Income tax season is here, and on cue, the banks are starting to roll out promotions. This can be an opportunity to buy miles at a very low price for a payment you’ll need to make anyway.

Full Guide on Earning Miles for Income Tax

Citi PremierMiles offering 1.5 mpd on income tax payments

As you may already know, Citibank has a feature called Citi PayAll, which allows you to earn points when using your Citi cards for income tax, rent, education expenses, condo management fees, or electricity bills.

Citibank is currently running a promotion specifically for Citi PremierMiles cardholders who pay income tax via PayAll.

From 11 May-31 August 2020, cardholders will earn 1.5 mpd on their income tax payments via PayAll, 25% more than the usual 1.2 mpd. The bonus 0.3 mpd will be credited to within 8 weeks from the end of the promo period.

With PayAll’s usual 2% fee, the cost per mile is reduced from 1.67 cents to 1.33 cents

To be eligible, you must charge your payment by 31 August 2020. It may take Citibank a couple of days to charge your card, so don’t wait till the last minute to set it up.

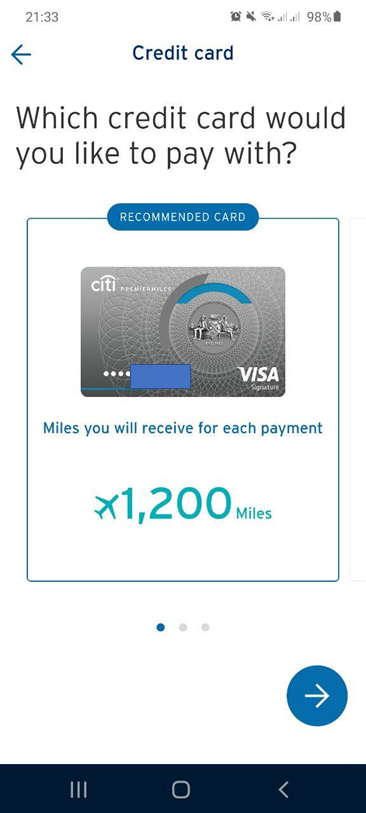

Last I heard, this bonus will not reflect on the Citi app. You’ll still see an earn rate based on 1.2 mpd when scheduling your payment. However, the T&Cs are pretty unambiguous about this, so I wouldn’t worry too much.

Moreover, the promotion is featured on the card’s public landing page, so it shouldn’t be a targeted offer.

Don’t use Citi PayAll to overpay your taxes

What I’ve always found strange about Citi PayAll is that they don’t request a copy of your NOA. Therefore, they have no way of knowing how much tax you actually need to pay.

Given the relatively low cost of buying miles through Citi PayAll, it’s unsurprising that some cardholders have tried to take advantage by overpaying their tax bill (and then requesting a refund via cheque). IRAS frowns on this, because it creates an additional administrative burden. From what I understand, taxpayers have received warnings for such behavior, and Citi’s on to you.

| 10. An Eligible Cardmember should not overpay his taxes via Citi PayAll. Where Citi has determined in its discretion exercised reasonably that an Eligible Cardmember’s payment(s) to IRAS exceed the amount of taxes which such Eligible Cardmember is required to pay to IRAS, Citi shall be entitled to claw back any Miles credited to such Eligible Cardmember’s Eligible Card account in connection with any amount so overpaid to IRAS using Citi PayAll. In such an event, Citi will refund the relevant portion of the Citi PayAll service fee in respect of such overpaid amount. |

Ah well, at least they’ll refund you the PayAll service fee.

Citibank offers the most transfer partners in Singapore

I’ve made the case that in these uncertain times, Citi Miles are probably one of the best currencies you can earn. They don’t expire, and with a choice of 11 different transfer partners, you’re more protected against any given one devaluing.

| Transfer Ratio | |

|

1:1 |

| 1:1 | |

| 1:1 | |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

| 1:1 |

A S$26.75 conversion fee applies for every transfer, and do note that Thank You points earned on the Citi Prestige/Citi Rewards cards do not pool with Citi Miles, so you’ll have to redeem them separately.

The flexibility of Citi Miles means they’re a great way to enjoy sweet spots in programs like Etihad Guest, British Airways Avios and Turkish Miles&Smiles.

For example, you could redeem a Singapore to Europe round-trip Business Class flight for just 90,000 miles with Turkish Airlines Miles&Smiles. That’s half the price that Singapore Airlines charges (albeit with fuel surcharges), which means you could fly two people for the cost of flying one with KrisFlyer.

Conclusion

This promotion represents the cheapest price at which Citi PremierMiles cardholders can generate miles while paying taxes.

| ❓ What’s the cheapest way of paying income tax with a credit card? |

| For a summary of all the different ways you can earn miles when paying taxes, do have a read of this guide. |

If this is something you’re interested in, be sure to schedule your payment well before 31 August 2020.

There’s another round of the Prestige offer from Apr to Jun

thanks! someone just forwarded to me.

Hi does anyone know what happens if i’m on a GIRO monthly instalment plan for taxes, and I pay more than the monthly instalment to enjoy the better promotion rate of 1.5 mpd for Citipayall, but do not over pay the total tax amount? Will that be ok?

No issue. They will adjust your future installments to lower amount