CardUp and DBS have partnered up to offer DBS/POSB cardholders special rates for CardUp payments.

CardUp’s usual fee is 2.6% (temporarily reduced to 2.25% for 2022), but new and existing customers who pay with a DBS/POSB card will enjoy fees of 1.7% and 1.8% respectively. This allows them to buy miles from just 1.04 cents each.

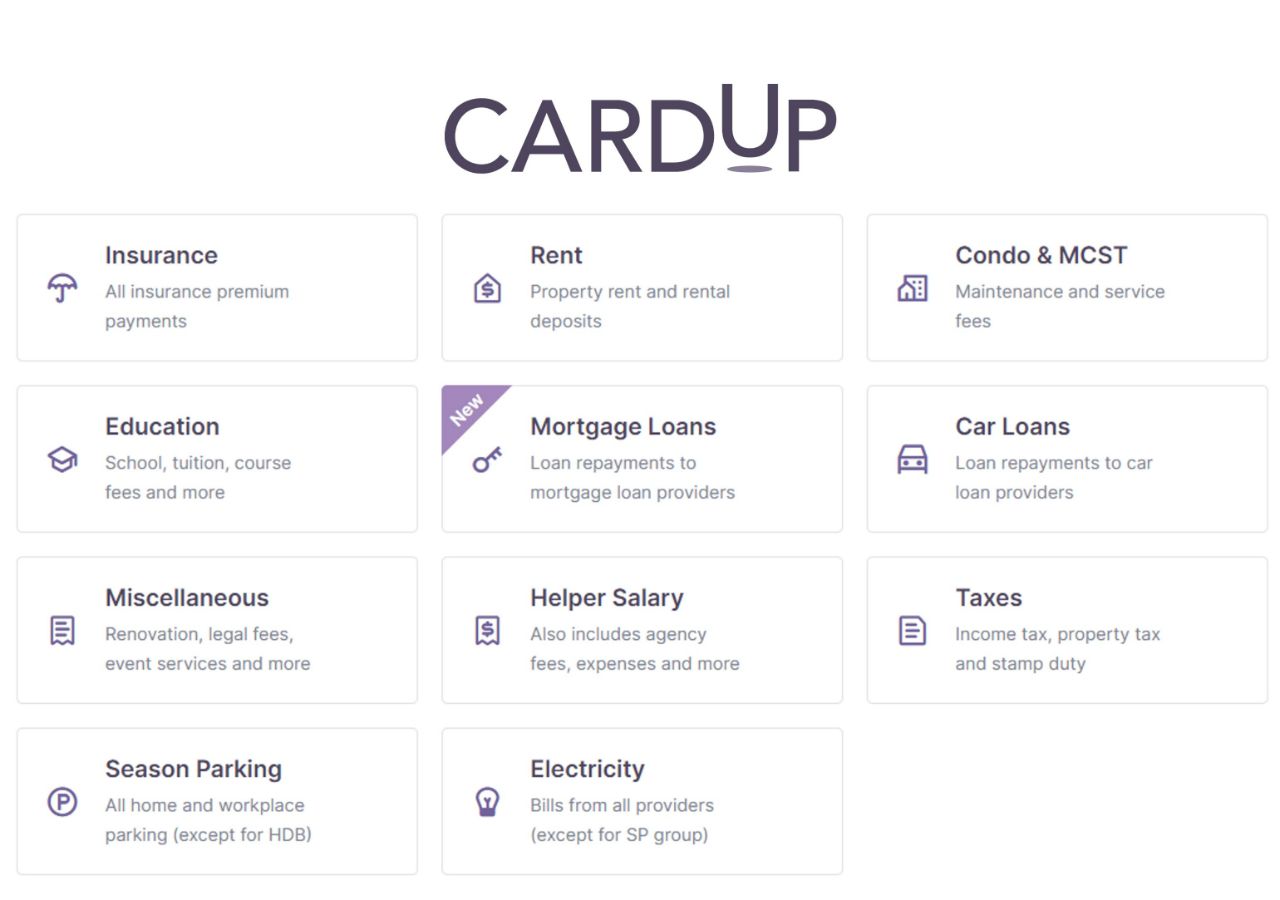

| ❓ What is CardUp? |

CardUp is a bill payment platform that allows users to pay rent, income tax, insurance premiums, MCST fees, season parking, mortgage installments and more with their credit card, earning miles in exchange for a small fee. CardUp is a bill payment platform that allows users to pay rent, income tax, insurance premiums, MCST fees, season parking, mortgage installments and more with their credit card, earning miles in exchange for a small fee. |

New customers: 1.7% fee

New CardUp customers (i.e. those who haven’t signed up, or have signed up but are yet to make a payment) can use the code DBSCARDUPNEW to enjoy a 1.7% fee on a one-off payment, or the first payment of a recurring series.

DBS American Express cards are excluded from this offer, and the maximum payment you can make is S$30,000.

Payments must be scheduled by 28 February 2022, with a due date by 3 March 2022. This code is limited to the first 300 users (you’ll be able to see if the code is still valid before confirming your payment). The full T&C can be found here.

Here’s an idea of the cost per mile (CPM, in cents) for DBS cards and a 1.7% fee.

| Card | MPD | CPM @ 1.7% |

DBS Insignia DBS Insignia |

1.6 | 1.04 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.39 |

I shouldn’t have to say this, but please don’t use the DBS Woman’s World Card. You’ll earn only 0.4 mpd, making the cost per mile way too high.

Alternatively, new customers can use the code MILELION for up to S$30 off their first payment- basically free miles on a payment of up to S$1,154.

To spare you the math, if your payment is <S$3,335, you’re better off using the MILELION code. If your payment is >S$3,335, the DBSCARDUP new code will save you more.

Existing customers: 1.8% fee

Existing CardUp customers can use the code DBSCARDUP to enjoy a 1.8% fee on the first two payments of a recurring series.

DBS American Express cards are excluded from this offer, and the maximum payment you can make is S$30,000.

Payments must be scheduled by 28 February 2022, with a due date by 3 March 2022. This code is limited to the first 300 users (you’ll be able to see if the code is still valid before confirming your payment). The full T&C can be found here.

Here’s an idea of the cost per mile (CPM, in cents) for DBS cards and a 1.8% fee.

| Card | MPD | CPM @ 1.8% |

DBS Insignia DBS Insignia |

1.6 | 1.11 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.47 |

You can subsequently edit the remainder of the series to add a different code like GET225 for further savings.

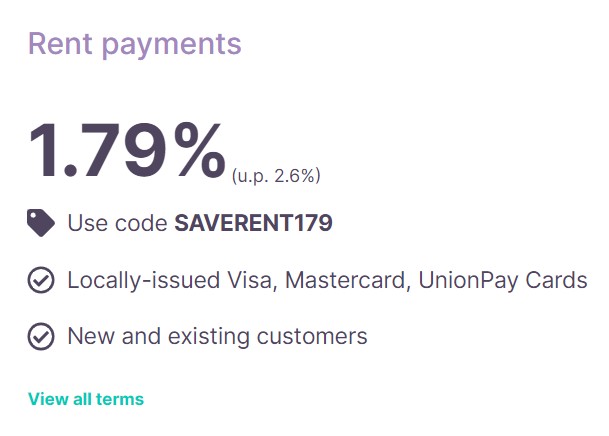

Paying rent?

If you’re looking to pay rent, CardUp recently extended its rent payment promotion until 30 June 2022.

Customers can use the code SAVERENT179 to enjoy an admin fee of just 1.79% on rental payments. This allows them to buy miles from as little as 1.1 cents each, depending on their credit card.

Recurring payments?

CardUp is also offering a concessionary 1.85% fee on the first six payments of a recurring schedule made with a Visa card and the code RECURRING185.

This code is available till 30 June 2022, and miles will cost upwards of 1.14 cents each depending on card.

Citi PayAll offer

|

| Citi PayAll 2mpd Promo |

If you hold a Citibank credit card, do remember that there’s a superior offer available for Citi PayAll.

From now till 31 March 2022, cardholders who charge a minimum of S$3,000 to Citi PayAll will earn 2 mpd with a 2% fee, which represents buying miles at 1 cent each. This is available for a maximum payment of S$90,000, and would certainly be my first port of call.

New Citi PayAll users will enjoy a further S$50 in GrabFood vouchers.

Conclusion

CardUp customers can enjoy a special fee starting from just 1.7% when they use their DBS/POSB cards to pay from now till 28 February 2022.

However, you’d be able to buy cheaper miles by going down the Citi PayAll route, assuming you’ve got at least S$3,000 of payments to make (but if it’s your first transaction with CardUp, you can use the MILELION code to earn free miles on up to S$1,154 of payments).