| The following is a sponsored post by Singlife. All opinions and analysis remain that of The Milelion. |

With banks cutting interest rates and Singapore Saving Bonds yields falling by the month, I’ve had to rethink where I park my short-term funds.

The ideal solution would be highly liquid and capital-guaranteed, earning a reasonable return while I wait to enter the markets. That’s what led me to sign up for a Singlife Account earlier this year.

For the uninitiated, a Singlife Account is a capital-guaranteed insurance savings plan that is protected up to specified limits by the SDIC. Although Singlife is careful to emphasize that the Singlife Account is not a savings account, it’s still highly liquid, earns competitive returns, and allows penalty-free withdrawals at any time.

The Singlife Account currently earns 2.5% p.a. returns on the first S$10,000, but those crediting rates will be adjusted downwards to 2% p.a. from 1 November 2020. Even so, it’s still among the best options on the market, considering the capital guarantee and liquidity:

| Account Value | Crediting Rate |

| First S$10,000 | 2.0% p.a. |

| Next S$90,000 | 1.0% p.a. |

| Amounts above S$100,000 | 0% p.a. |

| 👍 For a limited time, it’s possible to continue earning 2.5% p.a. on the first S$10,000. See the Save Spend Earn campaign below. |

Returns are calculated daily, and credited to your Singlife Account on the first day of the following policy month. Crediting rates may be subject to change in the future, but making a withdrawal from a Singlife Account is as simple as a routine FAST transfer anyway. There are no penalties for withdrawals, and returns will be pro-rated up to the day of withdrawal.

Since the Singlife Account is an insurance savings plan, there’s a protection element too. Singlife Account customers receive life insurance coverage for death or terminal illness of up to 105% of the account value. While this shouldn’t be your only source of life insurance coverage, it’s simply the icing on the cake.

Customers also receive retrenchment coverage, courtesy of their spending on the Singlife Visa Debit Card (which comes optional with the Singlife Account). If you’re retrenched and remain unemployed for at least four months, you’ll receive a retrenchment benefit for a period of three months. The retrenchment benefit is equal to the average monthly transaction value made on the Singlife Visa Debit Card during the six month period before retrenchment and the total retrenchment benefit payable is capped at S$10,000.

But retrenchment coverage aside, why would any self-respecting miles collector want to put spending on a debit card? That’s where the next part comes in…

Singlife’s Save Spend Earn Campaign

Although Singlife will be reducing its headline crediting rate to 2.0% p.a. from 1 November 2020, it’s still possible to continue earning 2.5% p.a. returns for a limited time.

From 1 November 2020 to 28 February 2021, Singlife will be running a campaign called Save Spend Earn. Customers who spend at least S$500 on their Singlife Visa Debit Card per card spend period will receive an additional 0.5% p.a. bonus return on their first S$10,000. This, when added to the regular 2.0% p.a. base return, yields a total of 2.5% p.a.

There are no exclusions on what counts towards the S$500 spending, which means you could use the Singlife Visa Debit Card to clock transactions that normally do not earn rewards on credit cards, such as:

- Charitable donations

- Education bills

- Insurance premiums

- Government payments

- GrabPay wallet top-ups

- Utilities bills

| ⚠️ Do note that while there are no category exclusions, card acceptance is dependent on the merchant |

This represents an excellent use case for the Singlife Visa Debit Card. An incremental 0.5% p.a. on an account value of S$10,000 means an additional ~S$4 per month, which represents an effective rebate of 0.8% on S$500 of spending.

It’s not life-changing, but it’s still better than the zero you’d get had you used your credit card on the aforementioned spend categories. Moreover, you’re simultaneously building up a track record of spending for the retrenchment benefit, should it be needed.

How does Save Spend Earn work?

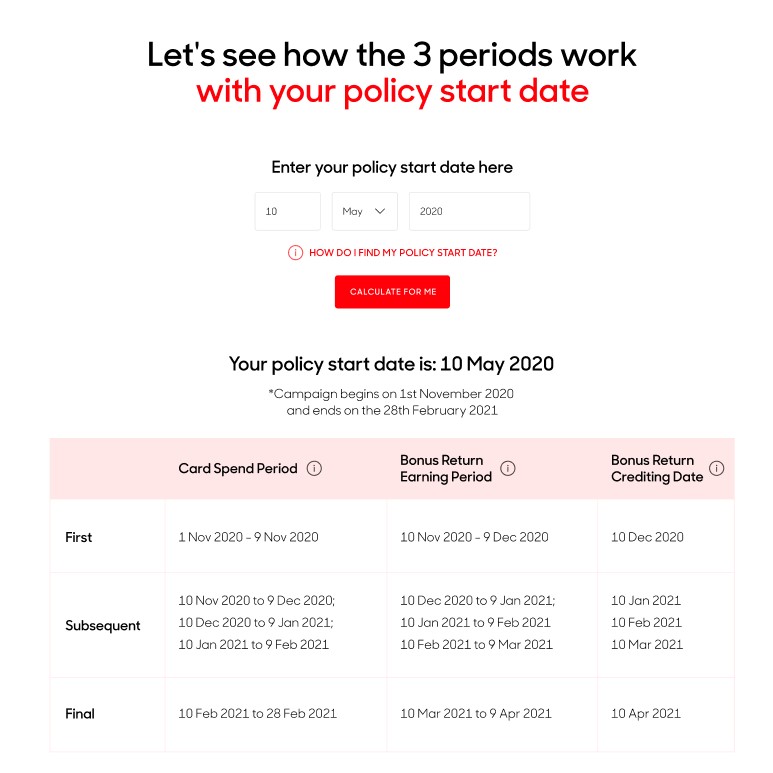

There are three dates/periods you need to take note of:

- Your card spending period, i.e when you need to hit the S$500 spend on the Singlife Visa Debit Card. Think of this as the “statement month” that certain credit cards use for bonus miles promotions

- Your bonus return earning period, i.e the period where you’ll earn the incremental 0.5% p.a. return on the first S$10,000 for the duration of one policy month

- Your bonus return crediting date, i.e when you’ll receive the incremental 0.5% p.a. return. This is the same as the crediting date of your base return

The first card spend period will run from 1 November 2020 till the day before your next crediting date. Let’s suppose that’s the 20th of every month, in which case you have:

| Card Spend Period | Bonus Return Earning Period | Bonus Return Crediting Date |

| 1 Nov to 19 Nov 2020 | 20 Nov to 19 Dec 2020 | 20 Dec 2020 |

| 20 Nov to 19 Dec 2020 | 20 Dec 2020 to 19 Jan 2021 | 20 Jan 2021 |

| 20 Dec 2020 to 19 Jan 2021 | 20 Jan to 19 Feb 2021 | 20 Feb 2021 |

| 20 Jan to 19 Feb 2021 | 20 Feb to 19 Mar 2021 | 20 Mar 2021 |

| 20 Feb to 28 Feb 2021 | 20 Mar to 19 Apr 2021 | 20 Apr 2021 |

That’s a simple enough scenario, but there’ll be some of you with return crediting dates that fall at the very start or very end of the month.

Suppose your next crediting date falls on the 1st of every month. Your relevant dates will then be:

| Card Spend Period | Bonus Return Earning Period | Bonus Return Crediting Date |

| 1 Nov to 30 Nov 2020 | 1 Dec to 31 Dec 2020 | 1 Jan 2021 |

| 1 Dec to 31 Dec 2020 | 1 Jan to 31 Jan 2021 | 1 Feb 2021 |

| 1 Jan to 31 Jan 2021 | 1 Feb to 28 Feb 2021 | 1 Mar 2021 |

| 1 Feb to 28 Feb 2021 | 1 Mar to 31 Mar 2021 | 1 Apr 2021 |

Similarly, if your crediting date is the 31st of the month, your relevant dates will be:

| Card Spend Period | Bonus Return Earning Period | Bonus Return Crediting Date |

| 1 Nov to 30 Nov 2020 | 1 Dec to 30 Dec 2020 | 31 Dec 2020 |

| 1 Dec to 30 Dec 2020 | 31 Dec 2020 to 30 Jan 2021 | 31 Jan 2021 |

| 31 Dec 2020 to 30 Jan 2021 | 31 Jan to 28 Feb 2021 | 1 Mar 2021 |

| 31 Jan to 28 Feb 2021 | 1 Mar to 30 Mar 2021 | 31 Mar 2021 |

If in doubt about your next crediting date, or when your bonus return will be credited, you can find it here. Singlife also has a dedicated Save Spend Earn campaign page that allows you to calculate your relevant periods by simply inputting your policy start date as seen in the illustration below:

I’ll certainly be taking advantage of the Save Spend Earn campaign to get something out of transactions that would normally earn nothing on my credit card.

Conclusion

Traditional bank accounts have fallen out of favor with me due to their declining interest rates and the need to jump through multiple hoops to unlock bonus interest (especially the requirement to invest or insure with the bank).

Insurance savings plans like the Singlife Account offer a competitive alternative, providing a place to store your emergency or warchest funds. There’s really very little to dislike here- competitive returns on the first S$10,000 of your short-term liquidity needs, capital guaranteed, and insurance coverage to sweeten the deal.

It’s a no-brainer as far as I’m concerned.

Learn more about the Singlife Account

Learn more about the Save Spend Earn campaign

The information is meant for your general knowledge and does not regard any specific investment objectives, financial situations or particular needs any person might have and should not be relied upon as the provision of financial advice.

Singlife Account is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact Singlife or visit the LIA or SDIC web-sites (www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is correct as of 2 October 2020

Sure, an extra $4 on normally excluded transactions is nice, but you could just as easily top up GPMC with Amex TCB and get 1.5% cashback- that’s an extra $7.50 in value. So not necessarily the best option.

that’s true- maybe think of merchants where GPMC is not accepted. i understand there’s quite a few, so this would be the alternative then.