CardUp has launched a “4th Payment Free” promo that’s valid for recurring quarterly and monthly payments for insurance, condo fees, education, or helper salaries.

By using the promo code EVERY4FREE, you’ll pay the regular 2.6% fee for 3 payments, then get the 4th at 0%. That’s an effective fee of 1.95%.

For example, if I make a S$1,000 payment each month, here’s what my fees look like for the first 4 months.

| Month | Payment | Fee |

| Oct-19 | S$1,000 | S$26 (2.6%) |

| Nov-19 | S$1,000 | S$26 (2.6%) |

| Dec-19 | S$1,000 | S$26 (2.6%) |

| Jan-20 | S$1,000 | 0 (0%) |

| If this is your first-ever payment with CardUp, you can get S$20 off a minimum payment of S$1,000 with the promo code MILELION |

The promo works slightly differently for quarterly and monthly payments, so do take note of the following:

|

Each payment must be a minimum of S$500 and you’re free to set up multiple payments with this promo code. For example, you could set up one insurance, one condo fee and one helper salary payment.

This code is valid for Visa or Mastercard credit cards issued in Singapore only and the full T&C can be found here.

What’s the cost per mile?

With the 4th payment free, the 2.6% admin fee is effectively cut to 1.95% per month. Here’s how much miles will cost with each card:

| MPD | CPM @ 1.95% | |

DBS Altitude Visa  OCBC VOYAGE  Citi PremierMiles Visa  OCBC 90°N Card |

1.2 | 1.59 |

|

|

1.25 | 1.53 |

| 1.3 | 1.47 | |

UOB PRVI Miles  SCB Visa Infinite SCB Visa Infinite(Spend >$2K per month)  UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 | 1.37 |

BOC Elite Miles World Mastercard |

1.5 | 1.28 |

UOB Reserve  DBS Insignia  Citi Ultima  OCBC VOYAGE (BOS/Premier Banking) |

1.6 | 1.20 |

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

| CardUp FAQ

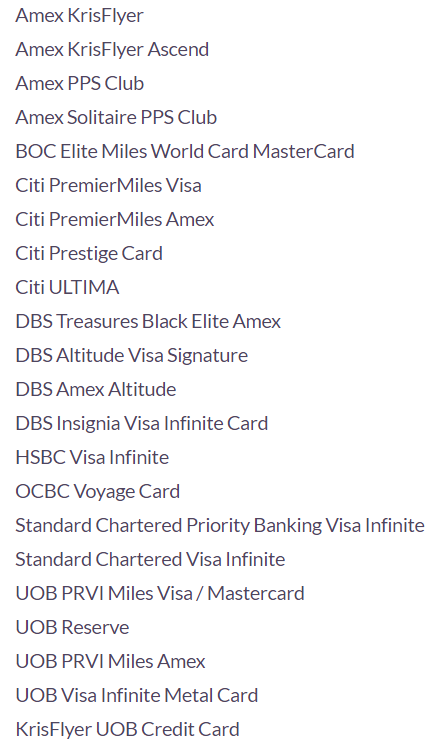

Q: What cards earn miles with CardUp?

Q: Do any cards earn 10X with CardUp? Q: Does CardUp spending count towards sign up bonuses/ promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

What about rental?

The EVERY4FREE code is also valid for rent, but you’re better off using the SAVERENT19 code to enjoy a 1.9% admin fee till the end of the year.

Alternatively, you could also pay rent via RentHero at a 1.85% admin fee until 31 December 2019- have a read of this post for more details.

Conclusion

This promotion lets you buy miles at the 1.2-1.6 cents range, which is generally pretty reasonable given our valuation of a mile. For a detailed list of ways to buy miles in Singapore, be sure to have a read of this article which summarizes the various options.

does it work for existing recurring payments (where to enter the promo code?)?

Hi Chris, The promo code can only be applied on an existing recurring schedule if the first monthly or quarterly payment in the recurring schedule is due on or after 26 August 2019. If so, you can then apply the promo code via the following steps: 1. Sign in to your CardUp account 2. Go to your CardUp Dashboard to view your upcoming payments * Note: EVERY4FREE is only valid on the following payment types – Rent, Insurance, Education, Condo & MCST Fees, Helper Salary, where the first payment in the series has a due date of 26 Aug 2019… Read more »

Says I’m not eligible to redeem this offer

Hi Guinnessrocks,

Are you facing any issue applying this promo code to a new recurring payment series, or to an existing one? We’ve left some instructions on an earlier comment above – if you require any further assistance, feel free to drop us an email at hello@cardup.co!

Cheers – The CardUp team

Can the “EVERY4FREE” and “MILELION” codes be stacked?

nope- one or the other.

Hi Aaron,

I made 2 payments last month towards MCST via Cardup on my BOC World Elite cards. I called up BOC today to check if points had been earned – to my surprise BOC phone officer confirmed to me that NO points are earned as the payment is classified as “top-up”. This is a real shame but am glad I checked.

Any comments thereof?

the BOC CSOs tend to give the wrong info about this- both cardup and boc’s product manager assure me that points are being awarded. see what actually happens to your bank statement?

edit: fwiw, i’ve raised the question again with the team and will update again when i hear back

I made 2 MCST payments via cardup last month on my BOC World Elite Mastercard. on 6 Sept I called BOC Customer Service and checked the miles I had earned for the transaction and was informed “zero” as it is a “top-up” service which I posted here in comments. Update: Aaron contacted me to assure me that CardUp transactions are eligible for BOC points. I pulled up the BOC transaction statement on excel and did the maths myself and voila! BOC miles have been posted for the transactions. As Aaron puts it ” The trials and tribulations of chasing miles”… Read more »