The AMEX KrisFlyer cobrand credit cards don’t have the highest miles earning rates on the market, but they’ve historically made up for it through solid sign up bonuses.

The last sign up bonus lapsed on 30 June, and a new one has taken place effective 1 July for applications approved by 30 September 2019. Here’s what has changed:

| Old Bonus (till 30 June) | New Bonus (from 1 July) | |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

5K miles for first spend

Spend $10K in first 3 months to get 15K miles, spend a further $10K in months 4-6 to get a further 15K miles |

5K miles for first spend Spend $10K in first 3 months to get 15K miles |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

5K miles for first spend Spend $5K in first 3 months to get 7.5K miles, spend a further $5K in months 4-6 to get a further 7.5K miles |

5K miles for first spend

Spend $5K in first 3 months to get 7.5K miles |

The main change is that AMEX has removed the additional bonus for spending in months 4-6. This means the total miles you’ll receive for hitting the sign up bonus now looks like this:

| First Spend Bonus | 5,000 | 5,000 |

| Base miles for hitting $10K (Ascend)/ $5K (Blue) | 12,000 | 5,500 |

| Bonus miles for hitting $10K (Ascend)/ $5K (Blue) | 15,000 | 7,500 |

| Additional miles for signing up through MGM | 7,500 | 5,000 |

| Total miles | 39,500 | 23,000 |

The AMEX KrisFlyer Ascend has a non-waivable first year fee of $337.05, while the AMEX KrisFlyer Credit Card waives the first year’s annual fee.

How does this offer compare to historical offers?

Any reduction in sign up bonuses is a bad thing, but if your card was approved on or before 30 June 2019, you’ll still be locked into the previous sign up bonus.

Otherwise, based on past data, you may be better off waiting for a better offer to come around. Here’s what I managed to put together on past sign up offers.

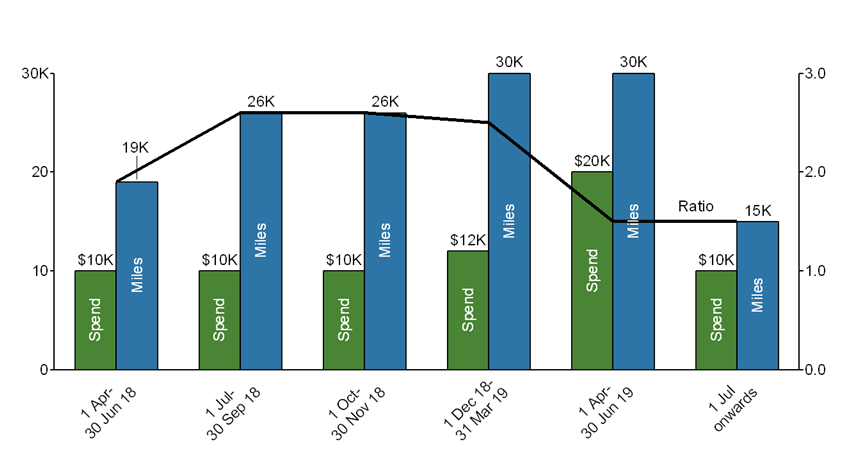

AMEX KrisFlyer Ascend

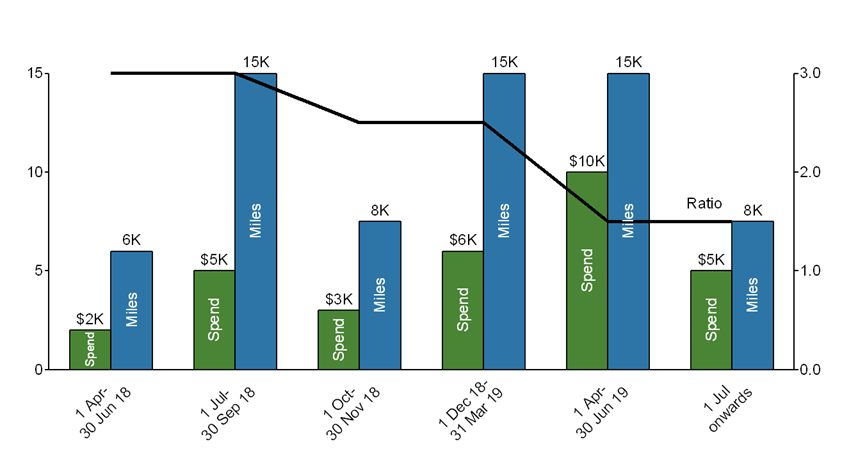

AMEX KrisFlyer Credit Card

The charts suggest that historical offers were more generous, although they probably oversimplify the situation, given that they say nothing about the cadence of the spending (i.e. over three months versus six), nor the size of the first spend bonus (which hasn’t always been 5K miles).

For the benefit of those who really want to dive into that level of detail, here’s additional information.

Conclusion

Given that the DBS Altitude and Citi PremierMiles Visa recently extended their sign up bonuses, you have a few options to choose from when picking a new card. I’d personally wait for a better offer to come along for the AMEX KrisFlyer cards, although as always, it really depends on how much you plan to spend over the next three months, and whether you’re alright with paying an annual fee.

For those who applied for an AMEX KrisFlyer card during April’s Milelion Million Mile giveaway, we’ll be conducting the draw for the 10 winners of 100,000 miles each this Wednesday, and winners will be announced later this month. Be on the lookout for that!

Be sure to check out all the latest credit card sign up bonuses here.

Signing up for credit cards through any of the links in this article may generate a referral commission that supports the running of the site. Found this post useful? Subscribe to our Telegram Channel to get these posts pushed directly to your phone, or our newsletter (on the right of your screen) for the latest deals and hacks delivered to your inbox.

How about the spend 10k and upgrade from kfb to ascend? Has the benefits deteriorated?

… and meanwhile, AMEX is plying Platinum Charge Card customers with increased benefits.

This sure adds to the trend of the Rich getting richer …

Yeah…probably cos KrisFlyer is more competitive and the economical no longer add up… so you go back to the roots of the top-tier premium products which is really what Amex is all about to start with…

is the upgrade from KFB to ascend an ongoing promo? If I spend $10k within 6 months, will i still get the link to upgrade? Or do I need to wait for the minimum tenure of 9 months. If so, what if there’s no upgrade promo after spending the $10k?

Is this still the crappiest card in the market, as per your article when it was first rebranded…or have you changed your heart? Haha

well, the sign up bonuses are well worth looking at (but maybe not this particular one). they’re clearly not market-leading when it comes to general spending miles rates (boc elite miles/uob prvi would be my choice there), but one thing amex has is they hardly have any exclusion categories. charities, utilities, donations, education, gvt services…so long as they take amex (which isn’t always a given) you’ll get points.

Yeah i hear you, but to have a co-brand partnership which is not the most competitive or leading product is just too sacrilegious…

Anyway, Amex just isn’t competitive – either in the cashback space, or miles space – and their turf is starting to be eroded in the premium space too. Fun times for the customers…

Good luck to them.

Hi Aaron, if I apply for Ascend and top up $10k in grabpay within the first 3 months, will it qualify for the signup bonus miles? I know there’s a $200 per month limit for the 3.3miles bit.

Yes, it will