| Update: Citibank has extended the deadline for the first payment from 30 June to 31 July 2020 |

Citi Prestige customers haven’t really been feeling the love from Citibank during this Covid-19 period. Although key benefits like 4th Night Free and lounge access can’t be used, there’s been no annual fee discounts forthcoming, much less waivers. Cardholders who appeal have been told that the deal’s the same as before: S$535 for 25,000 miles, or hit the road.

But there just might be early signs that Citibank’s realised they have to do more. The Citi Prestige limo benefit has just been enhanced to allow the accumulation of rides throughout 2020, and now there’s another small perk incoming.

Citi Prestige is offering $40 rebate on recurring bill payments

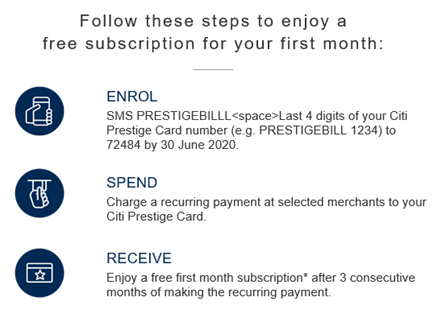

From now till 31 July 2020, Citi Prestige customers can register to enjoy the first month free on any recurring bill payment charged to the card.

A minimum of three consecutive months’ subscriptions must be charged, and the rebate is capped at S$40. Registration is required for this promotion, and can be done by following the steps below.

Citibank’s copywriters haven’t exactly been on top of their game recently. The eDM says to SMS the following to 72484:

PRESTIGEBILLL<space> Last 4 digits of Citi Prestige Card

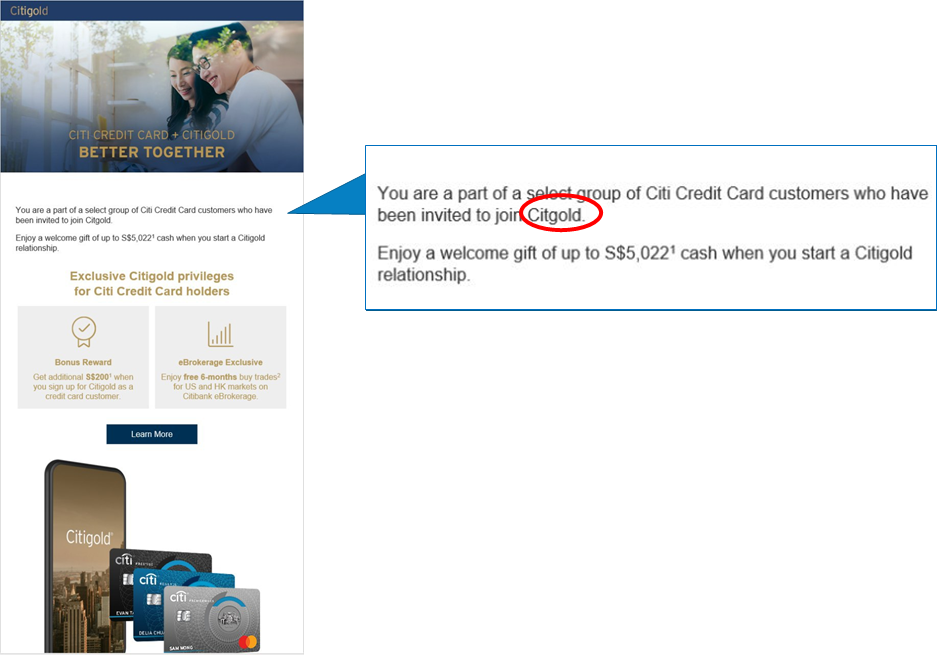

As the T&Cs confirm, that’s meant to be PRESTIGEBILL, not PRESTIGEBILLL, so do take note of that. I suppose that’s not as bad as misspelling Citigold in the mass invites that went out to Prestige cardholders recently…

What merchants are eligible for the Citi Prestige rebate?

Once your card is registered, charge a recurring payment at any of the following merchants to your Citi Prestige card. The first payment must be made by 31 July 2020.

| Telcos |

|

|

| Entertainment |

|

|

| Fashion |

|

|

| Media |

|

|

| Fitness |

|

|

| Utilities |

|

|

| Services |

|

|

| Insurance |

|

|

You’ll then receive a cash back amount equivalent to the qualifying recurring charge for the first month, capped at S$40. Cash back will be credited 6-8 weeks after the third month charge has been made

- If your first qualifying charge was made from 1-30 June, you’ll get your cashback by 31 October

- If your first qualifying charge was made from 1-31 July, you’ll get your cashback by 30 November

Do take note that while transactions at all of the merchants above will qualify for the rebate, not all of them will earn points. As per Citi’s overall exclusion list, you won’t earn points on

- Insurance

- Utilities

What’s also interesting is that the T&Cs seem to suggest that both principal and supplementary cardholders can participate in this promotion, with each cardholder getting their own S$40 rebate. Point 1(c) describes eligible cardmember as one who:

- Currently holds an Eligible Card as a cardholder (main and supplementary); and

- receives an invitation directly from Citibank via an SMS, eDM and/or other official Citi

communications for participation in this Promotion; and - registers to participate in the Promotion in accordance with clause 2 below

The full T&C of this promotion can be found here.

Conclusion

The Citi Prestige’s S$40 recurring bill rebate (on a S$535 fee) is not quite the S$500 rebate that American Express gave to their Platinum Charge cardholders (on a S$1,712 fee), but hey, it’s something.

Remember to register, and to pick a merchant where your first month’s subscription is at least S$40.

Thx for the reminder. I had deleted the DM mindlessly so I would have overlooked this campaign. And yes, PRESTIGEBILL is correct, while PRESTIGEBILLL didn’t invoke any automatic response lol.

How will you trigger a recurring payment with such short notice>?

Would manually made payment for 3 consecutive months count as “recurring” payment? The terms don’t define this clearly.

Else if recurring payment requires setup by merchant AND be charge within the same month, then it’s not possible for those whose invoices have just been issued and payment is soon due – the first payment would’ve missed the deadline of 30 June.

I’ve rung Citi Prestige and it appears that it has to be a recurring payment charged by a merchant. So manual payment to SP Services via the SP App using Citi Prestige is not going to accrue the cashback. Which brought me to the question of why they put SP Services in the list of participating merchants but that’s a question for another day.

Would appreciate if anyone could let me know if they found a different answer to this question

Seems people generally are confused on what the definition of “recurring” is. I called Citibank today and the CSO said “normally” it refers to something that the merchant needs to set up. BUT this is not defined clearly in clause 1.f. and I asked the CSO to refrain from hypothetical conjectures, but to clarify with the product manager responsible for this campaign whether it applies to payments that are paid manually for 3 consecutive months by the customer (which, in essence, are “recurring”) or requires merchant to set up. Will update once Citibank reverts. Essentially this campaign is badly… Read more »

Citibank has reverted. The CSO checked with the Product Manager, who said the cardholder will qualify if “the same merchant appears in the statement for 3 consecutive months” – implying, it does not matter if the recurring payments are initiated manually by the cardholder, or initiated by the merchant.

My supplementary cardholder received the eDM today, which has the PRESTIGEBILLL corrected (LOL) and says it’s until 31 July. But when you click the link to the T&Cs, it still says promotion period is 1 to 30 June. Citi’s copywriters truly have been sleepwalking of late…

Interesting. Do you have this in writing?

I’m trying to find out how to set up recurring payment for Singapore Power. I can’t seem to find a way to do it. Can someone enlighten me?

And I found this on the FAQ for SP. “Presently, recurring payment is provided through DBS Bank for DBS/ POSB Visa and Master Cards only.” So I think we cannot set it up for SP.

Do the payments need to be the same amount over the 3 months? Is manually paying (to say SP) on the same day each month considered recurring payment?