One of the nice things about the Citi PremierMiles Visa is that it’s not shy about offering bonuses to existing customers. And by “existing” I don’t mean existing Citibank cardholders; I mean existing Citi PremierMiles Visa cardholders.

Citi has just launched another “Spend & Get” promotion, which is basically an option to buy additional miles upon hitting a S$7.5/14K threshold. Assuming you’re going to spend that money anyway, it’s a fantastic price to buy miles- starting at just 0.97 cents each.

Who’s eligible?

To be eligible, you need to be a current Citi PremierMiles Visa principal cardholder who has held the card for more than 6 months prior to 21 January 2020. In other words, if you haven’t got a card yet, or you got it less than 6 months ago, you’re not eligible to take part.

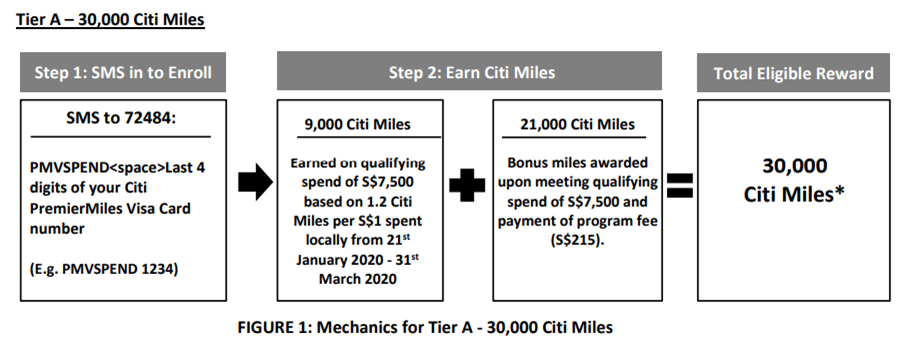

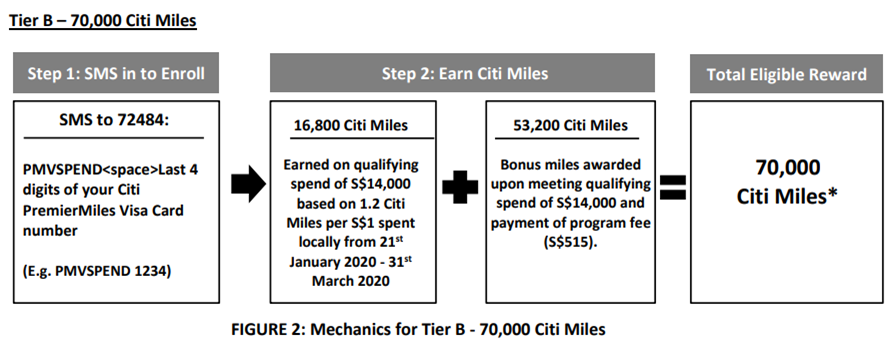

To participate, you’ll need to register by sending the following SMS to 72484:

PMVSPEND<SPACE>Last 4 digits of your Citi PremierMiles Visa Card (main card) number

(e.g PMVSPEND 1234)

The full T&C can be found here.

There are two flavors of this promotion.

Tier A: Spend S$7.5K and pay S$215 for 30,000 miles total

With Tier A, you need to register and spend at least S$7,500 by 31 March 2020. Within 2 months from 31 March 2020, you’ll be charged a S$215 admin fee and receive 21,000 bonus miles.

| Do note that Citi’s wording makes it seem like you’re paying S$215 for 30,000 miles- you’re not. That 30,000 miles is split into 9,000 base miles (S$7,500 @ 1.2 mpd) that you’re entitled to anyway, and the 21,000 bonus miles you get from paying the admin fee |

The equivalent cost per mile is 1.02 cents.

| Admin Fee | Miles | CPM |

| S$215 | 21,000 | 1.02 |

Tier B: Spend S$14K and pay S$515 for 70,000 miles total

With Tier B, you need to register and spend at least S$14,000 by 31 March 2020. Within 2 months from 31 March 2020, you’ll be charged a S$515 admin fee and receive 53,200 bonus miles.

| Admin Fee | Miles | CPM |

| S$515 | 53,200 | 0.97 |

The equivalent cost per mile is 0.97 cents.

Do note that if you register and hit the S$14,000 Tier B threshold, you cannot opt to pay the S$215 admin fee for Tier A instead.

What spending is eligible?

As per the T&C:

| “Qualifying Spend” refers to any retail transactions (including internet purchases) which do not arise from (i) any Equal Payment Plan (EPP) purchases, (ii) refunded/ disputed/ unauthorised/ fraudulent retail purchases, (iii) Quick Cash/Ready Credit PayLite and other instalment loans, (iv) Paywise/ cash advance/ quasi-cash transactions/ balance transfers/ annual card membership fees/interest/goods and services taxes, (v) bill payments made using the Eligible Card as a source of funds, (vi) late payment fees and (vii) any other form of service/ miscellaneous fees. |

Based on previous Citi promotions, Citi PayAll transactions will count towards the spending threshold (some people may point to (v), but I’ve asked about this previously and it doesn’t refer to PayAll- ask Citi yourself if you’re still paranoid). Likewise, insurance, education, government services, charitable donations and top ups of prepaid accounts will count towards the spending threshold, but won’t earn any base points.

Where have I seen this before?

If the mechanics of this promotion sound familiar, that’s because Citi’s run similar campaigns before:

- From July-Aug 2017, cardholders who spent S$9,000 and paid an admin fee of S$238 got 31,200 bonus miles

- From Feb-Mar 2019, cardholders who spent S$8,888 and paid an admin fee of S$288 got 28,223 bonus miles

Here’s how those campaigns measure up to this one.

| 2017 Promo | 2019 Promo | 2020 Promo | |

| Spend | S$9,000 | S$8,888 | S$7,500/14,000 |

| Admin Fee | S$238 | S$288 | S$215/515 |

| Bonus Miles | 31,200 | 28,223 | 21,000/53,200 |

| CPM | 0.76 | 1.02 | 1.02/0.97 |

Citi Miles are one of the most useful transfer currencies in Singapore

Citi Miles can be transferred to 11 different frequent flyer programs and 1 hotel partner at a 1:1 ratio.

| Transfer Ratio | |

Singapore Airlines KrisFlyer Singapore Airlines KrisFlyer |

1:1 |

| 1:1 | |

| 1:1 | |

Etihad Guest Etihad Guest |

1:1 |

EVA Air Infinity Mileagelands EVA Air Infinity Mileagelands |

1:1 |

Flying Blue Flying Blue |

1:1 |

IHG Rewards Club IHG Rewards Club |

1:1 |

Malaysia Airlines Enrich Malaysia Airlines Enrich |

1:1 |

Qantas Frequent Flyer Qantas Frequent Flyer |

1:1 |

Qatar Airways Privilege Club Qatar Airways Privilege Club |

1:1 |

Thai Airways Royal Orchid Plus Thai Airways Royal Orchid Plus |

1:1 |

| 1:1 |

Why would you be interested in earning anything other than KrisFlyer miles? Well, other frequent flyer programs have great sweet spots for certain destinations, which means you could earn your free flight with even less spending than if you had chosen KrisFlyer.

Some examples of sweet spots accessible through the Citi PremierMiles Visa are shown below:

| One Way Business Class | With Miles&Smiles | With KrisFlyer |

| Singapore to Europe | 45,000 miles | 92,000 miles |

| Singapore to North America | 67,500 miles | 92,000-99,000 miles |

| Singapore to South America | 75,000 miles | 119,000 miles |

| Do note that Miles&Smiles imposes fuel surcharges on award redemptions, while KrisFlyer only imposes them on non-Singapore Airlines redemptions | ||

Etihad Guest Etihad Guest |

||

| With Etihad Guest | With KrisFlyer | |

| Singapore to Koh Samui | 10,000 miles (Business) | 21,500 miles (Business) |

| Singapore to Seoul | 30,000 miles (Business) | 47,000 miles (Business) |

| Singapore to Colombo | 28,000 miles (Business) | 39,000 miles (Business) |

| Intra-Brazil | 3,000-17,000 miles (Economy) | 12,500 miles (Economy) |

| Intra-Europe | 5,000-10,670 miles (Economy) | 12,500 miles (Economy) |

| One Way Economy | With BA Executive Club | With KrisFlyer |

| Intra-Europe | 4,000-13,000 miles | 12,500 miles |

| Intra-Japan | 6,000-9,000 miles | 12,500 miles |

| Intra-Australia/Trans Tasman | 6,000-13,000 miles | 11,000-20,000 miles |

| Singapore to Hong Kong | 11,000 miles | 15,000 miles |

| Singapore to Perth | 13,000 miles | 20,000 miles |

Citi Miles do not expire, and can also be used to offset the cost of revenue flights and hotels via Citi’s travel portal (although for the best value, you’ll obviously want to convert them to miles).

Conclusion

0.97 cents is one of the lowest prices to buy miles in Singapore, so if you’re planning to spend anyway, I’d definitely shell out the admin fee for the miles.

If you’re reading this article after 21 January and have already hit the qualifying spending without registering, no worries- so long as you register before 31 March, you’ll still be eligible for the promotion.

(HT: yk)

Welcome back from the drawer, old friend Premiermiles. I’ve missed you.

But you didn’t analyse the opportunity loss of using a competitor card (eg. BOC Elite Miles or UOB PRVI Miles) that earns a higher 1.5 / 1.4 base miles per SGD spent… hence the calculated CPM would be slightly different.

Sure- if you have Boc elite miles it’s a 4200 mile opp cost, adjusted cpm is 1.05 cents. Still a great price.

Any idea funds used to top up Grab Pay will be counted towards the qualifying spend?

Curious about this too

No. Source: confirmed with citi customer care

I’ve got a big ticket AXA insurance payment which would qualify for the higher tier B, but they don’t accept credit card. The CSO mentioned that AXS credit payment is possible, so it seems that the 2 payment options would be Cardup vs AXS. Which option would be better – I’m confused as to how we would calculate this: Assuming AXS gets no base points, then subtracting the opportunity cost of the base points: $515 / (53,200 – 16,800) = 1.41 CPM VS Cardup, incurring an additional cost of 2.25%: ($515 + $315) / 70,000 = 1.18 CPM Does that… Read more »

If AXA doesn’t accept credit card to start, then the opportunity cost is moot. Your calculation for AXS should be solely $515 / 53200 = 0.97 CPM

no

“no” was very helpful….not

Hi,

Just wondering if I use PM cards to top up the youtrip card for an overseas trip. Will it count under the qualifying spend ?

try & let us know 🙂

zero points, but as mentioned it counts towards qualifying spend.

Will the spends of your supplementary card be eligible to be added to spends of main card holder? Thanks.

yup

I’m new to this Does spending by a sup-card holder qualify?

yes, even though it’s not said explicitly in t and c.

I signed up for this card in early Oct 2020. I did not receive the sms but sent a message myself to the listed number with the card details, and I did get a successful registration sms.

Not sure how strictly will they adhere to their T&C of needing to have signed up for the card 6 mths before 21 Jan 2020.

I received confirmation on successful sign up even though the card is less than 6 months. Any clues if Citibank will allow? Or should we write in to ask?

Does Etihad fly to Koh Samui? I tried online but cant find the route.

Bangkok air

any bill payment thru AXS will count towards the 14k right? Except for the 1.2miles

I vaguely recall this article previously mentioned ipaymy transactions. Has this been removed? What’s the latest as I’m looking to pay rent using ipaymy since the fee is lower than payall

Hi Aaron! Any idea if Cordlife payment is qualifying spend? Thanks!

I called Citibank earlier, the “qualifying spending” of $7,500/$14,000 is limited to merchants/transactions who provide miles.

Me: “Do I meet the qualifying spending if I pay $14,000 to my insurance? I know I don’t get the base miles but do I still get 53,200 bonus miles if I pay the program fee?”

Citibank: “no, that’s not qualifying spending. You need to spend $14,000 on qualified merchants”

hmm, that’s the opposite of what the citi CSO told me. she said it would count, but 0 points.

Will it work on ipaymy?

Hi Aaron, will cardup expenditure qualify too?

Hi sorry I’m looking to pay my AIA insurance premium to hit the spending threshold. Was wondering if it is feasible to do so through:

a) using AXS e-station to pay, just no accumulate base points; or

b) using Cardup or ipaymy – but will it accumulate base points.

Appreciate some advice on this please! Thanks

Anyone received this bonus yet? Or would it be closer to 31 may?

I just receive a reply from CITI, stated as under:

We acknowledge receipt of your message and we wish to clarify that

education and rental fees will no longer be considered for card rewards.

Meaning, you will not be awarded rewards/miles for these transactions.

For details on merchant/MCC excluded from earning rewards/miles – please

read http://www.citibank.com.sg/rwdexcl

Not yet, program fee hasn’t been charged also