It’s all good and well to rake in the miles when you can take a weekend trip at the drop of a hat, but how does Covid-19 change the equation?

With travel all but impossible right now, some miles collectors are starting to see their balances as more of a liability than an asset, and exploring Pay with Points or statement rebates as ways of cashing them out.

I frankly think this is a terrible idea in most cases, but understand how the view that “poor value is better than no value” can be attractive.

So let’s take a closer look at these options and how they work, and see if there’s any scenario where they can make sense.

Pay with Points vs Statement Rebate

Before we talk about value, let’s get some terminology out of the way. Some banks offer Pay with Points, some offer statement rebates, others both.

| Bank | Pay with Points | Statement Rebate |

|

✔ | |

| ✔ | ||

| ✔ | ✔ | |

| ✔ | ✔ | |

| ✔ | ✔ | |

|

✔ | |

| ✔ | ||

| ✔ | ||

| ✔ | ✔ |

What’s the difference? Flexibility.

How Pay with Points works

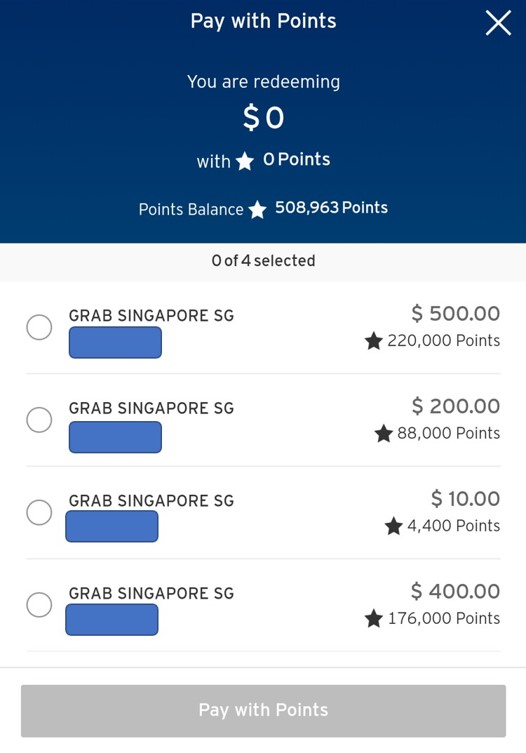

Pay with Points schemes allow cardholders to use credit card points to offset individual transactions of any amount.

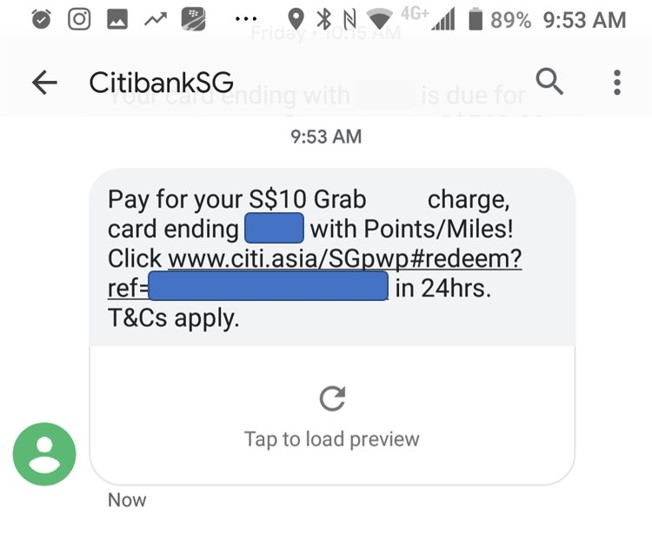

For example, Citibank cardholders may receive an SMS informing them they can offset a particular transaction with points.

Alternatively, they can login to their ibanking and see a list of transactions to redeem points for.

How Statement Rebates work

In contrast, statement rebates only allow for fixed denomination redemptions. For example, OCBC lets you redeem 1,000 Travel$ for a S$10 statement rebate, but if you have a smaller balance than that you won’t be able to redeem anything.

It seems intuitive that where Pay with Points options exist alongside statement rebates, the value you receive should be on par. However, that’s not always the case.

- Citi and HSBC offer the same value

- DBS and UOB offer different value

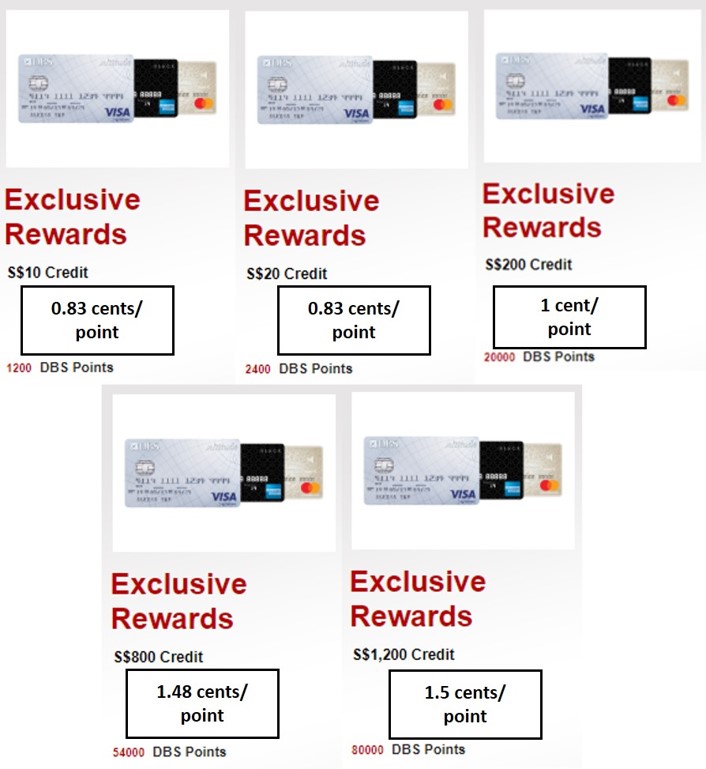

DBS Pay with Points yields a fixed value of 1 cent per point. If you opt for a statement rebate, you get anywhere from 0.83 to 1.5 cents per point, depending on the denomination you choose.

UOB Pay with Points yields a fixed value of 1.11 cents per point. If you opt for statement rebates, you get 1-1.15 cents per point.

Which bank offers the best value?

We can’t do a comparison on the basis of value per point, because bank points aren’t directly comparable- 1 DBS point isn’t the same as 1 OCBC$.

What we need to do is convert points to a common base, like airline miles. We can compare the implicit value you’re accepting for a mile, when you choose to redeem points for cash rebates. For instance:

- DBS Pay with Points values 1 DBS point at 1 cent

- 1 DBS point is 2 miles

- Therefore, you’re taking 0.5 cents per mile.

To further complicate matters, different cards may offer different value. For example, UOB PRVI Miles members can redeem 8,700 UNI$ for a S$100 rebate, but UOB Preferred Platinum Visa members can only redeem 2,000 UNI$ for a S$20 rebate.

In the table below, I’ve listed the possible values you could obtain for several popular cards.

| Value Per Mile | |

AMEX Platinum Charge AMEX Platinum Charge |

1.54 cents (promo rate until 20 July, 0.77 cents after) |

OCBC 90N/ OCBC 90N/OCBC VOYAGE |

1.0 cents |

SCB X Card SCB X Card |

1.0 cents |

AMEX Platinum Reserve/ AMEX Platinum Reserve/AMEX Platinum Credit Card |

0.86 cents |

SCB Visa Infinite SCB Visa Infinite |

0.78 cents |

DBS (all cards) DBS (all cards) |

0.42- 0.75 cents |

Maybank (all cards) Maybank (all cards) |

0.74 cents |

OCBC Titanium Rewards OCBC Titanium Rewards |

0.69 cents |

HSBC (all cards) HSBC (all cards) |

0.63 cents |

Citi Prestige Citi Prestige |

0.63 cents (promo rate till 30 June, 0.57 cents after) |

Citi PremierMiles Citi PremierMiles |

0.61 cents |

Citi Rewards Citi Rewards |

0.57 cents |

UOB PRVI Miles UOB PRVI Miles |

0.5- 0.57 cents |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

0.5 cents |

BOC Elite Miles BOC Elite Miles |

0.2-0.25 cents |

Outside of promotions, the best value you could get is 1 cent per mile. That’s a significant haircut compared to what you could earn when redeeming miles for flights, and for this reason I think redeeming points for cash rebates should be avoided at all costs.

Put it another way- if you’re going to redeem points for cash rebates, you might as well have used a cashback card in the first place. The best general spending cashback cards on the market (Citi Cash Back+, Maybank FC Barcelona, SCB Unlimited) will earn you 1.6% flat cashback. Compare that to the OCBC 90N, which earns you 1.2 mpd, or a 1.2% rebate when you factor in the 1 cent per mile valuation.

The picture obviously gets much worse if you’ve earned your points on a Citibank or DBS card, which have much poorer cash rebate options.

So what do I do with my points then?

In a word? Hodl.

While it’s true you can’t fly at the moment, your points haven’t become worthless overnight. We’re seeing early signs of recovery in the aviation market, and even if 2020 is a write-off, I don’t see how this fundamentally changes the equation. You’re not going to stop travelling altogether, after all.

If you’re worried about massive devaluations after Covid-19, you might be interested in watching our recent webinar on Covid-19 and The Miles Game. The consensus among the panelists was that it’s highly unlikely to happen, especially with Asia Miles and KrisFlyer. Devaluations, after all, are caused by too many miles chasing too few seats. Load factors are likely to remain poor in the near term, and the opportunity cost of award seats will be low. This creates an incentive for airlines to open up award space and remove mileage liabilities from their books.

Conclusion

Tempting though it may be to cash out your points for cash rebates, it really represents terrible value and should only be done as a last resort.

If you’ve already allocated your spending over the past couple of years based on a miles strategy, changing course now would only wipe out whatever gains you’ve been building towards.

So hold on to those points, watch for expiry (if any), and keep the faith.

What about switching to the dark side cashback cards during this time?

Actually I am curious to hear discussion on this too, given that most of us have probably amassed quite a bit of miles, but unable to sepnd them freely at least within the next 6-12 months.

I used some of my kris flyer miles at the kris shop before expiry. Not the worst deal nearly 100K miles for an ergonomic office chair.

how much is that office chair worth?

I just got my first cashback card after years of collecting air miles. Even if there is no devaluation in terms of miles needed for award tickets, travelling in Business Class in the next 12 to 18 months will be a sub-par experience – reduced meal service (or even none at all), need to wear a mask throughout flight, restricted lounge access etc. etc. And let’s not forget the greater risk of getting infected in an enclosed space with hundreds of other people. Would I really want to spend 184,000 miles on a ticket to London under such conditions? At… Read more »

Covid will probably weed out the less serious miles collectors

“We’re seeing early signs of recovery in the aviation market”

I’m curious to know what those signs are according to Aaron. Also, shouldn’t the balance tilt more in favour of cash rebates given the high likelihood of devaluation by the different programs? After all, a bird in the hand is worth 2 in the bush

1. domestic travel in the US bottomed out on 14 april, then has picked up since then

2. domestic flights resuming in india, vietnam, new zealand and south korea

3. scoot’s june schedule features 6 destinations, up from 2 in may

baby steps.

Actually I am curious to hear discussion on this too, given that most of us have probably amassed quite a bit of miles, but unable to sepnd them freely at least within the next 6-12 months.

Sounds like necessary domestic travel has come up. But international travel for leisure remains far away. some of the international flights are also necessitated by need to transport cargo…

Hey Aaron, totally-unrelated to CoviD19 but you might want to update your profile blurb…

Aaron founded The Milelion with the intention of helping people travel better for less and impressing chiobu. He was 50% successful.

my success rate remains solidly at 50%.

So did you fail at the impressing part or the chiobu part, or both.

We welcome a new official word: HODL

Kidding. I agree with the poor value we get trading for statement credit (and vouchers). Let’s be patient to see how this pans out. At the start, premium travel might not as luxurious, but who knows what it would look like next year.

For the Citi Rewards Card, at the bonus 10 ThankYou points per dollar level with a cash rebate of 440 points to $1, that’s still a decent 2.27% cashback when used as a cashback card isn’t it?

sure, but if you wanted to use a cashback card for online spending, why wouldn’t you just pick something with a much higher %? there are much better cashback cards for online.