The HSBC Revolution recently received a major facelift which saw it go from also-ran to wallet essential.

HSBC Revolution HSBC Revolution |

|

| Income Req. | Annual Fee |

| S$30,000 | None |

| Apply here | |

| Read the Full Review | |

The new-and-improved HSBC Revolution now offers 4 mpd on a wide range of bonus categories, including travel, shopping, dining, transport and more. There’s no more annual fee, and all cardmembers get a free copy of The Entertainer to boot.

And if that wasn’t enough, HSBC has just extended the welcome gift offer for the HSBC Revolution to 31 December 2020.

HSBC’s Welcome Gift Offer

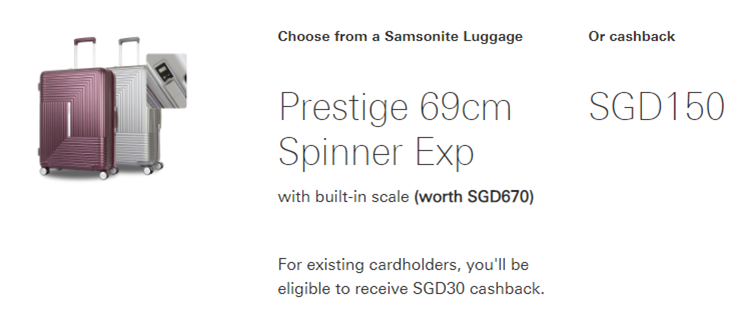

From now till 31 December 2020, new-to-bank HSBC customers can choose between a Samsonite Prestige 69 cm luggage bag (worth S$670) or S$150 of cashback when they spend a minimum of S$800 during the qualifying spending period (see below).

| New-to-bank customers are defined as those who do not currently hold a principal HSBC credit card, and have not in the last 12 months |

Applicants will be prompted for their choice at the time of application.

Existing HSBC customers are entitled to a welcome gift too, but it’s much more underwhelming- S$30 cashback with a minimum S$800 spend.

The qualifying spending period depends on when your card was approved:

| Card Opening Date | Qualifying Spend Period | Notification Date |

| 1-30 Sep 2020 | 1 Sep- 31 Oct 2020 | By 30 Nov 20 |

| 1- 31 Oct 2020 | 1 Oct – 30 Nov 2020 | By 31 Dec 20 |

| 1-30 Nov 2020 | 1 Nov -31 Dec 2020 | By 31 Jan 21 |

| 1-31 Dec 2020 | 1 Dec 2020- 31 Jan 2021 | By 28 Feb 21 |

| 1-15 Jan 2021* | 1 Jan -28 Feb 2021 | By 31 Mar 21 |

| *Why “1-15 January 2021” when the deadline is 31 December 2020? The latter refers to the application date, while the former refers to the card approval date | ||

The mechanics mean that it’s always better to apply towards the start of the month, as it gives you up to two months to meet your qualifying spend.

As an added bonus, all customers (whether new or existing) get S$30 of Lazada promo codes when they apply online with MyInfo via SingPass. No spending is required for this gift.

What spending is excluded?

The minimum spend of S$800 does not include the following:

|

The key exclusions to note here are insurance, utilities, education, government transactions as well as CardUp/ipaymy. These were all excluded from 1 July 2020 onwards as part of HSBC’s revised rewards terms and conditions.

The full T&C of this offer can be found here.

Conclusion

I recently updated my 2020 credit card strategy, and the HSBC Revolution plays a big part in my arsenal now.

What I particularly like is that it awards 4 mpd on both dining and hotels, which solves the age old question of “what card should I use to pay at hotel restaurants?” It’s also the most straightforward way of earning 4 mpd at Cold Storage (remember: UOB cards will only earn SMART$ here), and paying for staycations.

All in all, it’s a great multi-role card, and one to add to your wallet.