The 2022 income tax season is now underway, and for those looking to earn miles on their tax bill, CardUp has launched a promotion offering a 1.75% admin fee (discounted from the usual 2.6%) for all Visa payments.

This rate is valid for both new and existing customers, for one-off or recurring payments.

1.75% fee for income tax payments with CardUp

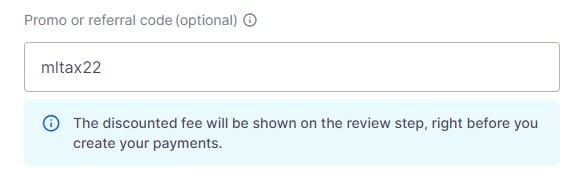

New or existing CardUp users who enter the promo code MLTAX22 will enjoy a 1.75% fee on income tax payments scheduled by 31 August 2022 with due date by 25 August 2023.

This promo code is only valid for Visa cards issued in Singapore; it cannot be used with Mastercards, American Express cards, or credit cards issued outside of Singapore.

| ❓ First-time user? |

|

If this is your first time using CardUp, use the code MILELION to save S$30 off your first transaction with no minimum spend required. This allows you to earn free miles on a payment of up to S$1,154 (based on CardUp’s regular admin fee of 2.6%). You can subsequently use the MLTAX22 for the rest of your income tax payments. |

The code can only be redeemed once per user, but remember: you can either use it for a one-off payment or a recurring payment series.

The T&Cs of this offer can be found here.

Cost per mile

The cost per mile will vary depending on which card you use. Here’s an idea of what you’ll pay with a 1.75% fee and the various Visa options out there.

| Card | Miles per S$1 | Cost Per Mile (1.75% fee) |

DBS Insignia DBS Insignia |

1.6 | 1.07 |

UOB Reserve UOB Reserve |

1.6 | 1.07 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 | 1.07 |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.07 |

SCB Visa Infinite SCB Visa Infinite |

1.0/1.4* | 1.72/1.23 |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.23 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.23 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.32 |

SCB X Card SCB X Card |

1.2 | 1.43 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.43 |

| *1.4 mpd applies with minimum S$2K spend per statement month, otherwise 1.0 mpd |

||

For example, someone who pays a S$1,000 tax bill via CardUp would pay S$1,017.50 after fees. If he uses a 1.4 mpd card, he will earn 1,425 miles (ignoring rounding), for which he has paid a fee of S$17.50. The cost per mile is therefore 1.23 cents each.

Depending on what card you use, the cost per mile can start from as low as 1.07 cents each, which is a very compelling price to pay. Assuming your tax bill is large enough, you could be “buying” a Business Class ticket to Japan or South Korea for just over S$1,000 plus taxes (94,000 miles @ 1.07 cents each).

Even if you have one of the more basic 1.2 mpd earning cards, you can still enjoy a relatively competitive price of 1.43 cents per mile.

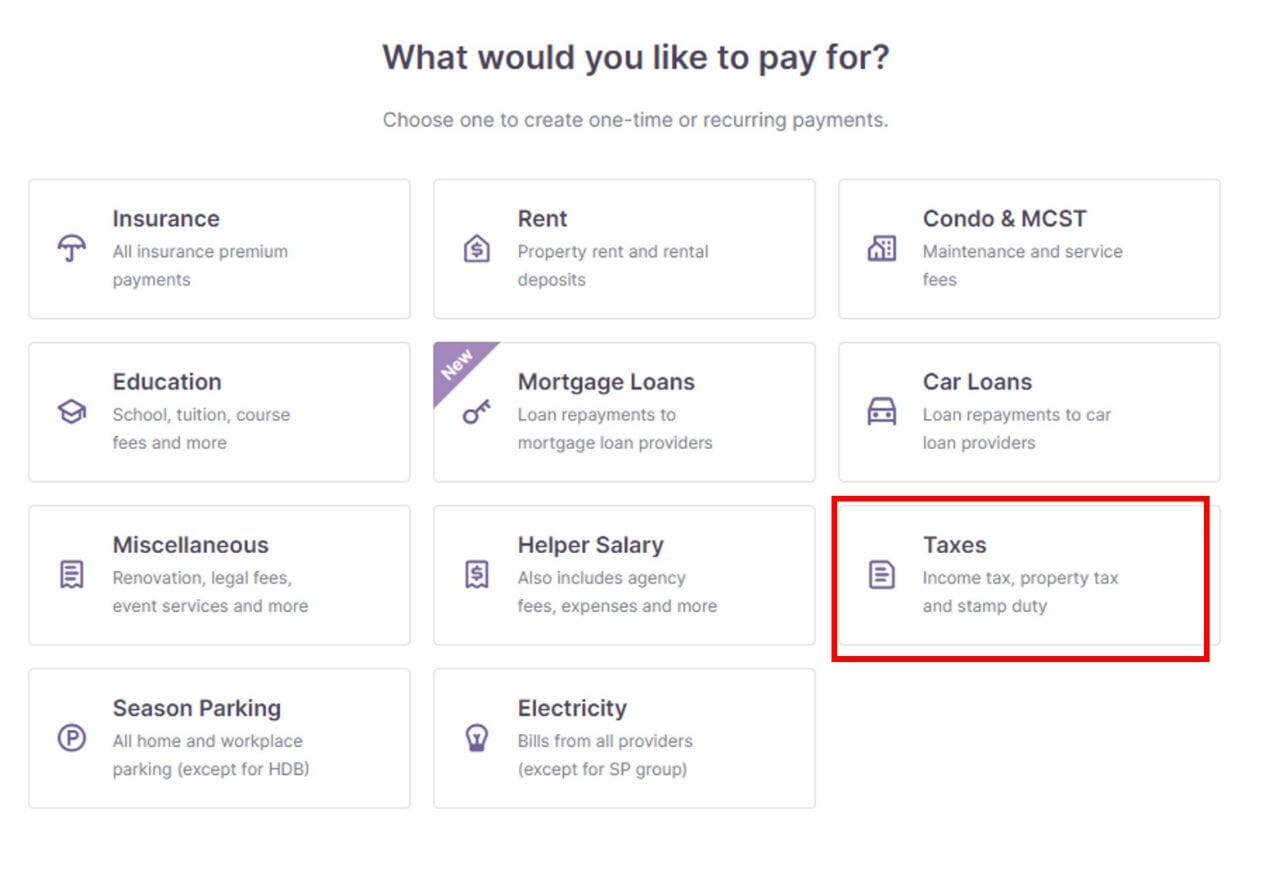

How to setup income tax payments

To schedule an income tax payment, login to your CardUp account and click on “create payment”.

Select “taxes”, then “IRAS-Income Tax”.

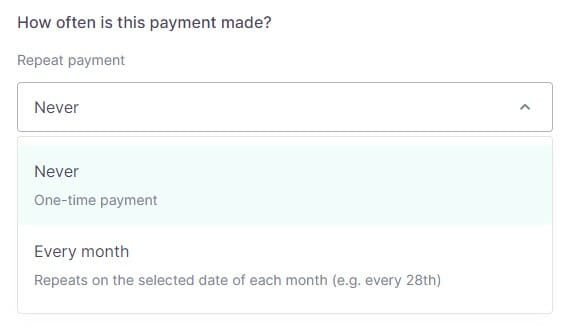

On the next screen, you’ll be prompted to enter the payment amount, as well as choose between a one-time or monthly payment.

One-time payment

If you go for this option, you can pay any amount up to the total tax due on your NOA. In other words, if your tax bill is S$10,000, you can pay up to S$10,000.

Recurring payment

However, I’m quite certain that most people would prefer to do recurring payments, in order to take advantage of the 12-month interest-free payment plan IRAS offers.

In order to create a recurring income tax payment on CardUp, you must first set up an existing GIRO instalment plan with IRAS.

This can be done via the following methods:

- Instant

- myTax portal (DBS/POSB and OCBC customers)

- Internet banking (DBS/POSB, OCBC and UOB customers)

- AXS stations (DBS/POSB customers)

- 3 weeks processing

- GIRO application form (all bank customers)

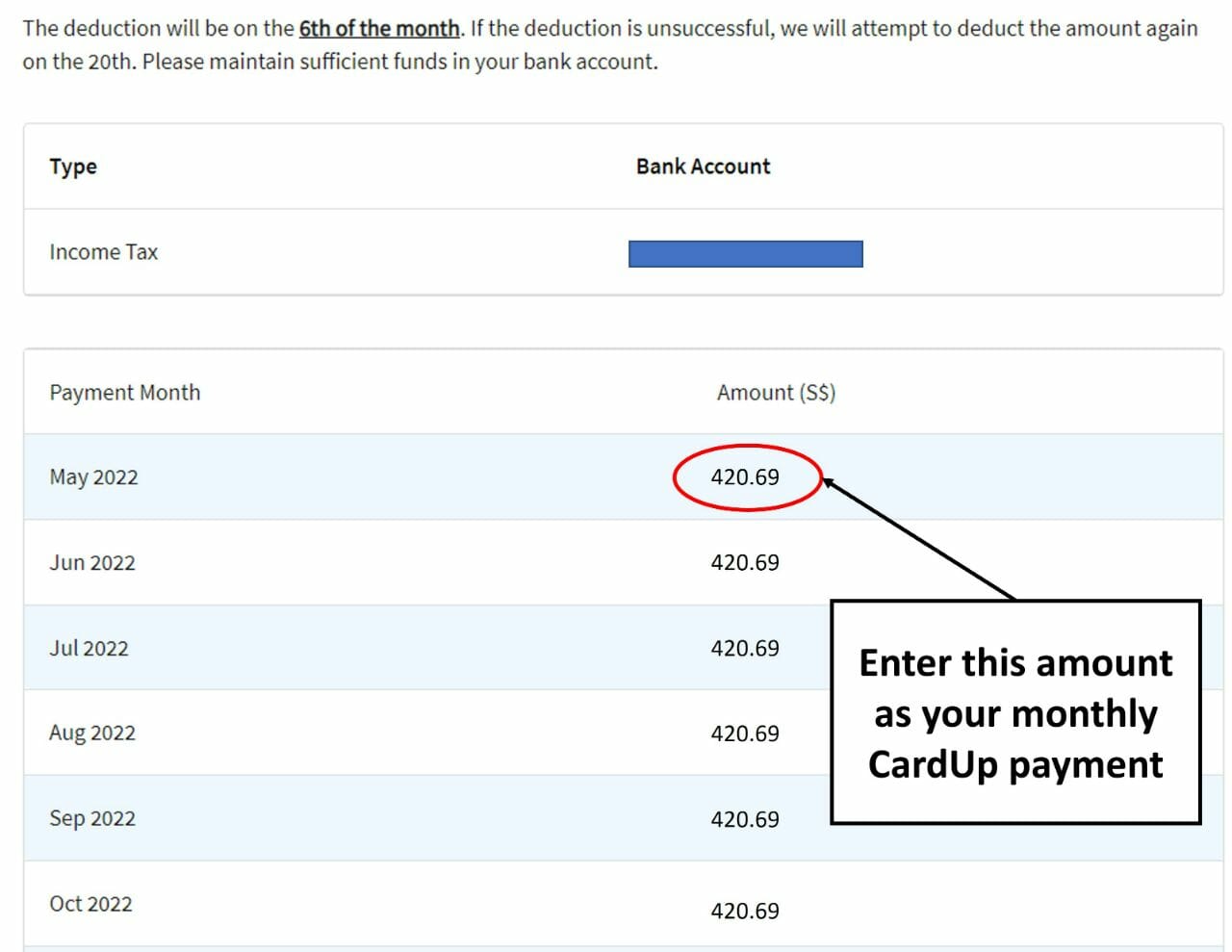

Once your GIRO arrangement has been approved, you can view the monthly instalment by logging to myTax Portal, selecting Account > View Payment Plan > View Plan.

This is the figure you need to enter as the payment amount in the CardUp portal, and don’t forget to put in the promo code MLTAX22.

You’ll also need to select the date of the first and last monthly payment. Do note that first and last few dates of every month will be blocked off. That’s because IRAS does their deductions on the 6th of every month, and CardUp payments need to arrive in advance of that to avoid double deductions.

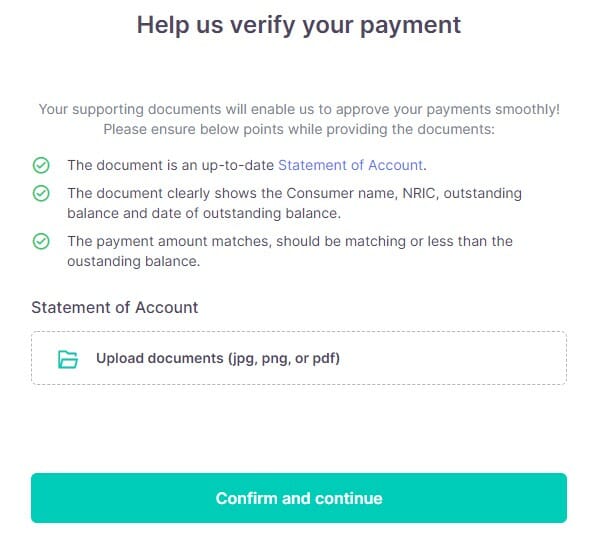

On the next screen, you’ll be prompted to upload a copy of your NOA…

…and finally you’ll be able to review the payment schedule before confirming it. Your fee should be based on 1.75% of the payment amount.

It’s important that you do not cancel your GIRO instalment plan even after setting up your CardUp payment.

Refer here for the full FAQs for setting up a recurring payment.

Citi PayAll alternative

|

| Citi PayAll 2.5mpd Promo |

Of course, we can’t talk about income tax payments without talking about Citi PayAll. Citi PayAll has just launched an upsized 2.5 mpd earn rate on all payments made by 31 July 2022, with a minimum spend of S$5,000 and a maximum spend of S$120,000.

With its 2% platform fee, this represents buying miles at 0.8 cents each– quite simply unbeatable.

But the 31 July 2022 cutoff is an important caveat. If you want to make full use of this promotion, you’ll need to finish paying your tax bill by then. In contrast, CardUp gives you till August 2023 to do so. You’ll need to weigh the implications on cashflow when deciding which one suits you better.

Otherwise, there are only three scenarios where I could see you going somewhere else:

- You don’t have any Citibank credit cards (and don’t intend to get one)

- You can’t meet the minimum spend of S$5,000 that Citi PayAll requires

- You’re trying to meet a sign-up bonus on a non-Citibank card (yes, CardUp spending counts towards sign-up bonus spending)

MileLion Income Tax Guide 2022

I’m currently in the midst of updating the Income Tax Guide for 2022, which features a detailed rundown of how to pay your taxes with a credit card, the various options, and important points to note.

Expect it out within the next few weeks as more promotions come onto the market.

Conclusion

Cardup is offering a 1.75% promotional fee for income tax payments, which allows users to purchase miles from as little as 1.07 cents each. It’s the same rate we saw last year, and the ability to schedule recurring payments means you can take full advantage of IRAS’s interest-free instalment plans too.

However, Citi PayAll’s promotional rate of 2.5 mpd with a 2% fee offers a cheaper option, and it’s hard to see anyone beating that.

Hi, would this work with the HSBC Revolution as long as I keep monthly payment below $1,000? Thanks

hsbc does not earn points with cardup

Pathetic. Might as well use the HF card..

does card up still work with uob visa signature or uob ppv?

Do you have any updates for tax promo rate for 2023?

still a bit early, maybe in another month or so.

Fingers crossed they have a good deal

2023 promo is out – https://www.cardup.co/personal/pricing