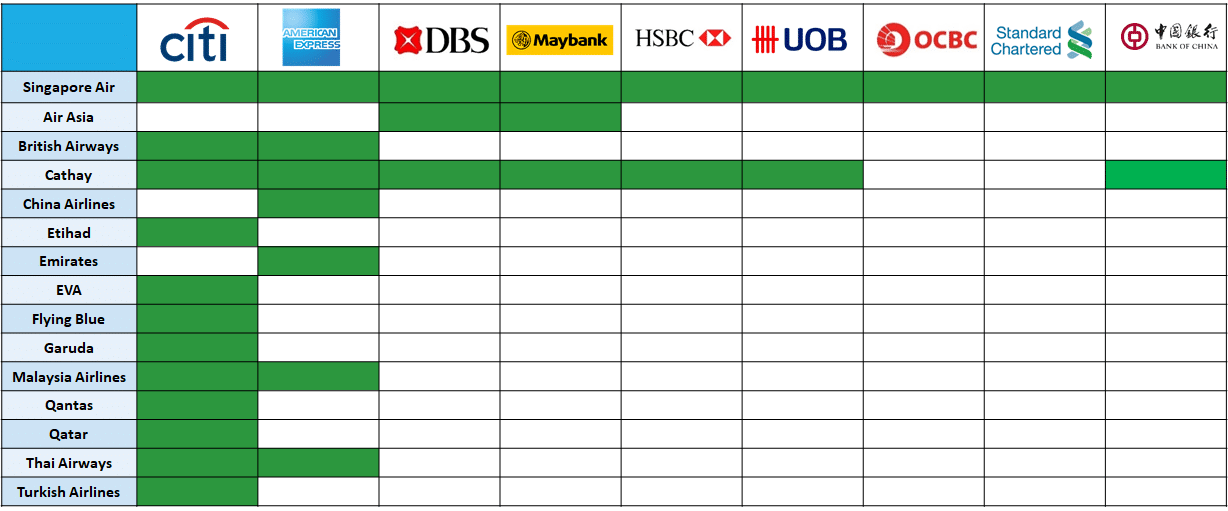

On the other, Citibank has the widest variety of points transfer partners of any bank in Singapore. They’ve got the usual suspects of KrisFlyer and Asia Miles, but also offer three extremely useful points currencies- British Airways Avios, Etihad Guest and Turkish Airlines Miles & Smiles.

Citi ThankYou points earned through the Rewards card are valid for up to five years. Note the “up to”- in reality, the validity for some of your points will be shorter, as Louis covers here.

Can this be stacked with SingSaver sign up gifts?

Unfortunately, no. You’re going to have to pick one or the other.

If you sign up for the Citi Rewards Visa card by 31 January through this SingSaver link you’ll get $200 of Grab/NTUC/Taka vouchers ($30 for existing Citi customers) upon approval. You’ll also have the opportunity to earn up to $50 additional cash as part of the miles vs cashback competition.

If you sign up for the Citi Rewards Visa card through this link or the one in the box below, you’ll be eligible for the 10,800 miles sign up bonus.

[credit_card_shortcode cc_id=”21829″]

Which is a better deal? It depends on how you value things- 10,800 miles should be worth about $216, assuming you value a mile at 2 cents each. However, one might argue that $200 of NTUC vouchers would be more flexible in terms of use, plus there’s no spending requirement to get them.

Either option you choose, the first year annual fee of $192.60 is waived.

Conclusion

I can’t imagine many miles chasers who wouldn’t already have this card, but if you’re new to the game you absolutely should consider adding it to your arsenal. Be sure to join our Telegram Group and learn about a few other MCCs which earn 10X with this card!

Am I considered a new customer if i have corporate credit card but not personal one?

you should be, but when in doubt call and check.

The 10X reward points per month is actually not for the first $1,000, but the first $1,111. It’s the bonus points (9X) that are limited to 10,000 points, which translates to 10,000/9 = $1,111. This seems to be the case for my two recent statements.

Just want to say this seems to be true for me too, even though their T&C only says “points” instead of “bonus points” or “10x points”

Anyone have experience with missing the 3k mark and getting an “extension” on the promotion for another month to hit the qualifying spend? Miscalculated my spending 🙁

Hi! Is the bonus 10.8k miles promotion also valid for the Mastercard version if I click through your link? It is directing me to the Visa card application. Thanks!

click on this link and select the citi rewards MC. you’ll get the same offer. thanks!

https://milelion.com/recommends/citibank-rewards-mastercard/

Thanks and sorry I didn’t see the reply earlier. For some reason, I didn’t get the notification of the reply. I’ve just signed up via the link. May I know how will the bonus 10.8k miles be credited? Automatically after the requirement is fulfilled?