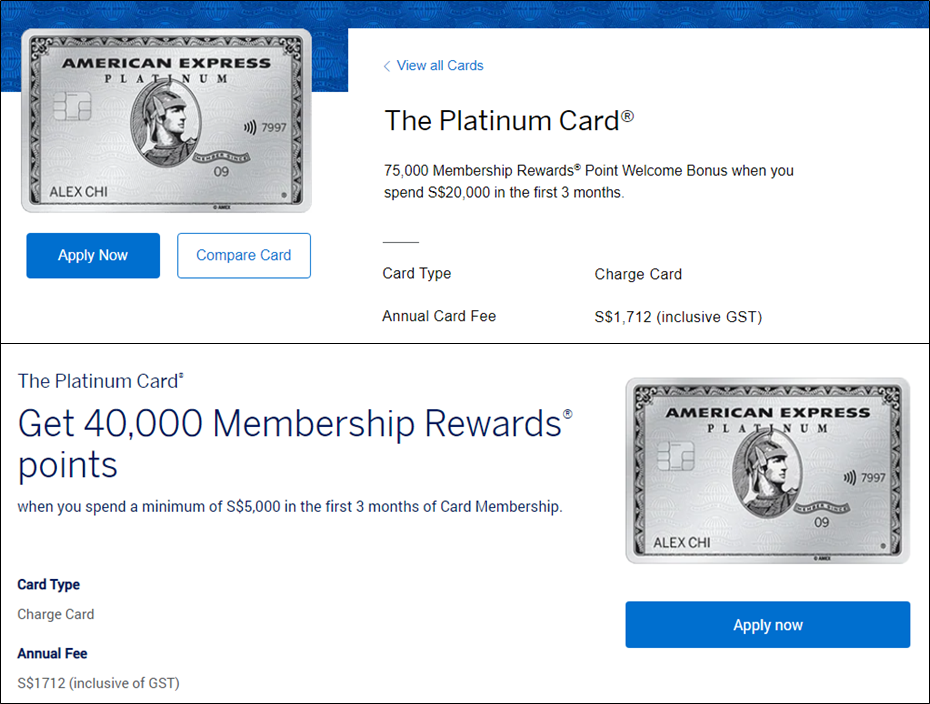

The AMEX Platinum Charge packs a whole load of perks, but with an annual fee of S$1,712, it’s a significant financial commitment. This means it’s important to take a close look at the benefits before deciding whether to pull the trigger.

I last did a valuation of the AMEX Platinum Charge’s benefits a year ago, but as 2019 draws to a close, I figured it’d be good to update the analysis once more.

AMEX Platinum Charge Valuation Overview

A quick caution before we begin: it’s important you don’t take this valuation figure as final, because valuation is inherently subjective. You should carefully consider the perks in light of your own lifestyle and travel patterns: Do you travel often? What type of hotels do you stay? Do you like to eat out, and if so, at what kind of restaurants? How much do you spend on lifestyle a year? All these will make a difference to your personal valuation.

That said, here’s my take:

| First year benefit only |

Sign up bonus of 115,000 Membership Rewards (MR) points

| Availability | Estimated Value |

| First year | S$1,290 (if converted to KrisFlyer) |

If you sign up for the AMEX Platinum Charge through the MGM link below by 31 March 2020, you’ll receive 40,000 bonus MR points when you spend S$5,000 in the first 3 months.

Get 40,000 additional MR points with the AMEX Platinum Charge here

Spending a further S$15,000 within the same period (i.e S$20,000 total) will unlock another 75,000 bonus MR points, so you’ll have a total of 115,000 bonus MR points (and 25,000 base MR points).

We’re only going to value the bonus points, since that’s one of the card’s perks. 115,000 MR points are equivalent to 71,875 KrisFlyer miles, which based on my latest valuation of 1.8 cents each are worth ~S$1,290.

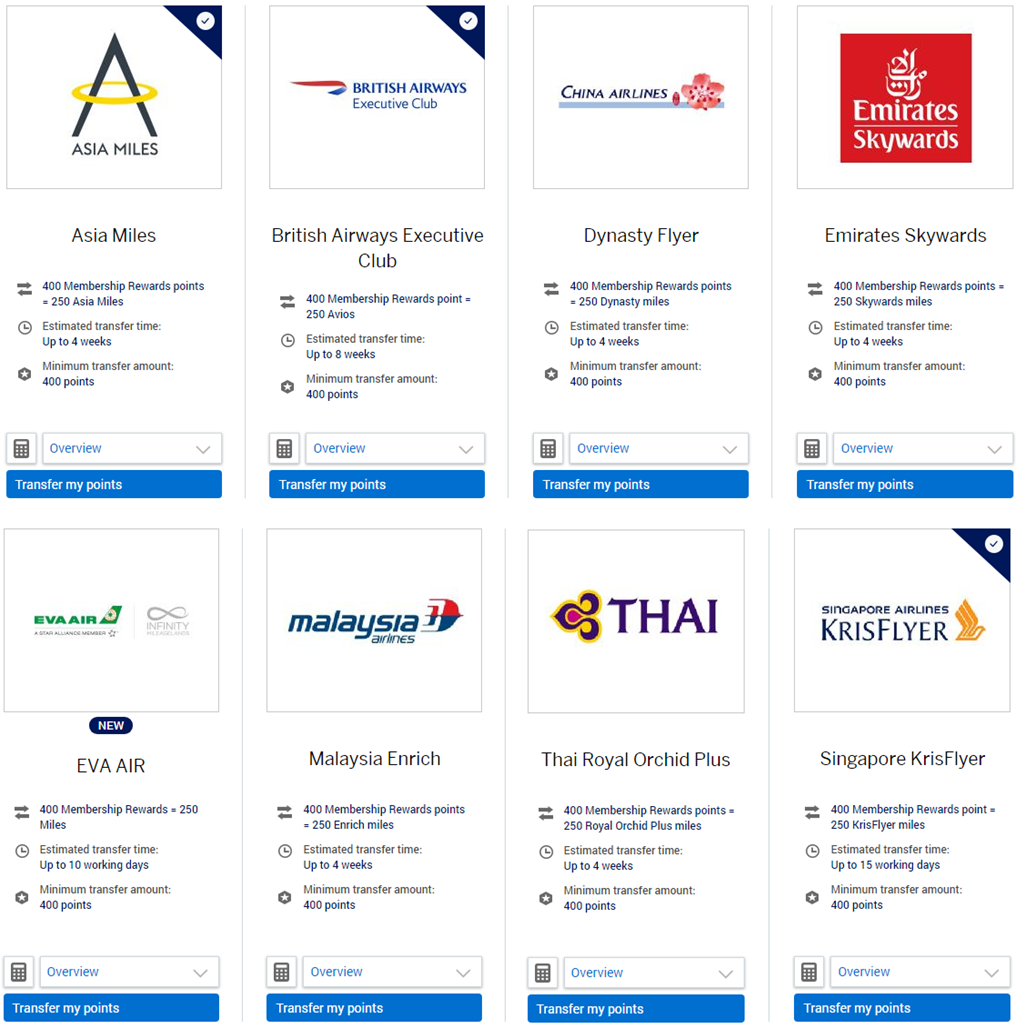

MR points can also be transferred to Asia Miles, British Airways Executive Club, Dynasty Flyer, Emirates Skywards, EVA Infinity MileageLands, Malaysia Airlines Enrich, or Thai Royal Orchid Plus, all at the same ratio.

MR points do not expire, and there are no transfer fees involved.

S$800 hotel and airline credit

| Availability | Estimated Value |

| Each membership year | S$800 |

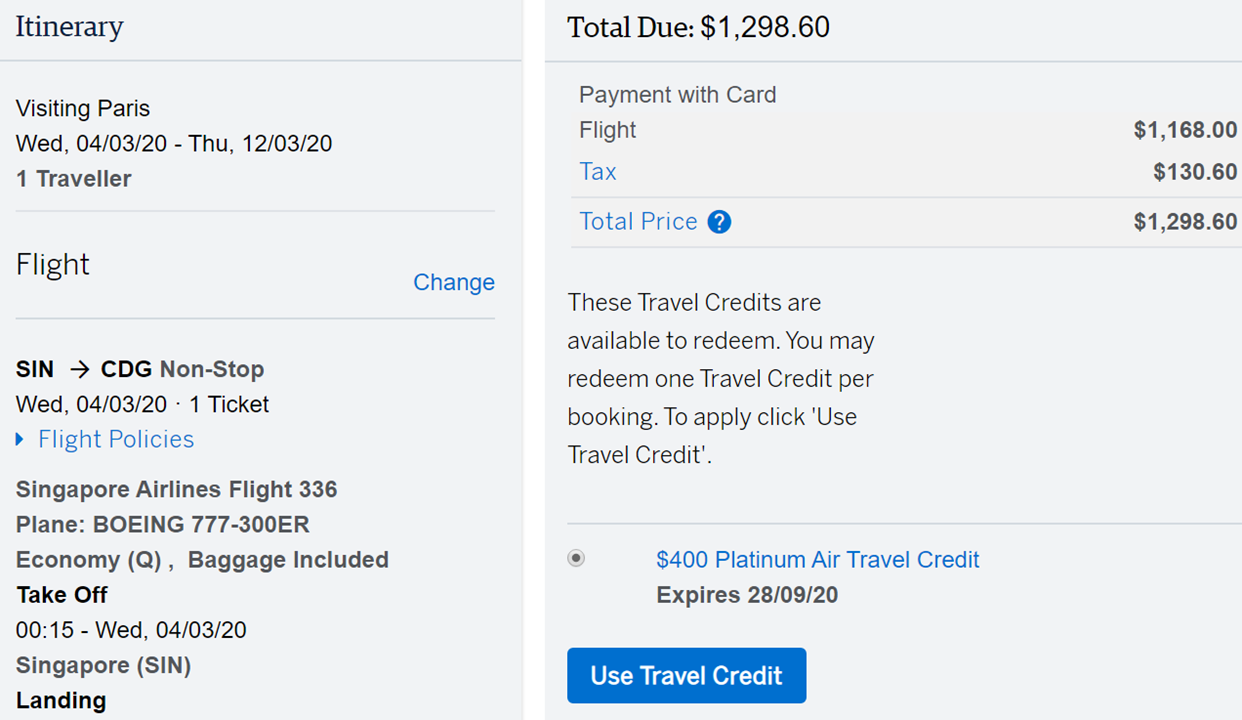

AMEX Platinum Charge cardholders receive a S$400 airline and S$400 hotel credit each year of membership. Both these credits need to be used via the AMEX Travel Portal, where you can book flights and hotels with no additional booking fee.

The airline credit can be spent on tickets in any cabin on a full service airline. It can also be stacked with special programs like the IAP, which allows you to purchase discounted Premium Economy, Business, and First Class fares on Singapore Airlines, American Airlines, British Airways, Emirates, Etihad, Japan Airlines, and Qatar Airways.

The hotel credit can be used for any hotel you can find on the AMEX Travel Portal. Do note it’s no longer possible to stack the credit with bookings made through the Fine Hotels & Resorts program, or The Hotel Collection.

2 free nights at selected Mandarin Oriental/Banyan Tree hotels

| Availability | Estimated Value |

| First year | S$700 |

As a welcome gift, AMEX Platinum Charge cardholders receive a two night stay at selected Mandarin Oriental/Banyan Tree resorts worldwide. Cardholders can also opt to do a one night stay at the Capella Singapore or Mandarin Oriental Singapore.

|

|

The value of this gift depends on the property you pick, and can range from as low as S$140 a night at the Angsana Phuket to as high as S$650 at the Mandarin Oriental Hong Kong. I worked out the median value of all the properties on offer to be about S$350 a night, so over two nights that totals S$700.

1 free night at the St Regis/ W Singapore

| Availability | Estimated Value |

| Each membership year | S$380 |

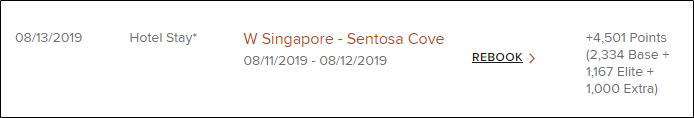

AMEX Platinum Charge cardholders receive a complimentary one night stay (inclusive of breakfast) at the St Regis or W Singapore each year of membership.

After browsing through different dates, the lowest breakfast-inclusive rate I found for the St Regis and W was about ~S$380, so that’s the value I’ve taken. In case you were wondering, the free stay does count towards your elite nights for the purposes of elite status requalification, and you’ll earn points on incidental expenditures like dining and spa treatments.

American Express has recently expanded the number of places where the annual one-night stay voucher can be used to 19.

Unlimited airport lounge access

| Availability | Estimated Value |

| Each membership year | S$590 |

AMEX Platinum Charge cardholders have no shortage of lounge options. All cardholders (whether principal or supplementary) can access the following lounges:

- An unlimited visit Priority Pass (+1 guest, available to the principal cardholder and first supplementary cardholder)

- Plaza Premium Lounges (+2 guests)

- Delta Sky Clubs, when flying on Delta

- Centurion Lounges (+2 guests)

- International American Express Lounges (+2 guests)

It’s hard to estimate a value for this, but the cost of an unlimited visit Priority Pass (with no guest benefits) is US$429 so we can take that as a baseline and adjust it up or down depending on your travel patterns. Your valuation will obviously be lower if you’re an infrequent traveler, and higher if you vacation with family in tow, or if you get the two complimentary supplementary cards for additional lounge privileges.

S$300 of dining vouchers

| Availability | Estimated Value |

| Each membership year | S$300 |

AMEX Platinum Charge cardholders will receive S$200 of St Regis dining vouchers (4 X S$50) and a S$100 Tower Club voucher. All these vouchers have no minimum spend, and in the case of the St Regis, can be stacked with the Love Dining discount.

There’s also a S$50 Marriott dining voucher, but this has a minimum S$100 spend so we won’t include it in our valuation.

Complimentary travel insurance

| Availability | Estimated Value |

| Each membership year | S$250 |

Although complimentary travel insurance provided by credit cards is typically lackluster, the AMEX Platinum Charge offers much more comprehensive coverage.

So long as you book your air tickets with your AMEX Platinum Charge (or pay the taxes and fees on award tickets), you’ll be insured for:

- S$1M for death or total permanent disability

- S$1M of medical expenses, including dental

- S$1M for personal liability

- S$10,000 for trip cancellation or trip curtailment

- S$1,250 for loss of personal belongings

- Flight delays, baggage delays, lost luggage and missed connections

Do note that the policy does not cover for rental car damage, so you may want to get separate coverage for that if you think it’s necessary. I’ve valued this at roughly the cost of a discounted annual travel insurance policy.

Hotel/rental car elite status

| Availability | Estimated Value |

| Each membership year | S$200 |

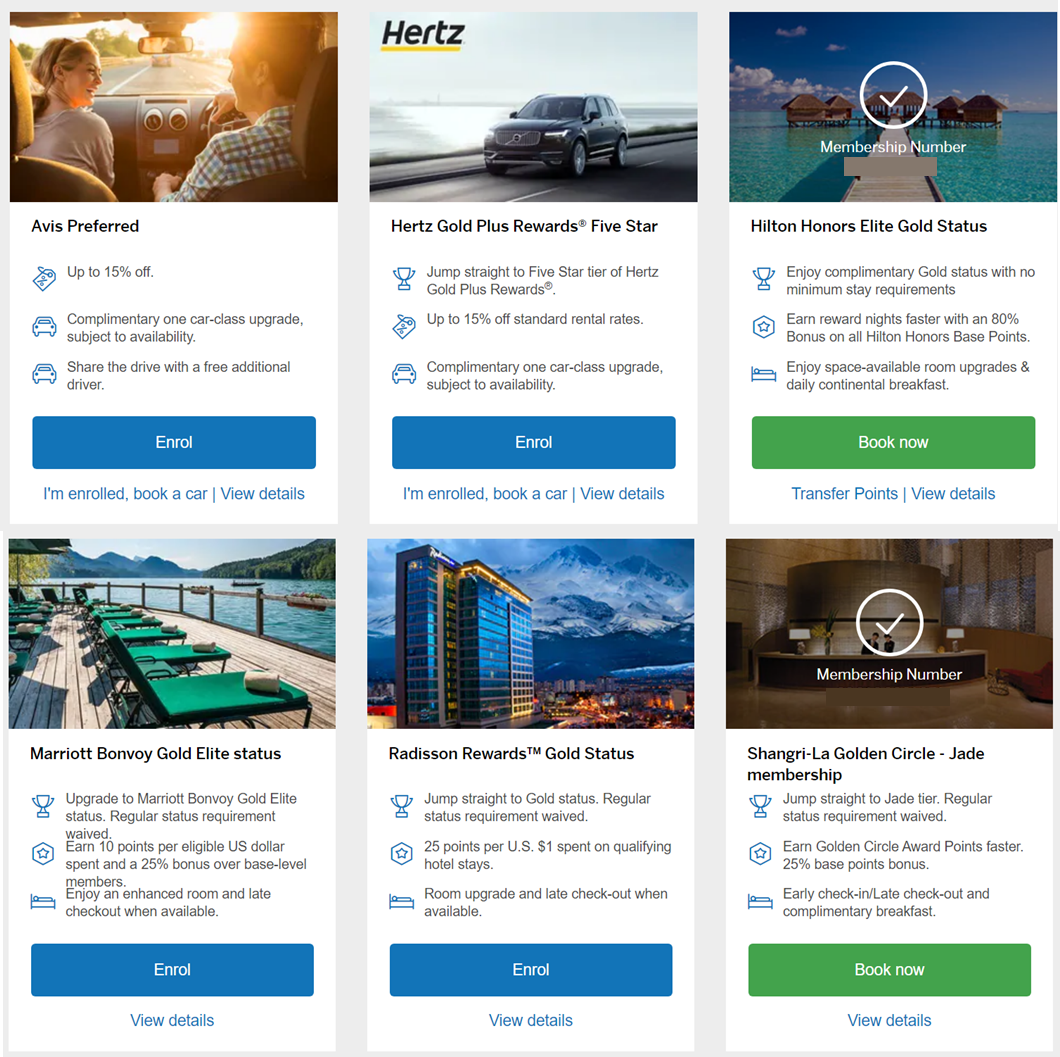

AMEX Platinum Charge cardholders receive complimentary elite status with the following hotels and rental car chains:

- Hertz Gold Plus Five Star

- Hilton Honors Gold

- Marriott Bonvoy Gold

- Shangri-La Golden Circle Jade

- Radisson Rewards Gold

Of all these, the most useful is probably Hilton Gold because you’ll receive free breakfast for 2 people every day of your stay. You’re also entitled to room upgrades, and although the better ones will probably go to Diamond members, getting an executive room upgrade will at least get you lounge access. There’s an 80% bonus on points earned through stays, and your 5th night redemption will be free (very useful when buying Hilton points for aspirational redemptions).

Valuing elite status is a tricky exercise, but I’ll ballpark the combined value at a conservative S$200 based on upgrades, bonus points and free breakfast.

Spa Vouchers

| Availability | Estimated Value |

| Each membership year | S$300 |

Cardholders receive three complimentary spa treatments each year- a 60 min complimentary detox massage at Adeva Spa, 90 min complimentary ginger detox massage at The Ultimate Resort Spa, and 60 min complimentary deep tissue body massage at Spa Rael.

The retail price is S$940, but that’s only relevant if you’d actually pay that out of pocket. For me, the most I’d pay for a good spa treatment is S$100 each time, so I’m going to take S$300 as my valuation.

Misc benefits

I’ve not assigned a value to the following benefits, but it’s worth taking note in case there’s something in here you fancy:

- Up to 50% off dining with Love Dining Benefits

- AMEX Offers including rebates on hotels, petrol, groceries and dining

- AMEX Fine Hotels & Resorts benefits including room upgrades, daily breakfast, early check-in, late check-out and a US$100 amenities credit

- Access to Tower Club facilities including gym (reservation required)

- Access to 67 Pall Mall in London

- Free entry to Capital, Zouk and Phuture with 1 guest (first 100 members and guests)

- Complimentary weekend parking at Great World City (Friday, Saturday, Sunday)

Bold= available through other AMEX Platinum cards too

In the past year cardholders have also enjoyed some unexpected surprises, like a complimentary night’s stay at the Outpost Hotel.

In addition, AMEX organizes periodic events for cardholders, like watch shows, wine sales and of course, the no-expenses-spared Platinum af’FAIR blowout, where everyone tries to eat and drink their S$1,712 worth. The events are always very well done; here’s some shots from a recent IWC show where you could make your own flower bouquet, sample artisanal gelatos, dissemble a watch movement and other fun things.

You can’t really place a value on these because of their randomness, but it’s still worth taking into account.

Remember that if you want to stretch your value even further, you can get up to two supplementary cards for free. Although you’ll only get one set of vouchers per principal cardholder, your supplementary cardholders can still enjoy:

- Unlimited lounge access (with the same guest allowances as the principal cardholder- only the first supplementary cardholder will receive a Priority Pass)

- Hotel/rental car elite status

- Tower Club access

- Complimentary travel insurance

- Love Dining benefits

- Access to Tower Club facilities including gym (reservation required)

- Access to 67 Pall Mall in London

- Free entry to Capital and Zouk with 1 guest

- Complimentary weekend parking at Great World City (Friday, Saturday, Sunday)

Conclusion

When you pay S$1,712 for a credit card, you definitely want to make sure it’s worth the investment. The AMEX Platinum Charge has so far worked out for me, and I imagine it’ll be suitable for frequent travelers or those who spend a fair bit on lifestyle expenditure like dining and staycations.

If you’ve decided to hop onboard, remember to get your 40,000 bonus MR points by signing up through the MGM link below:

Get 40,000 additional MR points with the AMEX Platinum Charge here

Any idea how strict they are with the income requirement of 200k?

150k+ should be ok

Corrections to lounge benefits:

Delta Skyclub no guests (cardholder only, supplementary cardholders included), must be flying Delta

Plaza premium is +2 guests, not +1

Thanks for the clarification. Plaza premium is +1 guest from the card, then + another from priority pass I think

Plaza premium is +2 from amex card – no need for priority pass for plaza premium. Tried many times across different plaza premium lounges

Not sure if this has expired, but the Shangri-La Golden Circle Jade status match to Krisflyer Elite Gold was a huge swing factor for me.

Even if it’s just for 1 year, the perks you get if you’re a frequent traveler (coach) is unparalleled.

Great summary.

Though many of these benefits come at an opportunity cost. E.g. the hotel and flight credits cannot be stacked with cashback/vouchers, we can’t use a 4mpd card, other OTAs may be cheaper etc. But yeah, tough to factor that in for sure.

Like you said: That whole thing is very subjective. For me 1 year is all I paid for. Citi Prestige covers my +1 airport lounges (almost “for free” given the AF of $535 comes with yearly 25k miles) which is really the only thing I don’t wanna miss out of the 1712’s offerings.

thanks! yes, valuation is highly subjective. interestingly i was in the opposite situation of you- i gave up my citi prestige for the AMEX PC because i simply wasn’t using the 4NF benefit, and my lounge benefits were covered by AMEX PC. The nuking of hte Citi prestige limo was the last straw.

CPMC priority pass is superior to amex’s because Citi’s still retains the restaurant credits – amex got rid of it in august

Still considering.. one reason is I may not hit 20k spending in the first 3 months to gain all the bonus.

use it to top up grabpay 🙂

Would cardup count towards the $20k spent?

Yup

Hi Aaron is the spa voucher for 1 pax or 2 pax?

1 pax. Companion rate about 40-50 bucks

The Outpost hotel offer was a bit of a farce – I know of a few people who tried to book and were told there was no availability and it was fully redeemed – even though nowhere it mentioned limited avails. in the end they got a $50 Taka voucher…not quite the same. Also the priority pass has been downgraded with the withdrawal of the restaurant perk. Overall (mainly for the PP with supp for our family of 4) I still renewed this year, but had they not thrown in some MR points I probably would have thought twice

Amex’s Jamie Lee gave me additional 90k MR points for renewal.

Do new cardholders also get the 1 night stay at W/St Regis?

yes

Thanks. Will the referral bonus be applicable to existing Amex cardholders (e.g. krisflyer card) signing up for the platinum charge card?

Yes, also will get

Thanks. I called the hotline and the cso said that existing Amex cardholders are not able to receive the 40k points if referred by a platinum charge card member.. Would be helpful to clarify.

you are eligible to receive the 40k points if you apply via the MGM link, so long as you do not hold an existing amex platinum charge card. it does not matter what other amex cards you currently hold.

I received the 40k points thanks to the Milelion MGM link. Thank you.

Can I check does PayPal transactions with online merchants count towards the $20k spend?

Yup, unless you’re using PayPal to pay for insurance

Can do other prestige credit cards for comparison also?

Thank you

try this: https://milelion.com/2019/04/13/2019-edition-120k-credit-card-showdown/

i’ve not included amex plat charge as i feel it occupies a segment apart from citi prestige/hsbc VI (much higher annual fee)

Anyone tried the Hilton Gold Status match? I applied for a match over 1 month ago and it remains pending. Amex CSO said it takes 8 – 10 weeks to process. Anyone has any reference point?

my status took about 4 weeks to upgrade.

Thanks! I might send them a chaser.

hi Aaron, whats the regular MPD rate on this card, if any?

0.78 mpd

My company gave me an Amex card since 1987. Amex used to be a prestigious card; now, I consider it, a pariah card: I have often encountered shops, restaurants and other establishments, in Singapore and overseas, refuse to accept Amex…even when they have Amex sign hung up on their doors. Thank God for Visa. It often rescues me from embarrassing moment, when a restaurant refused my Amex.