It may surprise you to learn this, but DBS was actually a late entrant to the $120K segment. The DBS Vantage only launched in June 2022, and with rival cards having many more years to build up a customer base, it was always going to be playing catch-up.

And so it debuted with a generous 80,000 miles sign-up offer, plus a limited-time 4 mpd on dining and petrol. Together with perks like an Accor Plus Explorer membership and 10 lounge visits, it made for a compelling proposition.

But in the absence of a welcome bonus (as is currently the case), and if you’re renewing, the value is much more marginal. There are much better alternatives to consider— unless, perhaps, you’re able to meet the minimum spend for an annual fee waiver.

DBS Vantage Card DBS Vantage Card |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The DBS Vantage really boils down to two key questions: is there a good welcome offer, and you get an annual fee waiver after the first year? | |

| 👍 The good | 👎 The bad |

|

|

| Full List of Credit Card Reviews | |

Overview: DBS Vantage Card

Let’s start this review by looking at the key features of the DBS Vantage Card.

|

|||

| Apply | |||

| Income Req. | S$120,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$599.50 |

Min. Transfer |

5,000 DBS Points (10,000 miles) |

| Miles with Annual Fee |

25,000 | Transfer Partners |

4 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | 1.5 mpd | Points Pool? | Yes |

| FCY Earn | 2.2 mpd | Lounge Access? | Yes: 10x Priority Pass |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The DBS Vantage comes in metal cardstock, and weighs 10g. That makes it one of the lighter metal cards on the market, if that sort of thing is important to you.

Although it’s made of metal, the card still has contactless capability, made possible by the much-maligned slit near the chip on the front (which is actually an embedded antenna). Alternatively, you could add it to Apple, Google or Samsung Pay, and tap your phone to pay at contactless terminals.

How much must I earn to qualify for a DBS Vantage Card?

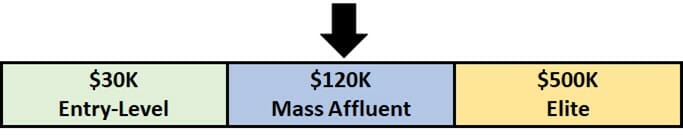

The DBS Vantage Card has a S$120,000 p.a. income requirement, and DBS enforces this very strictly.

How strict? For starters, you won’t even be able to see the DBS Vantage Card on the DBS/POSB card application portal if your income records with DBS reflect earnings of less than S$120,000. You’ll need to update your income records before you can apply.

Therefore, if you haven’t hit the magic S$120,000 figure yet, I wouldn’t be too optimistic about getting approved.

What welcome offers are available?

The DBS Vantage Card is not running a welcome offer at the time of writing.

However, DBS has historically offered 60,000 to 85,000 miles for new-to-bank customers, with a minimum spend of S$4,000 in 60 days. I expect a similar promotion to return soon.

With an 85,000 miles welcome offer, a new-to-bank customer would be paying just 0.71 cents per mile (S$599.50/85,000 miles), before even accounting for the rest of the benefits that Vantage has to offer. That’s very hard to turn down, and perhaps the bigger problem is the eligibility criteria (who doesn’t have a DBS card these days?).

On the other hand, existing DBS/POSB cardholders haven’t seen a welcome offer in quite some time, and it’s doubtful if one will ever return.

How much is the DBS Vantage Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$599.50 | Free |

| Subsequent | S$599.50 | Free |

The DBS Vantage Card has an annual fee of S$599.50 for the principal cardholder, and no fee for supplementary cards.

The first year’s annual fee must be paid, period. Subsequent years’ annual fees can be waived if cardholders spend at least S$60,000 per membership year.

The S$60,000 consists only of retail spend, i.e. anything that’s eligible to earn base rewards with the DBS Vantage. Refer to the section on exclusions below for more details on what does and doesn’t count.

Paying the annual fee gets you 25,000 miles, equivalent to buying miles at ~2.35 cents each. While that sounds much higher than what a mile should be worth, you can’t take that figure in isolation, since it’s necessary to factor in the other benefits of the card too.

| ❓ What do I get if I qualify for a fee waiver? |

| If you qualify for a fee waiver in subsequent years, you will not receive the 25,000 renewal miles. However, you will still receive all the other benefits, including a renewal of Accor Plus Explorer membership and 10 more Priority Pass visits. |

A “free” $120K card?

The DBS Vantage Card is one of only a handful of $120K cards to offer an annual fee waiver upon meeting a certain minimum spend (the other two being the OCBC VOYAGE and Maybank Visa Infinite). That has the potential to change the picture entirely.

The annual fee will be waived with a minimum spend of S$60,000, and let’s say for argument’s sake you spent the entire amount on CardUp with a 1.85% fee (the current promotion for recurring bill payments).

- The CardUp fee would be S$1,110 (S$60,000 x 1.85%)

- You would earn 91,665 miles (S$61,110 @ 1.5 mpd)

- Your DBS Vantage Card’s S$599.50 annual fee would be waived

So in that sense, you’re really paying S$1,110 for:

- 91,665 miles (remember: no renewal miles are awarded if the annual fee is waived)

- Accor Plus Explorer membership

- 10x lounge visits

- All the other DBS Vantage benefits (though frankly I can’t think of much else!)

If we use a value of 1.5 cents per mile, S$250 for an Accor Plus Explorer membership (it retails for S$418 in Singapore but you could buy it overseas for less), and S$33.50 per lounge visit (the value of F&B you can enjoy at restaurants at Changi Airport), then it all comes up to ~S$1,960.

We can argue about what the “proper” valuation of these benefits should be, but assuming you agree with my figures, then the DBS Vantage Card could be one of the more lucrative general spending cards on the market.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ⭐ Bonus Spending |

| 1.5 mpd | 2.2 mpd | N/A |

SGD/FCY Spending

DBS Vantage Card cardholders earn:

- 3.75 DBS Points for every S$5 spent in Singapore Dollars

- 5.5 DBS Points for every S$5 spent in foreign currency (FCY)

1 DBS Point is worth 2 miles, so that’s an equivalent earn rate of 1.5 mpd for local spending, and 2.2 mpd for FCY spending.

This makes the DBS Vantage among the highest-earning cards in the $120K segment, especially when you factor in its lack of minimum spend and rounding policy (which contrary to popular belief, does not award points in S$5 blocks- see below).

| 💳 Earn Rates for S$120K Cards (sorted by sum of local and FCY earn rate) |

||

| Card | Local | FCY |

StanChart Visa Infinite StanChart Visa Infinite |

1.4 mpd# | 3 mpd# |

Maybank Visa Infinite Maybank Visa Infinite |

1.2 mpd | 3.2 mpd@ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.4 mpd | 2.4 mpd |

DBS Vantage DBS Vantage |

1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE |

1.3 mpd | 2.2 mpd |

Citi Prestige Citi Prestige |

1.3 mpd^ | 2 mpd^ |

HSBC Visa Infinite HSBC Visa Infinite |

1 mpd | 2 mpd |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd | 0.69 mpd |

| #With minimum S$2K spend per statement month. Otherwise 1 mpd for both @With minimum S$4K spend per calendar month. Otherwise 2 mpd ^Additional 0.02 to 0.12 mpd awarded based on tenure with bank |

||

All FCY transactions are subject to a 3.25% fee, which on par with the rest of the market.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

With a 2.2 mpd earn rate and a 3.25% FCY fee, using your DBS Vantage Card overseas represents buying miles at 1.48 cents apiece. It’s not the worst possible rate out there, but there are many cards I’d sooner use for overseas spending than this one.

The DBS Vantage allows cardholders to switch between earning DBS Points or cashback, but I’m ignoring the latter because it values your miles at an poor 1 cent each. Seriously, there’s no need to ever dabble in that.

Bonus Spend

Unfortunately, the DBS Vantage Card has lacked a bonus earn category ever since the introductory 4 mpd rate for dining and petrol ended in December 2022. Since then, it’s only returned once, and even then on a limited-time basis for targeted cardholders.

Likewise, the 6 mpd bonus rate for Expedia flights and hotels ended on 31 March 2024 (along with the DBS Altitude), and has not been renewed.

When are DBS Points credited?

DBS Points will be credited when your transaction posts, which generally takes 1-3 working days.

How are DBS Points calculated?

Some people get concerned when they read that DBS Points are awarded in S$5 blocks. That’s understandable, given how Maybank, OCBC and UOB’s S$5 earning blocks result in lost miles from rounding, especially for smaller transactions (spend S$4.99? No points for you!).

The good news is that DBS’s calculations aren’t nearly as punitive. Here’s how you can work out the DBS Points earned on your DBS Vantage Card.

| Local Spend | Divide transaction by 5 and multiply by 3.75. Round down to the nearest whole number |

| FCY Spend |

Divide transaction by 5 and multiply by 5.5. Round down to the nearest whole number |

Notice how the transaction is not rounded down to the nearest S$5; instead, it’s divided by 5 straight away. This means the minimum spend to earn points is:

- S$1.34, if spending in SGD

- S$0.91, if spending in FCY

If you’re an Excel geek, here’s the formulas you need to calculate:

| Local Spend | =ROUNDDOWN ((X/5)*3.75,0) |

| FCY Spend |

=ROUNDDOWN ((X/5)*5.5,0) |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for DBS Points?

A full list of transactions that do not earn DBS Points can be found at point 2.6 of the T&Cs.

I’ve highlighted a few noteworthy categories below:

- Amaze transactions (not that you could pair the DBS Vantage with Amaze anyway, since it’s a Visa card)

- Charitable donations

- Education

- Government services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages)

- Hospitals

- Insurance

- Top-ups of prepaid accounts e.g. GrabPay and YouTrip

- Utilities bills

CardUp transactions are eligible to earn DBS Points. However, they do not count towards the minimum spend required for welcome offers, unless they are rental transactions coding under MCC 6513. For more on this confusing distinction, refer to this post.

What do I need to know about DBS Points?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 3 years | Yes | S$27.25 per conversion |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| 5,000 DBS Points (10,000 miles) |

4 | 1-3 working days |

Expiry

DBS Points earned on the DBS Vantage Card expire in three years.

This is rather disappointing, since DBS Points earned on the entry-level DBS Altitude Card never expire. All the same, I personally don’t consider non-expiring points to be that big a factor in deciding whether or not I get a card, since you get an additional three years validity once they’re on the KrisFlyer side.

Pooling

DBS Points pool across cards for the purposes of redemption. If you have 10,000 DBS Points on the DBS Vantage Card and 5,000 DBS Points on the DBS Woman’s World Card, you can redeem 15,000 DBS Points at one shot and pay a single conversion fee.

However, DBS Points are not pooled when it comes to card cancellations. If I have a DBS Vantage Card and DBS Woman’s World Card and decide to cancel the former, I’ll need to transfer my points out before cancelling or forfeit them.

Partners and Transfer Fee

DBS partners with the following frequent flyer programmes, and a minimum conversion block of 10,000 miles is required (it’s better to ignore AirAsia, because converting points there is like throwing them away).

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 500: 1,500 |

Transfers cost S$27.25 each, regardless of how many points are transferred.

Do note that the DBS Vantage, surprisingly, is not eligible for DBS’s “auto conversion programme” (I initially thought it was an oversight, but DBS’s comms team has told me that’s how it should be).

The auto conversion programme, for the uninitiated, charges a flat fee of S$43.60 per membership year, and automatically converts DBS Points to KrisFlyer miles each calendar quarter in blocks of 500 points. It is currently available to DBS Insignia, DBS Black Treasures Elite, and DBS Altitude cardholders.

Transfer Times

DBS quotes a points conversion time of 1-2 weeks, but in reality it usually takes about 1-3 working days at the very most for KrisFlyer (transfer times to other programmes may be longer).

If you need your points credited instantly, you can do so via Kris+. 100 DBS Points can be instantly transferred to 170 KrisPay miles, which can then be converted to KrisFlyer miles at a 1:1 ratio with no fees.

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

However, those 100 DBS Points would normally have earned you 200 KrisFlyer miles, so you effectively take a 15% haircut. Therefore I wouldn’t recommend taking this option, unless you need a small top-up to redeem a flight, or have an orphan DBS Points balance (<5,000 points).

If you choose to do so nonetheless, do remember that it’s a two-step process:

- Transfer DBS Points to KrisPay miles

- Transfer KrisPay miles to KrisFlyer miles

Do not forget the second step! If you wait more than 21 days, or spend any of the converted KrisPay miles via Kris+, the entire balance will be stuck in the Kris+ app. KrisPay miles expire after six months, and can only be spent at a poor ratio of 150 miles = S$1.

Other card perks

10 Priority Pass visits

Principal DBS Vantage Cardholders are entitled to 10 Priority Pass visits per membership year, which can be shared with guests. For example, the cardholder could bring his wife and use two visits, or could bring three family members and use four visits.

Once free visits are fully utilised, cardholders will be charged US$35 per additional visit.

10 passes may be more than sufficient for the casual traveller who doesn’t have kids, but otherwise you might want to consider a $120K card with unlimited lounge access. Sadly, this is becoming something of a rarity, with the Citi Prestige removing unlimited lounge visits, and the UOB Visa Infinite Metal Card planning to do so in June 2026.

| 💳 Airport Lounge Benefits (Income Req.: S$120K) |

|||

| Card | Lounge Network | Free Visits (Per Year) |

|

| Main | Supp. | ||

HSBC Visa Infinite HSBC Visa Infinite |

LoungeKey | ∞ | ∞ Up to 5 supp. cards |

OCBC VOYAGE Card OCBC VOYAGE Card |

Dragon Pass No Restaurants |

∞ | 2 |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

Dragon Pass | ∞ + 1 guest* | N/A |

Citi Prestige Card Citi Prestige Card |

Priority Pass | 12 Share |

N/A |

DBS Vantage Card DBS Vantage Card |

Priority Pass | 10 Share |

N/A |

StanChart Visa Infinite StanChart Visa Infinite |

Priority Pass | 6 Share |

N/A |

Maybank Visa Infinite Maybank Visa Infinite |

Priority Pass | 4 | N/A |

AMEX Platinum Reserve AMEX Platinum Reserve |

N/A | N/A | N/A |

| *Will be reduced to 12 visits per calendar year from 1 June 2026 |

|||

Accor Plus Explorer membership

Principal DBS Vantage Cardholders receive a complimentary Accor Plus Explorer membership with one complimentary hotel night each year. This membership will be automatically renewed each year you retain the card.

This normally retails for S$418 (though it can be bought for far less if you purchase a membership from another country), and includes benefits such as:

- Up to 50% off dining at participating Accor hotels across Asia Pacific

- 15% off drinks bill in Asia

- 10% off the best available public rate

- Access to Red Hot Room sales with up to 50% off

- 20 status nights per year

The free hotel night can be redeemed at participating Accor properties across the Asia Pacific region, including the Sofitel Singapore Sentosa Resort & Spa, Mondrian Seoul Itaewon, and Sofitel Darling Harbour Sydney.

The other big draw of an Accor Plus membership are the dining discounts, which are structured as follows:

- 25% off dining: 1 member only

- 50% off dining: 1 member and 1 guest

- 33% off dining: 1 member and 2 guests

- 25% off dining: 1 member and 3 guests

- 15% off drinks in Asia

Some examples of participating Accor Plus restaurants in Singapore include Prego, Mikuni and Asian Market Café at the Fairmont, SKAI, The Stamford Brasserie, and CLOVE at Swissotel and The Cliff and Kwee Zeen at the Sofitel Sentosa Resort.

Generic Visa Infinite benefits

DBS Vantage Cardholders enjoy the following additional perks, provided by Visa.

| 🏨 Hotel Elite Status | |

| 🚗 Rental Car Elite Status | |

| 👍Other Perks |

For more information on how these perks work, refer to the post below.

Summary Review: DBS Vantage Card

DBS Vantage Card DBS Vantage CardApply |

|

| 🦁 MileLion Verdict | |

| ☐ Take It ☑Take It Or Leave It ☐ Leave It |

If you’re thinking of getting the DBS Vantage Card, the ideal strategy would be to:

- Wait for an upsized welcome offer — ideally 85,000 miles for new-to-bank customers

- Clock S$60,000 spend per year to avoid having to pay the 2nd and subsequent years’ annual fees

Otherwise, you’re essentially paying S$599.50 for an Accor Plus Explorer membership, 10 lounge visits and 25,000 miles, which feels marginal to me.

There will be some opportunity cost involved, to the extent that spending could have been made with higher-earning cards, but most people will do this through a bill payment platform like CardUp, for which the Vantage is already one of the best options.

Ironically, the Vantage has arguably become more appealing not because of improvements, but because competitors like the Citi Prestige and UOB Visa Infinite Metal Card have cut lounge access and/or hiked annual fees. That’s not exactly a ringing endorsement, I know, but if you wanted a really premium card, the $120K segment might not be the right place to look anymore.

So that’s my review of the DBS Vantage Card. What do you think?

Can the Priority Pass allowances all be used in one go? Might come in handy at the PP restaurants/bars in places like SYD or MEL where a normal PP+Guest allowance ends at $72 (or zero for AmEx PP). Even handier if they did takeaway bottles…

Rule: 1 boarding pass = 1 PP swipe. the places which offer dining credit will follow this rule strictly, it’s part of the PP audit process. if you have 2 bp you can use 2 pp swipes etc.

PP T&C are not very clear when it comes to guests: they kind of say that it’s a lounge-based approach but then I could not spot the guest logo for the lounges I’ve looked up on PP website. Do you have more clarity on that, as in, 1 guest is always 1 additional swipe and, as long as I have not exhausted my credit card-sponsored PP allowance, I am good to go?

Hi Aaron

Thanks a lot for this, very helpful as always! Just to check on the below statement under “SGD/FCY Spending“, should it be “1 DBS point is worth 2 miles…” instead?

“5 DBS points are worth 2 miles, so that’s an equivalent earn rate of 1.5 mpd for local spending, and 2.2 mpd for FCY spending.”

fixed that, thanks.

Having just used the Citi Payall for my tax and also paid the annual fee, I’m struggling to see a reason to get this card as well.

That’s your problem, to me this card has little to do with annual fee/tax. So try better next time

Updated my income records (~100k) when applying for Woman’s World recently, was able to see the Vantage Card in the portal and received instant approval…so just a data point for reference.

hi aaron, do you know if the yearly renewal comes with the accor plus membership too?

the answer is in the article

Already spent all my AF budget on AMEX Plat Charge lol

Do u think it makes sense to apply for AMEX Plat Charge just for benefits (And fringe usage like card of last resort for hospitals etc, 10x accelerator purchases). And use DBS Vantage for everything else.

Not the most efficient of course but lazy to track across too many cards.

Anyone knows if DBS tax facility qualifies for the 8K? Not direct to IRAS.

Got a similar query too. The expenses exclusion applies for DBS points that’s something we all established.

But how about the $8k spending for the bonus miles. Can this be in any category?

Meaning to say, lets ignore the fact that it’s not economical miles wise to do so, but can you just spend $8k on hospital bills, don’t get the DBS points but meet the spending requirement for the bonus miles?

Hi, can I n ow of the Accor free night is only available for Asia hotel? Can I use it in Europe?

Asia is where you can find the most free hotel stays. No free night in the US just for reference. Europe might be similar too

By the way what’s the mpd of this card?

literally the first few things mentioned at the top of the article

lol

Looks like this is a close fight with OCBC Voyage. Could you please share just between Vantage vs Voyage which one is better? TIA

Vantage is better, cos DBS is sponsoring these…

Understand insurance doesnt earn miles but can it qualify for the 8k spending for bonus miles?

Got the card. Got my Accor Plus membership. It’s impossible to find any availability for the free 1 night (Accor Plus Stay Plus) anywhere. If you thought SQ Saver miles redemption is difficult, this looks like 10x more difficult. Strange why they make it so difficult as they charge 420 SGD for this.

agree, and actually can get a free room lower than $100, price above this either it is not available or you need to compensate

used this in Bangkok within the last 2 years, and was able to get 1 free night stay easily

Is the VTMILES code still applicable if I’ve submitted the income update earlier?

Think I have found the answer in TnC on 8 July 2022 10am. Weird that bank doesn’t proceed my income update request but adjusted based on my credit limit review request. I updated my income to apply for the DBS Vantage Card. However, I have missed the Up to 80,000 Miles Sign-Up Promotion. Do I have to call in for an extension? The promotion will be automatically extended to you if you have updated your income between 23 June to 27 June 2022 to apply for the DBS Vantage Card. You need not contact us to register. This promotion extension… Read more »

I applied under the original offer for 80k miles which stated I had to be approved by July 11th. I was only approved today. Do you know if I’m still eligible?

Can confirm that it is shown on ibanking for 100k-ish annual income as well. Instant approval.

Understand Cardup (non rent) is being confirmed with DBS whether it will be considered as part of the 8k spending. What about rent via Cardup? Also ipaymy.com?

Hi Aaron, Since DBS Altitude has a auto conversion annual programme for flat fee and since vantage card points pools, does it mean the miles we earn on vantage card will auto convert to KF if we are on the Altitude auto conversion programme?

Will miles be accumulated if I use the DBS Vantage Card to make a payment through the Kris+ app? I see that only Amaze transactions have been excluded?

I’ve made some payments with Kris+ and they earned DBS points.

So just want to check, for the promo on the spending of 8K in 60 days part, does it to have to be the type that qualifies for points? Or can I literally just charge to my grabwallet and transfer back?

Could I check if you have the exclusions for the signup bonus before 1 Oct?

I met the criteria in Aug, and the customer services said it takes 120-150 days for miles to be credited. This is part of the terms and conditions. Just wondering, did anyone receive the Vanmiles reward miles or is everyone still waiting?

Same question as Gina, anyone received their miles yet?

Any idea if they are still going to give 4mpd on dining and petrol in 2023?

We will find out tomorrow!

It’s been removed from website.. Sad

Sad; Won’t be using the card much now.

Hi All,

I had spoken to DBS CSO, and it seems that Cardup payments are excluded from the $8K minimum spend in the first 2 months.

I thought this was mentioned before that Cardup was included and i also cant find any exclusion in the terms as well.

Is anyone facing the same issue or gotten your Cardup transactions included as part of the minimum spend?

Thanks.

cardup payments for rent are included in min spend, per my discussions with dbs. other cardup is not included for sign up bonus spend, but will still earn regular points

Thanks Aaron for the clarification.

Jumping on this thread to clarify, if Government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages) are not eligible for DBS Points does paying our IRAS Income Tax with the DBS Vantage card thru Cardup make any difference, ie earn 1.5mpd on our income tax payments?

you will earn 1.5 mpd on tax payments via cardup

Can this be used to earn 1.5mpd with simplygo?

The app supporting the card is hopeless. No visibility on points earned, cannot administer and no accrual of spending until the end of the statement period. Literally have to subtract the balance from your limit to figure out spending. Aministering the card and points in my view are key to a product that costs this much

Hi Aaron, thank you for your detailed analysis. Enjoyed it 🙂

Will it be fair to say that aside from the elite ($500k) cards, Vantage is next best to rake up miles with Cardup, given 1.5 MPD and no limit placed on its miles earnings, esp with income tax and mortgages as the target items?

Hello Aaron! I read on DBS Vantage’s T&Cs that “payments made to CardUp, FavePay, iPaymy and SmoovPay are also subject to the exclusions listed in Clauses 11 (a) to 11 (n) above”. Does this mean that we can’t use DBS Vantage for 1.5 mpd for our insurance payments through CardUp anymore?

you will still earn base miles. however, such trxns will not count towards min spend for sign up bonuses

I think this card is way underrated. Frankly if you don’t have petrol spending, and this is your main CC so that you are spending more than 60k/year (can be achieved quickly if you pay Rent/Tax with third party service like Rent hero/CardUp) and all big expenses for your family, then I don’t see a better card. You basically don’t pay annual fees, having the highest mpd rate (excluding UOB lady’s card of course) and if you don’t travel more than 4/5 times per year you can have enough lounge access… The Accor package allows you to have a complementary… Read more »

Do you work for DBS? You used Accor free night in a $500 worth room? I’d say that’s a lie. I’ve been using this card for 3 years and I have never seen any free room more than $150 value. Most of the rooms are only available on weekdays only. And pay rent with carup or rent hero? Let’s use rent hero, the lower 1.7% fee among two, for example. Only if u pay 2000sgd per month, the fee is 408 sgd per annum. Equivalent to you annual card fee.. so how is this underrated???

Using your numbers of monthly rental, 2k*12+408 = $24408 spending gives you 36612 miles. Even at a very conservative 1.1cpm cost, that breaks even with the $408 of cardup fees already.

This card is also definitely a no Brain for me, just like the prestige as well. More than happy to pay $599 here and $545 there each year.

Just book 1 hotel in Hong Kong worth $300+ per night for 2

Suggest to rewrite tbis to emphasize earlier the different and friendlier rounding policy compared to DBS Woman’s World. I did not understand tbe rounding policy in the preceding version of this article.

Also, CardUp is underemphasized here. If you are paying income tax on $300,000 annual income via CardUp or you are paying income tax plus rent via CardUp, a high earner can readily get a fee waiver with a lower cost per mile.

Hi What do you mean by “get a fee waiver with a lower cost per mile”? I thought the article states that fee waiver with 60k spend means no renewal miles? Essentially the fee waiver route just gets the Accor Plus (10 lounge visits are not very useful if I have other PP-unlimited cards) right?

I have cut it up after a year. The annual fee simply isn’t worth it.

can check for subsequent years does spending 60k on cardup and ipaymy considered as fee waived or must it be only use on retail spend?

i know for a fact it does for cardup, so i’ll assume it does on ipaymy too. I’ve not paid annual fee since the first year i paid when it launched. these days i use it almost exclusively for cardup. no 25k bonus miles, but i still get my annual 10x priority pass and accor plus renewed(including the 1 night free)

I think for those who are looking to apply this card should be advised that Accor Plus Explorer membership for the free hotel stay are only worth like $100+ as most availability are for Ibis hotel… Premium hotel such as fairmount/sofitel & etc are NOT available 98% of the time. Even when theres available date, it would be on a weekday. rarely a friday pop out with additional charge YOU HAVE TO PAY (*Research basis in SG only)

Do you know if miles points will be awarded for using Cardup together with DBS Vantage Card for IRAS income tax and property tax payment ?