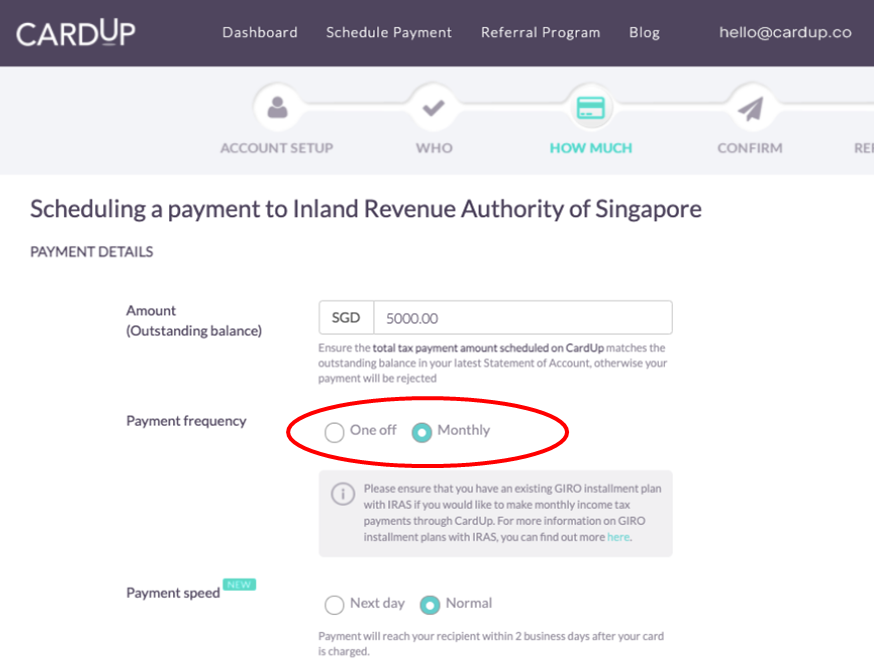

CardUp now offers a monthly payment option for IRAS income tax, allowing users to pay their NOA in monthly interest-free installments, instead of all at one shot.

This option can be selected on the CardUp dashboard when scheduling an IRAS income tax payment.

Scheduling monthly tax payments via CardUp

In order to set up monthly income tax payments with CardUp, you must first have a GIRO installment plan in place with IRAS.

- Instant online approval is available for DBS/POSB, OCBC, and UOB customers

- Customers of other banks must fill up and mail a GIRO form, which takes up to three weeks to process.

GIRO breaks up your tax due amount into 12 interest-free installments, which you can then pay off via CardUp. Obviously, you’ll need to maintain your GIRO arrangement even after the CardUp payment has been set up.

CardUp Income Tax Payment Promo: 1.75% admin fee

For income tax season, CardUp is currently offering a special admin fee of 1.75% with the promo code MLTAX2021 (full T&C here). Users must schedule their payments with a Singapore-issued Visa or Mastercard by 26 December 2021, with a due date by 7 January 2022.

There is no minimum or maximum payment to use this code, but it can only be redeemed once per user. Therefore, you either:

- Make one lump sum payment towards your tax due amount with a 1.75% fee (MLTAX2021) [despite what it says on the CardUp dashboard, you can make an ad-hoc payment of any amount up to your NOA outstanding]

- Pay your tax using the monthly option, with a 1.75% fee (MLTAX2021) on the first payment and a 2.25% fee (GET225) on subsequent payments

| 💡 Further discount for large payments |

| If your tax bill is at least S$30,000, you can write to CardUp and get a special promo code entitling you to a fee of 1.7% instead. A Visa card must be used for payment. |

To illustrate, suppose my income tax bill is S$16,000, paid under a GIRO plan (S$1,333.33 per month). I make a lump sum CardUp payment of S$5,000 in May with a 1.75% fee (MLTAX2021), then pay the rest through CardUp’s monthly payment feature with a 2.25% fee (GET225).

My payment schedule would look like this:

| Amount Due | CardUp | Net GIRO | |

| May 2021 | S$1,333 | S$5,000 | – |

| June 2021 | S$1,333 | S$1,000 | – |

| July 2021 | S$1,333 | S$1,000 | – |

| Aug 2021 | S$1,333 | S$1,000 | – |

| Sep 2021 | S$1,333 | S$1,000 | – |

| Oct 2021 | S$1,333 | S$1,000 | – |

| Nov 2021 | S$1,333 | S$1,000 | – |

| Dec 2021 | S$1,333 | S$1,000 | – |

| Jan 2022 | S$1,333 | S$1,000 | – |

| Feb 2022 | S$1,333 | S$1,000 | – |

| Mar 2022 | S$1,333 | S$1,000 | – |

| Apr 2022 | S$1,333 | S$1,000 | – |

| S$16,000 | S$16,000 |

There’s no deduction from my GIRO, because I’m always “ahead of my obligations”- the cumulative amount I’ve paid through CardUp is always more than the amount that’s come due. Remember: GIRO is only triggered to cover the difference when the amount paid to date is less than the amount due. For example, as of November 2021, 7/12 of my tax bill (S$9,333) is due. At that point, I’ve paid S$11,000 via CardUp, so there’s no GIRO triggered.

But suppose the same scenario, only this time I choose to make an S$800 monthly payment with CardUp (maybe I don’t need that many miles). In that case, my payment schedule would look like this:

| Amount Due | CardUp | Net GIRO | |

| May 2021 | S$1,333 | S$800 | S$533 |

| June 2021 | S$1,333 | S$800 | S$533 |

| July 2021 | S$1,333 | S$800 | S$533 |

| Aug 2021 | S$1,333 | S$800 | S$533 |

| Sep 2021 | S$1,333 | S$800 | S$533 |

| Oct 2021 | S$1,333 | S$800 | S$533 |

| Nov 2021 | S$1,333 | S$800 | S$533 |

| Dec 2021 | S$1,333 | S$800 | S$533 |

| Jan 2022 | S$1,333 | S$800 | S$533 |

| Feb 2022 | S$1,333 | S$800 | S$533 |

| Mar 2022 | S$1,333 | S$800 | S$533 |

| Apr 2022 | S$1,333 | S$800 | S$533 |

| S$16,000 | S$9,600 | S$6,400 |

What’s the cost per mile?

With the discounted admin fee, here’s how much buying miles will cost with the following Visa and Mastercard credit cards:

| Card | Miles per S$1 | Cost Per Mile (1.75% fee) |

Cost Per Mile (2.25% fee) |

DBS Insignia DBS Insignia |

1.6 | 1.07 |

1.38 |

UOB Reserve UOB Reserve |

1.6 | 1.07 |

1.38 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 | 1.07 |

1.38 |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.07 | 1.38 |

SCB Visa Infinite SCB Visa Infinite |

1.41 | 1.23 | 1.57 |

UOB PRVI Miles Visa or Mastercard UOB PRVI Miles Visa or Mastercard |

1.4 | 1.23 |

1.57 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.23 |

1.57 |

Citi Prestige Citi Prestige |

1.3 | 1.32 | 1.69 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.32 |

1.69 |

Citi PremierMiles Citi PremierMiles |

1.2 | 1.43 | 1.83 |

SCB X Card SCB X Card |

1.2 | 1.43 | 1.83 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.43 |

1.83 |

OCBC 90N OCBC 90N |

1.2 | 1.43 |

1.83 |

KrisFlyer UOB KrisFlyer UOB |

1.2 | 1.43 |

1.83 |

BOC Elite Miles BOC Elite Miles |

1.0 | 1.72 | 2.2 |

| 1. With minimum S$2K spend per statement month, otherwise 1.0 mpd |

|||

| ❓ A list of all the cards that offer miles and points for CardUp payments can be found here. Broadly speaking, any general spending card will earn points with CardUp (except HSBC). There are no 10X opportunities, however, so don’t use cards like the Citi Rewards or DBS Woman’s World Card. |

CardUp’s 1.75% offer is currently the most competitive on the market for the vast majority of cards. However, if you have a Standard Chartered Visa Infinite, it’s possible to buy miles at just 1.14 cents each via the card’s tax payment facility.

Conclusion

It’s great to see CardUp finally add a monthly payment option, but users will need to weigh the cashflow benefits of paying tax in monthly installments versus the higher admin fee involved (compared to making a lump sum payment with CardUp’s income tax promotion).

Don’t forget to schedule your tax payments by 24 August 2021 to take advantage of the 1.75% promotion.

Any questions about CardUp payments should be sent to hello@cardup.co

Nice to auto arrange this way but 2.25% is a bit steep for me. Last year I settle first month @1.75% then did one off months thru Ipaymy when they had promo rate like 1.99/1.88 etc they usually have one

On month with no good promo just let auto GIRO take care of it. Works for cheaper miles but only if disciplined enough!! Some months no miles but no fee either.

Your first payment schedule ($5k upfront) sounds like cardup is now allowing tax payments that isn’t exactly the amount owing on your tax bill? If that’s the case then that is a step forward. Cardup has dropped from my radar largely because of the inflexibilities they have when paying bills (I often split up payments to fit within the various spend limits across various cards). In fact one of the payments that cardup rejected was at the start of the year when I wanted to pay off the remaining amount of my upcoming giro instalment (included a copy of the… Read more »

Yes, I’ve confirmed with Cardup that they will be allowing partial payments going forward. For e.g., if your noa shows $1k, you can pay $700, 800, whatever so long as not more than $1k. Basically they want to avoid a situation where iras needs to grant a refund.

Aaron, how do you make the lumpsump payment of 5k? Do you first setup the monthly reocurring payment and afterwards make a oneoff payment with 5k?

you can set up the payments in whatever order you wish. for more specific questions it’s better to contact cardup customer service