If you thought that tracking credit card points on general spending cards was hard, just wait till you try it with specialised spending ones.

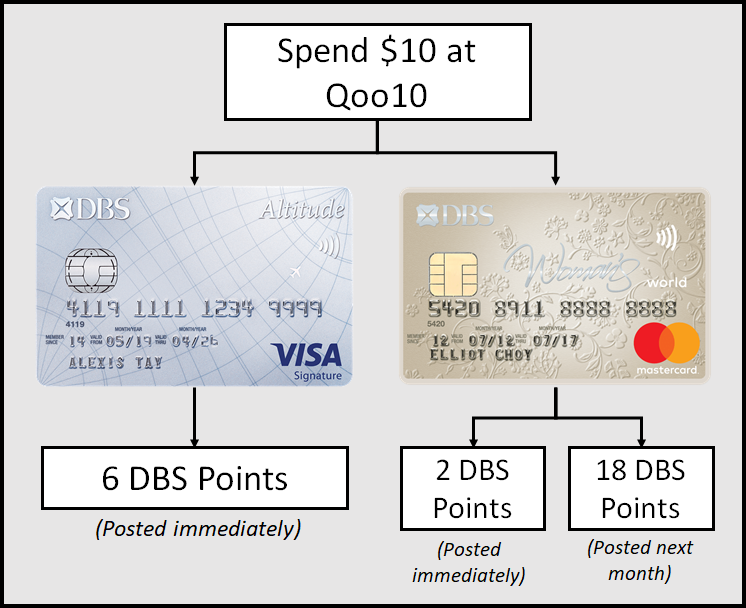

Unlike general spending cards, where you can expect the points to be credited as soon as the transaction posts, most (but not all) specialised spending cards split points into two batches:

- Base points are credited when the transaction posts

- Bonus points may be delayed till the month after, and awarded as one lump sum.

This can make tracking an absolute nightmare- and yet, it’s crucial for specialised spending cards. Because of the ambiguity inherent in MCCs (will a hotel restaurant code as dining, or accommodation?), tracking helps ensure you’re getting the bonuses you’re entitled to. Even if you’re not an Excel geek, it makes sense to eyeball your total spend and the number of points received each month, just to ensure everything’s in order.

In this post, we’ll look at how you can calculate points earned on specialised spending cards.

| 💳 Calculating Credit Card Points |

| ❓ General vs Specialised Spending Cards |

|

Specialised spending cards are those which earn bonus points (up to 4 mpd) on certain categories or types of transactions. For example, the Citi Rewards Card earns 4 mpd on all online transactions (except travel), and the OCBC Rewards card earns 4 mpd on shopping. General spending cards earn a flat 1-1.6 mpd on all transactions regardless of category or type. |

Calculations: Specialised Spending Cards

Here’s how various specialised spending cards award and round points.

| Card | Remarks | Bonus Points |

Citi Rewards Citi Rewards |

Base (1X:) Round down trxn. to nearest S$1, then multiply by 1 Bonus (9X): Round down trxn. to nearest S$1, then multiply by 9 |

Instant |

DBS Woman’s World Card DBS Woman’s World Card |

SGD Bonus (9X): Divide trxn. by 5 and multiply by 9, round down to nearest whole number FCY Bonus (7X): Divide trxn. by 5 and multiply by 7, round down to nearest whole number Combined |

Delayed (next c. month) |

HSBC Revolution HSBC Revolution |

Base (1X): Round trxn. to nearest S$1, then multiply by 1 Bonus (9X): Sum all eligible trxn. (including cents) and round down to nearest whole number, then multiply by 9 |

Delayed (next c. month) |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

For SIA, Scoot, KrisShop & Kris+ Base & Bonus (3 mpd): Sum all eligible transactions, round down trxn. to nearest S$5, divide by 5, then multiply by 15 |

Instant* |

| For Accelerated Miles Bonus (1.8 mpd): Sum all eligible transactions, round down trxn. to nearest S$5, divide by 5, then multiply by 9 |

Delayed (after end of m. year) |

|

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

Base (1X): Round down trxn. to nearest S$5, then multiply by 5 Bonus (7X): Round down all eligible trxn. to nearest S$5, then multiply by 35 |

Delayed (next c. month) |

Maybank World Mastercard Maybank World Mastercard |

Base (1X): Round down trxn. to nearest S$5, then multiply by 5 Bonus (9X): Round down trxn. to nearest S$5, then multiply by 45 |

Instant |

OCBC Rewards OCBC Rewards |

Base (1X): Round down trxn. to nearest S$5, divide by 5, then multiply by 5 Bonus (9X): Round trxn. down to nearest S$5, divide by 5, then multiply by 45 |

Delayed (next c. month) |

StanChart Journey StanChart Journey |

Base (3x): Multiply transaction by 3, then round to nearest whole number Bonus (4.5X): Sum all eligible trxn. (including cents), multiply by 4.5, then round to the nearest whole number |

Delayed (next s. month) |

UOB Lady’s Card/ UOB Lady’s Card/Lady’s Solitaire |

Base (1X): Round down trxn. to nearest S$5, divide by 5, then multiply by 1 Bonus (9X): Sum all eligible trxn. (including cents), round down transaction to nearest S$5, divide by 5, then multiply by 9 |

Delayed (next c. month)^ |

UOB Pref. Plat. Visa UOB Pref. Plat. Visa |

Base (1X): Round down trxn. to the nearest S$5, divide by 5, then multiply by 1 Bonus (9X): Round down trxn. to the nearest S$5, divide by 5, then multiply by 9 |

Instant |

UOB Visa Signature UOB Visa Signature |

Base (1X): Round down trxn. to nearest S$5, divide by 5, then multiply by 1 Base (9X): Sum all eligible trxn. (including cents), round down transaction to nearest S$5, divide by 5, then multiply by 9 |

Delayed (next s. month) |

|

*To pre-empt the inevitable nitpicking, it’s not instant in the sense that the miles appear as soon as your transaction posts, but it will be credited along with the base miles in the monthly transfer to your KrisFlyer account ^Bonus UNI$ from regular spending will post at the start of the following calendar month. Bonus UNI$ from the UOB Lady’s Savings Account will post at the end of the following calendar month C. Month = Calendar month | S. Month= Statement month | M. Year= Membership year |

||

A few points to note.

Instant vs delayed bonuses

While most specialised spending cards award base and bonus points separately, there are a few exceptions where base and bonus points are awarded together at the time of transaction posting:

- Citi Rewards Card

- Maybank World Mastercard

- UOB Preferred Platinum Visa

Needless to say, this makes reconciliation much easier, especially since UOB provides transaction-level points breakdowns.

If bonus points are credited as a lump sum, you need to work backwards to figure out what did and didn’t earn points.

While that’s a headache, one benefit of delayed posting is that certain transactions which may not earn base points can still earn bonus points.

For example, if you spent S$4 online with the DBS Woman’s World Card:

- 0 base points are earned (4/5*1 is rounded down to 0)

- 7.20 bonus points are earned (4/5*9, rounded to 2 d.p) and added to the monthly bonus amount

Likewise, where the UOB Lady’s Card and UOB Visa Signature are concerned, transactions at UOB$ merchants like Giant, Cold Storage and Starbucks do not earn the 1X base UNI$ (0.4 mpd), but are still eligible to earn the 3.6X bonus UNI$ (3.6 mpd) the following month.

Confirmed: UOB$ merchants qualify for bonus miles with UOB cards

Such transactions would earn no miles at all with the UOB Preferred Platinum Visa.

Round versus round down

It’s important to note whether your bank rounds or rounds down transaction and points amounts

- Round means 3.6 becomes 4, 3.4 becomes 3 (.5 is always rounded up)

- Round down means that both 3.6 and 3.4 become 3

Obviously, the former is more generous than the latter.

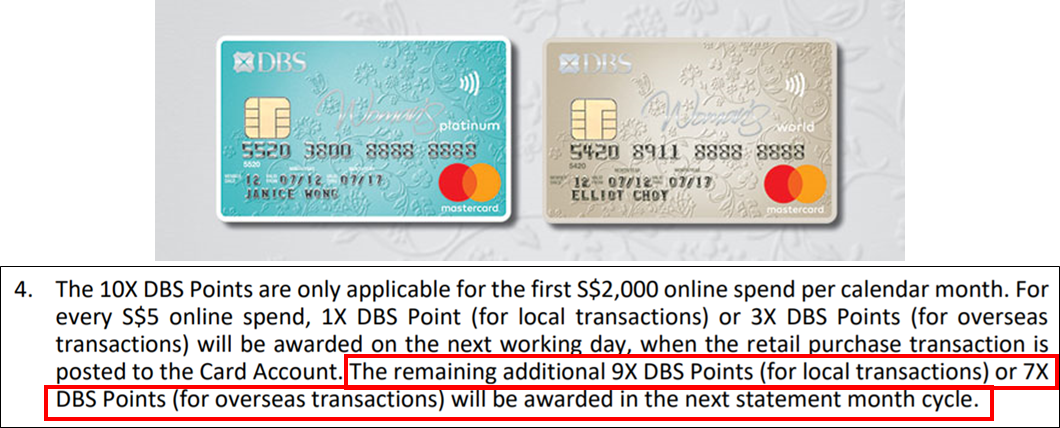

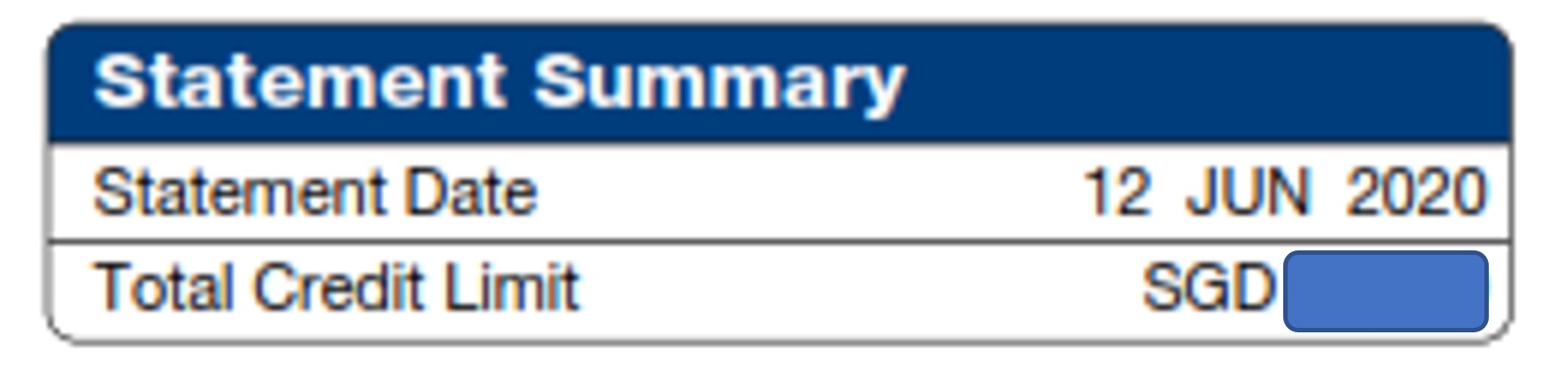

Calendar month vs statement month

When calculating bonus points, be careful to note whether your card applies a bonus cap based on calendar month or statement month.

Calendar month is straightforward (e.g. 1-31 January), but statement month needs a little explaining. Generate your e-statement and look for the statement date at the top right hand corner. This tells you what your statement month is; in the example below, it’s 12th to the 11th of the following month.

You should also take note of timing differences between the crediting of base and bonus points. For example, the HSBC Revolution card awards 1X base points in the current statement cycle, but the additional 9X bonus points will be credited by the last day of the following calendar month. Your statement cycle is unlikely to coincide exactly with the calendar month, which means you’ll need to carefully sort your transactions by date when reconciling.

Excel formulas

If you’re the sort who uses Excel to calculate your points, here’s formulas to plug and play. “X” refers to the eligible transaction amount, “Y” to the sum of all eligible transactions.

| Card | Formula for Points |

Citi Rewards Citi Rewards |

Base (1X): ROUNDDOWN(X,0)*1 Bonus (9X): ROUNDDOWN(X,0)*9 |

DBS Woman’s World Card DBS Woman’s World Card |

Local FCY Total Bonus (Local + FCY) |

HSBC Revolution HSBC Revolution |

Base (1X): ROUND(X,0)*1 Bonus (9X): ROUNDDOWN(Y,0)*9 |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

Base (1.2 mpd): ROUNDDOWN (X/5,0) *6 Bonus (1.8 mpd): ROUNDDOWN (Y/5,0)*9 |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

Base (1X): ROUNDDOWN(X/5,0)*5 Bonus (7X): ROUNDDOWN(X/5,0)*35 |

Maybank World Mastercard Maybank World Mastercard |

Base (1X): ROUNDDOWN (X/5,0)*5 Bonus (9X): ROUNDDOWN (X/5,0)*45 |

OCBC Rewards OCBC Rewards |

Base (1X): ROUNDDOWN(X/5,0)*5 Bonus (9X): ROUNDDOWN(X/5,0)*45 |

StanChart Journey StanChart Journey |

Base (3X): ROUND (X*3,0) Bonus (4.5X): ROUND (Y*4.5,0) |

UOB Lady’s Card/ UOB Lady’s Card/Lady’s Solitaire |

Base (1X): ROUNDDOWN (X/5,0)*1 Bonus (9X): ROUNDDOWN(Y/5,0)*9 |

UOB Pref. Plat. Visa UOB Pref. Plat. Visa |

Base (1X): ROUNDDOWN (X/5,0)*1 Bonus (9X): ROUNDDOWN (X/5,0)*9 |

UOB Visa Signature UOB Visa Signature |

Base (1X): ROUNDDOWN (X/5,0)*1 Bonus (9X): ROUNDDOWN(Y/5,0)*9 |

Remember that the formulas above give you the number of points you can expect to receive (e.g. UNI$, DBS Points, VOYAGE Miles, OCBC$), not miles. A further calculation is necessary to convert points to miles.

| Bank points | KrisFlyer miles |

| 1 BOC Point | 0.22 miles |

| 1 Citi Mile | 1 mile |

| 1 Citi ThankYou Point | 0.4 miles |

| 1 DBS Point | 2 miles |

| 1 HSBC Point | 0.4 miles |

| 1 HSBC Travel$ | 1 mile |

| 1 Maybank TREATS | 0.4 miles |

| 1 OCBC$ | 0.4 miles |

| 1 90°N Mile | 1 mile |

| 1 OCBC VOYAGE Mile | 1 mile |

| 1 SCB Point | 0.4 miles (for Journey, Visa Infinite) 0.29 miles (all others) |

| 1 UNI$ | 2 miles |

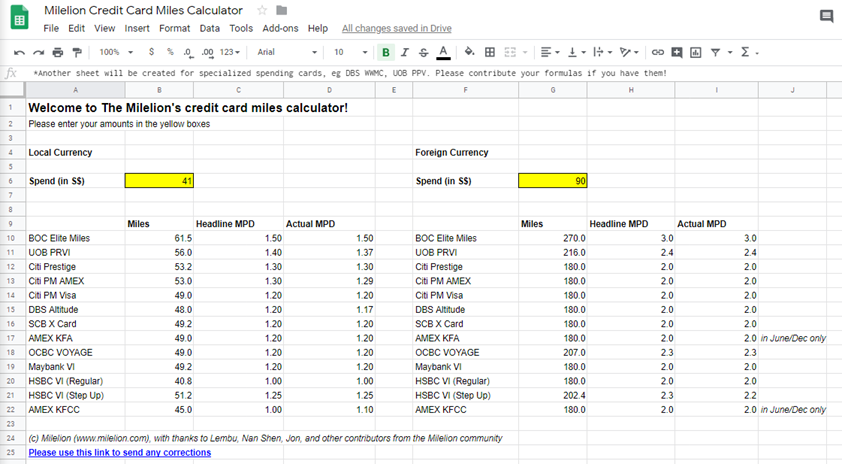

| Credit Card Points Calculator |

|

I’ve taken a stab at creating a credit card calculator for general spending cards, where you can plug in your spending amount and see how each card performs. It’s based on my own experience and community-contributed data points, so free to play around with it and update me if you see any errors in formulas. |

Conclusion

Is it worth tracking your credit card points? Definitely. By monitoring their points, cardholders have spotted miscoded transactions, which were rectified upon appeal. For example, at one point Citi Rewards Cardholders were not earning bonus points on Deliveroo. This was investigated and rectified eventually.

Is it worth tracking your credit card points at this level of detail? Well, only you can answer that.

Honestly speaking, I just eyeball my points balance each month. I’ve never actually created a spreadsheet to track them with the granularity that some do. For me, the main objective of checking your points is not to account for them to the last digit. Rather, it’s to help you:

- realise when you didn’t earn the bonus points you thought you would

- identify which transaction didn’t earn bonus points, and call up the CSO to investigate (if you have a case)

In other words, if I see a big discrepancy between what I have, and what I think I should have based on a ballpark calculation, it’s a sign that I should call up the bank and find out what’s going on. Of course, it’d be much better if banks just got it right the first time, but unfortunately the onus is still on the customer to spot discrepancies.

I only read 1/3 of the article and started going WOW, there are new insights for me, I certainly didn’t know about that particular quirk of the DBS WWMC card where base miles are not awarded but bonus miles still credit. Thanks Aaron!

The same case happens for UOB Lady’s card, where a transaction less than $5 will not earn any base UNI$ but if summed with other eligible transactions, it could still earn the 9x bonus UNI$.

Thanks Milelion for the compilation!

glad to hear that! thanks also to those who contributed their workings and data points. One member of the community kindly shared his spreadsheet, which was easily one of the most complicated i’d ever seen (and this after working 5 years in consulting)

Possible to share the spreadsheet? At least a screenshot?

My experience with DBS WW is that that for the bonus 9x points, they sum up total transactions by posted date for the entire calendar month (e.g. 1 Jun – 30 Jun, then apply the rounding formula you mentioned above. So this helps reduce the ‘loss’ due to rounding for individual transactions. Kinda what you mentioned in your article, just that might be simpler if you simply total up that calendar’s months posted transcations isntead of performing the formula transaction by transaction.

yup, i think that’s a valid approach too. in any case we round the individual transactions to 2 dp which should mean no loss due to rounding on the aggregate level.

No BOC EM?

seriously? go read the article on general spending cards. it’s literally mentioned in the first paragraph.

No love for UOB KF?

For DBS Altitude my understanding from recent conversations with CSO and backed by statement data, is that bonus points do NOT post immediately, but in the following months statement .

that’s correct. bonus points for airline/hotel spend post the following month.

i gotta agree on aaron’s conclusion. i made the mistake of not checking my purchase of alaska miles. it was not posted as flight spending on my altitude card. realised it too late. busted the deadline. could not get it reconciled. was offered $50 credit for my loss. such waste!

The excel formula for Maybank World Mastercard is same as what I use and accurate so far.

For Maybank Horizon Visa Signature, I use the following: For 1x, =ROUND(X,0). For 7x, =ROUND(X,0)*7

Others are welcome to verify.

Will one day milelion ever release a iOS/android app? That will be a great tool to record instantly, if possible add alert to inform the specify card had hit the earning cap. Lots of time, I exceeded the 1k spending earn rate for PPV.

would be nice!

Hi Aaron,

For UOB Visa Signature, what does exactly mean by next calendar month?

My statement cycle is 13th. I have been tracking since 13 Sep till now, but seems anything bonus point coming in yet.

Not sure does “next calendar month” mean next 13th or next 1st?

Best

any idea about the SCB Smart Card? since the bonus mpd has been extended to end 2023

i don’t have any data points on how the points are awarded, sorry!

Is it even possible to track bonus points on Citi cards anymore? Apart from the lump sum shown in the app? How can you even find when the CR points are going to expire?

This article is incorrect for the UOB lady’s card. Good old UOB. They round EVERY transaction to the nearest $5 before calculating the bonus miles.