Grab has launched a new GrabPay Power Up challenge, with a maximum bonus of 30,000 GrabRewards points to be won for making online transactions with the GrabPay Mastercard or GrabPay Wallet balance.

This won’t be attractive to those who can earn 4 mpd otherwise, but there are specific types of transactions where it can make sense.

GrabPay Power Up Challenge

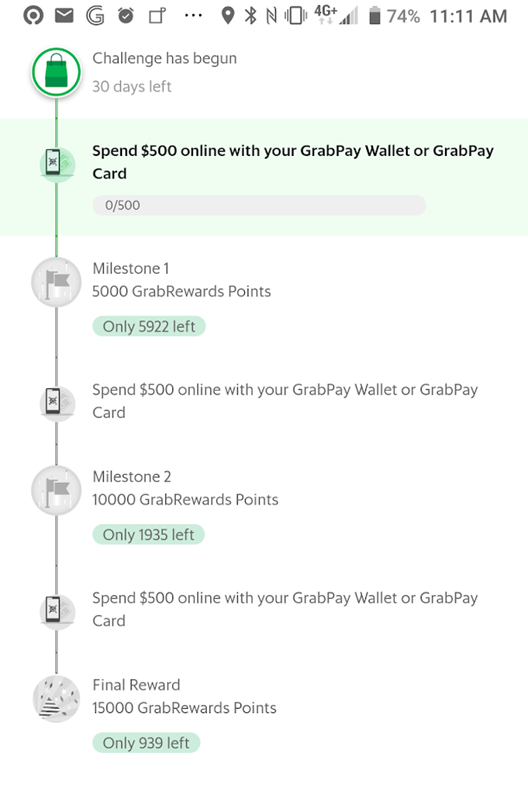

Registration is required, and can be done via the Grab app. Once registered, you’ll receive bonus GrabRewards points as follows:

- Spend S$500 online with GrabPay Card or Wallet: 5,000 points

- Spend a further S$500 online (i.e S$1,000 total) with GrabPay Card or Wallet: 10,000 points

- Spend a further S$500 online (i.e S$1,500 total) with GrabPay Card or Wallet: 15,000 points

In other words, you’re looking at a total of 30,000 bonus points for S$1,500 of spending. This is on top of the base points you’d normally earn (2-4 points, depending on your GrabRewards tier), so the total haul will be 33,000-36,000 points.

This challenge runs from 15 March to 14 April 2021, or until all the rewards are exhausted (they won’t last long, if past experience is anything to go by). Thankfully, Grab’s app shows a counter of how many rewards are left in each tier, so you can make an informed decision whether or not to participate.

Each user can participate in this challenge a maximum of once. The following MCCs are excluded from qualifying spending:

- MCC 6300: Insurance sales, underwriting and premiums

- MCC 8220: Colleges, Junior Colleges, Universities, and Professional Schools

- MCC 9399: Government services

What does this mean for the GrabPay Card?

Now that double dipping opportunities are almost all gone (unless you have an AMEX True Cashback or AMEX SIA Business Card, or registered for the AMEX promotion last November), GrabPay competes directly with your credit card for spending.

As you probably already know, Grab devalued its rewards program and KrisFlyer miles transfers in 2020. You now earn GrabRewards points as follows:

| Earn Rates from 2 Mar 2020 (Points/S$1) | |

| All Grab Services | |

| Member | 2 |

| Silver | 2 |

| Gold | 3 |

| Platinum | 4 |

10 GrabRewards points = 1 KrisFlyer mile, so spending with GrabPay represents an effective earn rate of 0.2-0.4 mpd. So how does this promotion change things? Assuming you’re within the relevant caps and a GrabRewards Platinum member:

| Miles if you used GrabPay Card | Miles if you used credit card (1.2-4.0 mpd) |

|

| Spend S$500 | 700 | 600-2,000 |

| Spend S$1,000 | 1,900 | 1,200-4,000 |

| Spend S$1,500 | 3,600 | 1,800-6,000 |

Since we’re talking online transactions, you’d do a lot better by earning a flat 4 mpd with a specialized online spending card (such as the DBS Woman’s World Card or Citi Rewards), but if you’ve exhausted those monthly caps then this is something you could consider.

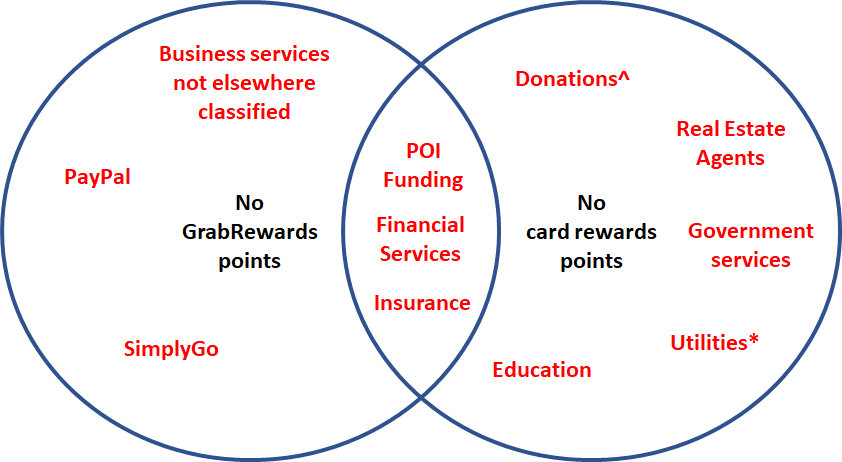

Alternatively, if you’re spending on categories where credit cards don’t earn points, this promotion could be useful too. Here’s a diagram to illustrate the possibilities (do note that Education and Government Services are explicitly excluded for the purposes of the Power Up promotion):

For example, someone who wanted to make a donation to charity would find that most credit cards don’t award points for this. In that case, he could try using the GrabPay Mastercard instead (keep in mind that Giving.sg doesn’t work with the GrabPay Mastercard), and hit the thresholds to trigger the bonus GrabRewards points.

Conclusion

With the high level of GrabPay adoption, I expect the caps to be quickly exhausted. If you have online spending to do that doesn’t attract 4 mpd on other cards, register for the promotion and get it done ASAP.

Doubt that untracked transactions will deny points for current tracked transactions. How could Grab deduct points people have earned though there were transactions before. It will be a nightmare to manage it. The least Grab can do is offer points to both untracked transactions and tracked transactions after exhausting limit.

Based on my previous experience with Grab, I think you underestimate them. They will give some BS reason not to honor the transactions, probably something in the fine print that gives them the absolute right to final determination.

Their poor CSO has no authority to grant any exceptions, except only to tell you to email them and they will write to tell you what you already know. :))