| This is a targeted offer and may not appear for everyone |

The AMEX KrisFlyer cobrand cards may have big sign up bonuses, but they’re not particularly known for great earning rates on overseas spend.

If you hold the AMEX KrisFlyer Ascend or the AMEX KrisFlyer Credit Card, you earn 2.0 mpd on overseas spending, only in June and December. If you hold the AMEX PPS Card or AMEX Solitaire PPS card, you earn 2.0/2.4 mpd on overseas spending only after you’ve spent at least $3.8K per month, and even then only on the incremental spend above $3.8K.

| Card | Regular Rate | Enhanced Rate | Remarks |

| AMEX KrisFlyer Credit Card | 1.1 | 2.0 | June and Dec Only |

| AMEX KrisFlyer Ascend | 1.2 | 2.0 | |

| AMEX PPS Credit Card | 1.3 | 2.0 | For incremental spend >$3.8K per month |

| AMEX Solitaire PPS Credit Card | 1.3 | 2.4 |

Given that other cards like the UOB PRVI Miles and BOC Elite Miles World Mastercard offer 2.4/3.0 mpd on overseas spend year round without minimum spend or cap, that’s a really weak offering.

Earn a bonus 3 mpd on foreign currency spending, capped at 1,500 miles

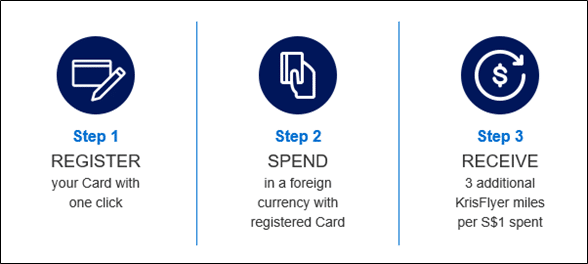

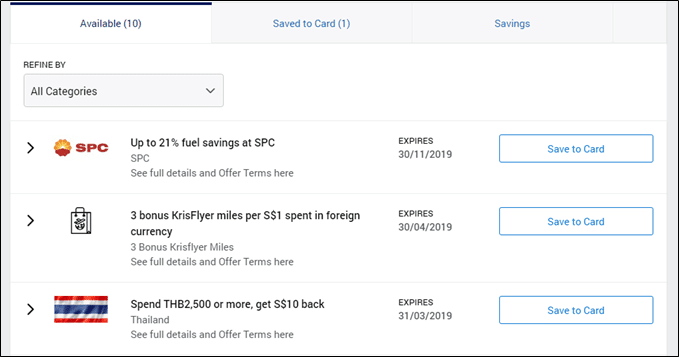

If you do hold an AMEX KrisFlyer cobrand card anyway, you’re going to want to check your offers section because AMEX is offering a small bonus on foreign currency spending.

From now till 30 April 2019, cobrand cardholders who save the offer to their card earn a bonus 3 mpd on overseas spending, capped at 1,500 bonus miles.

It’s a fairly modest bonus, but it boosts your earning rate to 4.1-4.3 mpd, at least for the first $500. For comparison’s sake, the best overseas spending rates you can enjoy currently come from

- UOB Visa Signature- 4 mpd, provided you spend min $1K max $2K in FCY per statement period

- SCB Visa Infinite- 3 mpd, provided you spend at least $2K in a statement period

- BOC Elite Miles World Mastercard- 3 mpd, no cap (but watch out for the T&C changes)

- UOB PRVI Miles- 2.4 mpd, no cap

- OCBC VOYAGE- 2.3 mpd, no cap

Remember, you’ll need to save this offer to your card to enjoy it- no save, no bonus. Go to the Amex offers section of your AMEX dashboard to do so. This is limited to the first 10,000 cards that register.

I can’t link directly to the T&C, because they’re within the dashboard, so I’ve copied and pasted them below.

Terms and Conditions

- Valid for payments made in a foreign currency at merchants that accept American Express. Payments can be made in-person, in-app or online.

- Foreign currency means any currency other than Singapore Dollars. If your transaction is converted into Singapore Dollars before being submitted to us (for example, if the merchant gives you the option of converting the transaction to Singapore Dollars at the point of sale), your payment will not be eligible for the offer.

- When you make a payment in a foreign currency, it will be converted to Singapore Dollars based on the rate of exchange at the time your Card is charged. Any miles awarded as part of this offer will be calculated after currency conversion to Singapore Dollars, excluding Foreign Exchange Charges that are incurred. For more information about Foreign Exchange Charges on your Card, refer to your Card Member Agreement.

- Payments must be charged to your Card by 30 Apr 2019 to be eligible for the offer. If a merchant does not charge your Card by this date (e.g. due to a delay in dispatching your goods), you may not be eligible for the offer.

- The Promotion is open to individuals who hold personal basic American Express® Singapore Airlines Credit Card issued in Singapore by American Express International Inc. only (“Eligible Cards”), excluding American Express Corporate Cards and American Express Cards issued by Citibank Singapore Limited, DBS Bank Ltd and United Overseas Bank Limited (“Card Members”).

- Supplementary Cards are not eligible for this offer.

- Offer is limited to the first 10,000 eligible Cards which are successfully registered for the offer.

- Offer is limited to a maximum of 1,500 bonus KrisFlyer miles per Card to which the offer is saved and only spend on this Card counts towards the Offer.

- Your Card must be enrolled in the KrisFlyer loyalty program and have an active KrisFlyer account to receive the KrisFlyer miles.

- KrisFlyer miles are not redeemable for cash.

- Bonus KrisFlyer miles should be reflected in your Card Account within 5 business days from qualifying spend but may take up to 90 days from offer end date.

- Bonus KrisFlyer miles will not be applied to your Card account if your Card has been suspended or cancelled.

- KrisFlyer miles may be reversed if your qualifying purchase is refunded or cancelled.

- Full Offer Terms available here.

Conclusion

This is a nice bonus to have if you already have a cobrand card, but the relatively low cap and the fact that it’s not June/Dec means you won’t want to use your KrisFlyer Ascend/KrisFlyer Credit Card for overseas spending beyond $500 these two months.

AMEX cards do have a 2.5% foreign currency transaction fee, but it’s (surprisingly) the lowest in the market right now.

Yes, it is targeted. My friend received the offer but I did not.

Hmmm.. just checked and this isn’t offered for my krisflyer pps credit card… wonder if they track your spend and don’t offer to those who would spend overseas anyway..

I haven’t used my KrisFlyer card overseas at all, and I wasn’t targeted for the offer either.

Is Amex still the lowest FCY transaction fee in the market when taking into account the double conversion (from say CAD to USD, then USD to SGD)?

Every bank does double conversion