Standard Chartered has launched an intriguing new product called the Smart Credit Card. Leaving aside the somewhat unimaginative name, the value proposition is surprisingly solid: up to 7.7 mpd on fast food, streaming entertainment and bus/MRT rides.

New-to-bank customers will enjoy a welcome gift of a pair of Marshall Mode II headphones (worth S$299) or S$230 cash, while existing customers will receive S$30 cash. New customers will also receive a complimentary Disney+ subscription of three months.

Standard Chartered Smart Card

|

||

| Sign Up Here | ||

| T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$30,000 | None | 3.5% |

| Regular Earn | Bonus Earn | Cap |

| Up to 0.64 mpd | 5.6 mpd/7.7 mpd on fast food, streaming, public transport | S$818 per statement month |

The Standard Chartered Smart Card is now open for applications, with a S$30,000 income requirement and no annual fee.

Cardholders normally earn a very underwhelming 1.6 rewards points per S$1 spent (equivalent to 0.46/0.64 mpd- see the explainer below) on all spending.

| ❓ Got Visa Infinite? |

|

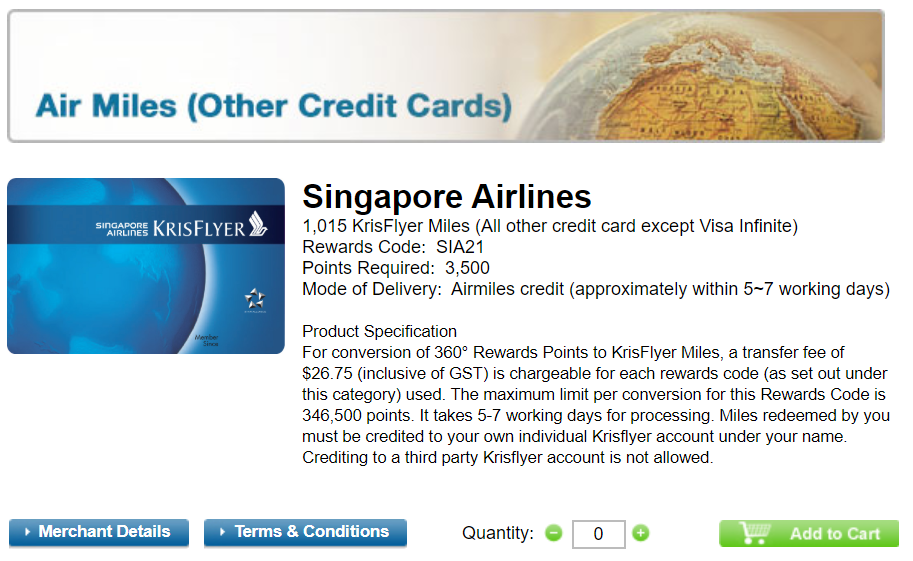

StanChart’s rewards ecosystem is much more favourable to those with a Standard Chartered Visa Infinite or Standard Chartered X Card. These cardholders can redeem KrisFlyer miles at an enhanced rate of 2,500 points = 1,000 miles.

All other cardholders redeem KrisFlyer miles at a rate of 3,500 points= 1,015 miles.

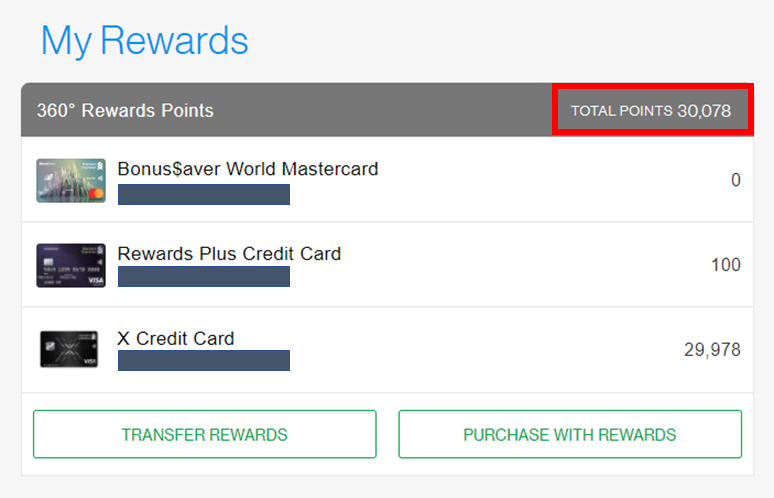

Here’s the fun part. If you have a Visa Infinite or X Card, all your rewards points can be redeemed at the 2,500 points = 1,000 miles rate. You can see this illustrated in my example below- the 100 points on my Rewards+ card are pooled with those from the X Card.

tl;dr: 1 SCB rewards point= 0.4 miles for Visa Infinite cardholders, and 0.29 mpd for all others. |

However, if cardholders spend on fast food, streaming entertainment or public transportation (no min. spend required), they’ll earn:

- the regular base rate of 1.6 rewards points per S$1 (0.46/0.64 mpd)

- a bonus of 17.6 rewards points per S$1 (5.10/7.04 mpd)

This means a total earn rate of 19.2 rewards points per S$1 (5.57/7.68 mpd), capped at S$818 per statement month. That’s actually very good if you frequently spend on these categories.

| Category | Merchants |

| 🍔 Fast Food |

|

| 📺 Streaming Entertainment |

|

| 🚆 Bus/MRT |

|

For comparison, the best alternative cards would earn “only” 4 mpd on such transactions (e.g. UOB Preferred Platinum Visa for mobile payments at fast food merchants, or the Citi Rewards for monthly streaming subscriptions).

The main catch is that the bonus earn rate is positioned as a limited-time promotion, valid till 31 December 2022.

| Update: A previous version of this article stated that the offer is only valid till 31 December 2021. SCB has clarified it should be 31 December 2022. |

Get Marshall headphones or S$230 cash

From 8-25 October 2021, new-to-bank customers who sign up for a Standard Chartered Smart Credit Card will receive a pair of Marshall Mode II headphones (worth S$299) or SS$230 cash upon approval and a minimum spend of S$300 within 30 days.

Existing cardholders will receive S$30 cash.

| ❓ Definitions |

| New-to-bank customers are defined as those who do not currently hold a principal Standard Chartered credit card, and have not done so in the 12 months prior. Existing cardholders must not have applied for the same card within the last 12 months. |

To get your gift, follow the instructions below:

- Apply through any of the links in this article

- You will be directed to a SingSaver landing page. Enter your email address and click “confirm”

- Complete your application and take a screenshot of the Application Reference Number (for Standard Chartered, it’s in the format SGYYYYMMDDxxxxxx)

- Fill in the SingSaver rewards form that will be sent to your email. It’s vital you fill in the form– no form, no reward. You’ll be able to indicate your choice of gift in the rewards form if applicable.

The S$300 qualifying spend excludes the following:

|

All gifts will be fulfilled within 4 months of approval. You will not receive your gift immediately upon meeting the minimum spend- the reason for the delay is the need to confirm eligibility with the bank. Please take note of this timeline before applying, and only apply if you’re willing to wait.

For those who want to track the fulfillment of their reward, SingSaver provides estimated fulfillment timelines for Citibank and Standard Chartered cards on its website.

Any enquiries about gift fulfillment should be sent to info@singsaver.com.sg

Get a free Disney+ subscription

If you’re a new-to-bank customer, Standard Chartered is offering a complimentary 3-month Disney+ subscription as well, with no minimum spend required.

Eligible cardholders will receive their Disney+ promotion redemption code within 60 working days of the date of activation of the physical card. This must be used within 3 months.

The T&C for this offer can be found here.

Conclusion

|

| Sign Up Here |

The Standard Chartered Smart Card could be a very useful companion to have, thanks to its upsized earn rate on fast food, streaming and public transport.

If your main card is a Standard Chartered X Card or Visa Infinite, it’s a no brainer to add this one to your wallet too.

What do you make of the new Standard Chartered Smart Card?

If they won’t extend the bonus rate, this smart card might be dumped as a stupid card next year 😆

Who’s going to binge on fast food for the next 3 month?

Updated- it’s not a typo, the promo rate is really good till 31 Dec 2022

yay~

Meh Card

Good for bbfas I guess

Does existing customer need to spend 300 in order to get 30?

Does anyone know if McDelivery is included in the 7mpd promo?

Did anyone get their Disney+ free subscription link yet?

After the promo period does the smart card still earn any miles? Incase we don’t meet the minimum threshold to transfer out