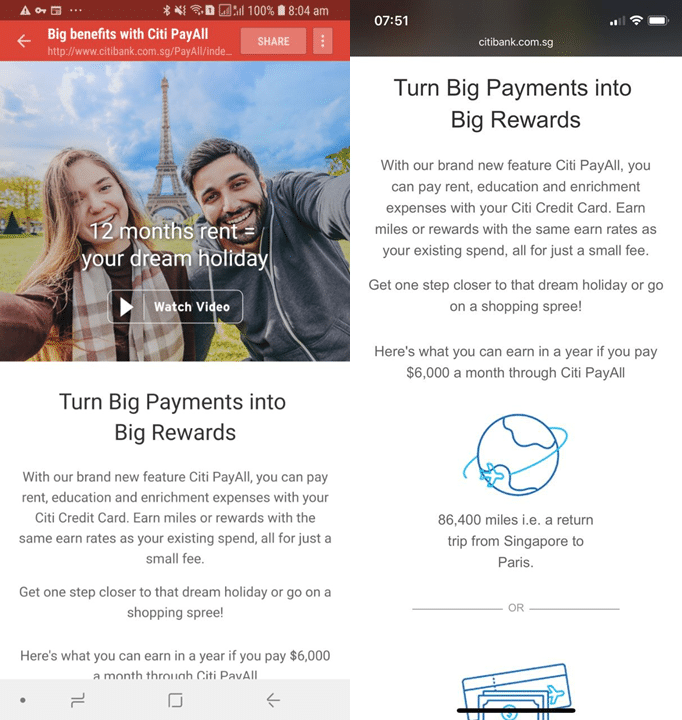

In November last year, Citibank started a targeted beta test of a service called PayAll, which allowed customers to earn rewards when paying rental and education expenses with Citibank credit cards.

It wasn’t a particularly new concept, but what made PayAll different was that the admin fee Citi was charging was way below the competition.

During the beta, the lowest possible admin fee was 1.2%, meaning that if you had a Citi PremierMiles Visa card earning 1.2 miles per dollar, you’d be paying 1 cent per mile. This was flat out one of the lowest costs to buy miles anywhere in Singapore.

Citi PayAll is now available to all Citi customers for an admin fee of 2%

The first iteration of Citi PayAll was an invitation-only beta, but Citibank rolled out an app update yesterday which made the Citi PayAll feature available to all Citi customers.

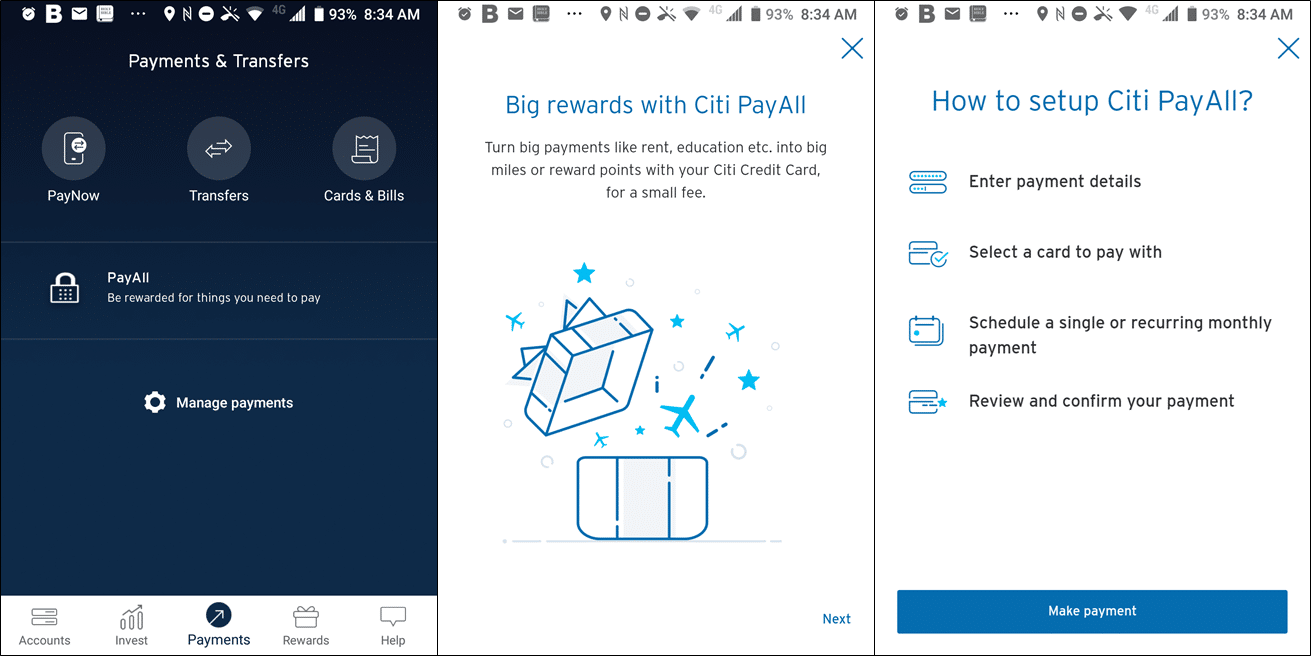

When you load the Citi app, you’ll see a Payments tab at the bottom of your screen. Tapping on it brings you to the PayAll introduction page.

You’ll then have the option to schedule a rent, education, tax, MCST or electricity bill payment.

Enter your payee’s details and amount…

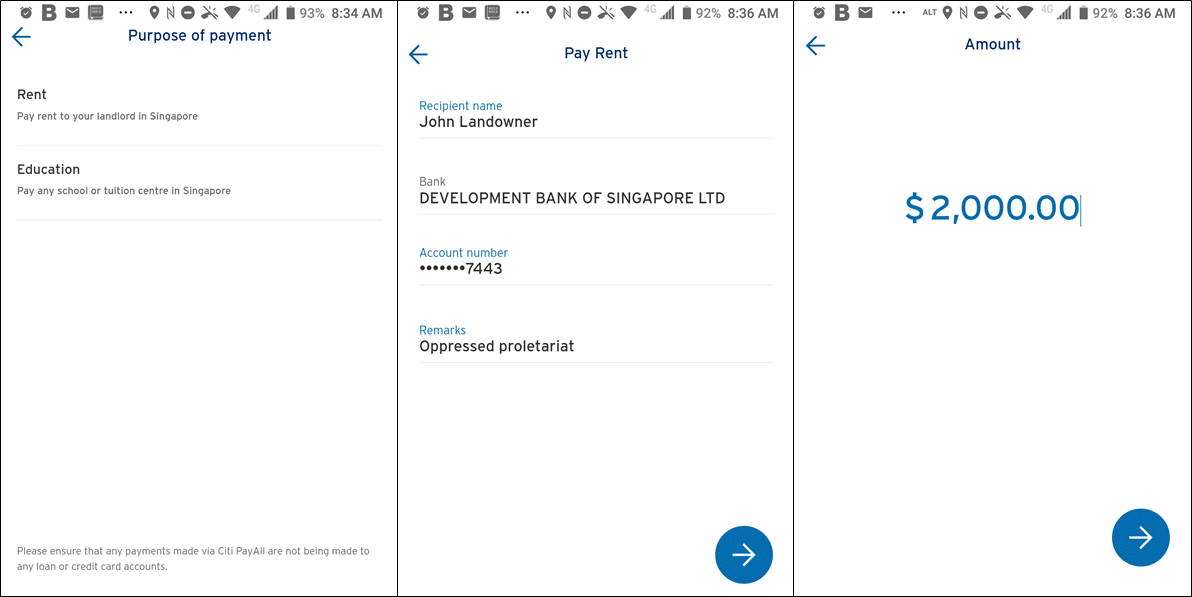

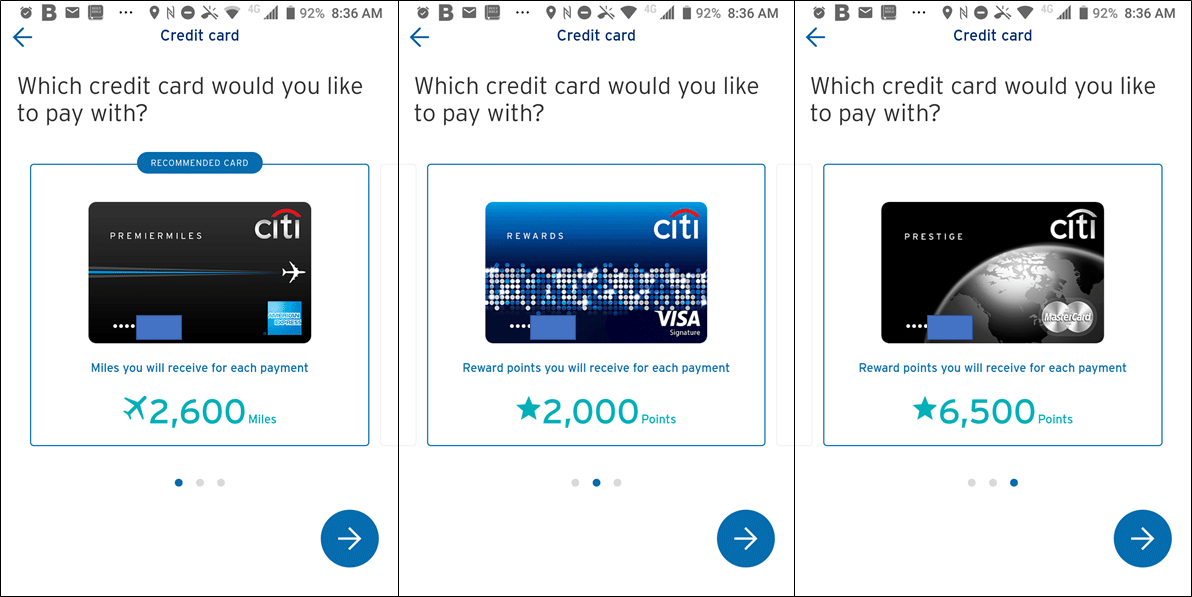

…and then the fun part. Citi shows you in unambiguous terms how many miles or points you will receive for your given payment. I’ve chosen a $2,000 payment, which earns me

- 2,600 miles with the Citi PremierMiles AMEX (1.3 mpd)

- 2,000 points (800 miles) with the Citi Rewards Visa (0.4 mpd)

- 6,500 points (2,600 miles) with the Citi Prestige (1.3 mpd)

You’ll then see the applicable admin fee, which is the same whether you opt for a single payment or monthly payments. I’ve been charged $40 per month on a base payment of $2,000, so that’s a fee of 2%.

A word about admin fees- although the admin fee for the PayAll beta was tiered (1.2-3%, assuming you paid at least $2K), it seems that PayAll now has a fixed 2% admin fee, regardless of what amount you pay.

Buy miles as low as 1.25 cents each, with the right card

How does the card you hold affect the price at which you buy miles through PayAll?

| Card | Cost Per Mile @ 2% |

Citi Rewards Citi Rewards |

5 |

| 1.67 | |

Citi Prestige* Citi Prestige* |

1.54 |

Citi ULTIMA Citi ULTIMA |

1.25 |

*Does not factor in the end-of-year relationship bonus, which can increase your earn rate to as high as 1.42 mpd

Needless to say, you shouldn’t consider using PayAll with a Citi Rewards card. However, the equation becomes much more interesting if you hold any other miles/points earning Citi card. Even at the Citi PremierMiles Visa’s relatively “high” 1.67 cpm figure, you’re still doing much better than many other options in Singapore as the table below summarizes:

[table id=4 /]

That’s awesome, in my opinion, especially given the no-risk approach. Every month we get questions like “does Cardup/ipaymy stilll earn base points with Card X” because everyone’s afraid this will be the month the banks pull the plug. Citi is at least promising that you will earn this many points for your payment.

Citi Miles and Thank You points are the most valuable loyalty currency in Singapore

The icing on the cake for me is how valuable Citi Miles and ThankYou Points are. While most banks offer KrisFlyer and at most Asia Miles, Citi gives you a choice of 12 different frequent flyer programs to transfer your points, including useful ones like British Airways Avios and Etihad Guest.

Conclusion

Citi PayAll is no doubt going to shake up the payment facility market in Singapore, and I’m interested to see how the incumbent payment platforms will respond. Once the service expands, it’s going to be much easier to acquire miles for less.

What happens if you have set up a recurring payment under the payall beta app? I set up a 5k payment on my PremierMiles Amex so was paying less than 1c a mile, will the fee now go up?

Grandfathering the old rates would be amazing but doubtful. In the updated app my current PayAll payment is showing with the old, beta rates for my next payment scheduled in March.

I just checked mine and the next payment due in a week is also at the old fee structure – here’s hoping

The next recurring payment I have scheduled is still showing 1.5%

I would complain if Citi changed the fee structure on an existing recurring payment

Anyone know if the transactions count towards the $8888 spending required for the preniermiles promo?

Ditto this.

I just called to ask and they said yes

What about BOC cardup? I was offered 2% fees last lunar new year’s day. Am earning 1.5mpd. I think Payall is worse off.

Sure, but you need to look at regular pricing. I’m sure ipaymy/cardup may offer promos that lower the headline fee, but can you rely on those year round?

Is there a cap to how much we can charge? I can’t find it anywhere. Previously it was 10k during the trial.

Not sure if the fee is the same for everyone but it shows the fee of 30 dollars when I try 2000$ in the app. That would mean even cheaper cpm

Hmm… I’m getting $40 for $2k (and generally a 2% fee)… sounds like it might be targeted? Lucky you!

Just tried to setup up a payment for 5350 – got 80.25, which works out to 1.5%. Must be targetted.

that is very, very interesting…all i’ve heard so far is 2%. were you part of the beta?

Yes, I did use the service in the beta when the fee was 1.2%

Nope – wasn’t part of the beta which makes it even more interesting. I am not sure whether they have a tired pricing for Citigold vs others perhaps?

I was charged 1% $48 on $4800/- PM

I participated in the beta and enjoyed a 1.5% fee including until end of April when I paid my income tax. Now every new payment I try to set up has a 2% fee, although existing recurring payments still had the old fee. Guess Citi must have phased out the reduced fees.

Anyone have any idea whether the income tax facility for this will be up in time for tax season this year?

any idea whats the max amount one can pay?

Hi All

my fren got his payall at 1.5% (he didn participate in the previous campaign tho) and received this dubious and confusing SMS frm Citi:

There was a charge of SGDXX on Citibank Card by DUMMY NAME DUMMY CITY SG

For a moment, we thought it’s some fraudulent charge on the card. Did anyone else get this sms too?!

i guess citi didn do their testing properly… :S

he also got an SMS asking him to put that trxn on PAYWISE at 0% interest with 3% fee. by taking up paywise, the miles will be reversed right??

I am a Citigold member and i just checked my payall function. I am offered 1.5% for only two months. Dinno why they say 2 months..

I am also a Citigold member. I was not aware the 1.5% was offered for only 2 months but confirm they do enforce this rule as far as I am concerned. Now into my 3rd month using the payall function and the fee jumped to 2%.

What about paying with a CC (Visa or AMEX) via MySam Web?

Sorry, ignore my silly question…

for citi payall payment to landlord, the info requested is payee name and account number. does this mean we can set up recurring payment schedule to any individual?

will citibank request credit card holder to provide rental agreement?

Attempted to make my first-time Citi PayAll payment today to my condominium’s MCST. However, the CitiPayall interface kept prompting with an error “Invalid MCST number”. I was certain that it was correct, so I went to the Live Chat support via Online Banking to enquire.

Turns out, not every MCST in Singapore is “partnered” to accept Citi PayAll payments. Was advised that since my condo’s MCST is not able to accept, I have to make alternative payment arrangement.

Opportunity Cost = 4320 miles per year , for an expense I cannot avoid as a homeowner. Disappointing.

Hey, you can “cheat” the PAYALL system by listing it under the “Rent” category. I did that for my 2019 Q2’s MCST payment and it went through. (Just setup for my Q3 MCST payment).

The way I see it, so long as the payment function can be set up (regardless of category), Citibank doesn’t clamp down on whether it is an accurate category, the payment will go through and we will still get our points.