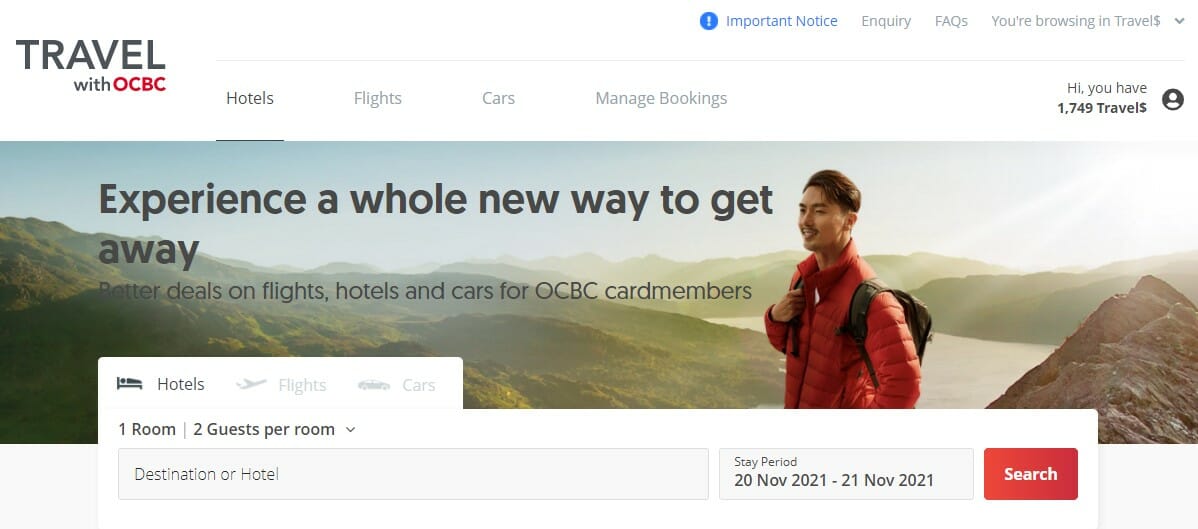

OCBC has launched a travel portal called Travel with OCBC, which enables OCBC cardholders to spend their rewards points on flights, hotels and rental cars, with no blackout dates, no capacity restrictions and instant confirmation.

|

| Travel with OCBC |

While the concept isn’t new (other banks have similar portals for spending rewards points on travel), what’s exciting is the excellent value OCBC is offering till 30 November 2021 for Travel$ redemptions, particularly for Business Class flights.

As we’ll soon see, the depressed pricing for premium cabins brought about by the pandemic has created some unique opportunities for outsized value. Round-trip Business Class to Europe for the equivalent of ~76,000 miles, with no capacity controls, no cash co-payments, and the ability to earn miles and elite credits?

While that sounds too good to be true, it’s very, very possible.

Overview: Travel with OCBC

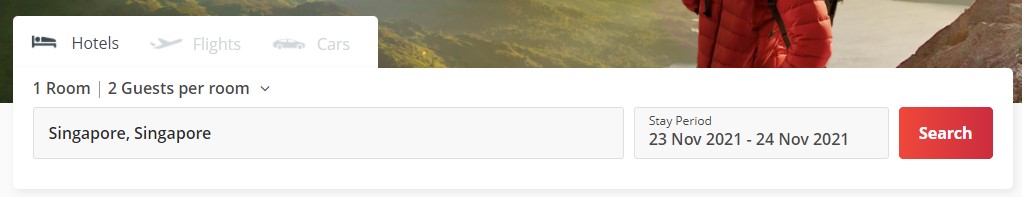

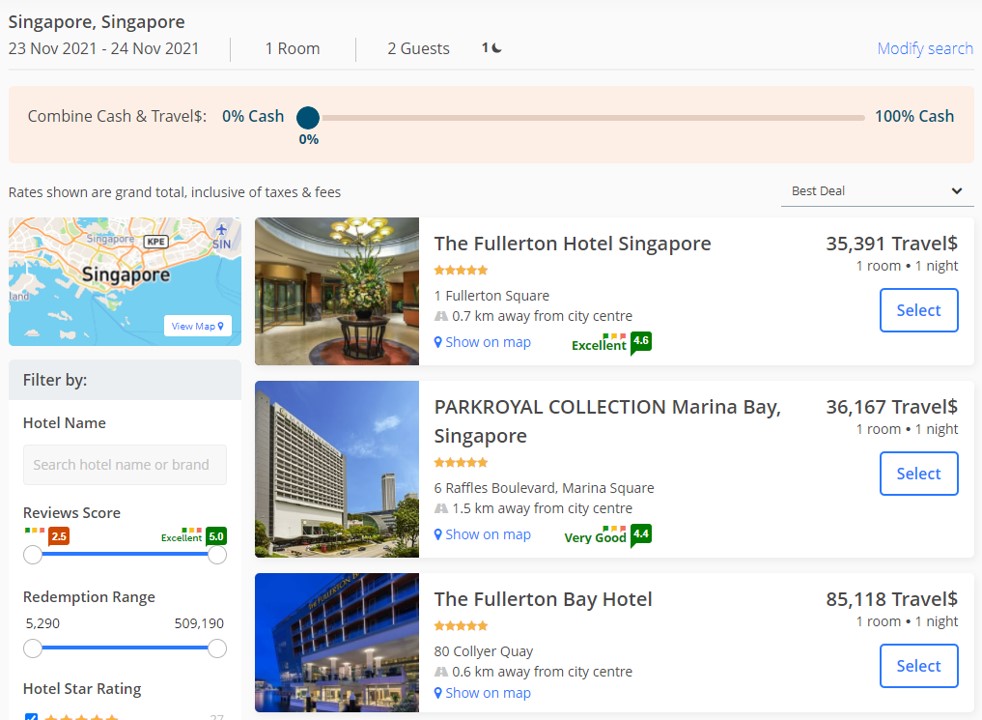

First, let’s do a quick overview of the Travel by OCBC interface. It’s similar to what you’d find on many other OTAs (online travel agents): enter your desired dates, destination and number of travellers, then hit “search”.

To redeem OCBC rewards points and enjoy preferential hotel rates (which can be up to 40% lower, based on the searches I’ve done), remember to sign-in using your OCBC internet banking credentials.

Travel with OCBC offers bookings for hotels…

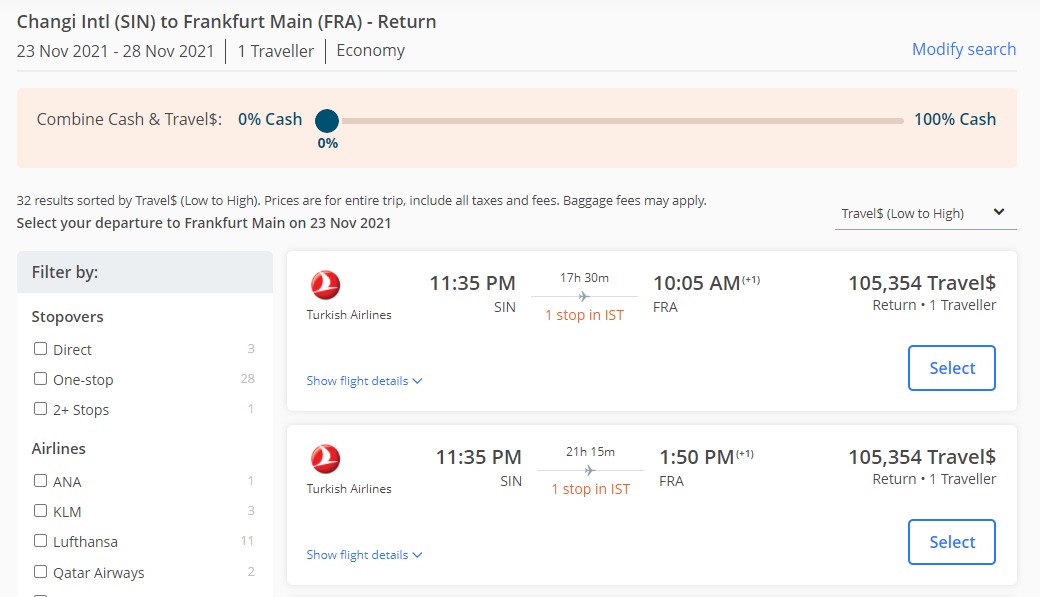

…flights…

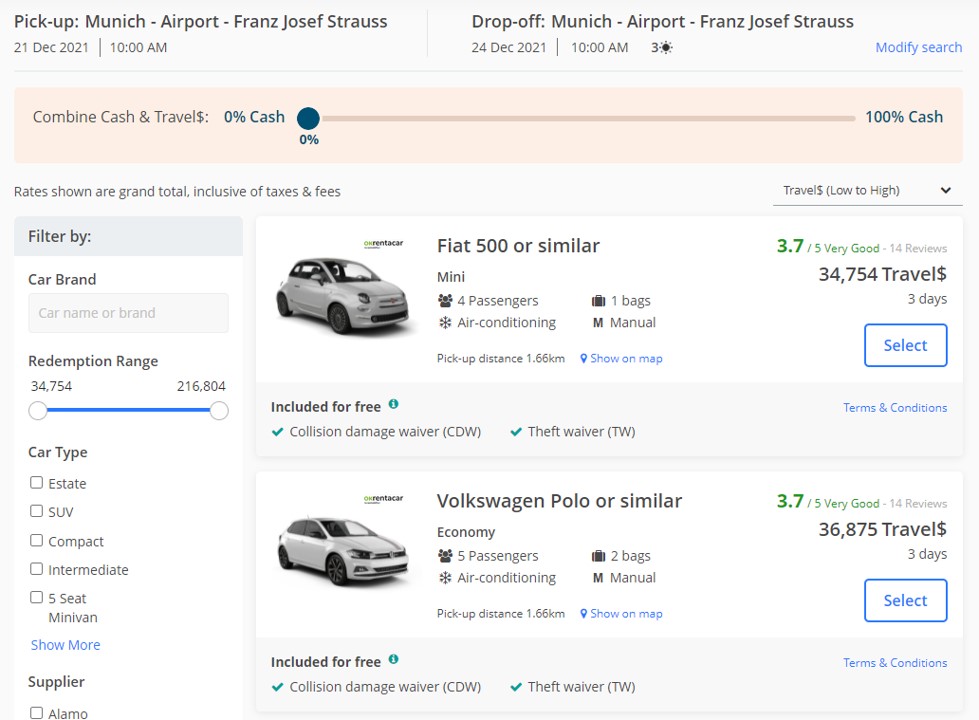

…and rental cars.

All bookings must be made at least 2 days in advance.

What’s unique about Travel with OCBC is that payment can be made either in cash, rewards points (OCBC$, Travel$, VOYAGE Miles), or a mixture of the two. Notice the sliding bar at the top of each screen which lets you change the mix.

| ⚠️ Important Note on Fees |

|

Hotels: No changes can be made to bookings, even if flexible. You will need to cancel and book again, and a service fee of 2.5% of the refundable amount applies. This fee is waived for payments made with points or via the OCBC Pay Anyone mobile app (where you can use your OCBC credit card to pay, and still earn rewards) Flights: Changes are subject to a S$50 fee, in addition to any fare differences and fees charged by the airline. Rental Cars: Changes are subject to a S$20 fee, in addition to any rate differences and fees charged by the rental car company. |

The value per point differs depending on what you redeem (hotels, rental cars, flights), and for flights, what cabin you redeem (Economy, Premium Economy, Business, First). Here’s the value per point that I’ve observed, based on my searches:

| Travel$ | VOYAGE Miles | OCBC$ | |

| Hotels | 0.87 | 0.90 | 0.36 |

| Rental Cars | 0.87 | 0.90 | 0.36 |

| Valuations are accurate as of date of publishing and may be subject to change in the future | |||

| Travel$ | VOYAGE Miles | OCBC$ | |

| Economy | 0.87 | 0.90 | 0.36 |

| Premium Economy | 1.22 | 1.35 | 0.36 |

| Business | 2.52 | 2.52 | 0.36 |

| First | 2.88 | 3.06 | 0.36 |

| Valuations are accurate as of date of publishing and may be subject to change in the future |

|||

The way I see it, the sweet spot for value is redeeming Travel$ /VOYAGE Miles for Business Class tickets.

Booking sweet spot airfares on Travel with OCBC

Here’s where things get really exciting.

For a limited time, you can get ~2.52 cents per Travel$ or VOYAGE Mile when booking Business Class airfares on Travel with OCBC. That’s a very good valuation, especially when you combine it with ongoing Business Class fare deals.

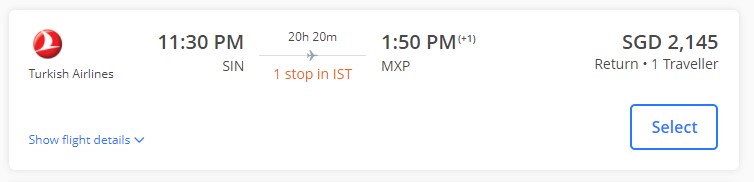

For example, Turkish Airlines is currently offering sub-S$2,500 round-trip Business Class fares to Europe, which means sub-100,000 Travel$ redemptions. That’s phenomenal.

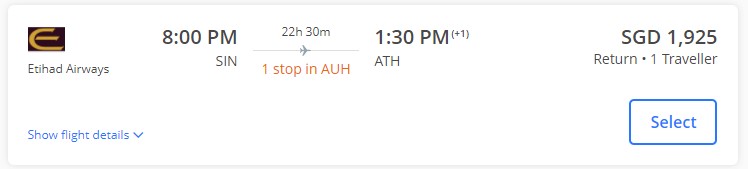

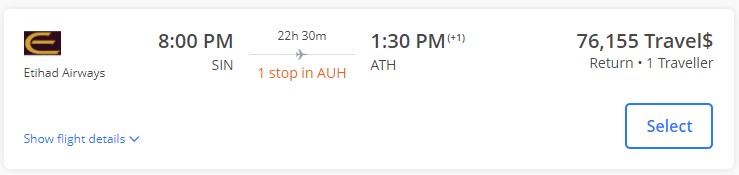

Likewise, Etihad is offering sub-S$2,000 round-trip Business Class fares to Athens, which means you could redeem a ticket for just ~76,000 Travel$.

Here’s a summary of what I managed to find. For the sake of comparison, I’ve added how much each of these tickets would cost if you redeemed it with KrisFlyer miles- keep in mind there’s still taxes (and fuel surcharges, in certain cases) to be paid with cash on KrisFlyer redemptions, while the Travel$ prices are nett.

| Return Business Class from Singapore to… | Redeem with Travel$ | Redeem with KrisFlyer |

| Rome | 91,641 Travel$ Turkish |

184,000 miles + S$115 SIA |

| Berlin | 93,298 Travel$ Turkish |

184,000 miles + S$1,014 Lufthansa |

| Barcelona | 90,703 Travel$ Qatar |

184,000 miles + S$85 SIA |

| Oslo | 91,641 Travel$ Turkish |

184,000 miles + S$904 Lufthansa |

| London | 100,304 Travel$ Turkish |

184,000 miles + S$457 SIA |

| Athens | 76,155 Travel$ Etihad |

184,000 miles + S$900 Lufthansa |

| Zurich | 91,541 Travel$ Turkish |

184,000 miles + S$104 SIA |

| Copenhagen | 89,994 Travel$ Turkish |

184,000 miles + S$87 SIA |

| Milan | 84,860 Travel$ Turkish |

184,000 miles + S$95 SIA |

Consider Berlin. For half the number of miles, you could:

- Get a confirmed seat on the exact date you want, instead of praying that award space opens up

- Avoid paying hefty fuel surcharges and taxes in cash (they’re already included in the Travel with OCBC price)

- Earn miles and elite status credits with your preferred frequent flyer programme (since Travel with OCBC is basically like buying a paid ticket)

Savings are the most pronounced when we consider destinations Singapore Airlines doesn’t fly to (because redeeming Star Alliance awards may come with fuel surcharges), but it’s still incredible value when you consider the destinations they do.

London, for example, is notorious for high airport taxes thanks to its Air Passenger Duty. Redeeming a Singapore Airlines flight would cost 184,000 miles + S$457 of cash. Redeeming Travel$ for Turkish Airlines? 100,304 Travel$, no cash.

While Turkey was classified as a Category II country at the time this article was published, Qatar and the UAE will join the VTL in December. This means you can transit in Doha and Abu Dhabi to and from Singapore, with no impact on your eligibility for SHN-free travel.

Given a value of 2.52 cents per Travel$ and the current KrisFlyer award chart, it’s possible to work out a heuristic of sorts:

- For Europe: if fare <S$4,655, booking on Travel with OCBC is better than KrisFlyer

- For West Coast USA: if fare <S$4,800, booking on Travel with OCBC is better than KrisFlyer

- For East Coast USA: if fare <S$5,010, booking on Travel with OCBC is better than KrisFlyer

- For Australia: if fare <S$3,135, booking on Travel with OCBC is better than KrisFlyer

This hasn’t even taken into account the fact that Travel with OCBC tickets don’t have blackout dates, fuel surcharges/taxes to pay in cash, and earn miles & elite status credits.

Launch promotions

From now till 15 January 2022, OCBC cardholders who book hotels, flights or car rentals on the Travel with OCBC platform will earn up to 8 mpd as follows:

| Card | Earn Rate | Cap |

OCBC 90N Visa OCBC 90N Visa |

8 mpd | S$1,000 (first 5K cardmembers) T&Cs |

OCBC 90N Mastercard OCBC 90N Mastercard |

3 mpd | S$1,000 (first 1.2K cardmembers) T&Cs |

OCBC VOYAGE OCBC VOYAGE |

4 mpd | S$1,000 (first 1K cardmembers) T&Cs |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite |

4 mpd | S$1,000 (first 500 cardmembers) T&Cs |

The earn rate applies to the cash portion of your booking. For example, if you paid for your booking with S$100 and 2,000 Travel$, you’d earn 3-8 mpd (depending on card) on the S$100 portion.

All stays, flights and car rentals must be completed by 30 June 2022, and bonus Travel$/OCBC$/VOYAGE Miles will be credited up to two months after booking completion.

One important thing to note: Travel with OCBC charges a 2.5% service fee for any cancelled reservation made on the platform. This fee is waived for payments made with points or via the OCBC Pay Anyone mobile app (which lets you use your OCBC card anyway).

Other promotions

OCBC cardholders will receive S$60 off a minimum spend of S$400 for their first ever booking on Travel with OCBC with the promo code TRAVEL60. This is valid for use until 31 January 2022 (T&Cs apply).

Customers who are approved for an OCBC 90°N Visa between 8 November 2021 and 31 January 2022 will receive a voucher for S$100 off a minimum spend of S$500 on their first booking on Travel with OCBC. This offer only applies to new-to-bank customers, i.e. those who do not currently hold any principal OCBC credit cards, and have not in the past 12 months (T&Cs apply).

Conclusion

Travel with OCBC is marking its launch with some sensational rates for redeeming flights with Travel$ and VOYAGE Miles. Do keep in mind these are limited-time launch rates which will be adjusted from 1 December, so it’d be a good idea to check out the portal in the next few days and lock in any flights.

Travel with OCBC will also offer some special deals on staycations, which I’ll cover in an upcoming post.

| Travel with OCBC is developed, operated, and maintained by a third party provider. All products and services made available through Travel with OCBC are provided by third party providers. T&Cs apply. |

Half the miles, no YQ, no blackout. Powerful stuff

We would need to know the usual redemption rates to assess the long-term viability of switching to an OCBC card.

perhaps factor in the cost/ease of earning voyage miles (1.3 mpd) / travel$ (1.2/1 mpd) at the normal rates compared to the other 4mpd cards, and the OCBC redemption rates may not seem that great after all. also, redeeming on OCBC is dependent on the actual cost of the flights as well.

that said, always good to have options and not be limited by award availability.

A lot of people made hay when ocbc had the no cap 4 mpd launch offer with the Ocbc 90n MC, and the current (albeit capped) 4 mpd on fcy spend with Ocbc 90n visa is another good opportunity to rack up too.

There are people who have a lot of use for general spend cards and this is great for them. Also up to 1.6 mpd.

VMs can be bought at 1.14 cpm using Cardup which means the EY flight to Athens costs $868, the QR flight to Barcelona costs $1,034 and the TK flight to Zurich costs $1,143! Incredible.!

Thanks Aaron. If we don;t have any Travel$ to redeem, is it still worth to buy these tickets using the Visa 90 N Card for points instead of using kris flyer?

Any idea if SQ business tickets purchased (100% voyage miles) through Travel with OCBC would be able to earn krisflyer miles and PPS value from the flight?

Valuation has been crippled with first & business class CPM dropping by 15%, not sure if still a worthwhile product especially with expensive plane tickets relative to miles redemption (SQ KF)