From 15-17 February 2022, SingSaver is running a flash sale on the Standard Chartered Smart credit card, with Dyson Omni-glides, Apple AirPods Pros, or S$300 cash up for grabs.

The first 10 new-to-bank applicants in each time slot per day (11 a.m, 2 p.m, 5 p.m) will receive an Dyson Omni-glide (worth S$649).

If you’re outside the first 10, you’ll still get a choice of a pair of Apple AirPods Pros (worth S$379) or S$300 cash.

|

||

| Apply Here | ||

| 15-17 Feb 2022 | ||

| 11 p.m | First 10 | Dyson Omni-glide |

| 11th onwards | AirPods Pro/ S$300 | |

| 2 p.m | First 10 | Dyson Omni-glide |

| 11th onwards | AirPods Pro/ S$300 | |

| 5 p.m | First 10 | Dyson Omni-glide |

| 11th onwards | AirPods Pro/ S$300 | |

| ❓ New-to-bank customers are defined as those who do not currently hold a principal Standard Chartered card, and have not in the 12 month period before application. Debit cards, supplementary cards and corporate cards don’t count. | ||

Existing Standard chartered customers will receive S$30 cash per approved card.

Your application must be received by 11.59 p.m on 17 February 2022 and approved within 14 days to be eligible. Successful applicants will be required to spend at least S$350 on qualifying transactions (see below) within 30 days of approval.

The full T&C can be found here.

Application Steps

- Apply through any of the links in this article

- You will be directed to a SingSaver landing page. Enter your email address and click “confirm”

- Complete your application and take a screenshot of the Application Reference Number (for Standard Chartered, it’s in the format SGYYYYMMDDxxxxxx)

- Fill in the SingSaver rewards form that will be sent to your email. It’s vital you fill in the form– no form, no reward.

You’ll be able to indicate your choice of gift in the rewards form if applicable.

The first 10 approved applicants per time slot will be determined based on the timestamp as per the start time of the submission of the Rewards Registration Form (submission of email address) and the end time of the submission of the Rewards Redemption Form. The counter to determine the first 10 people resets at 11 a.m, 2 p.m & 5 p.m (per time slot) each day during the promotion period.

For more information on how the first 10 applicants are determined, refer to this article.

Qualifying Spend

The approved card must be activated and a minimum qualifying spend of S$350 made within the first 30 days of approval.

“Qualifying spend” refers to any retail transaction, except the following:

|

Gift Fulfillment

All gifts will be fulfilled within 4 months of approval. You will receive an email enabling you to collect your gift from a fulfillment centre.

Do note that you will not receive your gift immediately upon meeting the minimum spend- the reason for the delay is the need to confirm eligibility with the bank. Please take note of this timeline before applying, and only apply if you’re willing to wait.

For those who want to track the fulfillment of their reward, SingSaver provides fulfillment timeline updates for Citibank and Standard Chartered cards on its website.

With regards to the Dyson Omni-glide specifically, winners will be published here by 30 June 2022.

Any enquiries about gift fulfillment should be sent to info@singsaver.com.sg

Get a free Disney+ subscription

If you’re a new-to-bank customer, Standard Chartered is offering a complimentary 6-month Disney+ subscription as well, with no minimum spend required.

Eligible cardholders will receive their Disney+ promotion redemption code within 60 working days of the date of activation of the physical card. This must be used within 3 months.

The T&C for this offer can be found here.

Recap: Standard Chartered Smart Card

|

||

| Apply Here | ||

| T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$30,000 | None | 3.5% |

| Regular Earn | Bonus Earn | Cap |

| Up to 0.64 mpd | 5.6 mpd/7.7 mpd on fast food, streaming, public transport | S$818 per statement month |

The Standard Chartered Smart Card has a S$30,000 income requirement and no annual fee.

Cardholders normally earn a very underwhelming 1.6 rewards points per S$1 spent (equivalent to 0.46/0.64 mpd depending on whether you hold a Standard Chartered Visa Infinite or X Card- see the explainer below) on all spending.

| ❓ Got Visa Infinite? |

|

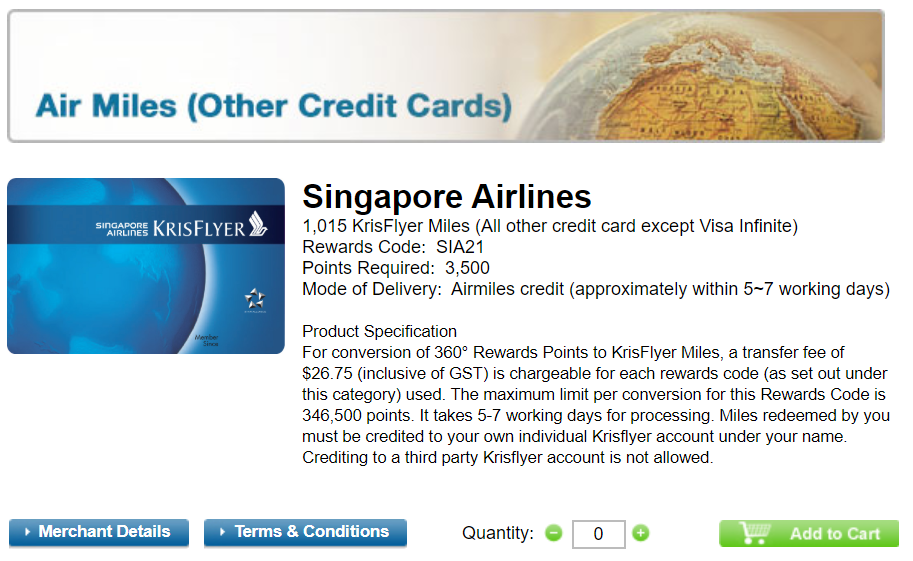

StanChart’s rewards ecosystem is much more favourable to those with a Standard Chartered Visa Infinite or Standard Chartered X Card. These cardholders can redeem KrisFlyer miles at an enhanced rate of 2,500 points = 1,000 miles.

All other cardholders redeem KrisFlyer miles at a rate of 3,500 points= 1,015 miles.

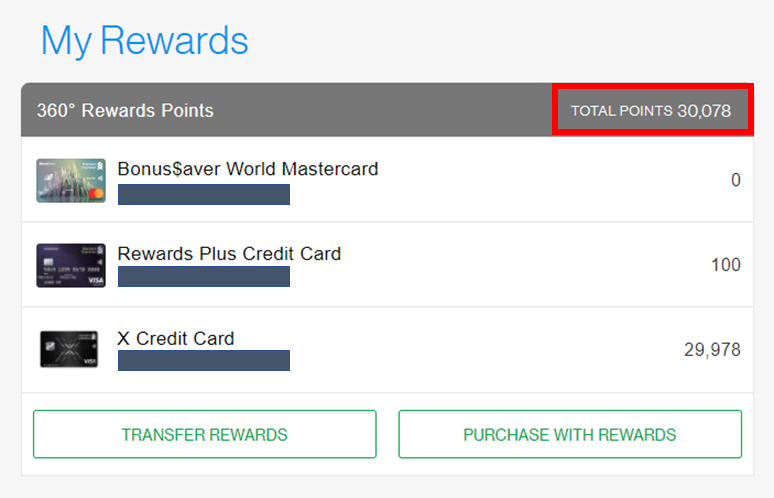

Here’s the fun part. If you have a Visa Infinite or X Card, all your rewards points can be redeemed at the 2,500 points = 1,000 miles rate. You can see this illustrated in my example below- the 100 points on my Rewards+ card are pooled with those from the X Card.

tl;dr: 1 SCB rewards point= 0.4 miles for Visa Infinite cardholders, and 0.29 mpd for all others. |

However, if cardholders spend on fast food, streaming entertainment or public transportation (no min. spend required), they’ll earn:

- the regular base rate of 1.6 rewards points per S$1 (0.46/0.64 mpd)

- a bonus of 17.6 rewards points per S$1 (5.10/7.04 mpd)

This means a total earn rate of 19.2 rewards points per S$1 (5.57/7.68 mpd), capped at S$818 per statement month. That’s actually very good if you frequently spend on these categories.

| Category | Merchants |

| 🍔 Fast Food |

|

| 📺 Streaming Entertainment |

|

| 🚆 Bus/MRT |

|

For comparison, the best alternative cards would earn “only” 4 mpd on such transactions (e.g. UOB Preferred Platinum Visa for mobile payments at fast food merchants, or the Citi Rewards for monthly streaming subscriptions).

This bonus rate is valid till 31 December 2022.

Conclusion

|

| Apply Here |

The Standard Chartered Smart Card could be a very useful companion to have, thanks to its upsized earn rate on fast food, streaming and public transport. Moreover, if your main card is a Standard Chartered X Card or Visa Infinite, it’s a no brainer to add the Smart Card to your wallet too (since there’s no annual fee and the points pool anyway).

For those who don’t already have a Standard Chartered credit card, there’s an additional gift of a Dyson Omni-glide, Apple AirPods Pros or S$300 cash in it for you.

SC CSO does not have idea how bonus points are credited and will always refer to their backteam and will do a follow up call. If this will happen every month might just drop this card.