One of the unanswered questions when UOB launched the KrisFlyer UOB Credit Card was what this meant for the UOB PRVI Miles portfolio. After all, these two cards seemed to be targeting the same customer profile- wouldn’t there be cannibalization?

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

UOB PRVI Miles UOB PRVI Miles |

|

| Income Req | $30K | $30K |

| Annual Fee | $192.60 | $256.80 |

| Local Spend | 1.2 mpd | 1.4 mpd |

| Overseas Spend | 1.2 mpd | 2.4 mpd |

| Specialized Spend | 3 mpd on SIA-related transactions 3 mpd on online shopping & travel, dining and transport with min $500 spend on SIA-related transactions |

10 mpd on Kaligo, 7 mpd on selected airlines with Expedia, 7 mpd on Agoda, 7 mpd on UOB Travel, caps apply |

| FCY Fee | 3.25% | 3.25% |

| Renewal Miles | 10K | None- AMEX version offers 20K miles with $50K annual spend |

| Transfer Partners | SIA | SIA, Cathay |

It’s still unclear what the long-term plan for the PRVI Miles cards is, but in the meantime, UOB has decided to link them (along with the UOB Visa Infinite cards) to the KrisFlyer UOB Deposit Account.

Earn up to a bonus 6 mpd on your spending

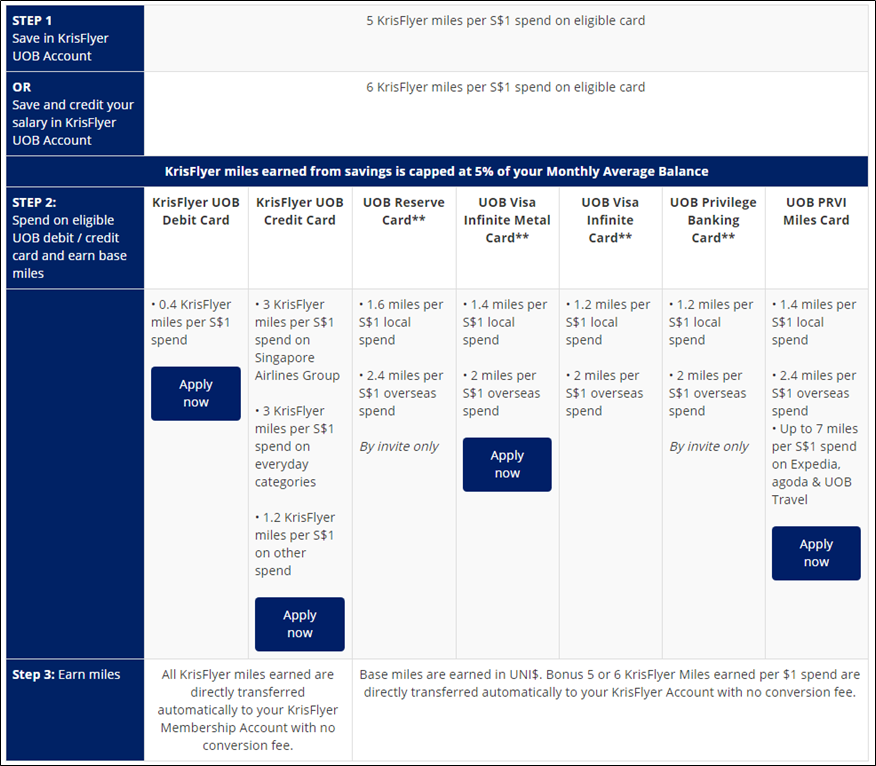

Here’s how it works. If you hold one of the following cards…

- UOB Reserve

- UOB Visa Infinite Metal

- UOB Visa Infinite

- UOB Privilege Banking

- UOB PRVI Miles (AMEX, Mastercard, Visa)

…and open a KrisFlyer UOB account with a min $1K balance, you can earn a bonus 5 mpd (or 6 mpd with a salary credit of ≥$2K/month) on your card spending.

So, for example, if I hold a UOB PRVI Miles card, credit my salary to the KrisFlyer UOB account and spend $1K locally in a month, I will get:

- 700 UNI$ (equal to 1,400 KrisFlyer miles) from my card

- 6,000 KrisFlyer miles (credited directly to KrisFlyer account) from my bank account

On paper, that’s fantastic- $1,000 of spending earns me 7,400 miles, or a jaw-dropping 7.4 mpd. What’s the catch?

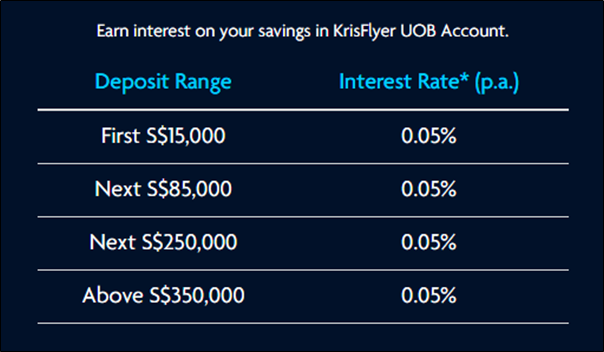

You earn virtually 0 interest

Whatever money you put in the KrisFlyer UOB account earns you almost 0 interest. No matter what your balance is, you’ll earn a flat rate of 0.05% interest per year.

“Ok,” you say. “So the interest is terrible, but I’ll make it up through the bonus miles.” If that’s your thought process, well…

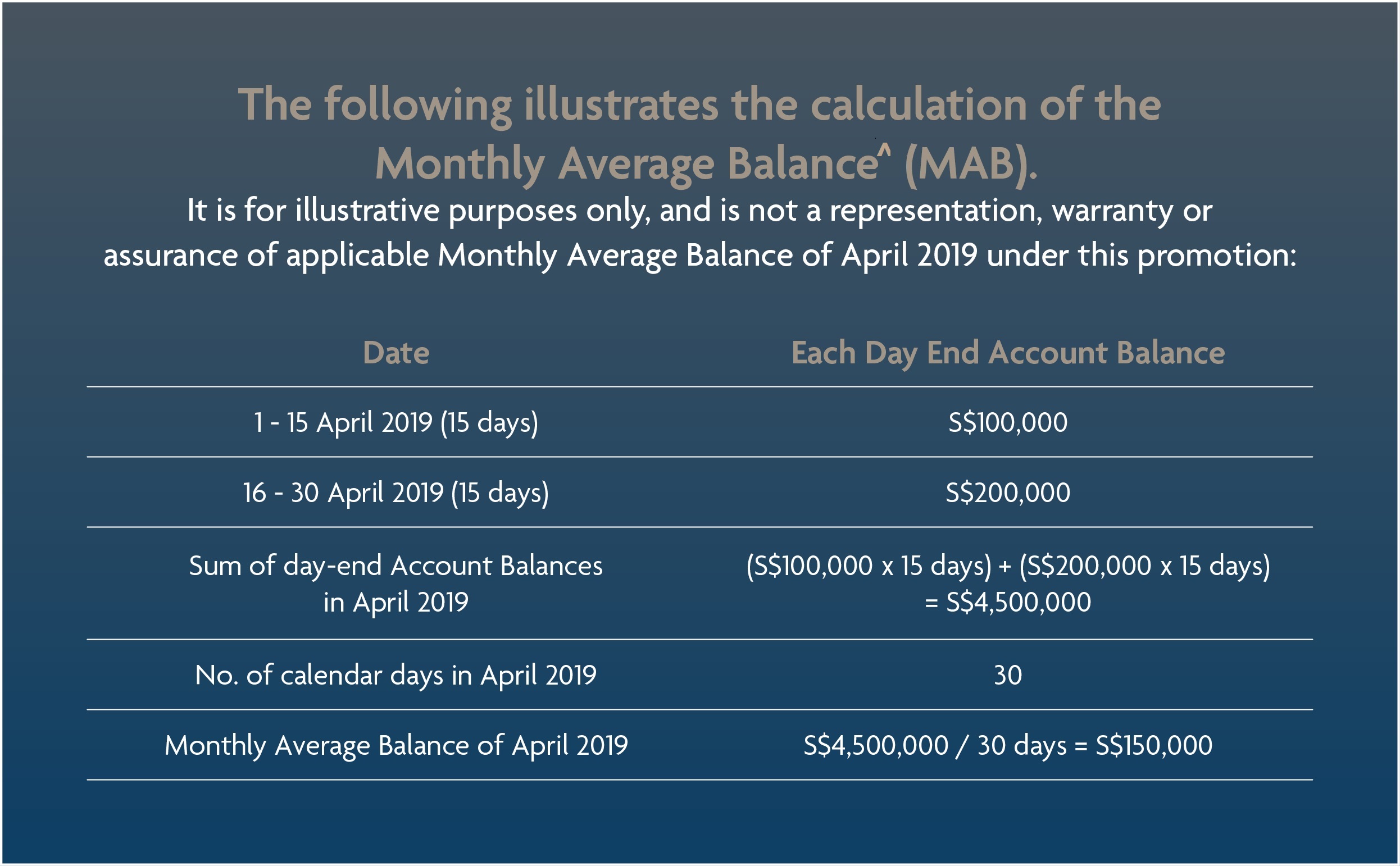

The bonus miles are capped at 5% of your MAB

A bonus of 6 mpd sounds too good to be true, and in a way, it is. The maximum bonus miles you can earn is capped at 5% of your monthly average balance (MAB).

For example, if your MAB is $20K, you can earn a maximum of 1,000 bonus miles (5% of 20K) each month. That means you’ll exhaust your bonus cap after spending just $167 (1,000/6 mpd).

Your total return for the month is then:

- 1,000 bonus miles (~$20)

- $0.83 of interest (0.05% X $20K divided by 12)

That’s a pretty dismal return, considering that you could generate much more interest (all in cash) with one of the hurdle accounts like the OCBC 360 or DBS Multiplier.

Remember our earlier example of spending $1K per month on the UOB PRVI Miles card and getting 6,000 bonus miles? For you to actually earn the full 6,000, you’d need to have an MAB of $120K in your KrisFlyer UOB Account.

$120K, earning 0.05% interest per year. It’s just crazy.

Conclusion

What I can’t understand about the KrisFlyer UOB account is why it penalizes its customers twice. First, there’s hardly any interest, and second, you can’t even make up the lost interest through miles because of the cap. Whatever bonus miles you earn would be more than offset by the loss of interest, and the 5% cap is just too punitive to make it a viable offering.

The UOB PRVI Miles card, in and of itself, is an excellent all-round workhorse. But there’s really no need to pair it with the KrisFlyer UOB account.

| Apply for a UOB PRVI Miles Card in SingSaver’s Battle of the Cards and get $50 cash upon approval for both new and existing UOB customers. Plus, get a further $50 cash if the card you pick gets the most applications! Valid till 12 May, see more details here |

Typical UOB.

“The UOB PRVI Miles card, in and of itself, is an excellent all-round workhorse”

Disagree.. I just cancelled the card in view of other cards with better mileage/$ spend.

The only mass market card which outperforms it is the boc

If your spending are in $5 increments. Calculation actually shows its nearer to 1.1 mpd if you take into account the $5 increments that UOB imposes.

Yeah, fair enough. If that bothers you then Citi would be better

Yes! precisely 🙂

Do the caps stack – eg if you have the UOB krisflyer debit, UOB Krisflyer credit and UOB privi, does your bonus then get capped at 5% x 3 = 15% of MAB? That would make it a much more interesting proposition

that’s a nice thought but unfortunately no. One krisflyer uob account can only be linked to one card

regarding the MAB limitation. would you say that this would make more sense for individuals who have a higher MABs? im thinking in terms of tradeoffs here that you’ve mentioned. a higher MAB would mean i can earn more miles but that means i would have to spend more. also having a higher MAB would mean that lump of money being wasted on poor interest rates. e.g. scenario MAB = $100,000 Cap = 5000 miles Expenditure to hit cap = $675~ (6mpd from saving in Krisflyer UOB Account, 1.4mpd PRVI miles) Interest = $50 also on that note, can’t really… Read more »

It IS UOB after all – this is the only bank that consistently declines to waive the fees for my JCB card (which, if you’re a J-Pop fan, is the only Singapore credit card that iTunes Japan accepts). I agree with your previous analysis on the UOB VI Metal card – it is pretty useless – will be dumping when the card anniversary date’s due. When I think of UOB, the joget will inevitably come to mind – sometimes they take a few steps forward with a promising product, then they shoot themselves in the foot in taking a few… Read more »

Combined with grab for 3mpd, of total 9mpd, that’s quite lot

If i have uob prvi and uob kf credit, will this 2 card be automatically linked to the uob depsoit account? Or only 1 card can be linked to earn the 6 bonus pts?

For now, I can only think of using this UOB KF debit card to get the 0.4 mpd insurance payment (plus whatever dismal bonus miles capped at 5% MAB), pls comment if anyone has better proposition for insurance payment (not incl cardup/ those with additional fees). Thanks Milelion, this article was launched in 2019 but I guess still pretty much relvant here in 2024