CardUp has launched a new offer for the month of April, which offers a discounted 1.85% fee for a single payment of any kind. This would be useful for those who have received their income tax NOA early, but could equally be used for any other payment supported by CardUp, like MCST fees, insurance premiums, education fees and more.

CardUp continues to offer a 1.79% fee for rental payments, and a 1.8% fee on the first six payments of a recurring schedule.

Cardup 1.85% fee details

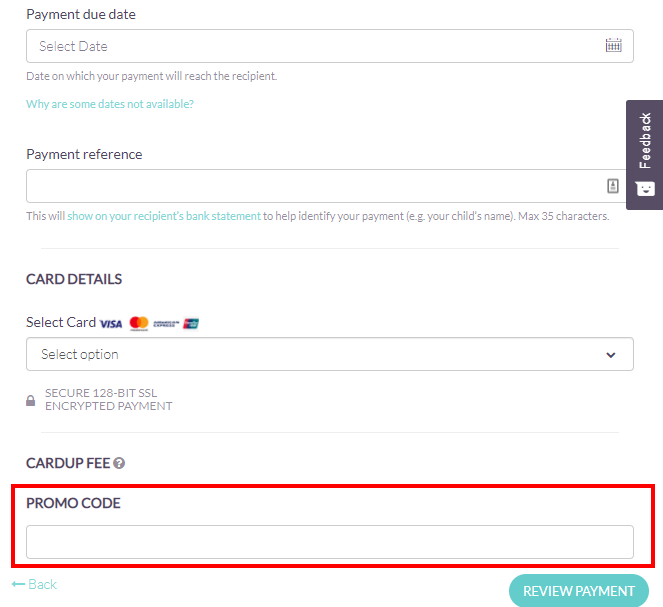

CardUp users who use the code MILELION185 will enjoy a discounted fee of 1.85% on a single payment scheduled on or before 30 April 2021, with payment due date on or before 7 May 2021.

This applies to Singapore-issued Visa or Mastercard cards, with a minimum payment of S$500 and a maximum of S$10,000 (should you wish to make a larger payment than this, contact CardUp directly- they’ll sort out a concessionary rate).

Simply enter MILELION185 in the promo code field when setting up your payment.

The full T&C of this offer can be found here.

As always, you can save S$20 off the admin fee for your first CardUp payment of S$1,000 or more with the promo code MILELION.

What’s the cost per mile?

Here’s how much it would cost to buy miles through various credit cards with the 1.85% fee. Remember, this offer is only valid for Singapore-issued Visa and Mastercard cards.

| Card | Miles per S$1 | Cost Per Mile @ 1.85% |

Citi ULTIMA Citi ULTIMA |

1.6^ | 1.14 |

DBS Insignia DBS Insignia |

1.6 | 1.14 |

UOB Reserve UOB Reserve |

1.6 | 1.14 |

OCBC Premier, PPC, BOS VOYAGE OCBC Premier, PPC, BOS VOYAGE |

1.6 | 1.14 |

SCB Visa Infinite SCB Visa Infinite |

1.4* | 1.30 |

UOB PRVI Miles UOB PRVI Miles |

1.4 | 1.30 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.30 |

Citi Prestige Citi Prestige |

1.3^ | 1.40 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.40 |

Citi PremierMiles Citi PremierMiles |

1.2^ | 1.51 |

SCB X Card SCB X Card |

1.2 | 1.51 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.51 |

OCBC 90N OCBC 90N |

1.2 | 1.51 |

KrisFlyer UOB Card KrisFlyer UOB Card |

1.2 | 1.51 |

BOC Elite Miles BOC Elite Miles |

1.0 | 1.82 |

| ^Be sure to check out Citi PayAll’s offer for first-time users as well, valid till 30 Apr 20 *With minimum S$2,000 spend per statement month, otherwise 1.0 mpd |

||

I value KrisFlyer miles at around 1.8 cents each, so most of these options would make sense. However, it all boils down to what your personal value of a mile is, and how well-stocked you are with miles at the moment.

Other CardUp offers

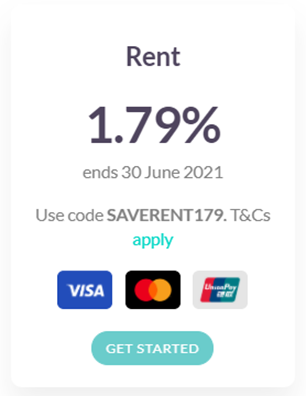

Rental

If you’re planning to make rental payments, don’t forget that you can enjoy a special rate of 1.79% with the promo code SAVERENT179. This is valid for payments scheduled on or before 30 June 2021, with due dates on or before 5 July 2021.

A 1.79% fee represents an opportunity to buy miles from just 1.1 cents each.

Other recurring payments

Alternatively, if you have other sorts of recurring payments to make, use the promo code RECURRING18 to enjoy a rate of 1.8% on the first six payments. Do note that you currently can’t schedule IRAS payments as recurring, but CardUp is working to see if ad-hoc partial payments can be arranged for the upcoming tax season.

A 1.8% fee represents an opportunity to buy miles from just 1.11 cents each.

CardUp FAQ

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

|

CardUp FAQ Q: What cards earn miles with CardUp?

Q: Do any cards earn 4 mpd with CardUp? Q: Does CardUp spending count towards sign up bonuses/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

CardUp has yet to announce their income tax promotion (that usually happens around early May), so this 1.85% offer could be useful for those who have already received their NOA. If you can afford to wait, however, you might want to do so as historically we’ve seen slightly cheaper fees for income tax payments specifically.

Be sure to schedule your payments on or before 30 April 2021 if you wish to use the current offer.

Any options for Amex crowd trying to clear signup bonuses?

last year there was a special offer for AMEX tax payments. can wait till may?

Geeky math time. For those with the OCBC Voyage Premier looking to arbitrage the current promo till 30 June; it’s likely you’ll get a ~2.285% cash back (35000 VM for S$500) and with the fees of 1.85%, you arbitrage ~0.435%. But you’ll have to forsake the time value of money and pay your entire tax bill upfront. The resulting hurdle rate of this cash has to be lower than 0.8% for it to make sense. I.e. if you can place your entire tax bill in a savings account that can pay >0.8% for the next 12 months (google there are… Read more »