| The following is a sponsored post by HSBC Singapore. The opinions remain those of The MileLion. |

Back in September 2020, I wrote about the impact that COVID-19 was having on the miles vs cashback equation.

At the time, six months had passed since the MOH issued an advisory against all overseas travel. Singapore’s borders were shut. We’d gone through an unprecedented two-month circuit breaker, airlines were on life support, and a vaccine was nowhere in sight. There was no knowing when we’d set foot on a plane again, much less go on a holiday.

Now here we are, two years later. Singapore has reopened its borders to both vaccinated and unvaccinated travellers, and most countries have scrapped pre-departure testing and quarantine. Vaccinations are giving travellers the confidence to venture out again, and Singapore Airlines’ load factors on flights to Europe and the USA are even higher than pre-COVID. So while it might be tempting hubris to say that we’re out of the woods, the environment is certainly a lot more favourable towards earning miles.

Or is it? Travel may have resumed, but with inflation running rampant and a possible recession on the cards, many people have decided that belt-tightening is in order. Cashback cards help take a bite out of day-to-day expenses, and what good is a vacation in Paris if the utilities bill is overdue?

So in that spirit, I thought it’d be a good time to revisit the miles versus cashback debate, and share some thoughts on which would be the more suitable option, depending on your circumstances.

Revisiting miles vs cashback

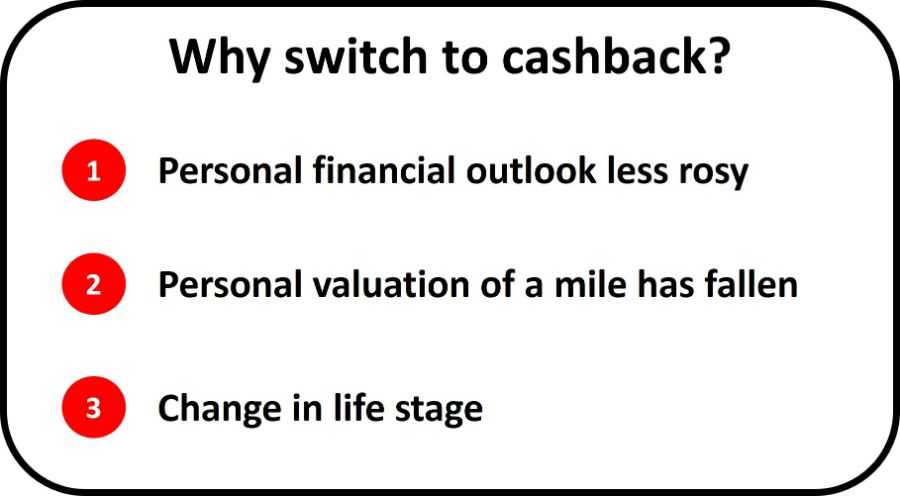

In my previous analysis of the topic, I mentioned three scenarios where someone might consider switching from miles to cashback.

- Personal financial situation has deteriorated and saving on day-to-day expenses is now the priority

- Personal valuation of a mile has fallen below cashback threshold

- Indefinite suspension of international travel makes miles strategy payoff timeline too uncertain

While the reopening of borders and resumption of quarantine-free travel has all but eliminated (3), (1) and (2) remain just as relevant as before. In fact, now that I think about it, there’s another factor I didn’t consider previously: a change in life stage.

Let’s look at each of these in turn.

Personal financial outlook less rosy

With inflation spiking around the world and central banks reigning in pandemic-era cheap money, everything’s getting more expensive. Whether it’s your mortgage, electricity bill, weekly supermarket run or a date night on the town, you’re bound to feel the pinch in some way or another. Couple that with the looming spectre of a recession, and no one would blame you for deciding that now might be a good time to tighten the purse strings.

A switch to cashback cards would go a long way towards shoring up the bank account, and as much as I love miles, I’ll be the first to acknowledge they’re often a gateway to additional spending- you don’t fly to New York City just to sit in the hotel room, do you?

So if your analysis of your current financial situation concludes that belt tightening is required, then a cashback card would be a much more appropriate tool. Put it this way: a miles card saves you money on future discretionary spending; a cashback card is a here-and-now discount on everything.

Cutting back on discretionary spending and keeping a balanced budget may not get as many likes as a champagne photo with runway lights bokeh in the background, but trust me: fiscal prudence never goes out of style.

Personal valuation of a mile has fallen

The recent travel chaos in Australia and Europe is a stark reminder that for all the doom and gloom of 2020 and 2021, the aviation industry has come roaring back.

Full airplanes are good for airlines; less so for mileage junkies. As load factors increase, so does the opportunity cost of offering a seat for redemption. That means fewer award seats and even devaluations, both of which can lower your personal valuation of a mile.

After the recent KrisFlyer award chart devaluation, I reduced my valuation of a mile from 1.8 cents to 1.5 cents. Of course, that’s not enough to tip the balance in favour of cashback, particularly because I’m averaging close to 4 mpd on all my spending, but someone with a lower valuation and lower average mpd might need to re-examine their figures.

| If you earn this on your miles card… | Switch to 1.7% cashback if your value of a mile falls below… |

| 1.1 mpd | 1.55 |

| 1.2 mpd | 1.42 |

| 1.3 mpd | 1.31 |

| 1.4 mpd | 1.21 |

| mpd= miles per dollar | |

For example, if you’re putting all your spend on a 1.2 mpd card and you value a mile at less than 1.42 cents each, you’d be better off switching to a card earning 1.7% cashback.

Regardless of where you fall on the valuation spectrum, it’s good housekeeping to periodically review your value of a mile based on typical redemption patterns (destination, cabin, award type) and acquisition cost (assuming you purchase miles through bill payment services or annual fees). Your valuation should reflect what you’re actually able to get when redeeming miles, not what you hope to!

Change in life stage

Switching to cashback could also make sense if you’re entering a different life stage that rules out travel for a period, like having a kid. I know some intrepid couples who think nothing of lugging a cranky 6-month old on a transpacific flight, but I think even I’d take some time off when my turn comes.

Since the entire ethos of the miles game pivots around earn and burn, if you’re not able to burn on a regular basis then a temporary switch to cashback might be prudent. The last thing you want is to be staring down a devaluation when you don’t have the flexibility to hop on a plane and burn your stash.

So tl;dr:

- if your financial outlook has shifted such that conserving cash is a priority

- if your personal valuation of a mile has fallen below the cashback threshold

- if your current life stage involves less travel

then there’s no shame in switching to cashback. Remember: whatever switch you make doesn’t have to be permanent. You can always come back to miles when the situation is more favourable.

Overview: HSBC Advance Credit Card

So assuming you’re planning to switch to cashback, here’s how the HSBC Advance Credit Card can fit into your strategy.

Apply Here Apply Here |

|||

| Income Req. | S$30,000 p.a. | Spend ≤S$2K | 1.5% cashback |

| Annual Fee (Including GST) |

S$192.60 (first year free) |

Spend >S$2K | 2.5% cashback |

| Supp. Cards | Up to five free for life | Cashback Cap | S$70 per calendar month |

| HSBC Advance Credit Card Terms & Conditions | |||

The HSBC Advance Credit Card has a minimum income requirement of S$30,000 p.a., and an annual fee of S$192.60, waived for the first year. Subsequent years’ annual fees can be waived with a minimum annual spend of S$12,500.

HSBC Advance credit cardholders will earn:

- 1.5% cashback on all local and overseas transactions, with no minimum spend

- 2.5% cashback on all local and overseas transactions, when you spend above S$2,000 per calendar month

For avoidance of doubt, the 2.5% rate will apply to all spending, not just incremental spend above S$2,000.

The maximum cashback that can be earned each calendar month is S$70 (additional cashback can be earned through HSBC Everyday+; see below). Cashback will be credited to your HSBC Advance Credit Card account by the last day of the following calendar month.

Extra 1% cashback with HSBC Everyday+

|

| T&Cs apply. SGD deposits are insured by up to S$75K by SDIC |

HSBC Advance credit cardholders who hold an HSBC Everyday Global Account (EGA) and qualify for HSBC Everyday+ can earn an additional 1% cashback (T&Cs apply) on all card spending, on top of the regular earn rate of 1.5% or 2.5% cashback.

To qualify for HSBC Everyday+, they must perform at least five eligible transactions with any HSBC credit card and/or fund transfers from an HSBC EGA to a non-HSBC account each calendar month, and deposit the following fresh funds into an HSBC EGA each month:

- HSBC Personal Banking: At least S$2,000/month

- HSBC Jade and Premier: At least S$5,000/month

The bonus 1% cashback is capped at S$300 per month for HSBC Personal Banking, and S$500 per month for HSBC Jade and Premier customers.

For example, an HSBC Advance credit cardholder who spends S$2,500 a month and meets the HSBC Everyday+ qualifying criteria will receive a total of S$87.50 cashback, split into:

- S$62.50 cashback from the HSBC Advance Credit Card (2.5% of S$2,500)

- S$25 cashback from the HSBC Everyday+ (1% of S$2,500)

ENTERTAINER with HSBC app

All principal HSBC credit cardholders receive complimentary access to the ENTERTAINER with HSBC app, which packs more than 1,000 1-for-1 offers for dining, takeaway, entertainment, travel and wellness.

This includes restaurants and cafes like The Coffee Academics, Paul Bakery and Hoshino Coffee, quick bites/drinks from Dunkin Donuts, Cat & the Fiddle, Spinelli Coffee, and 1-for-1 stays at more than 175 hotels worldwide.

HSBC Advance Credit Card sign-up offer

|

| Apply Here |

From now till 7 December 2022, new-to-bank cardholders who sign up for an HSBC Advance Credit Card will have a choice of the following gifts:

| New-to-bank cardholder | Existing cardholder |

|

|

| ❓ Definitions |

|

New-to-bank cardholders: Do not hold any HSBC principal credit cards (except HSBC Visa Infinite), and did not cancel an HSBC principal credit card (except HSBC Visa Infinite) within the last 12 months Existing cardholders: Existing HSBC principal credit card (except HSBC Visa Infinite) must be issued more than 12 months earlier, and did not cancel any HSBC credit card (except HSBC Visa Infinite) within the last 12 months |

Both new and existing customers must spend at least S$500 by the end of the month following approval, as shown in the table below.

| Card Account Opening | Qualifying Spend Period | Notification Date |

| 1-30 Sep 2022 | 1 Sep to 31 Oct 2022 | By 30 Nov 2022 |

| 1-31 Oct 2022 | 1 Oct to 30 Nov 2022 | By 31 Dec 2022 |

| 1-30 Nov 2022 | 1 Nov to 31 Dec 2022 | By 31 Jan 2022 |

| 1-31 Dec 2022 | 1 Dec 2022 to 31 Jan 2023 | By 28 Feb 2023 |

In other words, it’s best to apply for the card as early in the month as possible, so as to give yourself up to two months to meet the minimum spend.

HSBC credit cardholders must also provide consent to receive marketing and promotional materials from HSBC at the time of application, and have not revoked it at the time of gift fulfilment.

The T&Cs of this offer can be found here.

Exclusions

The following transactions will not count towards the minimum spend for the sign-up gifts, or the HSBC Advance Credit Card cashback programme:

- CardUp and ipaymy

- Charitable donations

- Educational institutions

- Governmental organisations

- Insurance premiums

- Utility bills

The full list of exclusions can be found in the T&Cs, at point 4.

Conclusion

|

| Apply Here |

If you’ve decided that cashback makes more sense at this stage of your life, whether it be due to financial situation, a lower miles valuation, or a temporary halt on travel, then the HSBC Advance Credit Card offers one of the highest earning rates on the market- especially if you can meet the S$2,000 minimum spend and/or hold an HSBC Everyday Global Account.

Don’t forget to apply by 7 December 2022 to enjoy the sign-up offers.

Tbh, Revolution card, even if you earn the points to burn as cashback, is not a bad card. 10X points is 2.5% cashback if used to offset your expenses.

It’s by far an easy-to-use card that satisfies daily needs (eg. grocery, restaurant, transportation, shopping, retails, online payment). With 10X capped at S$1K, it will be a good tool to control spending.

A very versatile card for mile/cash back

Suggested strategy:

cash rebate: 1% (EGA account) + 2.5% (oneligible spending) = 3.5% cash back

mile card: 4mpd (on eligible category)

how does 10X points equate to 2.5% cashback?

Cashback options are still very meh. Honestly even if you can get 1k cashback per year that doesn’t move the needle much for cash conservation.

Already balls deep in the miles game. Miles all the way!

It amazes me how, in these days of belt-tightening, banks still impose minimum spend requirements to enjoy cashback. Spend more, just to earn a bit more? Apply for the UOB Absolute Amex Card which gives 1.7% flat. Best no-minimum-spend rate.

It is simple. I hope that once in a while Citibank will offer miles at $8/1000 (or even $10). While that continues to occur, the best option, unless you have a way of getting 4mpd is to use the UOB Absolute cash back of 1.7% – then use that cash to buy miles when the Citi offer comes along.

As a parent with young kids, there are a few options on spending your KF miles and they don’t have to be on airfare. We’ve used miles to book staycations, via krisflyervrooms.

I’d love to read an article on how you achieve an average of 4 mpd!

not hard actually!

https://milelion.com/2022/09/09/the-milelions-2022-credit-card-strategy/

This could not be easier. There are enough 4 mpd cards to cover everything from groceries, online shopping, dining, forex spend etc… Anyone who doesn’t average close to 4 mpd might as well stick with cashback. Lol.

Thanks for the write up Aaron. Didn’t know about the $70 a month CB cap.

But I like this card. No minimum spend to earn the CB rates, fewer restrictions than miles card on what can earn CB. Good to have card.

> Switching to cashback could also make sense if you’re entering a different life stage that rules out travel for a period, like having a kid. I know some intrepid couples who think nothing of lugging a cranky 6-month old on a transpacific flight, but I think even I’d take some time off when my turn comes. Actually, I think it would be great if you could still write about all the tips for travelling with a cub (whenever that is). The value of a mile might actually ***increase*** for some when they’re travelling with an infant or toddler because… Read more »

ha! I suppose at some point in time the content will need to pivot in that direction…