Google Pay launched P2P payments in Singapore back in April, and has steadily expanded its offerings since. Users can now order food, buy movie tickets, make in-store payments and send money to friends and family via the app, all while earning cash rewards (in fact, it’s the only way to earn rebates on PayNow transfers).

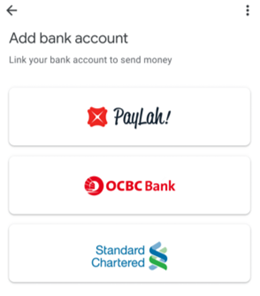

To transfer money via Google Pay, you’ll need to link a bank account. Initially, only OCBC accounts were supported, but Google Pay now supports DBS PayLah and Standard Chartered Bank as well.

If you don’t already have a Google Pay account (it’s available for both Android and Apple devices), you can get S$5 free (previously: S$3) when you sign up via the link below and make a payment of at least S$10 (just send money to a friend or family member).

Get S$5 free when you sign up for Google Pay here

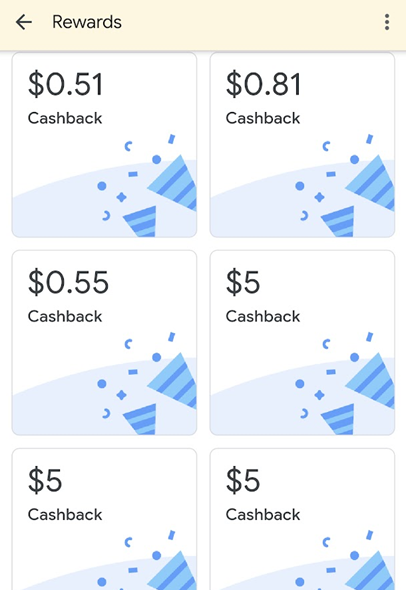

Google Pay Scratch Card Promotions

From now till 31 October 2020, Google Pay users can earn up to S$50 each week via scratch cards for making in-store payments, or sending money via PayNow to friends & family.

A week is defined as Monday 9 a.m to the following Monday 8.59 a.m.

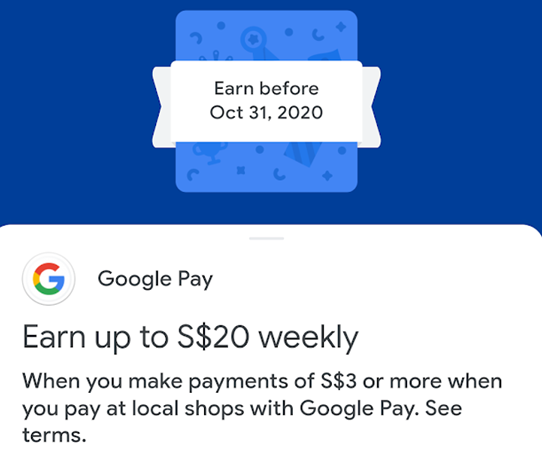

In-store payments: Up to S$20 weekly

When you use Google Pay to make a payment of at least S$3 in-store, you’ll receive a scratch card worth up to S$10.

You can earn a maximum of two scratch cards per week through in-store payments. Each payment must be unique; i.e spending S$3 twice with the same merchant only earns you a single scratch card.

Payments can be done either through Tap & Pay (available for Android devices with NFC capability) or QR code (for all other devices). In-store payments exclude transit transactions, but I doubt you’d spend S$3 on a single transit transaction anyway.

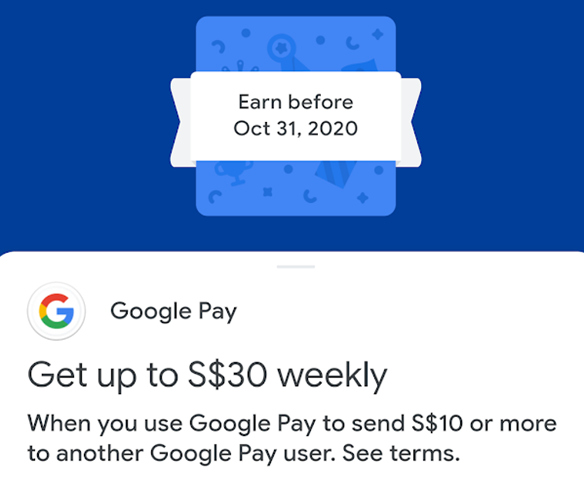

P2P money transfers: Up to S$30 weekly

When you use Google Pay to send at least S$10 to another Google Pay user, you’ll receive a scratch card worth up to S$15. I distinctly recall that there was previously no need for the receiving party to also be on Google Pay (since all transfers work via the PayNow system), so it looks like Google has tightened up the T&Cs for this slightly.

You can earn a maximum of two scratch cards per week through P2P money transfers. Each transfer must be unique; i.e spending S$10 twice to the same person only earns you a single scratch card.

Other Google Pay offers

In addition to the above promotions, Google Pay users can earn S$2 cashback when making two qualifying payments of at least S$10 or more on food via Google Pay. This is valid for food orders made between 21-28 September 2020.

Google Pay users can also save on movie tickets with GV and Shaw when purchasing tickets through the app. Refer to the “offers” section for more details.

How do I set up Google Pay Singapore?

To start, simply download the Google Pay app on either your Android or iOS device.

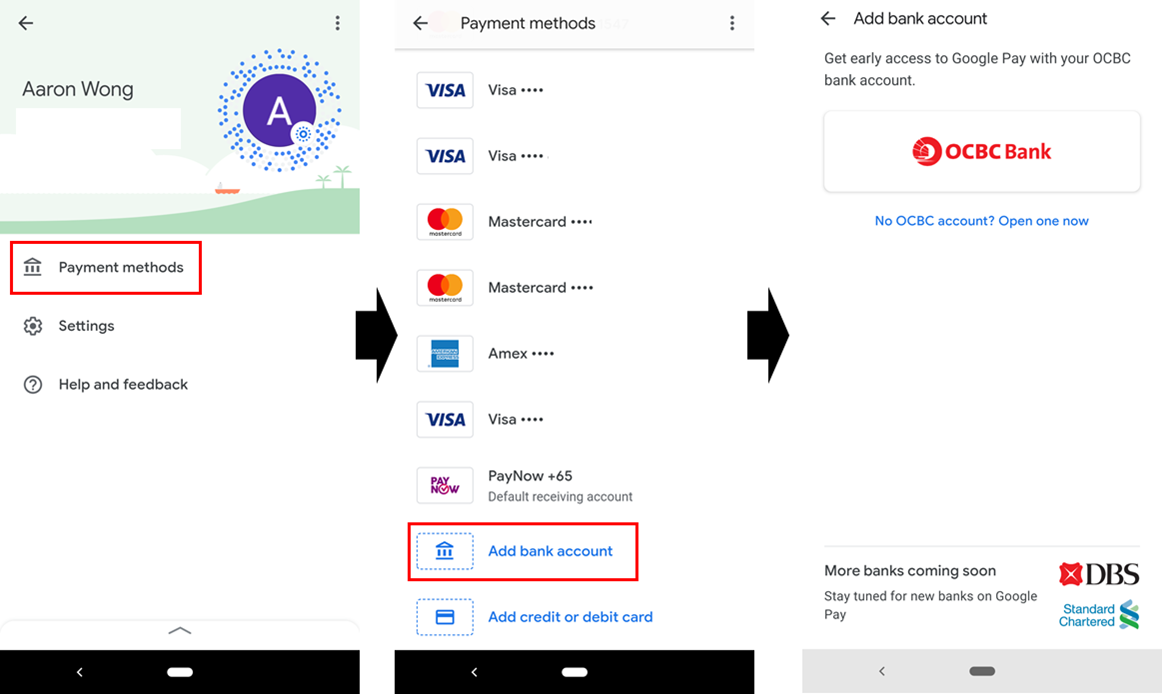

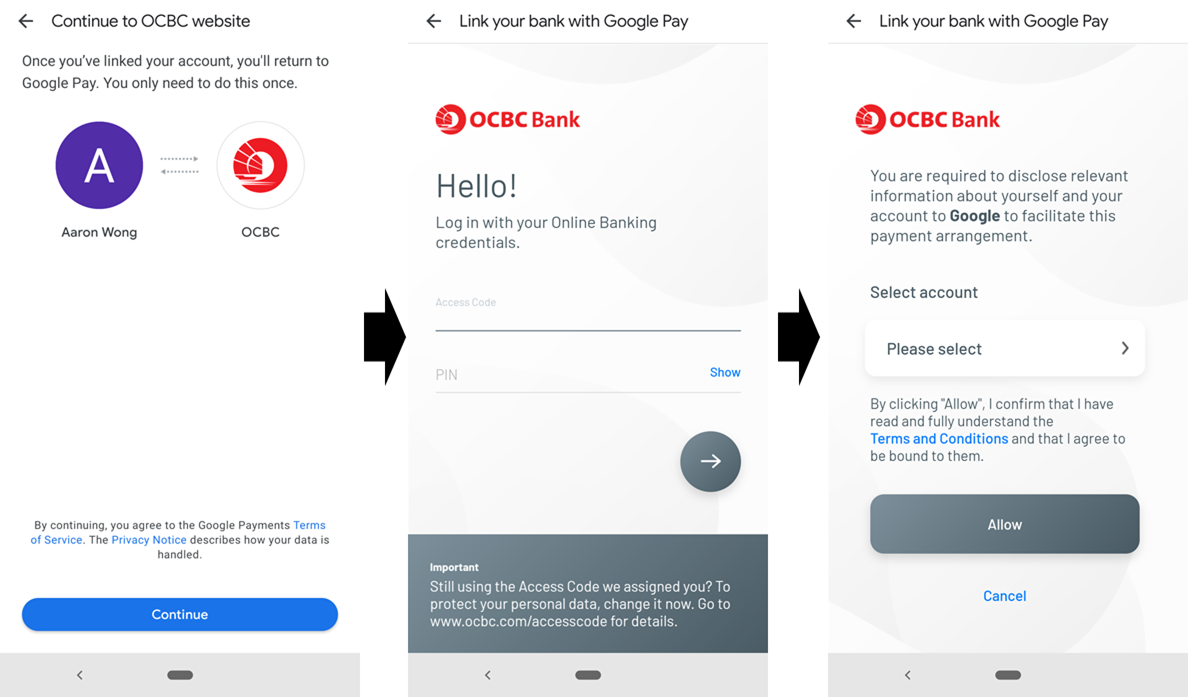

Navigate to your profile settings and tap “Payment Methods”. Then tap “Add bank account”, and select OCBC, DBS PayLah or Standard Chartered Bank. I’m going to show the process flow for OCBC below, but it’s very similar for DBS PayLah and Standard Chartered Bank.

You’ll be prompted to login to your online banking account to do a one-time setup. Select the account you want to pair with Google Pay Singapore, enter the OTP and you’re good to go.

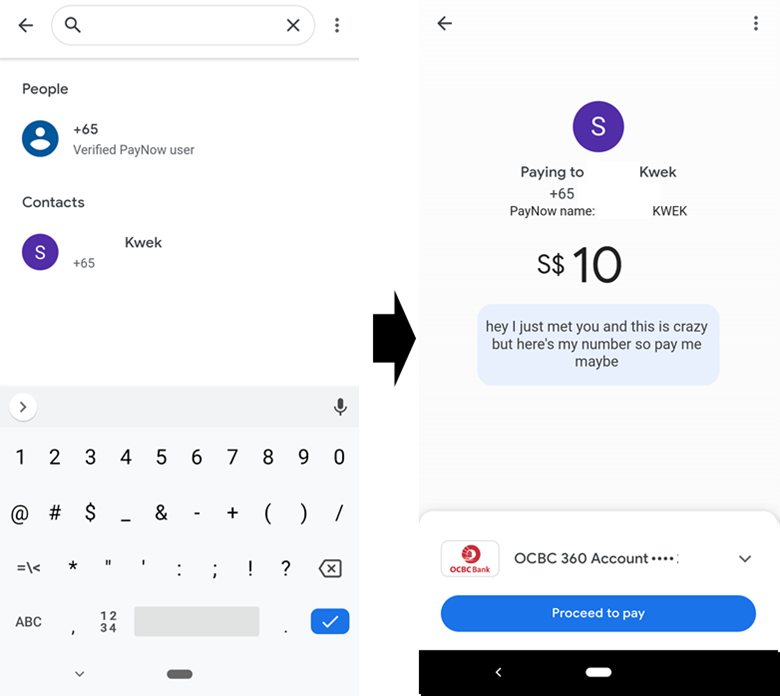

Sending money is equally straightforward. Google Pay Singapore harnesses the PayNow platform, so you can send money to anyone’s mobile number as you would with any other banking app. There’s no need for the receiving party to use Google Pay- so long as they have a registered PayNow account, they’ll receive the funds.

Standard Chartered customers have a daily transfer limit of S$1,000, while OCBC customers have a cap of S$2,000. For DBS PayLah, you are limited by the wallet limit of your account. Google Pay itself has a daily transfer limit of S$2,000.

Conclusion

Google Pay is an easy way to earn some money back on your PayNow transfers, and while the amount you win is purely algorithmic lottery, it’s a lot better than zero (although you occasionally get a “try again” prize).

It also allows you to stack cashback on top of whatever miles you earn on your credit card, when making in-store payments via Google Pay. There’s really very little to lose by creating an account.

Hello, can you explain how In-store payments work? The QR code scanner embedded in the app doesn’t work on the Paynow QR codes..

I haven’t tried it before, but I think google pay uses a special QR code called a Spot Code.

actually, try updating your google pay app, it should fix the issue