As a long-suffering Arsenal fan, I’ve learned that the only way you can survive is by seeing the funny side of everything. Whether it’s enjoying the comic stylings of Emmanuel Eboue, finding out you signed the wrong Denilson, or complaining to Singtel that your mio TV doesn’t work because Arsenal only seem to pass the ball backwards or sideways, you figure out various coping mechanisms.

It’s also why I never gave the Maybank Manchester United Visa Platinum card a second look, despite it being on the market for almost 8 years. But it has a fascinating bonus mechanic, the likes of which I’ve never seen on any other card. And it can be extremely useful, in some cases…

Maybank Manchester United Visa Platinum

| Income Req. | Annual Fee | Miles from Annual Fee | FCY Transaction Fee |

| S$30,000 |

S$80 (2 year fee waiver) |

None | 2.75% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 0.4 mpd + 1% cashback | 2 mpd + 3% cashback if Man Utd win | 12-15 months | |

Manchester United and Maybank signed an agreement in 2011 which saw the latter becoming the club’s official retail banking partner in Malaysia, Singapore, and the Philippines.

In April 2012, Maybank launched the Maybank Manchester United Visa Platinum card in Singapore.

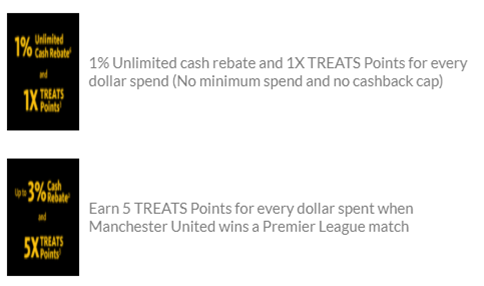

Like Alexis Sanchez, the card normally doesn’t do much. Every S$1 spent earns 1% cashback and 1X TREATS points (0.4 mpd). Assuming you value a mile at 1.8 cents each, your overall earn rate is about 0.95 mpd, barely worth taking note of (like Eric Djemba-Djemba).

But things get a lot more interesting with the bonus mechanism. You’ll receive a bonus 2% cashback and 4X TREATS points (1.6 mpd) for a total of 3% cashback and 5X TREATS points (2 mpd) on days when Manchester United wins an English Premier League (EPL) match.

For example, if Manchester United win an EPL match on Saturday, 22 Feb 2020 (UK time), all transactions from 0000 hours to 2359 hours on Saturday, 22 Feb 2020 (SG time) will earn 3% cashback + 2 mpd.

The following transactions do not earn any Maybank TREATS points:

See the full list here. |

The total cash rebate is capped at S$20 per match day win, so you’d max out the cashback with a total spend of S$667. However, there is no cap on the bonus miles, which effectively makes this a 2 mpd general spending card, much higher than the 1.1-1.6 mpd offered by the competition.

This mechanism also means that the card has the rare distinction of being the only product to get an almost annual devaluation 😉 Alex Ferguson’s departure has been very bad for Maybank miles collectors.

| Season | Wins/Played | Win % |

| 2012/13 (Alex Ferguson’s last season) |

28/38 | 74% |

| 2013/14 | 19/38 | 50% |

| 2014/15 | 20/38 | 53% |

| 2015/16 | 19/38 | 50% |

| 2016/17 | 18/38 | 47% |

| 2017/18 | 25/38 | 66% |

| 2018/19 | 19/38 | 50% |

| 2019/20 (season-to-date) | 10/26 | 38% |

When the Maybank Manchester United card first launched, cardholders enjoyed 28 days of 3% cashback + 2 mpd. In the current season so far, they’ve only had 10. Think about that the next time you’re tempted to complain about stealth devaluations…

How do you maximize the bonus?

But back to the bonus mechanism: The prospect of earning 2 mpd + 3% cashback is too enticing to turn down, even if it means holding the official credit card of The Great Satan Devil™.

There are two ways of approaching this.

The first is the blind faith approach: you spend throughout matchday with abandon, because only plastic fans doubt that a win will happen.

The second is the ye-of-little-faith approach: you wait till the final whistle blows before spending anything.

The latter sounds like the more logical option, but therein lies a problem: most of the matches end too late. Now, for the sake of those who don’t follow football, a typical match takes just under 2 hours to complete, including stoppages and half-time.

Here’s the rest of Manchester United’s EPL games for the 2019/20 season:

| Match | Date (SG) | Start Time (SG) |

| vs Watford | 23-Feb | 10 p.m |

| vs Everton | 1-Mar | 10 p.m |

| vs Man City | 9-Mar | 12.30 a.m* |

| vs Spurs | 16-Mar | 12.30 a.m* |

| vs Sheff Utd | 21-Mar | 11 p.m |

| vs Brighton | 4-Apr | 10 p.m |

| vs Bournemouth | 11-Apr | 7.30 p.m |

| vs Aston Villa | 19-Apr | 11.30 p.m |

| vs Southampton | 25-Apr | 10 p.m |

| vs Crystal Palace | 2-May | 10 p.m |

| vs West Ham | 9-May | 10 p.m |

| vs Leicester City | 17-May | 10 p.m |

| *Remember that even if a match starts after midnight SG time, it’s being played on the prior day in the UK, and hence your opportunity to spend has already gone | ||

Only the Bournemouth game on 11 April ends early enough for you to have time to make purchases, and even then, probably only online (or at Mustafa).

I suppose you could take a punt on the matches starting at 10 p.m- if Manchester United have a healthy lead by the 80th minute mark, you’d have about 10 minutes to do all your shopping (and pray that De Gea doesn’t channel his inner Taibi). I can imagine people camped at their computers with all their credit card info keyed in, just waiting for the final whistle to click “purchase”.

But…if you’re buying things online, you could just as well use the Citi Rewards Visa, OCBC Titanium Rewards, or DBS Woman’s World Card to earn 4 mpd. Therefore, I only see a very narrow set of circumstances where this card would be useful.

(1) If you’ve maxed out the 4 mpd caps on other online spending cards

You might argue that in this case it’s better to use the HSBC Revolution for an uncapped 2 mpd on online transactions, but remember the Maybank Manchester United card earns 2 mpd + 3 % cashback.

(2) If you’re making an online transaction which won’t earn bonus points on other cards

The card’s T&Cs don’t mention any exclusions for education payments, CardUp, or RentHero, so these could be potential options for using the Maybank Manchester United card.

I’m particularly intrigued about the CardUp/RentHero use case, because earning 2 mpd + 3% cashback would more than offset the admin fee. In some cases, you could even earn miles for free!

| CPM for $500 trxn | CPM for $1,000 trxn | CPM for $2,000 trxn | |

| CardUp (2.25% fee) | 0 | 0.12 | 0.61 |

| RentHero (1.85% fee) | 0 | 0 | 0.42 |

I’m in the process of checking with CardUp/RentHero if they know anything about this, because if rewards are confirmed, the Maybank Manchester United card would be hands down the best card to use.

Remember that with CardUp and RentHero, your card needs to be charged immediately on matchday for you to earn the bonus, so time your payments accordingly.

| Will the Maybank Manchester United card earn 2 mpd on GrabPay top-ups? It’s a Visa, so GrabPay top-ups should code as MCC 7399, which isn’t a prepaid account. I’ve never tested it, but on the surface I see no reason why it shouldn’t. Test a small amount if you’re nervous. |

(3) If you’re making offline, general spending transactions

As mentioned earlier, general spending cards will earn 1.1-1.6 mpd on offline transactions, making them inferior to the Maybank Manchester United card’s 2 mpd + 3% cashback.

The main issue is finding a merchant open so late at night. Either you spend earlier in the day and take a gamble, or you wait till the match is over but have an extremely limited merchant selection. This card does reward the faithful!

One major caveat

There’s one line in the T&Cs which worries me:

| Maybank will use the date on which the transaction is posted to the Cardmember’s Card account to calculate the TREATS Points awarded, unless the transaction is excluded by Maybank in its absolute discretion. |

Posting dates may not be the same as transaction dates, and since you basically have a 24-hour window to spend, this term becomes very important. You could be in a situation where you spend on a day that Manchester United wins, but your transaction only posts the day after.

Update: Maybank has clarified that the bonus reward of 2% cashback and 4X TREATS points is based on transaction date, while the base reward of 1% cashback and 1X TREATS points is based on posting date. That’s good to know!

What can you do with Maybank TREATS points?

Maybank TREATS points can be transferred to the following frequent flyer programs for S$26.75 per transfer.

Note that the transfer ratios differ by program; in my analysis above where 1X TREATS= 0.4 mpd, I’m assuming you’re transferring to either KrisFlyer or Asia Miles. You could transfer your TREATS to Malaysia Airlines, but really, why bother?

| Program | Transfer Ratio (TREATS: miles) |

Singapore Airlines KrisFlyer Singapore Airlines KrisFlyer |

2,000: 1,000 |

Asia Miles Asia Miles |

5,000: 2,000 |

AirAsia BIG AirAsia BIG |

12,500: 5,000 |

Malaysia Airlines Enrich Malaysia Airlines Enrich |

3,500: 1,000 |

TREATS points expire in 12-15 months, unless you’re a Rewards Infinite member, in which case they never expire.

Conclusion

I’ll be the first to say that the use cases for this card are extremely limited, but if nothing else, it’s a fascinating bonus mechanism. And if you have CardUp/RentHero transactions, this might just be the best card to use.

If you’ve got any experience using this card, please sound out in the comments below.

This is marketing gimmick by Maybank at best. Delete and pass.

This one promoting next level gambling…

at least the FC Barcelona card doesn’t tie the cashback to whether they win…

This card was arguably less of a gamble back in the days when fergie was in charge….

Well since you’ve brought the odds out, let’s do some quick maths. Assumptions: – Your general spend card is BOC EM (1.5 mpd) – You value miles at 1.8 cpm – You don’t max out the cashback cap per day. – 100% chance of transaction posting on the same day (I’ll get to that in a bit). I’m going to convert everything to miles for easy comparisons. MU win: 2.0 mpd + 3% cashback = 3.6 mpd MU loss or tie: 0.4 mpd + 1% cashback = 0.95 mpd You gamble 0.55 mpd for a potential 2.1 mpd profit. Therefore,… Read more »

Hey Aaron, not that it changes things much right now, but this match day points bonus seems to only have started from the 2016/17 season. Maybank added the cashback last year/this season, and for a while at the end of 2019 they changed it to win, lose, or draw 😅

based on the video from when the card was first launched, the match day points bonus also started in 2012 (https://www.youtube.com/watch?v=8VSI8r_Qgvg)

you might be right on the cashback. that wasn’t mentioned at the start. maybe they felt they had to make up for man utd’s declining performance 😉

Ah, I stand corrected on the match day points bonus!

Just a thought, when you say “there’s miles miles to be earned” should that not be “there are miles to be earned”? ‘There is miles’ doesn’t sound right. Great article though!

As a general rule of thumb, expressions of time, money, and distance are singular. Just like how you would say “there is money to be earned” as opposed to “there are money to be earned”, the same can be said for miles.

When you’re talking about “earning” miles, you are also treating miles as a currency, and you can substitute “miles” for “money” in the previous sentence, so “there’s miles to be earned” sounds correct to me.

Respectfully, I disagree. Currency: “There is a dollar to be made” “There are dollars to be made” I don’t think you say “There is dollars to be made” But I do agree that you say “there’s a fortune to be made” or “there’s money to be made”. In those sentences fortunes and money are not treated the same way as currencies are. Equally: “There is one mile left in my KF account” “There are 1 million miles in his KF account” To me, it should be ‘there are miles to be earned’ Time “There is one minute left in the… Read more »