As any miles chaser knows, studying credit card T&Cs is one of the less glamorous parts of the hobby. After all, there’s nothing more riveting than pawing through page after page of legalese, obfuscation, and disclaimers.

But once in a while you stumble upon something interesting. A loophole for churning miles, a little-known benefit, or in the case of UOB, a clause that awards bonus points for porno websites.

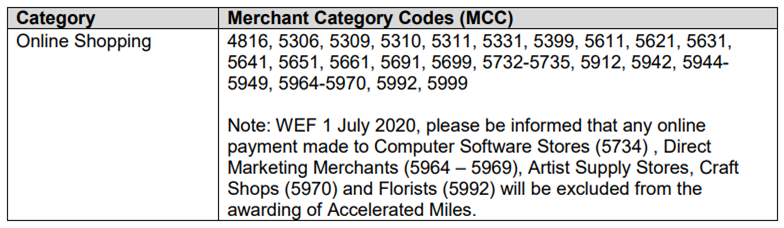

It all started when I spotted an update to the T&Cs of the KrisFlyer UOB Credit Card. These changes, which take effect from 1 July 2020, exclude additional categories of transactions from earning bonus points:

Computer software, art supplies, and florists were all pretty intuitive to me, but what on earth were direct marketing merchants?

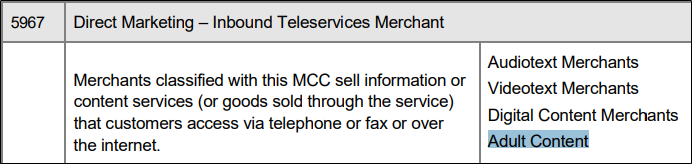

A quick glance at an MCC guide told me that the ranges in question covered the following:

- MCC 5964: Direct Marketing- Catalog Merchant

- MCC 5965: Direct Marketing- Combination Catalog and Retail Merchant

- MCC 5966: Direct Marketing: Outbound Telemarketing Merchant

- MCC 5967: Direct Marketing- Inbound Telemarketing Merchant

- MCC 5968: Direct Marketing- Continuity/Subscription Merchant

- MCC 5969: Direct Marketing- Others

That wasn’t any clearer, so I decided to look for community-reported examples on WhatCard.

MCC 5964… Ali Express…

MCC 5968…Linkedin, The Economist, New York Times…

MCC 5969…Adorama, BH Photo…

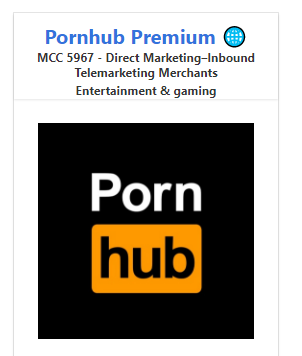

MCC 5967…wait what.

I was certain that someone was trolling me. But then I did a bit of research, and learned that MCC 5967 was indeed the standard-issue code for smut.

Let’s back up a bit.

High-Risk MCCs

When merchants want to accept credit cards, the first thing they need to do is apply for a merchant account with an acquiring bank. The acquiring bank assigns the merchant an MCC, a four-digit code reflecting the merchant’s principal business.

| 🤓 Things you didn’t need to know |

| MCCs were originally created in 2004 by the United States Internal Revenue System to simplify 1099 (income tax) reporting. You can see the original MCC list here in all its mid-2000s glory. |

MCCs are important because they determine how much a merchant pays to accept card payments, otherwise known as the interchange rate.

Certain MCCs qualify for a business for a lower interchange rate. For example, charities, educational institutions, and government agencies typically enjoy discounted interchange fees. That’s good for them, but less profitable for the bank, and why most credit cards typically exclude rewards for such transactions.

Conversely, certain MCCs attract a higher interchange rate because they’re deemed “high-risk”. They may historically see higher volumes of refunds, chargebacks, and fraud claims, like pawn shops, money transfer services, and precious stone dealers. Others may carry reputational or regulatory risk, like firearms or gambling.

| ☝️ Not all high-risk is sleaze |

| It doesn’t mean that high-risk MCCs are exclusively reserved for shady businesses. There are perfectly respectable enterprises like travel agencies which are still considered high risk, because factors outside their control (like Covid-19) may result in high volumes of refunds or chargebacks. |

Or porn.

A touchy subject

As a general rule, card networks don’t like to deal with porn. This isn’t so much a moral objection as it is a practical one.

The free-for-all nature of porn sites (especially ones which allow for user-uploaded content) is a legal minefield, throwing up issues of child abuse, sex trafficking, rape, and revenge porn. That’s not to mention bestiality, incest, scatalogical content and every permutation of deviant sexual activity.

Moreover, porn sites are fertile (fnar) grounds for chargebacks arising from fraud, buyer’s remorse, or spousal discovery. It’s a classic trope: wife stumbles upon a strangely-named merchant (as you can imagine, porn sites rarely bill under their actual name) on the monthly card bill, and asks her husband to take it up with the bank.

“Sir, your card statement shows you making several recurring transactions to Crisp and Wholesome Moving Pictures LLP”

“Well that’s preposterous, I only use the internet for sending flowers to my grandma and occasionally arguing”

Then there’s the reputational issues. Who wants to spend millions of dollars on branding, only to see your logo plastered alongside acts of wanton carnality? Add to that pressure from campaign groups and federal investigations, and it’s easy to see why some companies decide it’s just not worth the aggravation.

American Express has a longstanding global policy of not processing porn transactions. Square and Chase have shutdown accounts associated with pornographic performers. Numerous payment processors won’t touch them, and in November 2019, PayPal stopped supporting payments to Pornhub. On the whole, the industry is given a very wide berth.

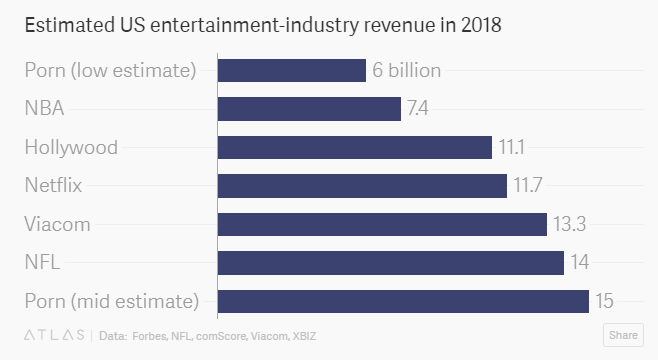

And yet they can’t shun it altogether. When porn accounts for three of the world’s top 10 visited websites and potentially grosses more than the NBA, Hollywood, or Netflix, you can bet the dollar signs make compunctions go out the window.

So a compromise was reached. Hiving off a separate MCC would allow the industry to be ringfenced, and 5967 was duly chosen. Its description? The aggressively bland (or titillatingly euphemistic, depending on your point of view) “Direct Marketing- Inbound Teleservices Merchant”. If you squint hard enough, you can kind of see why that’s apt.

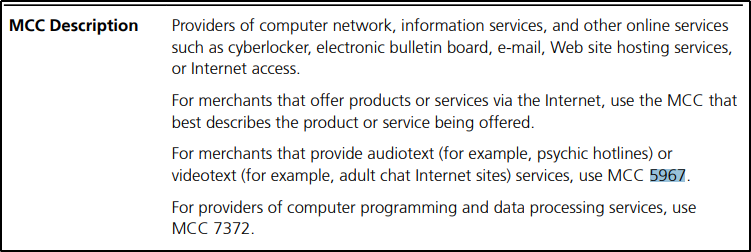

This is now the prescribed MCC for all adult content, whether with Visa…

…or Mastercard

| ☝️ The last bastion |

As mentioned, American Express prohibits the acceptance of cards for “adult digital content” as per its global policy. However, the BBC reports that a pilot is underway with a single company in the US for American Express acceptance. Commerce, it seems, finds a way.  |

Porn enterprises now occupy a nebulous grey area within the well-defined structures of card networks’ red tape and legal policies. Even though they’re officially recognised with their own MCC, they’re still treated like illegitimate children in some ways.

Visa, for example, does not extend fraud liability protection to merchants processing under MCC 5967, even if they use its “Verified by Visa” 2FA system. It also levies a higher penalty on MCC 5967 merchants for exceeding chargeback thresholds than for similarly non-compliant merchants processing under a different MCC. It’s kind of like the cool kids telling that creepy (but rich) kid he can join their clubhouse, “but sit in that corner and don’t touch anything”.

UOB is the only bank that explicitly awards bonus points for MCC 5967

Which brings us back to UOB. Even though the KrisFlyer UOB credit card will no longer award bonus points on MCC 5967 from 1 July 2020, there’s another UOB card which does.

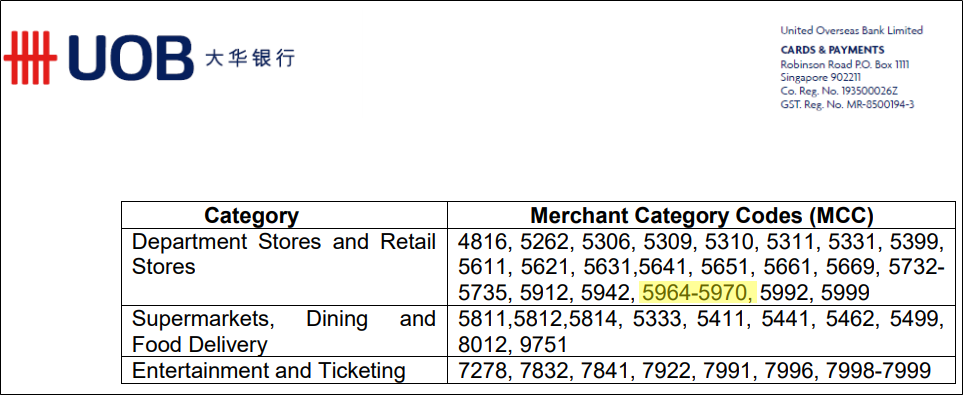

The UOB Preferred Platinum Visa earns 10X UNI$, or 4 mpd, on selected online transactions. On page 2 of its T&Cs, you’ll find a listing of eligible MCCs, and lying innocuously in that approved range is none other than our good friend 5967.

Now, before someone blasts this post with the title MILELION ACCUSES UOB OF PROMOTING PORNO, let me state for the record that this is obviously an oversight rather than a deliberate inclusion, and to be fair, MCC 5967 is not explicitly excluded from the T&Cs governing online spending bonuses on the Citi Rewards, DBS Woman’s World Card and HSBC Revolution.

That said, it just tickles me that at some point the UOB legal team were going through this document and saying “MCC 5964-5970? Yeah, no issues here.” How long this clause remains, I have no idea, but I’ll never look at a UOB card the same way again.

Conclusion

Pornographic transactions are a tricky area for banks and card networks to deal with, but the problem is likely to solve itself, given how bitcoin and other decentralized cryptocurrencies are better candidates for payment anyway.

So that’s the story behind MCC 5967, the most salacious four-digit combination you’ll ever find in the T&Cs.

Let’s keep the comments PG, please.

| Editorial comment: I’m writing about the pornography industry in fairly frank terms, but I’m under no illusions as to the problems it creates. For anyone struggling with this issue, here’s a really encouraging article to read. |

What a missed opportunity to have the numbers “9” and “6” in the MCC, and have them in that order…

It’s like an arguing couple.

The level of porn intellectual here is research material

I second this

4 miles per d…

Jokes aside, it’s a testament to how much the card networks have whitewashed the MCC 5967 name that UOB can just think “Oh, ‘Direct Marketing- Inbound Telemarketing Merchant’? That sounds like an online shopping MCC, let’s put it as a bonus category.”

Also, apparently Pornhub has an apparel store with a Clothing Store MCC…

One would have thought their interest would lie in less, rather than more, clothing

Why can’t the make it a law for all online transactions to declare the MCC during payment. Is really part of transparency.

By not doing so only implies lack of transparency and more dubious intentions

Which card do I use for KTV?

KTV should by 5813 so you can use UOB Lady’s (4mpd if you select Entertainment as bonus category), KF (3mpd), HSBC Revolution (2mpd). Or you can PayWave and get 4mpd on PPV.

This man KTVs

I can neither confirm nor deny what you just said.

Yes, KTV for Men…Where I sing and eat peanuts…which card to use pls sir?

It would be hilarious if I need to take my wife’s UOB Lady’s card to KTV, in order to maximise….our airmiles. Cause I love traveling with her…

But I heard the Internet was for porn