One of the major inconveniences about the GrabPay wallet was the fact it’s essentially a closed-loop system. Funds, once inside, could not be withdrawn again- it’s why everyone hates that guy who pays them back with GrabPay instead of PayNow.

|

| GrabPay Funds Transfer |

But Grab’s realised this is a big impediment to GrabPay adoption, and has moved to address it. Effective 8 February 2021, it’s possible to transfer funds out of your GrabPay Wallet to bank accounts and other e-wallets in Singapore, with no fees involved.

A maximum of 2 transfers can be made per day to bank accounts or e-wallets, and each transaction is capped at S$5,000. Transfers to your own account will not count towards your annual GrabPay spending limit of S$30,000, but transfers to other accounts will.

What GrabPay wallet funds can I transfer?

Now I realise some of you may already be seeing dollar signs. “If I top up my GrabPay wallet with the AMEX True Cashback Card and then cash out the balance to my bank account, I’ll be earning 1.5% out of nowhere- who needs GME?”

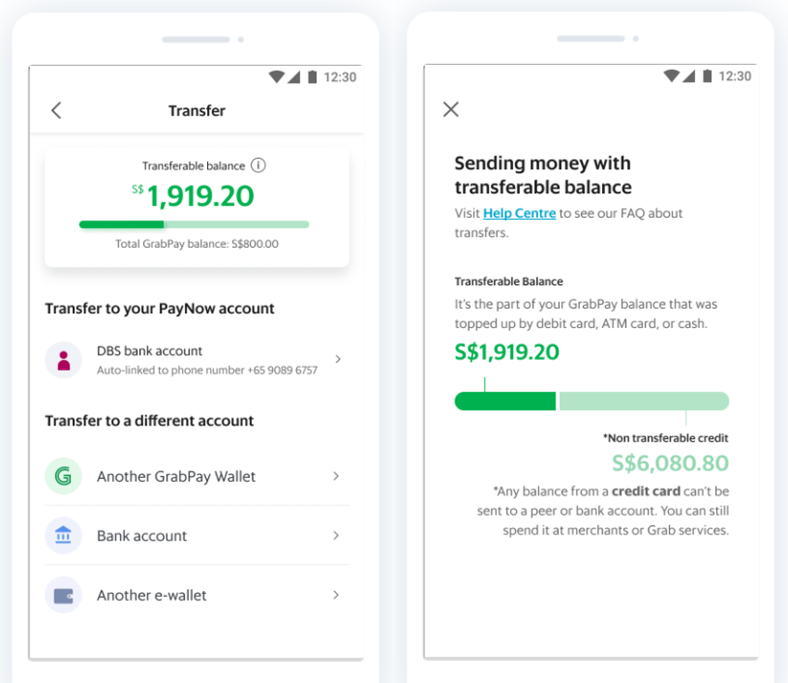

Cute, but Grab’s obviously not that dumb. Your GrabPay wallet will be split into two categories: a non-transferrable balance, and a transferrable balance. Funds topped up from credit cards or foreign debit cards cannot be transferred out; they can only be spent within the Grab ecosystem (e.g on GrabFood and rides).

Funds from other sources, such as local debit cards and QR codes, can be transferred out.

| Non-Transferable Balance | Transferable Balance | |

| Source of Balance |

|

|

| Balance can be used for |

|

|

| *This seems to suggest that you can no longer top-up your GrabPay account with a credit card, then send those funds to a friend | ||

Even though you can’t use this as an infinite loop for credit card rewards, this doesn’t mean it’s useless. I can think of three possible use cases here:

- You could use this to clock S$500 on the Singlife Visa Debit Card to trigger the bonus 0.5% p.a interest under the Save Spend Earn campaign

- You could top up S$10 using Google Pay and your GrabPay QR code, triggering 1x scratch card and 1x Huat Pal

- Mark this as speculative, but the Maybank Platinum Debit Card gives 0.4 miles per S$5 on all local spending, and I don’t see GrabPay top-ups under their exclusion list…

Unfortunately, the following won’t work:

- The Razer Prepaid Card offers 1% cashback on all purchases, but the T&Cs exclude GrabPay top-ups

- The UOB One Debit Card earns 1% cashback on Grab, but excludes GrabPay top-ups

- The OCBC Yes! Debit Card earns 1% cashback on Grab, but excludes GrabPay top-ups

- Spending S$800 per month on the HSBC Everyday Global Debit Card unlocks bonus interest of 0.14-0.34% p.a, but GrabPay top-ups are excluded

If you have any other bright ideas, do give a shout out below.

Where can I transfer GrabPay wallet funds?

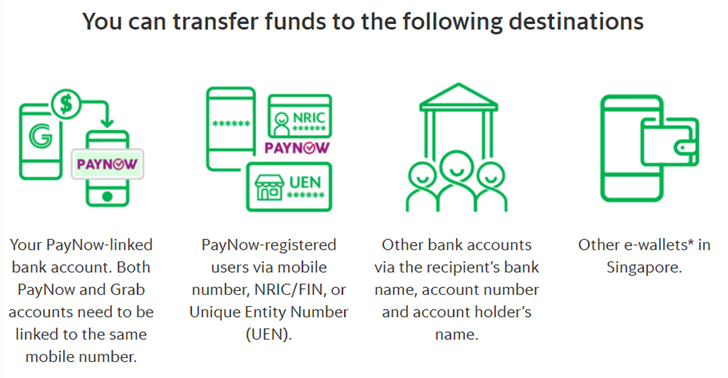

Your GrabPay transferrable balance can be cashed out to:

- A PayNow-linked bank account

- A PayNow-registered mobile user

- Other bank accounts with the recipient’s bank name, account number and account holder’s name

- Other e-wallets in Singapore

Cash outs to other e-wallets are currently limited to LiquidPay, MatchMove, Razer Pay, Singtel Dash, and TransferWise.

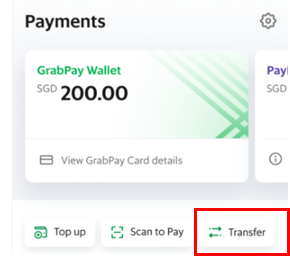

The transfer feature will appear under your GrabPay Wallet tab in the Grab app. I don’t see it yet in mine, but here’s the screenshot provided by Grab. I assume it will be added with the next app update.

Before you can transfer any funds, you’ll need to verify your identity and upgrade to a Premium GrabPay wallet (the process is free). You’ll also be required to set up a GrabPIN, if you’ve not already done so.

Conclusion

A big day for GrabPay, as it moves towards a more open-ended ecosystem. While you won’t be able to use this as a means of churning credit card rewards, there may still be some use cases with certain debit cards in Singapore.

If nothing else, it brings GrabPay closer to a “true” cash solution.

Any other ideas come to mind?

Does that mean you can no longer top up

GrabPay with Amex, then use that to send to a friend?

it would appear so, actually

After the EZ-Link top up debacle, where one guy transferred $266,000 cash out of his EZ-Link accounts topped up with credit cards, this is a good safeguard.

How does this impact Grabinvest? Can this money now be cashed out to a local bank account rather than only be spent in the Grab Ecosystem?

If my friend topped up $10 using credit card and grab pay me $10. Can I transfer out this $10 to my bank account?

How do I know it the $10 that my friend paid me is transferable or non-transferrable?

System hiccups aside, if you received it, it means it has to be transferable to begin with.

If like that, I use credit card to top up say $1000, then “pay” my sibling who will transfer out to bank account then then do a normal fund transfer back to me. Round trip to earn credit card rewards and rebate.

Look, my friend. In the new world, you can’t even pay your sibling. That $1k is non-transferable.

Will they make sure spending is on the non-transferable balance first?

This is speculative too, but SCB debit card gives 1% cashback and I don’t see GrabPay top ups explicitly excluded either.

61.4.7 top-ups of any stored value facility;

https://av.sc.com/sg/content/docs/scb-tc-booklet.pdf

For razer pay card, I don’t think it is possible to top up grab anyway

I still have >$500 in GrabPay balance, topped up to over a few thousand when Citibank was still awarding miles for topping up with their Rewards card. Strange that the entire balance shows as transferable. Not complaining though.

Either a once-off grandfathering, or the programmer screwed up.

Top up using credit card. AutoInvest. Cash out from AutoInvest. Refund to bank account.

Autoinvest needs organic spend and then you add on a few dollars on top of the transaction to put into Autoinvest. Ergo, not a sustainable solution.

Yes, I discovered this “hack” too. Nice way to turn non-transferable balance into transferable balance. In other words, withdrawing credit card top-ups 😁

https://coldbrewpouroverespresso.wordpress.com/2021/07/04/withdraw-credit-card-top-up-to-grabpay-as-cash/

What is GME?

Anyone tried UOB KF debit card?

Tried SingLife top up to Grab, doesn’t go thru. Anyone have same experience?

Nope, both mine and my wife’s works perfectly

do you top up using what methods? cards? can you transfer back or transfer to paynow once in grab wallet?

Can I get grabpay or amaze card if I live in somalia?