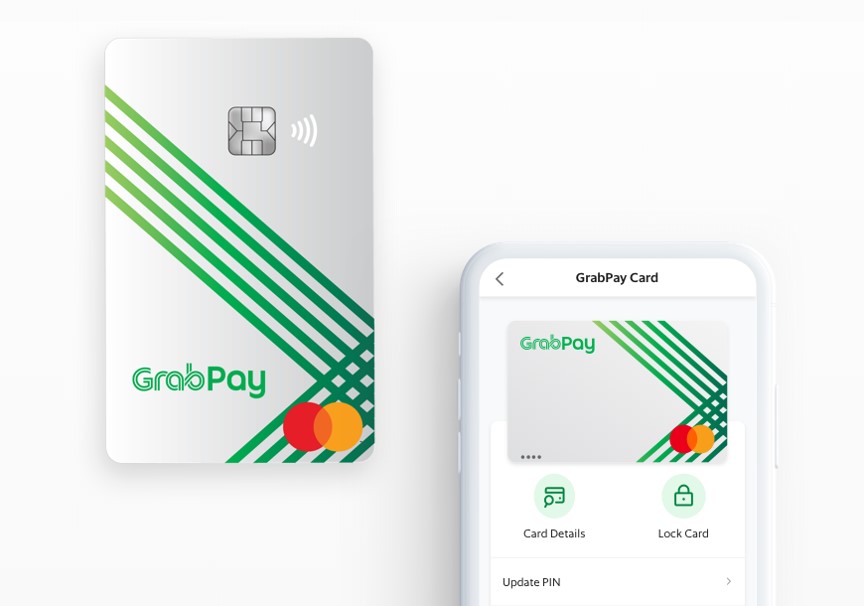

Grab’s quest for world (or at least regional) domination continues with the official launch of the GrabPay Card, Asia’s first so-called “numberless card” (card details are stored within the app, not displayed on the physical card).

If this sounds like old news to some, that’s because the GrabPay Card actually soft-launched in June 2019. Up to this point, however, it’s been invite-only. With the official launch, applications are open to anyone with a Grab account in Singapore.

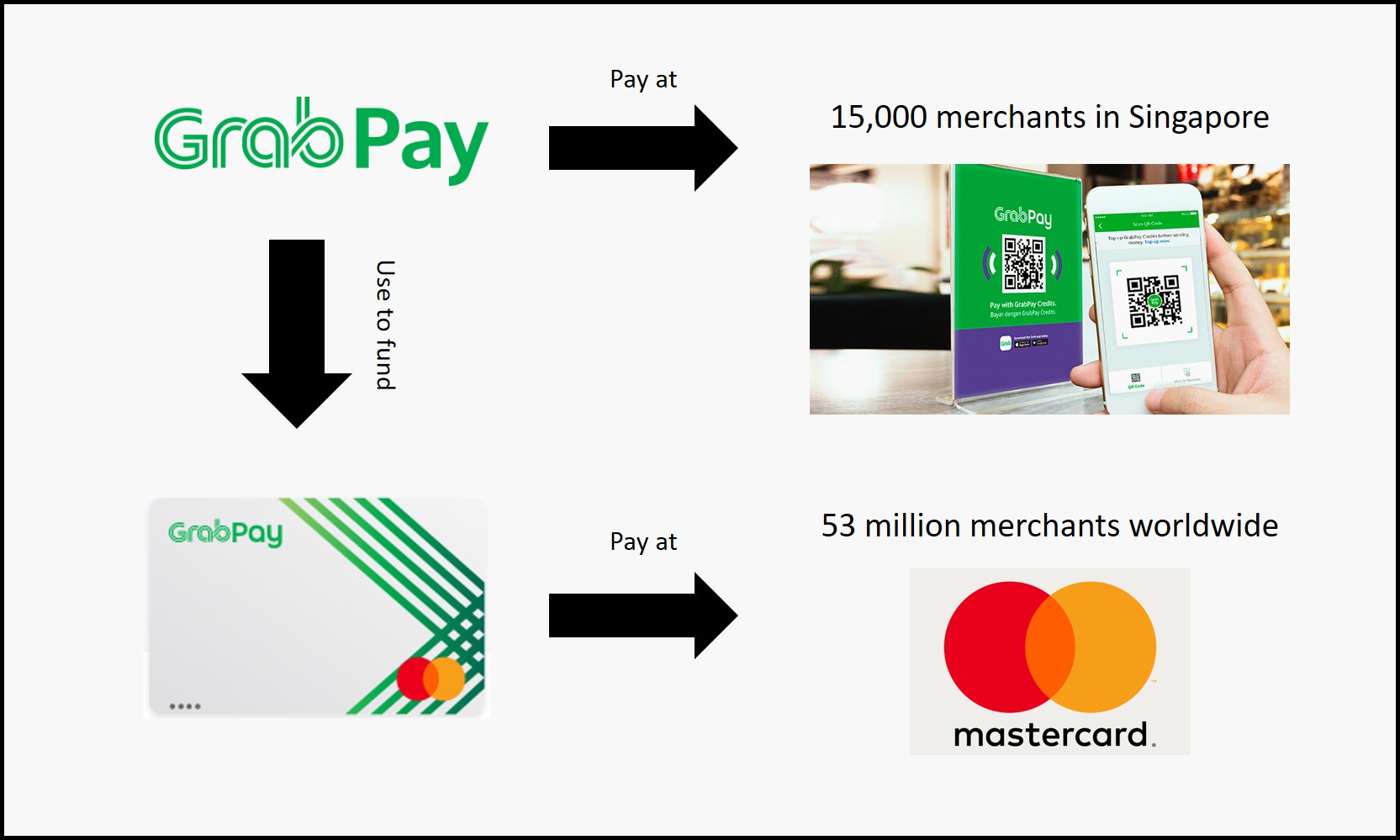

What’s the GrabPay Card? Think of it as a way to spend your GrabPay balance at merchants who don’t take GrabPay.

Maybe that’s too confusing. Let’s try again: the GrabPay Card allows you to spend your GrabPay balance anywhere Mastercard is accepted. This means your GrabPay balance becomes a lot more liquid- you can’t cash it out to a bank account, but you can spend it at any of the 53 million merchants worldwide which accept Mastercard.

| tl;dr |

| The GrabPay Card is a great option for miles (and even cashback) chasers- as long as it’s possible to earn rewards on GrabPay top-ups. Take that away, and the value proposition declines significantly (although it’s still useful for transactions like hospital and education bills where banks don’t award points) |

Getting a digital and physical GrabPay Card

If you already have your card, congrats! Skip to the next section to read about card features, benefits, and use cases.

Otherwise, you can get a GrabPay Card by following these steps:

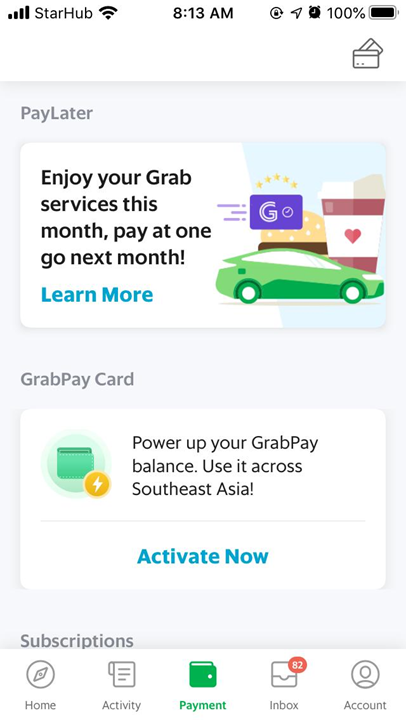

1. Go to the Payment tab in the Grab app and scroll down until you see the “Activate Now” button for the GrabPay Card

2. Swipe through the next few screens until you’re prompted to verify your account. Select SingPass MyInfo for faster verification

3. Once verification is complete, you’ll get an alert from the app

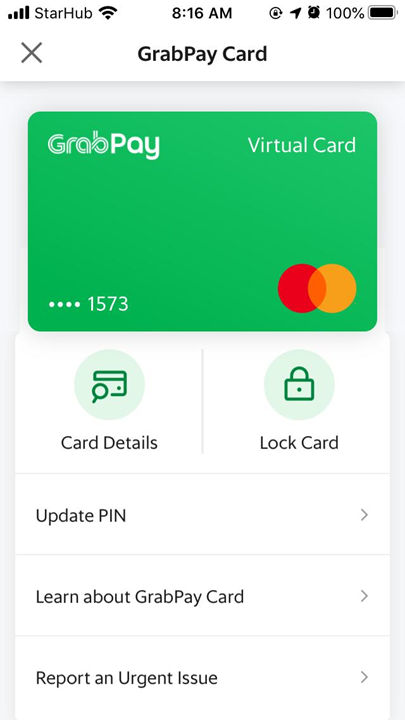

4. You’ll be prompted to set up a GrabPay pin, if you don’t already have one, after which you’ll be able to access your digital GrabPay Card. Tap “card details” to see your card number and CVV, and tap “lock card” to temporarily disable your card if you’re not using it.

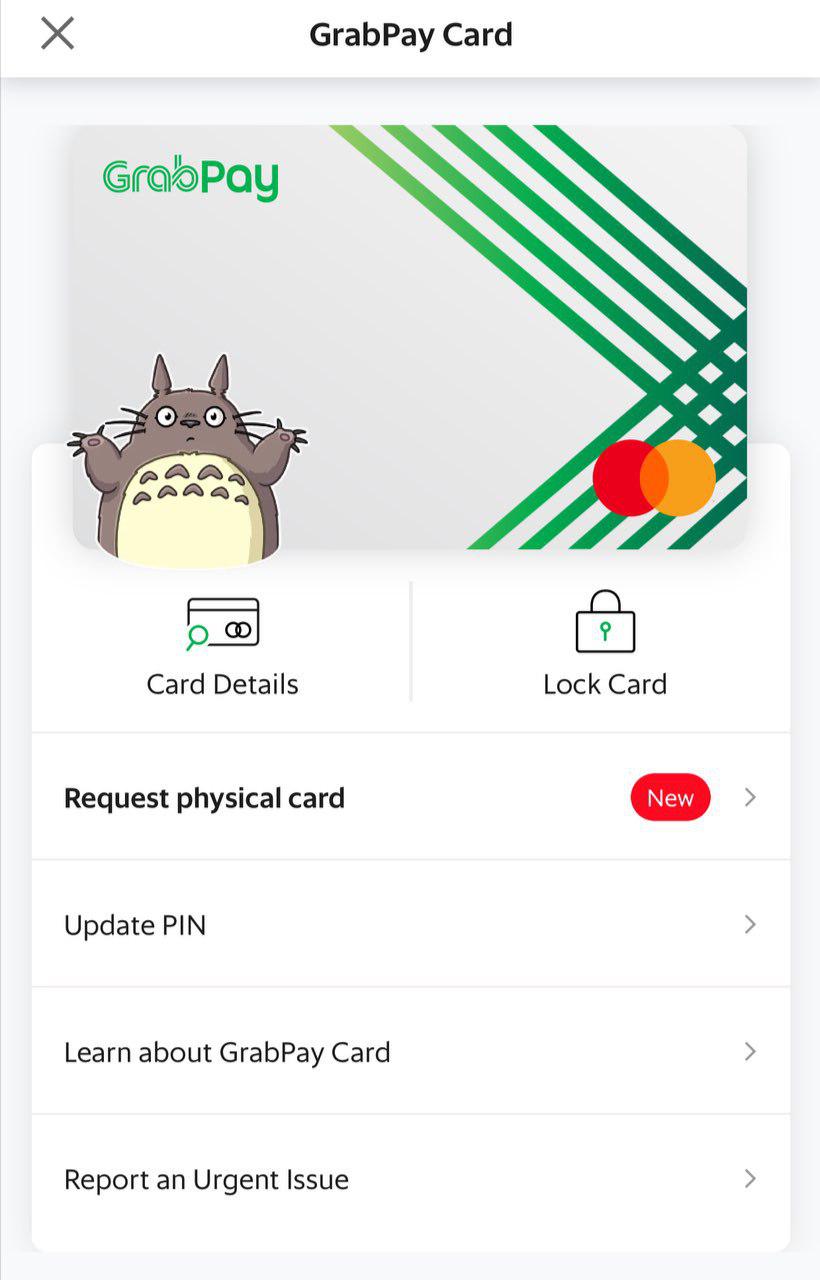

Your digital GrabPay Card can be used to make online or in-app payments. If you want to use it at offline merchants, you need to request a physical card. The physical card is being rolled out in batches, which means that not everyone will see the option to get one just yet.

If you’re eligible, you’ll see a “request physical card” option in your card menu.

Alternatively, if you have a Samsung phone that supports Samsung Pay, you can add your digital GrabPay Card to your wallet and make offline payments by tapping your device at any NFC-enabled terminal. Apple Pay, Fitbit Pay and Google Pay do not currently support the GrabPay Card.

GrabPay Mastercard Basics

| Income Req. | Annual Fee | Other Fees | FCY Fee |

| N/A (prepaid card) | None | S$10 for card replacement S$5 for overseas ATM withdrawals |

2.0% |

| Local & FCY Earn | Transaction Limit | Points Validity | |

| 5-10X GrabRewards Points per S$1 (0.53-1.14 mpd) |

S$30,000 per year | No expiry with ≥1 transaction every 6 months | |

The GrabPay Card is a prepaid Mastercard debit card that is funded by your GrabPay balance. The digital version is free to acquire, and the physical version is free until 31 January 2020, after which a fee may apply. There is a S$10 card replacement fee if you lose your physical card.

| Grab has been flip-flopping with the fees involved for issuing a physical GrabPay card. The first version of the FAQs said there was a S$10 fee, a subsequent version revised it to free, and the latest version now says it’s free until 31 Jan 2020, after which a nominal fee may apply. |

You can use your GrabPay Card to withdraw money at overseas ATMs for a S$5 fee, and spending overseas attracts a 2% fee. We’ll look at how this compares to other prepaid cards like Revolut and YouTrip later in this review.

GrabPay has a transaction limit of S$5,000 per year, which is raised to S$30,000 once verification has been completed (you’ll anyways need to verify your account to get a GrabPay Card). A maximum of S$5,000 can be stored on the GrabPay Card at any time, and there is a monthly spend limit of S$10,000.

Grab has set up a dedicated hotline for the GrabPay Card: 66550005. Card enquiries are handled 10 a.m- 9 p.m on weekdays, and 10 a.m- 6 p.m on weekends and public holidays. Lost, stolen or suspicious card activity can be reported 24/7.

Earn GrabRewards and credit card points (for now)

Spending on the GrabPay Card earns between 5-10 GrabRewards points per S$1, depending on your status.

These points don’t expire so long as you have at least 1 Grab transaction in a 6 month period.

GrabRewards points can be converted into KrisFlyer miles at the following ratio (some additional options have been added, but the rate below is the best possible):

- Member/Silver/Gold: 1,500 points = 160 miles

- Platinum: 1,400 points = 160 miles

Based on the earn and burn rates, your equivalent MPD with the GrabPay Card is as follows:

| Miles Per Dollar |

|

| Member | 0.53 |

| Silver | 0.53 |

| Gold | 0.80 |

| Platinum | 1.14 |

You can also exchange GrabRewards points for Grab vouchers, which I see as a kind of restricted “cashback”, because it’s only usable within the Grab ecosystem. The value per point depends on the voucher’s denomination, but at the extremes you have:

- Lowest Value: S$5 voucher for Regular member- 2,200 GrabRewards points

- Highest Value: S$25 voucher for Platinum member- 8,800 GrabRewards points

This allows us to derive the following “cashback” figures:

| “Cashback” |

|

| Member | 1.1-1.4% |

| Silver | 1.2-1.4% |

| Gold | 1.9-2.1% |

| Platinum | 2.6-2.8% |

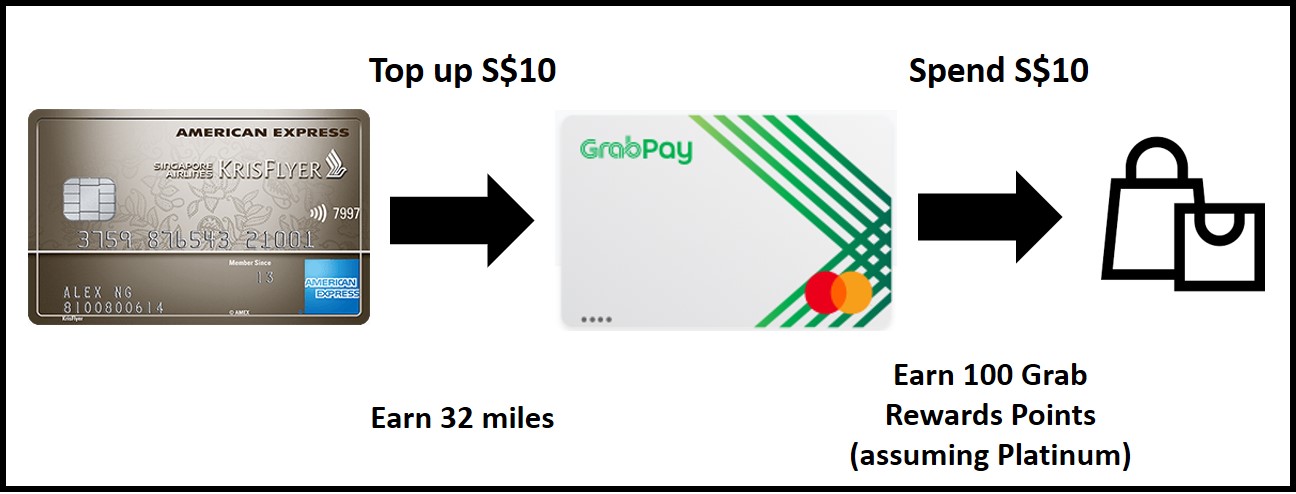

But seasoned Grab veterans know this is only half the story. The true appeal of the GrabPay Card lies in the ability to earn credit card miles/points/cashback on your GrabPay top-ups in addition to the GrabRewards points earned by spending.

For example, if you top up S$10 to your GrabPay balance using the AMEX KrisFlyer Ascend, you earn 32 miles (S$10 x 3.2 mpd). Spend that S$10 through your GrabPay Card, and you earn 100 GrabRewards points (S$10 x 10), assuming you’re Platinum. Therefore, you double-dip on credit card and GrabRewards points, earning a rather impressive 4.34 mpd (3.2 + 1.14) in this particular scenario (and before someone whines about breaking the first rule of Fight Club, can I just say that the banks aren’t as oblivious as you think).

At the moment, there are still certain cards that allow you to earn rewards for GrabPay top-ups. How long this continues is anyone’s guess, but like I said, the banks aren’t dumb- they’ll offer this as long as it makes sense for them.

| The Grab MCC confusion |

|

On paper, Grab has three main MCCs to take note of:

But it’s not always so straightforward, and can depend on what card you’re using. My understanding is that GrabPay top-ups on AMEX and Mastercard code as 4121, while top-ups on Visa code as 7399. Others report that even Grab rides are coding as 7399 on Visa cards, which makes you wonder how DBS is going to properly award the 4 mpd on Grab rides with the DBS Altitude. Long story short, the situation is fluid and can change without notice. If you’re paranoid, test small transactions and check your points. |

As long as the rewards continue to flow, it’s a no-brainer to top up your GrabPay account with the right credit card and spend with the GrabPay Card.

Use cases for GrabPay Card

But even if the GrabPay top-up gravy train eventually grinds to a halt, there will still situations where the GrabPay Card could be useful.

I’m thinking about transactions that banks usually exclude from earning rewards, like insurance, government, payments, education fees, utilities, hospital bills, and non-profits. Grab awards points on some of these, at least allowing you to get something out of these transactions.

Not everything’s a sure shot though. The following transactions have reportedly not earned GrabRewards points when paid with the GrabPay Card (thanks to the GrabPay Telegram group for compiling this)

- CardUp

- AXS

- YouTrip

- SAM

- ipaymy (other than rental)

- Revolut

- TransferWise

- EZ-Link app

- Points.com

- Alipay Tour pass

Exclusion categories are not documented by Grab, so this list is far from exhaustive. As I said earlier, when in doubt, test a small amount. One would imagine that Grab has more leeway to offer rewards because of the lower costs involved in running the GrabPay card (at least, compared to a traditional bank).

Also, not all merchants accept the GrabPay Card. Here’s some transactions which have reportedly failed.

- vCashCard

- giving.sg

- GoFundMe

- Singtel Dash

- Manulife

- Grab (hah!)

- TADA

- Nets Flashpay App

- Zipster

- BigPay

The perfect travel companion?

Grab bigs up the GrabPay Card as “the perfect travel companion”, citing the low FX fees and (potential) lounge access as two main perks. We’ll look at the lounge access in a bit, but I first wanted to analyze the FX fees.

The GrabPay Card charges a 2% foreign currency transaction fee on all non-SGD transactions, and uses standard Mastercard currency conversion rates for exchange.

Given the overseas earn rate and fees, here’s how much you’ll pay per mile with the GrabPay Card, versus other credit cards on the market.

| FCY | Fee | CPM | Remarks | |

UOB Visa Signature UOB Visa Signature |

4.0 | 3.1% | 0.78 | Min S$1K, max S$2K spend per statement period. Payment must be processed outside of Singapore |

OCBC 90°N Card OCBC 90°N Card |

4.0 | 3.25% | 0.81 | Until 29 Feb 2020, 2.1 mpd after |

BOC Elite Miles BOC Elite Miles |

3.0 | 3.0% | 1.0 | Payment must be processed outside of Singapore |

SCB Visa Infinite SCB Visa Infinite |

3.0 | 3.5% | 1.17 | Spend ≥S$2K in a statement period, otherwise 1 mpd |

SCB Rewards+ SCB Rewards+ |

2.9 | 3.5% | 1.21 | Capped at S$2.2K of FCY spend per year |

HSBC Visa Infinite HSBC Visa Infinite |

2.25 | 2.8% | 1.24 | Spend ≥S$50K in the previous membership year, otherwise 2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

2.0 | 2.5% | 1.25 | June/Dec only, otherwise 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

2.0 | 2.5% | 1.25 | June/Dec only, otherwise 1.1 mpd |

OCBC VOYAGE OCBC VOYAGE |

2.4 | 3.25% | 1.35 | Until 31 Dec 2019, 2.3 mpd after |

DBS Treasures AMEX DBS Treasures AMEX |

2.4 | 3.25% | 1.35 | |

UOB PRVI Miles UOB PRVI Miles |

2.4 | 3.25% | 1.35 | Payment must be processed outside of Singapore |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

2.0 | 2.75% | 1.38 | Minimum spend of S$300 per month required. Capped at S$7.5K per month |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

2.0 | 3.1% | 1.55 | Payment must be processed outside of Singapore |

DBS Altitude DBS Altitude |

2.0 | 3.25% | 1.63 | |

Citi PremierMiles Visa Citi PremierMiles Visa |

2.0 | 3.25% (from 15 Dec 19) | 1.63 | |

Citi Prestige Citi Prestige |

2.0 | 3.25% (from 15 Dec 19) | 1.63 | |

GrabPay Card |

0.53-1.14 | 2% | 1.75-3.77 |

Yes- the fact that you had to scroll so far down to see the GrabPay Card suggests there isn’t a strong case to use it overseas. Although the FCY fee is the lowest of any bank, so too is the earn rate.

Even if you’re stacking it with points from your top-ups, it’s still a better idea to use specialized spending credit cards overseas, and save your GrabPay Card for transactions you can’t normally earn bonuses on.

Another question people may ask is how the GrabPay Card compares to multi-currency debit cards.

As the table above shows, someone who doesn’t care about rewards and just wants the cheapest way to pay abroad will find better value in Revolut or YouTrip. So for me, the GrabPay Card is in an awkward position for overseas spending- it’s not as rewarding as credit cards, but it’s not as cheap as multi-currency debit cards.

Where lounge access is concerned, the GrabPay Card gives cardholders access to the Mastercard Flight Delay Pass. This program grants complimentary lounge access to Mastercard cardholders whose flights are delayed by 120 minutes or more.

There’s no need to actually pay for your flight with a Mastercard to be eligible (there used to be, but the latest T&Cs don’t mention it). Instead, you simply register your upcoming flight details. If Mastercard’s flight monitoring system detects a delay of more than 120 minutes, you’ll get an SMS confirming your eligibility for lounge access, provided in partnership with LoungeKey.

The silly thing is that you can only register 2 flights until 30 June 2020, and your allowance is considered “used” even if the flight isn’t actually delayed. On the flip side, most Mastercards will be eligible for coverage, so you can always register a different Mastercard for a fresh allowance of 2 flights.

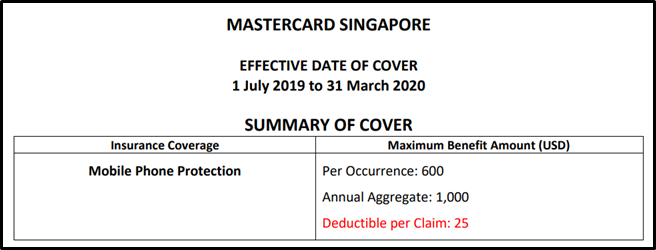

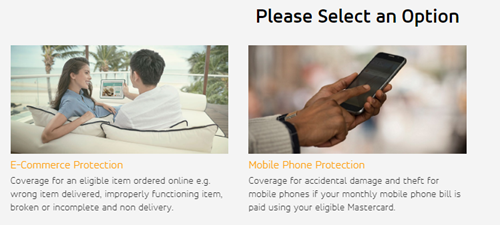

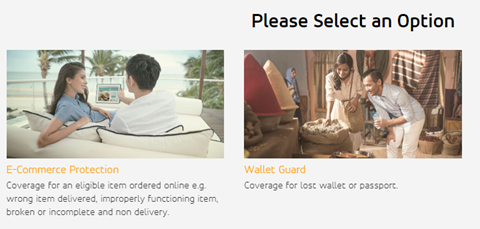

Complimentary mobile phone insurance

One unique perk about the GrabPay Card is that it offers protection against against accidental damage and theft of your mobile phone, so long as you pay your monthly phone bill with the GrabPay Card.

“Wait a minute,” you say. “That’s just a generic Mastercard benefit, isn’t it?”

Well, that’s the thing. The coverage is provided by Mastercard, but I haven’t found another Singapore-issued Mastercard with the same feature.

Mastercard has a website that allows you to check your card-related benefits by keying in your card number (yes, it’s safe to use).

Enter your GrabPay Card number, and you’ll see the following options:

I tried the following Mastercards, but didn’t see “mobile phone protection” offered.

- OCBC 90N Card

- KrisFlyer UOB Credit Card

- OCBC Titanium Rewards (Blue & Pink)

- OCBC World Elite Debit Card

- BOC Elite Miles World Mastercard

- DBS Woman’s World Mastercard

Instead, these cards offer “Wallet Guard“, which insures you against theft of your wallet, up to US$100. If you have other Mastercards in your wallet, feel free to test them out and let me know if any of them offer mobile phone protection.

Both prepaid and postpaid plans are eligible for coverage.

- For Postpaid, the mobile provider’s monthly billing statement for the billing cycle preceding the month in which the Accidental Damage or Theft occurred is paid using the Eligible Card.

- For Prepaid, the Issuer’s monthly billing statement shows a top-up value related to the mobile provider’s services preceding the month in which the Accidental Damage or Theft occurred.

Coverage will be suspended if you fail to make an eligible bill payment or top-up using your GrabPay Card in a particular month. It will resume after a 15-day waiting period following the date of any future bill payment or top-up, so be aware of potential gaps in coverage should you miss a payment.

The plan does not cover cosmetic damage, or accidental damage that does not affect the phone’s ability to make or receive calls. In other words, I don’t think this would cover a cracked screen, assuming the touch interface is still working. It also doesn’t cover what’s delightfully termed “mysterious disappearances”, where you basically lose your phone in the absence of wrongdoing.

The full T&C of the coverage can be found here.

Conclusion

Much of the GrabPay Card’s value proposition is contingent on the willingness of banks to extend rewards to GrabPay top-ups. When (and this really is when, not if) this ends, the GrabPay Card will still be useful for transactions that banks don’t give rewards for, but a significant amount of its appeal will be gone.

So this is a classic case in making hay while the sun shines. One day the opportunity will end. We will have a moment of silence, and then get on with our lives.

Hi, I don’t see Grab card or Activate now option in Payments tab in my app. What to do?

Google up and read the FAQ. Took me 5 seconds to find out why mine isn’t available either

from my understanding it should be available to anyone in SG with a grabpay account, now that it’s officially launched.

Took you more than 5 seconds to type this useless reply

Muahaha, come on don’t be a Jatin the crybaby.

Thank you for writing this review! By far the best quality analysis comes from Milelion even when it’s not strictly about Miles

glad you found it useful!

I’d second that. Thorough analysis, interesting insights (who knew about the phone damage and theft cover before this?) and, most of all, a clear focus on how this is relevant to mile chasers/hackers (without veering off to the side topic of UOB One which is where a lot of other people end up). I’d just add a couple of points to the inevitability of banks excluding Grab Pay top-ups from credit card rewards/points/miles/cashback: 1. Grab and UOB announced their partnership on 31 Jan 2019. A lot has happened since then, but it seems obvious that the partnership did not pan… Read more »

thanks for the additional insights! the grab uob partnership slipped my mind- will be interesting to see how that develops (if at all), because right now the extent of intergration seems to be some grab vouchers on the KF card.

I wonder when will this prepaid card frenzy end. It is an easy way to acquire users for sure, but it is an extremely inefficient way to do it, and can only sustain if their venture capital masters continue to raise money. Instead of using a good earning card like UOB signature, Grab wants us to use our credit card to top up , then to use their card to make payment. All in the name of manufacturing revenue (hey, like how we manufacture spending!) Good for us, and even better for Visa and Mastercard, but real stupid for the… Read more »

That’s like to say Google makes no money because it provides everything free of charge. However, Google makes billions out of advertisements from all its free services. Grab makes money in a similar fashion by selling out its users.

“Grab makes money in a similar fashion by selling out its users.” I never leave any money in my Grab wallet so they won’t be able to sell me out (a la Mileslife)!! – BTW That’s a joke even though the concern regarding unsustainable business models is valid – just look at share bikes,

Who pays the merchant/interchange fees for grab topups? It must be costing someone a fair amount of money. As long as the banks are getting the fees why would they care about paltry rewards? Apart from UOB with their 5% + 5% for $2000 a month which must be costing them a lot of money the other banks are likely getting an earn from grab topups.

Does Amex KF cards offer 1.1/1.2/1.3 mpd after the $200 cap for 3.2mpd on grabpay top ups?

It only costs $10 to find out – and currently yes they do. The pertinent question for all the cards which award points for Grab topups is whether or not the points will get clawed back as most of the T&Cs specifically exclude topups to mobile wallets. At least Amex KF cards specifically include Grab topups so there is really no chance of them trying to claw back any miles.

That was enlightening. clicked on the link which enumerates cards which give miles on grabpay topups – DBS WWMC in there – is this still valid

Classic case of ymmv. Some have reported yes, others no. Try at your own risk

Thanks Aaron. Again, very detailed, But i think the “top-up using a bank card to earn miles” doesn’t work anymore. I used Citi PremierMiles for everything, I thought that I would get miles from telco, utility bills, commuting, topping up Grab etc.. however, since CITI have updated their Reward Exclusion List. (I called Citibank), the lady told me that no reward for topping Grab using Citi card. I am not considering changing to other cards, perhaps for cash backs. I wonder, do you happen to know, if i use Grabpay Card to pay power bills, telco, and earn GrabRewards… then… Read more »

give.asia also fails with this card, says “unsupported payment”.