Earlier this month, I wrote about how DBS Bank looked set to launch a $120K card of its own called the DBS Vantage. This came courtesy of a leak on the Accor Plus website, which revealed that cardholders would receive a complimentary Accor Plus Explorer membership with up to 50% off dining and a free hotel night each year.

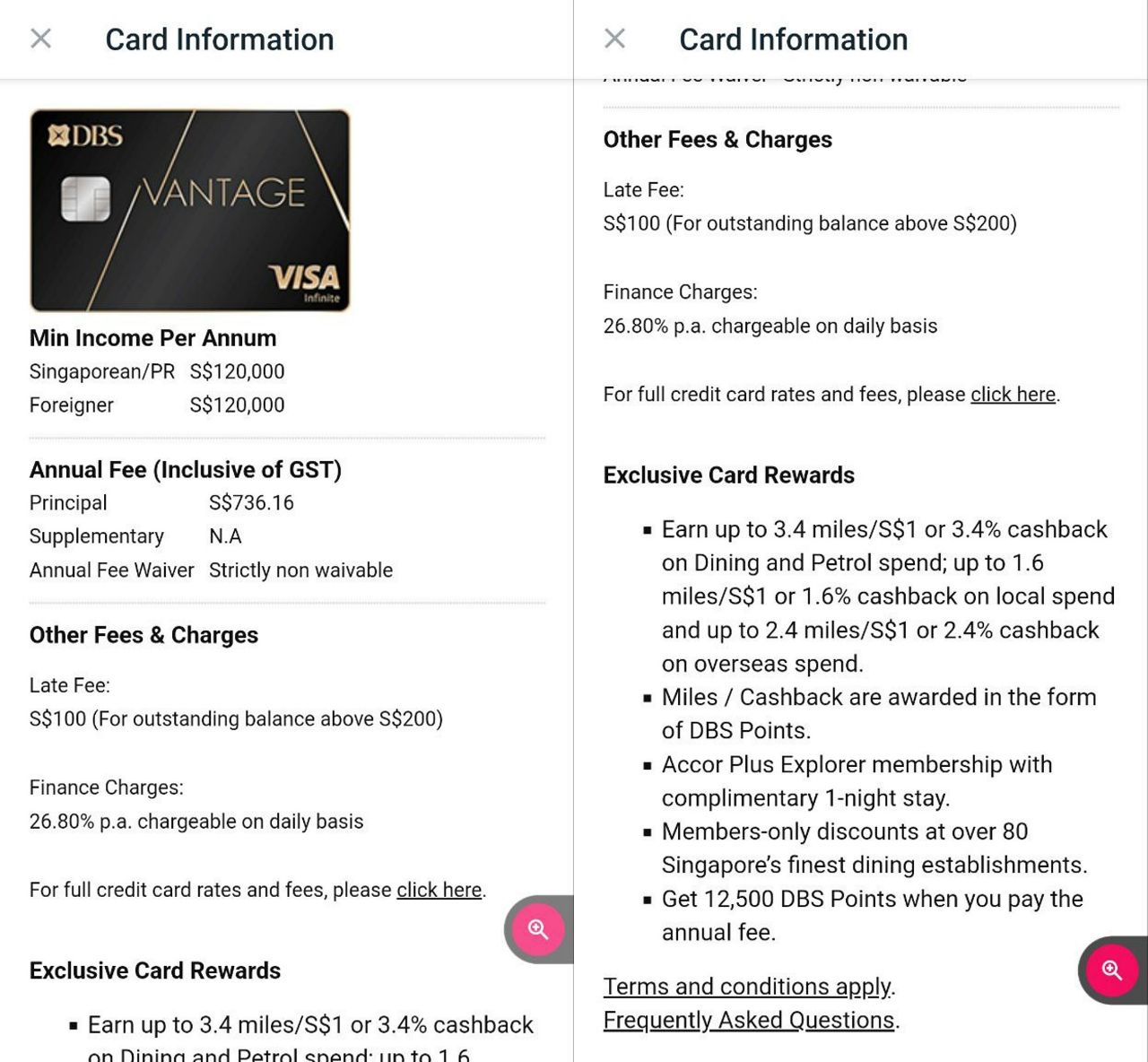

Little else was known beyond that, but this morning a member of The MileLion Telegram Group shared the following screenshots from the DBS website.

Is this what the DBS Vantage will look like? Yes and no. I reached out to DBS to confirm if this was the real deal, and was told the following:

“The card is still being finalised and the actual proposition will differ from the card information shown in the images.”

All I can say is thank goodness for that, because if this card went to market, it’d be the most DOA thing I’d seen since the KrisFlyer UOB account.

DBS Vantage: Is this it?

|

||

| DBS Vantage (Unconfirmed) |

||

| Income Req. | Annual Fee (AF) | FCY Fee |

| S$120,000 |

S$736 | 3.25% |

| Regular Earn | Bonus Earn | Miles with AF |

| Up to 1.6 mpd (Local) Up to 2.4 mpd (FCY) |

Up to 3.4 mpd | 25,000 miles |

|

||

From what I’ve gathered so far, it looks like the DBS Vantage will indeed be a consumer-facing card (one working theory I had earlier on was that it might be a corporate card similar to the UOB Regal).

A minimum income of S$120,000 is required, with an annual fee of S$736. Now, that alone should make you sit up and rub your eyes, because it’d make the DBS Vantage the most expensive card in the $120K segment.

| Card | Annual Fee | Welcome Gift |

DBS Vantage DBS Vantage(Unconfirmed) |

S$736 | 25,000 miles^ |

HSBC Visa Infinite HSBC Visa Infinite |

S$650 (S$488 for HSBC Premier) |

35,000 miles |

UOB VI Metal Card UOB VI Metal Card |

S$642 | 25,000 miles^ |

Maybank Visa Infinite Maybank Visa Infinite |

S$600 (1st year free) |

None |

SCB Visa Infinite SCB Visa Infinite |

S$588.50 | 35,000 miles |

AMEX Plat. Reserve AMEX Plat. Reserve |

S$535 | 2N stay at Fraser properties |

Citi Prestige Citi Prestige |

S$535 | 25,000 miles^ |

OCBC VOYAGE OCBC VOYAGE |

S$488* |

15,000 miles^ |

| *Alternative option: Pay S$3,210 for 150,000 miles ^Also given upon renewal |

||

For the record, I’m not opposed to high annual fees per se. After all, I shell out S$1,712 each year for the privilege of owning an American Express Platinum Charge. But with high fees come high expectations, and what I’m seeing doesn’t impress me at all.

What’s good?

Let’s start with the good stuff: the DBS Vantage sports decent earn rates. 1.6/2.4 mpd for local/overseas spending would make this even better than the top-of-the-line DBS Insignia (1.6/2.0 mpd), a card with a S$500,000 income requirement and a S$3,210 annual fee!

I don’t see how they could do that without ticking off some important customers, which perhaps explains the pesky “up to” qualifier. This suggests that a minimum spend must be hit to earn this rate, which then begs the question: what’s the regular earn rate, and how much is the minimum spend?

Cardholders also earn “up to” 3.4 mpd on dining and petrol spend. That’s clearly not the best possible outcome, given how you could earn 4 mpd with the right cards, but it’s still a good rate for a general spending card.

What’s bad?

Sadly, it kind of falls apart for the DBS Vantage after that.

Those “members-only discounts at over 80 of Singapore’s finest dining establishments”? Well, if they’re anything like what DBS Insignia cardholders get, I can’t say I’m holding my breath.

For the uninitiated, the DBS Insignia has a partnership with Dining City, which is meant to be their attempt at a Love Dining style programme.

Full marks for ambition, but the delivery leaves a lot to be desired. I did a quick survey of the discounts on offer, and it’s pretty grim:

- 10% discount: 1 restaurant

- 15% discount: 49 restaurants

- 20% discount: 4 restaurants

- 25% discount: 4 restaurants

- 50% discount: 2 restaurants

The median discount on offer is 15%, with just two restaurants at the 50% off mark: Cali at Ascott Raffles Place and Cali at Park Avenue Rochester. But both these outlets are already offering 50% off through Eatigo– no expensive annual fee required!

Contrast that to Love Dining, which offers couples 50% off dining at more than 40 restaurants. Even if you’re talking about dining in larger groups, a party of four would save more with Love Dining (25%) than most of the restaurants in the Dining City collection (yes, I know the list of restaurants isn’t a perfect overlap, but indulge the oversimplification).

Assuming the DBS Vantage can’t have better perks than the DBS Insignia, there’s very little to get excited about here.

This means the only benefits of note are the Accor Plus Explorer membership and the 25,000 miles each year. An Accor Plus membership is certainly useful, but it retails for S$408. Add that to the value of 25,000 miles (S$375, assuming 1.5 cents per mile), and you only end up slightly ahead of the DBS Vantage’s S$736 annual fee.

Surely there’s got to be more? Nope. That’s it. There’s no mention of airport lounge access, airport limo transfers, or many of the perks you’d expect from a card in this segment. Now, if you were charitable you might say they just ran out of bullet points, and there’s more stuff to come. I suppose that’s theoretically possible, though you’ll forgive me for being a bit skeptical.

But hey, we’re talking hypothetically anyway because this isn’t the actual DBS Vantage right?

Right?

Conclusion

The DBS Vantage is indeed set to become DBS’s first $120K card, although I’ve been told that the information which went live this morning does not represent its final form.

The key question in my mind is: how different will the final product be?

If we’re talking radically different, then fair enough, I’ll reserve judgement till then. But if we’re talking marginal differences, then the DBS Vantage would indeed be overpriced and underwhelming.

If this were the DBS Vantage, would you pay S$736 for it?

Maybe it’s metal? That’ll get a few people excited between the legs…

given the price segment it’s targeting, i fully expect it to be metal.

I expect they give a 24K gold card with Dimond on it. Annual fee can be 2K with no Miles/Cashback, No limo transfer, No airport lounge and no other benefit at all.

i’ll be surprised if the final version is any different. perhaps they will just clarify the perks with more bullet points for the lounge access, limo etc which is expected from 120k cards.

long live the Citi Prestige (and counting down the days until 4NF is again nerfed…)

Moreover these days, more advantageous to be MasterCard! Courtesy Amaze.

@DBS, please do not bother with the card if this is the case. Really waste of time to come up with the marketing collateral and waste of paper to print brochures/forms. Pointless card

DBS used a brief pre-launch teaser to solicit free market feedback. Haha haha

was thinking the same

Will ask our marketing team to do the same 🙂

Your sign up offers already so lousy and have been around for a long time. No need to test la

Every Time first 100 or 200 new to bank with minimum spend. It’s a funny thing.

I’m getting the vibe they “leaked” the info/teaser just so that the Milelion would write an article about it and then they can use the information “for analysis” and “market feedback” hahaha. Someone needs to pay Aaron more for doing the market diligence and research on behalf of these companies.

If it is 700+ annual fee, sorry, bye

Shocking that they think a $700 AF card will attract the Gen Y 120k+ income with close to useless actual benefits. I will gladly pay the AF for 1712 but not this paper weight DOA card.

How about starting with a 100k sign-up bonus and a 4mpd for all spend if you really want to go all out in getting new clients to stick with your card?

Looks like a glorified priority pass…

LOL…$700+ non-waivable fee but no Priority Pass or lounge access. Definitely not a travel card

Apart from a metal looking card which looks slick, nothing else looks remotely interesting.

They could still do the one off sign up offers ala SCB X. Tough to justify paying for this now that Citi Payall makes it so cheap to buy miles, which are more flexible (Aaron is too generous with 1.5mpd valuation).

I would say this makes 1.6 mpd local gen spend still puts it at the top of class in earn rates. Just hope they can make this a much more lifestyle orientated card along the lines of Chillax that Amex has.

I would expect that $700+ AF to come with: limo rides (at least 8 times/ year) dedicated concierge unlimited lounge at least 35k miles with AF paid, including renewals exclusive dining and event invitation that is unique (not something equivalent where you can easily get from eatigo, chope) metal card (at least 10g) Some perks that may interest me: limo rides are expanded beyond SG Changi Airport. This makes transiting between domestic airports less of a hassle. Apart from priority pass lounge, expand to include plaza premium (this would increase a significant coverage, especially countries with no priority pass lounges)… Read more »

I believe DBS will only meet the 6th of your expectation, metal card. Any they will give more. Maybe 1Kg instead of 10g.

DBS not desperate to go all out attract card holders costing more to maintain that what they can make from card holders. Haha haha

Pretty sure this was not an actual “leak” lol they’re putting it out there to see what the response would be so they can tweak the final product

quite a bad card LOL

Another 2 months, any update on this thing? I saw your citi prestige article today and I suddenly remember this, what if it’s coming soon, should I wait for it?

your guess is as good as mine. i don’t have any intel as to when the card will be launched.

This card is slated to be announced on 19 April, keep a lookout for it!

Thanks Harry! I definitely can wait till next week😆

Hey love, where is the launch 😆

“i heard it on the internet so it must be true”

So cute, send my kiss to you, lol

DBS decided to cancel the launch of this card.