Back in June, DBS launched the Vantage Card, its first foray into the $120K card space. As far as first attempts come, it’s respectable enough, with strong earn rates and solid benefits ensuring it’s not just there to make up the numbers.

But what really caught the eye was the sign-up bonus of up to 80,000 miles. That was only available for a mere five days, after which DBS reduced the bonus to up to 60,000 miles. It’s still attractive, but obviously less so than before.

The 60,000 miles sign-up bonus was scheduled to lapse on 31 July 2022, but was extended to 30 September 2022. DBS has now further extended the offer to all applications submitted by 31 January 2023.

DBS Vantage 60,000 miles sign-up bonus

DBS Vantage DBS Vantage |

||

| Apply Here |

||

| Card T&Cs | ||

| Sign-Up Bonus T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$120,000 |

S$588.50 | 3.25% |

| Regular Earn | Bonus Earn | Miles with AF |

| 1.5 mpd (SGD) 2.2 mpd (FCY) |

4 mpd on dining & petrol (cap at S$2K per c. month) |

25,000 miles |

|

||

| Update: The offer for existing customers has been removed. |

New DBS Vantage Cardholders who apply by 31 January 2023, spend S$8,000 within 60 days of approval and pay the first year’s S$588.50 annual fee will receive the following:

| New | |

| Pay S$588.50 annual fee | 25,000 miles |

| Spend S$8,000 within 60 days | 35,000 miles |

| Total | 60,000 miles |

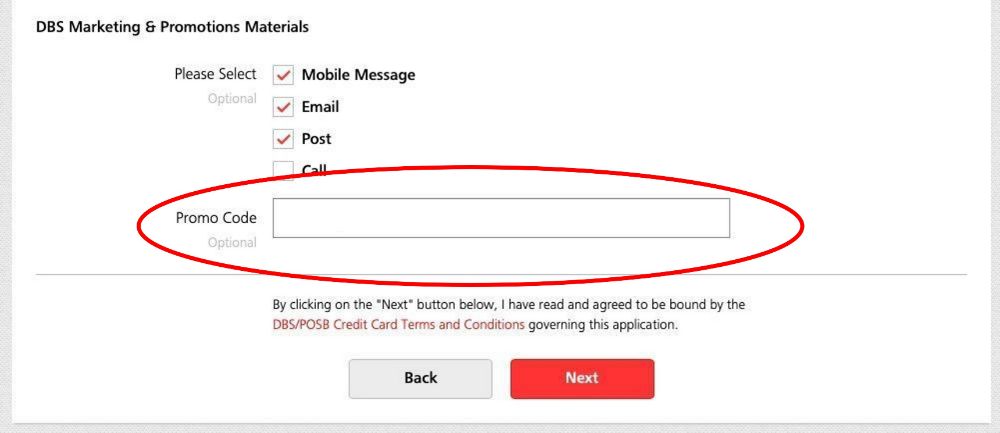

| Must apply with promo code VANMILES | |

| ❓ “New” Definition | |

| New cardmembers are defined as customers who are currently not holding on to any Principal DBS/POSB Credit Card and have not cancelled any Principal DBS/POSB Credit Card within the last 12 months. | |

This bonus is on top of whatever base miles you normally earn with the DBS Vantage:

- 1.5 mpd on local spend

- 2.2 mpd on FCY spend

- 4 mpd on local or FCY dining or petrol spend (capped at S$2,000 per calendar month)

You must enter the promo code VANMILES when applying. No code, no bonus! The promo code field can be found towards the bottom of the application page, under the “DBS Marketing & Promotions Materials” section.

If you applied but forgot to enter the promo code, do give DBS customer service a call. There’s no guarantee it can be fixed, but anecdotally I’ve seen a few comments from people who managed to get it rectified.

What counts as qualifying spend?

You will have 60 days from the date of card approval to clock at least S$8,000 of qualifying spend.

Qualifying spend includes both local and foreign retail sales and posted recurring bill payments, excluding the following:

| a. posted 0% Interest Instalment Payment Plan monthly transactions; b. posted My Preferred Payment Plan monthly transactions; c. interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS; d. payments to educational institutions; e. payments to financial institutions (including banks, online trading platforms and brokerages); f. payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); g. payments to hospitals; h. payments to insurance companies (sales, underwriting and premiums); i. payments to non-profit organisations; j. payments to utility bill companies; k. payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral service and legal services and attorneys); i. any top-ups or payment of funds to payment service providers, any prepaid accounts or purchase of prepaid cards/credits (including but not limited to EZ-Link, GrabPay, NETS FlashPay, Transit Link, Razer Pay, ShopeePay, Singtel Dash, AMAZE*); m. any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers); n. any transactions related to crypto currencies; o. payments made to CardUp, FavePay, iPaymy and SmoovPay are also subject to the exclusions listed in Clauses 9 (a) to 9 (o) above; and p. any other transactions determined by DBS from time to time |

For the latest sign-up bonus extension, DBS has updated the T&Cs to add point (o), which states that any payments made through platforms such as CardUp, FavePay, iPaymy and SmoovPay are subject to the exclusions listed above.

For example, if you were to pay education bills or insurance premiums through CardUp, such spending would not count towards the S$8,000 minimum spend (it would still earn the base 1.5 mpd earn rate).

DBS has previously clarified with me that only rental transactions made via CardUp will count towards the sign-up bonus.

For the avoidance of doubt, supplementary and principal cardholder spending will pool when calculating whether the minimum qualifying spend has been met.

If you’re just shy of hitting the sign-up bonus, some “stored value facilities” which will still count towards qualifying spend are:

- NTUC or Cold Storage vouchers

- Amazon, Lazada or Qoo10 gift cards

- Chope gift cards or vouchers (this has the added advantage of coding as restaurant spend for 4 mpd!)

- Hotel points or airline miles (check out the latest offers in the Weekly Deal Summary)

When will the miles be credited?

The 25,000 miles for paying the S$588.50 annual fee will be awarded immediately (in the form of 12,500 DBS points) when the annual fee is charged. This happens at the time of card approval.

The 15,000/35,000 miles for the sign-up bonus will be credited within 120-150 days from the date of fulfilling the qualifying spend (in the form of 7,500/17,500 DBS points).

DBS Points earned on the DBS Vantage expire in three years, and can be converted to any of the following frequent flyer programmes with a S$26.75 admin fee.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

How to maximise your sign-up bonus

The thing about sign-up bonuses on most general spending cards that they usually entail some form of opportunity cost.

For example, if a 1.2 mpd card offers 10,000 bonus miles for spending S$3,000, the “real bonus” is much less, to the extent that the S$3,000 could have been spent on a 4 mpd card.

But the beauty of the DBS Vantage is that it’s offering 4 mpd on dining and petrol till 31 December 2022, capped at S$2,000 per calendar month (the cap is shared between dining and petrol). Therefore, you can minimise the opportunity cost by concentrating as much spend on these two categories as possible.

For example, if you get approved on 30 July 2022, your 60-day qualifying spend period covers July, August, and part of September. Then split your S$8,000 spending like so:

- July 2022: S$2,000 on dining/petrol

- August 2022: S$2,000 on dining/petrol

- September 2022: S$2,000 on dining/petrol + S$2,000 on general spend in FCY (or do it in July/August, it really doesn’t matter)

| 💡 Alternative Option |

| if you’d rather apply later, then aim to get approved towards the end of August, so that your 60 day period can cover August, September and October. |

That would yield a total of 88,400 miles, split into:

- 25,000 miles from paying the S$588.50 annual fee

- 35,000 miles for meeting the S$8,000 minimum spend (assuming new customer)

- 24,000 miles from spending S$6,000 on dining/petrol

- 4,400 miles from spending S$2,000 in FCY

Of course, you need to weigh for yourself whether it’s worth paying the 3.25% FCY fee to clock overseas spending, but even if you did it all in SGD, your total haul as a new customer would be 87,000 miles– not all that different.

Conclusion

DBS Vantage DBS Vantage |

||

| Apply Here |

Is the DBS Vantage’s 60,000 miles sign-up bonus a good deal? It’s always hard to take up an offer when you know a better one just passed you by, but in the cold light of day, it’s still a good-sized bonus for a new-to-bank customer.

The key issue is spending S$8,000 in 60 days. I certainly wouldn’t condone spending for the sake of spending, but if you just so happen to have a big ticket expenditure coming up, this is something to consider.

Don’t forget to read my full review of the DBS Vantage Card, and apply by 31 January 2023 with the promo code VANMILES.

how about payment via PayPal? will that be excluded also?

For the 10 Priority Pass Visits, can I bring in 9 guests at 1 time and then it’s used up?

Yes

Even less attractive now

The actual physical card looks bad. Not full metal, but some sort of weird combination of metal and plastic! The Vantage logo makes card looks like being cut across. There is also this weird horizontal “cut line” from edge to the chip.

it looks very glossy, from the photos i’ve seen

Yup indeed the execution looks cheap.

Can use to pay IRAS with the DBS payment facility? I still have a big balance left because I’m on GIRO

Does this card has paywave function?

yes

Hi Aaron..

Do you know..? If dining overseas, 4mpd or 2.2mpd..?

Thanks!

Does giftano count toward sign up bonus?

Will current DBS cardholders get the 25k miles for paying annual fee?

Does this mean that cardup transactions of any kind are still eligible for those who sign up before 1 Oct?

My experience with hotel points purchase and minimum spend criteria: Was in 1st batch of applicants needing to hit 8K spend for miles bonus. Had clocked over 8k within 60 days but didn’t get the bonus points after more than 180 days, so called to check. DBS said hotel points purchases are not counted towards minimum 8K spend based on MCC. Hence, did not get the sign up bonus.

Of course, I did refer the staff to this blog but their decision stands.

So, may need to add a caveat on minimum spend section with regard to this.