Citibank shows no signs of letting up on their Citi PayAll blitz. After a fantastic 2021 (which saw promos and flash deals galore), they’re kicking off 2022 by offering 2 mpd on all Citi PayAll transactions until 31 March 2022, with a minimum spend of S$3,000.

|

| Citi PayAll 2mpd Promo |

This allows cardholders to buy miles at just 1 cent each, a fantastic opportunity to stock up your account by paying rent, insurance premiums, MCST fees, education expenses, utilities bills, or even friends and family for “services rendered” (though there may be income tax implications involved).

Earn 2 mpd on Citi PayAll transactions

From 1 January to 31 March 2022, eligible Citi cardholders will earn a flat 2 mpd on up to S$90,000 of Citi PayAll transactions with a minimum spend of S$3,000. Both the payment setup and charge dates must fall within the promotion period.

The following cards are eligible:

| Card | Earn Rate | Cost Per Mile @ 2% |

Citi ULTIMA Citi ULTIMA |

2.0 mpd |

1 cent |

Citi Prestige Citi Prestige |

2.0 mpd |

1 cent |

Citi PremierMiles Citi PremierMiles |

2.0 mpd |

1 cent |

Citi Rewards Citi Rewards |

2.0 mpd |

1 cent |

| The Citi Lazada Card is also mentioned in the T&Cs, but that’s likely to be a vestigial leftover, since it’s not included in the illustration table | ||

What’s particularly awesome about this deal is that Citibank is offering the same rate across all eligible cards. You’ll earn 2 mpd, regardless of whether you’re using the Citi ULTIMA, Prestige, PremierMiles or Rewards. How’s that for egalitarian?

As a reminder, the S$90,000 cap applies on a customer level, regardless of how many Citibank cards you hold. For example, you can’t earn 2 mpd on S$90,000 worth of payments on both the Citi Rewards and Citi PremierMiles; only the first S$90,000 of combined spending will count.

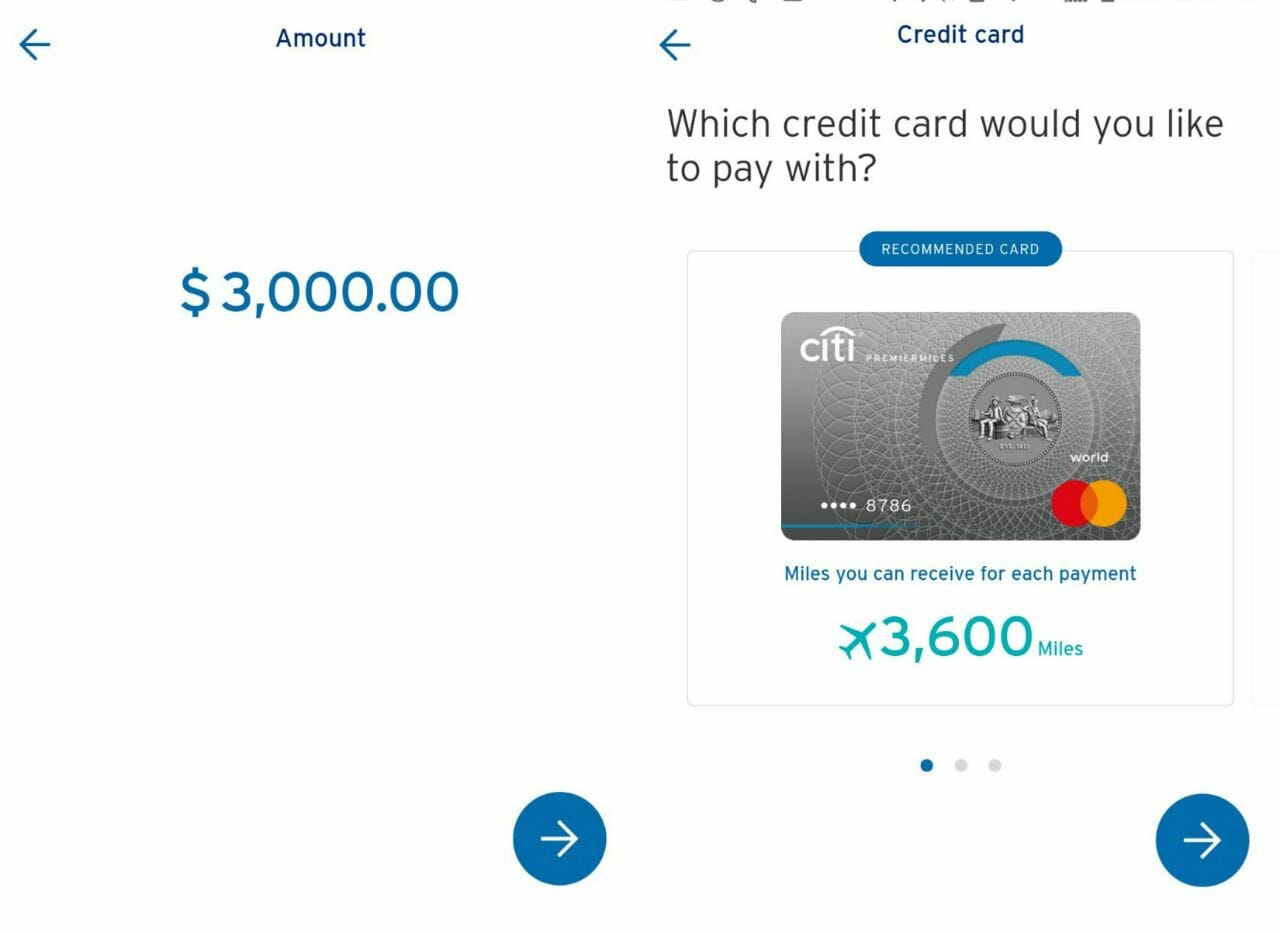

Also, be advised that the Citi app shows the regular earn rates by default- this is rather unhelpful and bound to cause a lot of confusion. For example, the Citi app tells me I’ll earn 3,600 miles for a S$3,000 payment (1.2 mpd), when in fact it should be 6,000 miles (2 mpd). You’ll just have to take it on faith that the bonus 2,400 miles will show up later.

As a reminder, Citi PayAll currently supports the following types of payments:

| 💰 Citi PayAll: Supported Payments | |

|

|

The “miscellaneous payments” category is surprisingly broad. You could use PayAll to pay for wedding expenses, donations, renovations, even the nebulously defined “travel expenses” and “payment for retail good and services”. Most of these don’t even require supporting documentation; you can simply transfer funds to someone else’s bank account.

But before you rush off and pay your wife S$50,000 for love and affection, remember that such transactions may have income tax implications. In general any income exceeding S$20,000 is liable to tax, provided it’s deemed to be derived in the course of a trade.

| ❓ How does this compare to 2021’s offers? |

| In 2021, Citibank ran a 2.5 mpd offer for Citi PayAll, which didn’t require any minimum spend and was capped at S$120,000 |

When will bonus miles/points credit?

Cardholders will receive their regular base rewards when the Citi PayAll transaction initially posts.

Bonus rewards will be credited within 12 weeks from the end of the promotion period, i.e. by 23 June 2022.

New customers: Get S$50 in GrabFood vouchers

If you’ve never made a Citi PayAll transaction prior to 1 January 2022, you’ll receive S$50 in GrabFood vouchers when you make at least S$3,000 of Citi PayAll transactions by 31 March 2022.

This consists of 2 x S$25 promo codes, which will be sent within 12 weeks from the end of the promotion period, i.e. by 23 June 2022.

| ❓ How does this compare to 2021’s offers? |

| Last year’s new customer offer was certainly more generous, with new customers getting a S$50 cash credit on their first Citi PayAll transaction of any amount. |

Terms and Conditions

The T&C for both the 2 mpd and S$50 GrabFood voucher campaign can be found here.

Is it worth it?

Yes.

Buying miles at 1 cent each is an incredible offer, especially since Citibank partners with 11 different frequent flyer programmes. There are some great sweet spots with FFPs like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles. Even the newly-revitalised Qatar Privilege Club might be a good bet.

| 💳 Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

| For a full list of transfer partners, refer to this article | |

Even if you opt for plain vanilla KrisFlyer miles, you could get >1 cent per mile in value for certain redemption options.

| Options for Spending KrisFlyer Miles | ||

| Redemption Option | Value per mile | |

| ✈️ | Award flights | 2-6 cents |

| 🏨 | Shangri-La Golden Circle conversion | 1.1-1.4 cents |

| ✈️ | Pay for flights with miles | 0.95 cents |

| 🚘 | KrisFlyer vRooms | 0.8 cents |

| 🛍️ | KrisShop | 0.8 cents |

| 🏬 | CapitaStar conversion | 0.7 cents |

| 📱 | Kris+ | 0.67 cents |

| 🎡 | Pelago | 0.67 cents |

| ⛽ | Esso Smiles conversion | 0.33- 0.67 cents |

To illustrate, someone who maxes out this promotion would earn a total of 180,000 miles at a cost of S$1,800- enough for a round-trip First Class ticket to Sydney on Singapore Airlines.

Conclusion

Citibank is offering 2 mpd on all Citi PayAll payments till the end of March 2022, which means buying miles for a very competitive 1 cent each. Provided you’re able to hit the minimum spend of S$3,000, it’s something I’d give serious thought to.

New customers can receive an additional S$50 in GrabFood vouchers on top of the 2 mpd, which only sweetens the deal.

Methinks CardUp and other bill payment services will have quite the fight on their hands this year, as Citibank looks determined to continue its dominance of this space.

There’s likely more to these promotions than mere dominance in the points for cash space. I suspect, the Credit Cards line of business potentially bought a hefty inventory of miles / points from partners, only to have the HQ decide to exit a bunch of markets (13 markets in all, 10 in Asia). In big firms, divesture decisions are take at the absolutely highest of levels supported by advise from Top tier consulting firms / MBBs. Until it’s announced, the information is kept with the select few because it can drastically impact stock prices. These promotions maybe a way of… Read more »

so, for now paying IRAS for 2021 will be best using this promo?

Only if your spend category will earn 4mpd on those cards. Citi Payall would be for those spends that’s usually excluded from credit card rewards e.g. taxes

How do you pay rent or tax using Amaze? Unless you use Amaze with Cardup/Ipaymy which would work out costing more than 1c per mile.

For a 60k bill, would you recommend rewards or prestige?

I guess it depends on

ah thats good to know, I just started using these 2 cards. the no expiry for Prestige is a good selling point. Also I saw that the maximum for rewards for a 90K transaction is 360,000 vs Prestige of 157,500. So wondering if there is a difference between Prestige points vs Rewards

Why wouldn’t you use Prestige? Earn some free limo rides

oh thats a good benefit too

Premier miles has a cap of only 72k.. can’t get more even if I want

Isn’t that the cap based on 90K spending? Its the same for the rest of the cards.

Ah I misunderstood the t&c, the cap is on the bonus miles means 90k + 72k so total of 162k miles possible

Have anyone tried using Citi pay all for renewal of vehicle COE?

worth it to use this to pay income tax ?

Didn’t see “India International Insurance” from the Pay Insurance list.

So only restricted to 16 Insurance companies listed?

Hi Aaron, can someone who currently does not has any Citibank card now apply for a Citibank card to enjoy this promotion?

Yup

90K per cardholder? Is it possible to have 2 cardholders, but convert to miles on the same miles account (e.g. krisflyer)?

Good article but I won’t overthink the taxation issue though. I just transferred $90k to my spouse. If there’s no employer/employee relationship or payment for service, the transfer cannot be considered an income. Today, if I pass $90k to my children out of love, they also do not need to report this IRAS.

I asked the same question to the Citibank staff during an audit (I put the word “loan” in comments, hence audited). She also assured me that this information won’t be shared with IRAS anyway.

Sure, but they might prevent you from getting miles for this transaction. What did they conclude?

hmm interesting. do you still manage to get the miles for transferring $90K to spouse using PayAll ?

Waiting for OP’s reply.

I got the miles. But the $90,000 is missing so far. Did not entered the account despite waiting the whole day. I called the bank – the CSO seem to treat it like a $90 transaction. I don’t trust this bank anymore even if they eventually manage to trace the funds. Crap.

Hi Aaron, does the min 3k is on a single transaction or cumulatively?

if i use citi rewards card with payall, will it also use up the $1K /mth limit for 4 mpd ?

Is the minimum spend of 3K cumulative or per transaction? Tncs don’t seems to explain.

based on previous campaigns, it is cumulative. if you want to be 100% sure, you might want to get it in writing from citibank customer service

Unfortunately, it is not cumulative. it has to be min $3K per transactions. Have ding-dong with the CSO and they insist it is so and refused to award the bonus points….have escalated to the product team. will see how it goes. Separately, I see the Apr to July 2.5miles promotion T&C, it did not said “Combined Charge of min $5K across all eligible cards….” Hope this is not another failed case where Citibank made it grey and refused to award the Bonus points/miles.

Do you think there will be a better campaign for tax payments? I already paid a chunk using this 2mpd campaign but have a lot more to pay. Last year it was 2.5mpd for payall payments during tax time.

Hi. 🙂

If you earn 2 miles per dollar (mpd) spent, doesn’t it mean the cost per mile is 50 cents?

How did you get 1 cent as the cost per mile?

I am not great with math haha