From now till 17 May, apply for an SCB Visa Infinite and get up to $200 cash. This reduces the annual fee to $388.50, allowing you to pick up miles at 1.1 cents each. SCB now offers instant approval and provisioning of cards, allowing you to start using your card straight away.

The best part? You don’t strictly need to earn $150K+ per year. Read on for details.

The SCB Visa Infinite is one of the best miles cards to buy miles on the cheap.

That’s because the card offers the cheapest tax payment facility in Singapore (as low as 1.14 cents per mile), plus the chance to buy a further 35,000 miles when you pay the $588.50 first year annual fee (1.68 cents per mile)

And it gets even better: from now till 17 May, SingSaver is running a flash sale for SCB Visa Infinite applications:

- New-to-bank customers will get $100 cash upon approval (existing: $30)

- A total of 15 customers can win a further $100 cash by providing the most creative answer to question “what do you wish could be instant in your life?” See contest details below

Get up to $200 when you apply for the SCB Visa Infinite here

Here’s how the math works out:

| Welcome Miles | Effective Cost | Cents Per Mile | |

| Normal | 35,000 | $588.50 | 1.68 |

| SingSaver Existing (no win) | 35,000 | $555.50 | 1.60 |

| SingSaver New-to-Bank (no win) | 35,000 | $488.50 | 1.40 |

| SingSaver Existing (win) | 35,000 | $455.50 | 1.31 |

| SingSaver New-to-Bank (win) | 35,000 | $385.50 | 1.11 |

As you can see, the price per mile can drop as low as 1.11 cpm, which would make this the cheapest way of buying miles in Singapore.

[table id=4 /]

Do note that the second year renewal gift for the SCB Visa Infinite is only 20,000 miles, so you need to take the call as to whether you enjoy the card enough to pay the full fee from the second year onwards.

The SCB Visa Infinite earns 1.4 mpd locally and 3.0 mpd overseas, provided you spend at least $2K in a statement period (1 mpd for both otherwise). This puts it among the highest general spending cards in Singapore. It also comes with six Priority Pass visits, which isn’t the best in class. However, if you view this as a pure miles buying exercise, then anything incremental is just a bonus.

On paper, the minimum income for the SCB Visa Infinite is a hefty $150K. That said, there have been enough data points from people who have received approval with incomes in the $80-120K range for me to believe this isn’t a strict requirement. It’s certainly worth a shot if you’re interested, particularly because SCB now offers instant approval.

Apply online and get instant approval

Applying for a card and waiting a week for it in the mail is so five years ago. We’re now in the age of “instant provisioning”, where you can use your card immediately upon approval by adding it to your mobile wallet.

SCB is now offering instant approval and provisioning for the following cards:

- SCB Unlimited Cashback

- SCB Rewards+

- SCB Spree

- SCB NUS Alumni Platinum Credit Card

- SCB Prudential Platinum Credit Card

- SCB Visa Infinite

Instant approval and provisioning is available for both new-to-bank and existing customers. You need to apply using SingPass MyInfo, which will automatically populate fields like your mobile number, mailing and email address.

Upon submission, you should get instant confirmation whether your card is approved or not (there will be some instances where the system needs additional time to validate your application, and you’ll be told if this is the case).

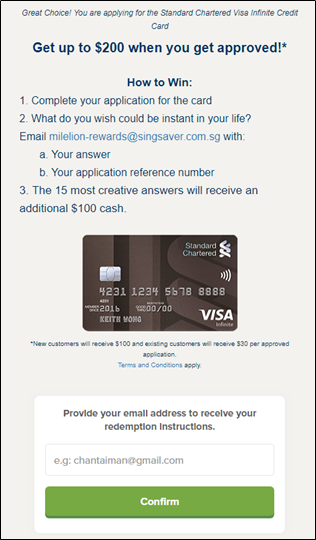

Contest: Win $100 bonus cash for successful SCB Visa Infinite applications

So, in light of that, the contest question is:

“What do you wish could be instant in your life?”

Send your answer to milelion-rewards@singsaver.com.sg by 31 May 2019, and the 15 most creative answers win a bonus $100 cash each.

The full T&C can be found here, but to summarize: you must apply for a SCB Visa Infinite card by 17 May 2019, and receive approval + complete the rewards redemption form by 31 May 2019. This contest is open to both new-to-bank and existing SCB customers.

Sidenote: this promotion is separate from the ongoing SingSaver Battle of the Cards contest, so you can’t double dip on the two. If you want to participate in the Battle of the Cards, use the links in this article instead.

Conclusion

If you’re looking to pick up miles for less, this is probably one of the best ways. So get cracking with your answers, and be sure to submit your applications by 17 May!

Surely you mean..i can’t think of a few ways better than this rather than i can

I think Aaron sentence using “can” is correct. Must read the entire sentence in entirety.

Or… read another way, I “can’t” think of “many” better ways to buy miles. Ain’t linguistics fascinating.

you cunning-linguist, you… 🤣

Are you a master-debator? 😜

Hi, just to check 1.4miles is awarded after the min 2k spend or is it on the whole 2k?

Example: for the first 2k you’re awarded 1mpd

And after that then you’ll be awarded 1.4mpd?

Thanks

Kel

Whole 2k

Hi Aaron,

Do you know if tax payment counts towards the $2K min spend? Or do we need to charge $2K to the card when the tax payment application is approved?

Also, does the earn rate vary month to month depending on whether we hit the min spend? Or do we need to maintain $2K min spend every month?

The Stanchart website’s FAQ is silent on this.

Thanks!

i always thought it was yes, but some people say no. CSOs also give inconsistent answers, so i’m sorry but I can’t confirm

Then I suppose we should make sure we hit the $2K min spend the month our tax payment application goes through, just to be safe.

Scb just confirmed to me over instant message that tax pay facility counts toward 2k, so I have it in writing now…

Thanks for the update Aaron.

To squeeze maximum ROI from of this deal, apply for the card, get a free supplementary card for your spouse, and pay both your income tax using the card. Sign up bonus miles – 35K (1.40 cents per mile) Miles from taxes with $40K tax bill – 56K (1.14 cpm) Total – 91K miles (1.24 cpm) Almost enough for a Business Saver return flight to Japan. Since the cpm for signing up (assuming you’re new to bank and did not win) is higher than the cpm for tax payment, it is better to combine your tax payment than to apply… Read more »

Yes, the tax payment facility counts towards the min 2k monthly spend. I chatted with the bank representative online.

Applied… but when retrieving myinfo, SC website generated errors… althought I received SMS from singpass that SC has successfully accessed the information

So no instant approval… just a note.

correct- instant approval isn’t always guaranteed, sometimes they’ll need to pull more info for verification, or sometimes there’ll be website oddness

Applied too but information retrieved from MyInfo wasn’t complete. Emailed SCB to provide them with additional income information and followed up with multiple phone calls but never got through to anyone. Been more than 10 days and have not received a single reply from them. I guess there must be a lot of applications for the Visa Infinite card.