| Update: SCB will be ending the 100,000 miles sign up bonus early. All X Card applicants who apply by 31 July 2019 and get approved by 31 August 2019 will still be eligible. After that, the bonus will become 60,000 miles. |

Standard Chartered has opened applications for the X Card, which offers an unprecedented 100,000 miles sign up bonus.

I’ve written a full review on the X Card here, but the tl;dr version is that although the card is absolutely worth getting for the sign up bonus alone, its other features are underwhelming compared to competitors.

For example, the X Card earns 1.2/2.0 mpd on local/foreign currency transactions (with an FCY fee of 3.5%, the highest in the market), and comes with only two complimentary lounge visits a year. This is well below what other cards with similar annual fees offer (although, to be fair, those cards don’t have a 100,000 miles sign up bonus), and therefore, there currently exists very little incentive to keep the X Card beyond the first year.

Since the 100,000 miles sign up bonus is the main draw of the X Card, it’s crucial that we properly understand how this works- in particular, what type of transactions do and do not count towards the $6,000 spending requirement.

| A quick recap of the 100K sign up bonus requirements |

If you qualify, you’ll receive 100,000 miles in two tranches:

Full T&Cs can be found here. |

Let’s focus specifically on the S$6,000 spending requirement, which must be incurred on eligible retail transactions. These transactions

- must have a transaction date falling in the first 60 days from card approval date

- must be successfully posted to the X Card account within the first 60 days from card approval date

- after posted, cannot be reversed on or before the first 60 days from card approval date

It’s crucial to note the distinction between transaction date and posting date. I may make a purchase at Merchant X today, but the transaction may only post to my credit card account two days later.

In the case of the X Card, you do not want to leave your spending till the last minute! Most transactions will post within 1-3 days, but when so many miles are on the line, you shouldn’t take chances.

What counts towards the S$6,000 spending?

Standard Chartered provides an extensive list in point 57 of the T&Cs describing what does and does not count towards the S$6,000 spending threshold.

| Exclusion List |

| (a) Insurance premiums, including premiums for investment-linked policies, charged to the X Card; (b) Bill payments (Examples of bill payment merchants include but are not limited to Telecommunications and utilities providers such as Starhub, Singtel and M1, Singapore Power); (c) Any payment via AXS network; (d) Any payment via SAM network; (e) Any bill payment made using SC EasyBill programme; (f) Payments to government agencies which include but is not limited to Land Transport Authority, Housing Development Board, Inland Revenue Authority of Singapore, Public Utilities Board, Immigration & Checkpoints Authority and the Ministry of Manpower; (g) Income tax payments; (h) Tax refunds credited to the X Card; (i) EZ-Link cards transactions; (j) CardUp transactions (k) ipaymy transactions; (l) RentHero transactions; (m) Transit Link transactions; (n) Any top-ups or payment of funds to any prepaid cards (with exception of EZ-Reload charged to your X Card) and any prepaid accounts, payment platforms, digital wallets including but not limited to Grab, Singtel, Dash, WorldRemit Singapore, YouTrip or any other accounts as the Bank may specific from time to time, including without limitation to the following accounts or any other accounts as we may specific from time to time (o) Any transactions pertaining to Merchant Category Codes 6211 (Security Brokers/Dealers), 7995 (Gambling/Lotto), 4829, 6536, 6537, 6538 (Money Transfer) and 6050, 6051 (cryptocurrency/Quasi Cash); (p) Credit Card Funds Transfers to the X Card, cash advances from the X Card, purchases via NETS and ongoing instalment payments; (q) Any fees and charges (including but not limited to annual fees, service fees, interest charges, cheque processing fees, administrative fees, cash advance fees, finance charges and/or late payment charges and other miscellaneous fees and charges) charged to the X Card; (r) Any amount charged to the X Card during the Promotion Period that is subsequently cancelled, voided or reversed; (s) Any charges incurred by the X Card but not submitted or posted to the X Card during the X Card Sign Up Promotion Period; (t) Any fraudulent transaction; and (u) Balance owing on the X Card account from other months |

As far as lists go, that’s pretty extensive. I’m not going to go through every item, because some are self-explanatory (e.g. fraudulent transactions, amounts that are cancelled/reserved), but here’s my take on what you should look out for.

Insurance Premiums

Banks have drastically different policies when it comes to paying insurance premiums with credit cards.

Some (e.g. HSBC Revolution) explicitly award points for paying insurance premiums. Others (e.g. Citi Prestige & PayAll) will only award points when you pay through the bank’s dedicated bill payment platform. Still others (e.g. DBS Altitude) don’t award any points for insurance, period.

Standard Chartered has excluded all insurance payments from the S$6,000 spending requirement. Given that CardUp etc. are also excluded, there seems to be little way of getting around this. At most, you can purchase motor, pet or travel insurance via PolicyPal, which still codes as 5734, i.e. software as a service. PolicyPal does not currently support the payment of life insurance premiums.

Bill payments including telecoms and utilities

When Citi ran its incredible 8 mpd Apple Pay promotion last year, one tactic to rack up the spending was to overpay your phone bill at a SingTel Kiosk which accepted contactless payments. That won’t be possible here, sadly, as the T&C exclude payments to Starhub, SingTel and M1 (it’s safe to say that VMNOs like Circles.Life will also be excluded).

No joy for paying your power bills either, as this category is also excluded. This would presumably cover all third party electricity suppliers on the OEM too.

Payment via AXS and SAM

Any transactions made through AXS or SAM stations will not count towards the S$6,000 spending. This includes both the physical stations as well as the virtual AXS e-station. In any case, only Mastercard payments are accepted at AXS, and the X Card is a Visa Infinite, so it wouldn’t work.

SC EasyBill payments

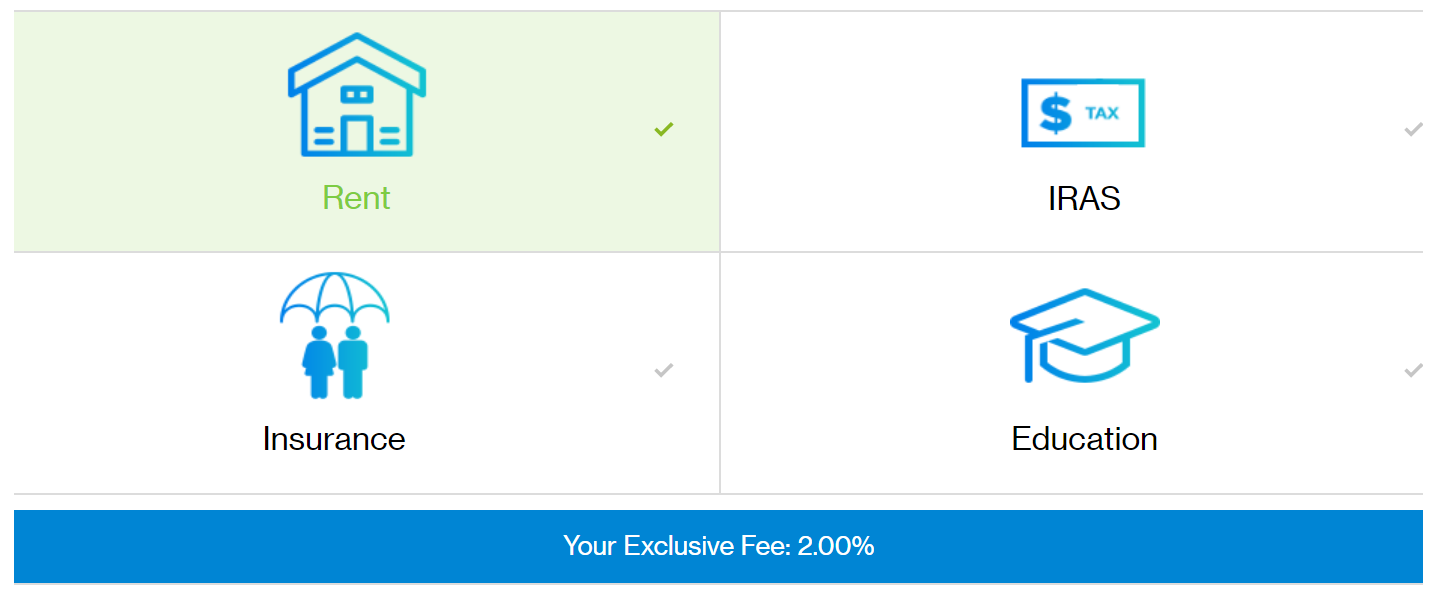

Back in June, SCB launched EasyBill, its competitive response to Citi’s PayAll service. This allowed you to pay income taxes, rent, education, and insurance bills with your SCB credit cards, earning points for a 2% fee.

It’s interesting that SCB has opted to exclude SC EasyBill payments from the S$6,000 spending requirement, because this could have been the shot in the arm the service needed to gain traction. After all, most people are liable to set up recurring payments and forget about them, so there’d potentially still be traction after the 60 days period. Moreover, SCB has already excluded CardUp, ipaymy and RentHero (see below), so that could further nudge people towards EasyBill adoption.

Payments to Government agencies

An unsurprising, but extensive exclusion category. This covers the usual suspects, such as the LTA, HDB, IRAS, PUB, ICA, MOM, and many more acronyms that I can’t even remember. Basically, as long as you see a “.gov” in the URL, you should consider it off-limits.

When UOB decided to exclude government agencies from earning points, they provided the following specific MCCs: 9211, 9222, 9223, 9311, 9402, 9405, 9399. I think it’s safe to assume the same exclusions apply here. You can consider the following non-Kosher too:

- People’s Association & Community Centres

- Town Councils

- Government Hospitals & Polyclinics

- Public recreation such as National Library Board, Singapore Sport Council, Swimming Complexes, NParks, SAFRA

- Postal services such as SingPost, VPOST

- LTA eServices

Private doctors and dentists (e.g Q&M, Nam Seng dental) should not have any issues, but I’d be very careful with hospitals. Although wholly-private facilities like Raffles Medical should be fine, I have absolutely no idea whether restructured hospitals are excluded.

A brief search on the HWZ Credit Card spreadsheet suggests that Farrer Park Hospital, Gleneagles, Khoo Teck Puat, KK Hospital, NUH, Sengkang General and Ng Teng Fong all code as 8062, which would make them eligible, but don’t quote me on that.

Some people have asked if Parking.sg is excluded. Surprisingly, despite its GovTech roots, the MCC of Parking.sg is 7523. This suggests its ok, but in any case no one is going to reach S$6,000 of spending on parking alone.

CardUp, ipaymy, RentHero

This is no doubt disappointing as it would have been the easiest way of hitting the spending requirement. From what I know, all three pay perfectly healthy MDRs to the banks, so this exclusion is probably more to do with discretionary vs non-discretionary spending rather than profitability per se.

I’d be fine with these three being excluded if SCB didn’t also exclude EasyBill transactions (see above), but these don’t count either. This was a prime opportunity for SCB to incentivize adoption of EasyBill, so it’s a shame they’ve not taken it.

Top ups to prepaid cards and accounts

With the exception of EZ-reload transactions charged to the X Card, any top-ups to prepaid accounts or digital wallets will not count towards the S$6,000 spending requirement. SingTel Dash, Grab and YouTrip are listed explicitly, but I would assume there are other exclusions too.

The exclusion of Grab is perhaps unsurprising, given the increased ubiquity of GrabPay acceptance. This does not mean that Grab rides are excluded from eligible transactions; Grab wallet topups code as GPAY Network (S) Pte Lt, while Grab rides code as GrabTaxi Pte Ltd. The latter should be safe; the former, not.

I know that the MCC of FavePay transactions depends on the underlying merchant, so my guess is it won’t fall afoul of this restriction. Remember- FavePay is not like GrabPay, in that the latter is a prepaid wallet, and the former is more of a payment facilitator. With FavePay, your card is charged at the moment of transaction; with GrabPay, you’re using credits you purchased earlier on your card.

Other grey areas

Donations are a commonly excluded category from earning points, but they’re notably absent from the X Card’s exclusion list. I can’t say if that’s oversight or design, but I definitely wouldn’t feel comfortable relying on this to hit my S$6,000.

Payments to educational institutions are not excluded, and indeed, the SCB Visa Infinite regularly awards base points for these transactions. This is provided the institution is not run by the government- so Learning Lab, private higher education institutions and the like should be fine.

| Edit: The updated T&Cs have excluded education payments. Make these at your own risk now |

PayPal shouldn’t be a grey area, given that it’s a perfectly legitimate way of paying for retail purchases, but unfortunately given recent developments like Citi’s initial attempt to exclude it altogether (which it backed down from), people are understandably jittery.

I wouldn’t risk it with payments to personal PayPal accounts, or to any PayPal account associated with an excluded MCC (e.g. investment services, forex trading). However, I see no issue with using the X Card to make retail purchases on sites like Singapore Airlines, Airbnb, eBay, Skype etc., although these all accept regular cards anyway so there’s really no reason to use PayPal.

It should be fine to use PayPal on the websites of SMEs which don’t accept credit cards, but you do want to make sure that they’re Business accounts and not personal ones (e.g. some blogshop owners may be using personal PayPal accounts for simplicity).

Note: Those thinking of spending on PayPal should have a read of Hans’ comment below and decide if they’re willing to take the risk

Summing it up

Here’s my personal take of what I’m comfortable/not comfortable considering as part of the S$6,000 spending requirement. I’m going to caveat everything below by saying I’m not SCB, nor have I spoken to anyone at SCB regarding this. Therefore, there is no guarantee that things will play out as described below, so take it with an Alexandria Ocasio-Cortez sized liberal pinch of salt.

| Comfortable | On the fence | Not comfortable |

| Private hospitals/ clinics/ dentists | Restructured hospitals | Donations |

| FavePay, Liquidpay and other “charged at payment” platforms | SimplyGo | Personal PayPal accounts |

| Grab rides | Business PayPal accounts (see reports in comments) | Any mobile wallet where you buy credits before paying |

| Stripe transactions | Education/ tuition fees (perhaps ok for private, not ok for public) | |

| NTUC vouchers, IKEA gift cards, Cold Storage vouchers, Qoo10 gift cards | ||

| PolicyPal | ||

| Points.com transactions |

Conclusion

Those of you planning big ticket purchases such as weddings, hotel banquets, overseas vacations or housing renovations should rest easy- there’s no way those won’t count.

Otherwise, if you’re planning to contact customer service to confirm the eligibility of specific merchants, I’d strongly urge you to get everything in writing. There is precious little point in winding up in a “he said she said” situation when your bonus doesn’t credit.

Cortez

thanks, bleeding heart liberal.

I like that very casual mentioning of AOC there. I conclude this is a political post!!! hahahah

we’ve got a Trump lover here! where’s your MAGA hat?

Hmm, when does not thinking highly of Cortez = Trump lover. Sophomoric binary thinking; in jest perhaps?

You can also buy Changi Gift Card if you’re a frequent traveller. Valid for 12 month and can use at Changi Airport both transit and public areas.

Does that really work?

Changi gift card does not earn any changi reward points, which is a bummer.

Great article !!

Is grabpay MasterCard considered a wallet you think?

GrabPay is explicitly mentioned in the article above…

Excluded in the terms & conditions

I was thinking the same question too till this noon, my colleague and myself realized that SQ is not in the partner list that you could redeem your 360 rewards points to miles.

So, to us, that 100K miles, not that attractive any more…

It definitely is on the list, they just left it out in that screenshot

It is definitely available for Krisflyer miles redemption. I know in Aaron’s post it seems like it is left out, nice observation there! But I blame SCB for that, Aaron screenshot it, it is not his fault. It is kinda in a different page where you redeem it.

It’s not in Aaron’s post but in the x card page FAQ, it’s lame…

How can they leave krisflyer out? How stupid that is! But anyways, good to know! Thanks dear!

From the T&Cs The X Cardholder can redeem his/her 360° Reward Points for KrisFlyer Miles or Cash Rewards in the manner set out in the Rewards Programme Terms. The X Cardholder may also redeem his/her 360° Reward Points for Hotel Partner Points or Airline Partner Miles in the manner set out via Transfer Rewards in the SC EasyRewards Terms and Conditions found in Rewards Programme Terms. Please take note of the applicable fees and terms and conditions that apply in the Rewards Programme Terms and in the SC EasyRewards Terms and Conditions found in Rewards Programme Terms in relation to… Read more »

Thanks PNG for sharing this. We applied already 🙂

Just to add on, from my own findings, SQ miles are under the SC Rewards Redemption webpage (only via browser). However, if you want to claim miles for other airlines you have to do it in the online banking app “Credit Card Rewards”, “Transfer Rewards”.

So for Cashback and SQ miles – SC Rewards online

For other airlines and travel credit – SCB Mobile App

Thanks Aaron – very clear on what to spend on – a fully automated coffee machine. Can’t spend 6k on Starbucks latte at one go. That will take 1000 mugs – do t think Starbucks stock 1000 mugs in a single store.

What about Starbucks card TOP up …

How about spending in carousell? Can simply ask someone to list an item for 6k and purchase it using caroupay. Only need to pay 2% service charge of the listing fee which is S$120 in this case.

That’s a good idea! Haha

Haha share if this works

How to know if it works till after when it comes time for the bonus miles to be awarded, at which time it’ll be too late incase it doesn’t work?

Service fee still applies? I thought the fee has been waived for a while now?

How? Can anot?

I guess NUS/NTU are not belongs to government agencies right ? Saw their logo in the government agency photo 😅

So total points we will receive is equivalent to 130,000 miles

30,000 = Annual Fee

100,000 = bonus after hitting the $6,000 spend?

No. You will get 160,000. You get an extra 30,000 on top of all that for not reading the article or Standard Chartered webpage.

Hahahaha I like you so much, so funny you

You can read?

And this is exactly why i dont get Stanchart here. Do they want to capture the new clientele base, or they are so obsessed about not giving away the miles? They will earn exactly the same cc fees in cardup, easybill etc, yet, they want to exclude these customers, and for sure, most people who use cardup are exactly the ones in the miles game. Putting up a huge miles signing bonus and excluding the majority playing the miles game, what are they thinking here? A $700 annual fees for a card that has no feature except the 70k bonus… Read more »

Ya, you are making every sense here, these few days we been talking about where to spend this 6K given so much exclusion.

And indeed, a visa infinite card with no attractive feature, like the CIMB one, but CIMB doesn’t charge annual fee ah…

Hello! I just wrote in to enquire about paying for hospital bill and they said “Please be advise that government sector, hospitals and schools are eligible for the $6K spend and get promotion.”

“However, government agencies which are not eligible are stated on the T&Cs – LTA, HDB, IRA, PUB, ICA, and the ministries, basically those govt agencies which are payable for monthly recurring services.” hope this helps someone!

Where did you write in to? Email?

thanks for this update! good that you have it in writing.

Hi P, the wrote back that Govt Hospitals are eligible too ! Woohoo

Never seen someone so happy to have to visit hospital and spend money.

This is amazing work! Thanks Aaron.

since u specifically mentioned ‘the learning lab’ (mcc 8299) i called scb and they said this is a qualifying transaction.

just as a side note, citibank doesnt give thank you points for learning lab when u swipe the card. i spoke to them as well.

Hi Aaron. Can I use this card for my children’s polytechnics tuition fee bill

A clear ‘first year only’ card if you have SC VI. Also, if you take into consideration the opportunity cost of using the X to hit $6K, the miles earn rate will be slightly reduced; more so if a major portion of it is in FCY.

Actually, local spending may incur the higher opportunity cost. Most local spending would be on UOB PPV by Paywave, thus earning 4mpd. Thus the opportunity cost is highest at 2.8mpd.

Agreed. My comparison was between SC VI and VIX. Your comment is true for DBS WWMC (<=$2K/pm) as well.

Would transactions on Points.com be counted towards this SCB X Card 6k Spend?

Might consider using this card to buy miles now during the 50% bonus Alaska Mileage Plan sale.

Anybody have standard charter email? i would like to find out if thithing to a church organisation counts as well.

Just wondering if re-contracting with any of those 3 telcos will be considered as qualifying transaction? Thank you!

This might not be applied for SCB, but just FYR, I bought travel insurance using WWMC via PolicyPal, x9 bonus points was not given by DBS.

Upon query using IB mailbox, DBS quote “… I wish to confirm that the relevant department has identified this transaction as a payment for an insurance broker. For such transaction, DBS Bonus points may not be given for payments to financial institutions (including banks, online trading platforms and brokerages)… “

further update from DBS: “… Firstly for all types of transactions, we give points based on system indicators, any disputes from customers we will have to check with our relevant department (Business Unit) on the confirmation of that said transaction that customer(s) is disputing on. System indicator is the merchant’s indicator in which this merchant is categorised under. As per the previous officer’s checking, this merchant PolicyPal is tagged under the same type of category regarding insurance and financial broking. As long as the merchant is registered/tagged under this, it doesnt matter what type of products they sell nor what… Read more »

[…] Aaron from the Million (also my unofficial “Shi Fu”) has listed in extensive detail of all exclusions. […]

Stupid question: does the annual fee count towards the spend

(q) Any fees and charges (including but not limited to annual fees, service fees, interest charges, cheque processing fees, administrative fees, cash advance fees, finance charges and/or late payment charges and other miscellaneous fees and charges) charged to the X Card;

thanks!!!

I’m guessing gift cards are ok? Like Amazon, etc.

Just received my card after four days after confirmation. As the card doesn’t come with much benefits there is no booklet like other cards etc

The email say I will receive the card in 3 working days. No digital card for me (no idea why).

Well, 1 week later no X-Card.

Bummer – wonder if SCB ran out of blank cards as response greater than X-Men movie release or ran out of the lighted box which I saw on some blog site. ……. anyway, I’m going overseas next week and can’t receive any card.

My box got no light ;(

Same….over a week and NO card. SC’s new strategy to make sure more people don’t make the 6k spend?

I asked about the eligibility of some transactions and received the following reply from Stanchart in my ibanking mailbox:

Please be informed that purchase of gift cards at shopping centres, SimplyGo and private overseas educational institutions are eligible transactions for the X Card sign up bonus of 70,000 miles for spending $6,000.

Please be advise that charitable donations are not eligible to count towards the qualifying spending of $6,000.

Now they say Charitable donations are excluded for $6,000 spending?? OMG….SCB, is really mucking it up and chopping & changing as things go along.

Would using the card to buy Ntuc/taka vouchers be eligible?

I believe Aaron answered ‘yes’ in another article’s comments.

How about capitaland vouchers? Is it eligible?

How about capitaland vouchers?

is casino levy excluded?

it’s an interesting thought, but if the MCC for gambling is excluded, i wouldn’t feel safe trying.

I spoke to an SC consultant using their online chat to check my SC X transactions, and he told me that my Paypal transaction is excluded. My Paypal transaction was made to a local SME to buy labels through their online shop – meaning I place the order on the merchant site, the website redirects to Paypal, I login to Paypal and use my SC X card to make the payment, and after completion it redirects me back to the merchant’s page saying transaction successful. For reference, the merchant is Inkbow. The SC consultant quoted the TNC clause 57 (n)… Read more »

thanks for this data point. people who call SCB are getting varied responses re: paypal, so this is a YMMV thing. i heard rumours that from next month’s statement they’ll include a tracker, but i’ll believe it when i see it.

I am in literally the same situation as Hans above (my payment was to a contact lens company Eyelookgood).

Prior to my payment, I had confirmed with the company that their Paypal account was a business account.

Just spoke with SCB customer service over online chat and over phone call – their conclusion was that all Paypal payments (business account or personal account) would not be eligible for the bonus miles promotion. According to them, this is because Paypal is considered a payment platform and hence not eligible.

Thanks for the update, have put a notice in the article

Now I am truly upset with SCB. There is nothing much I can do when I have to prepay online and PayPal pops out with no alternative online options. SCB is just being ridiculous in trying to limit their new card launch expenses

[deleted]

Not directly related but i notice different bank treats Grab code differently. X Card does reflect the code as per the article but i recently signed up for DBS Black Elite card and the merchant code and MCC is different. All my grab transaction, be it topup or rides, is reflected as “GPAY NETWORK (S) PTE L SINGAPORE 702”. I followed milelion’s digibot guide and further check show that grab ride is tagged as “LIMOUSINES & TAXICABS” while grab topup is tagged as “TRANSPORTATION SERVICES”. Interestingly, gojek rides is also tagged as “TRANSPORTATION SERVICES”. My question is whether MCC code… Read more »

does anyone know how to confirm if you have qualified (spent 6k) for the signup bonus? I am pretty sure i did but just want to confirm. Called their customer service they just asked me to check T&C clause 53 which says we will be notified via SMS, but i didnt received any SMS.