Citibank has launched a new targeted offer for Citi PremierMiles and Citi Rewards Cardholders, who can earn a 3.25% cash rebate on all foreign currency (FCY) spend till 31 January 2023.

A minimum FCY spend of S$5,000 is required, and a spending cap of S$8,000 applies.

This basically offsets the standard FCY transaction fee, and could be lucrative promotion for those who can meet the minimum spend- even if you already have an Amaze.

Earn 3.25% rebate on FCY spend with Citi cards

From 23 November 2022 to 31 January 2023, targeted Citi cardholders who register for this offer will receive a 3.25% cash rebate when they spend at least S$5,000 in FCY during the promotion period.

The 3.25% cash rebate is capped at S$260, which means you’ll max it out with a total FCY spend of S$8,000.

This offer is valid for the following cards:

- Citi Cash Back Card

- Citi Cash Back+ Card

- Citi PremierMiles Card

- Citi Rewards Card

| ⚠️ It won’t work for Amaze |

| Amaze converts all FCY transactions into SGD, so you will not earn the rebate on Amaze transactions charged to the Citi Rewards Card. |

For avoidance of doubt, the S$5,000 minimum spend can be combined across different cards. Citibank provides an illustration:

| 💳 Illustration 1: Cap Triggered |

||

| Card | Qualifying Spend | 3.25% rebate |

| Citi PremierMiles Card | S$1,000 | S$32.50 |

| Citi Rewards Card | S$2,600 | S$84.50 |

| Citi Cash Back+ Card | S$4,800 | S$156 |

| S$8,400 | S$260* | |

| *The cap is triggered as qualifying spend exceeds S$8,000 | ||

When will the cash rebate be credited?

Eligible cardholders who have fulfilled the qualifying criteria will receive their 3.25% cash rebate by 30 April 2023.

If you have spent across multiple cards, the entire cash rebate will be credited to the card with the highest FCY spend amount.

Do note that Citibank generally doesn’t have a good track record of keeping to its fulfilment timelines, so it’s possible you’ll be waiting longer than this.

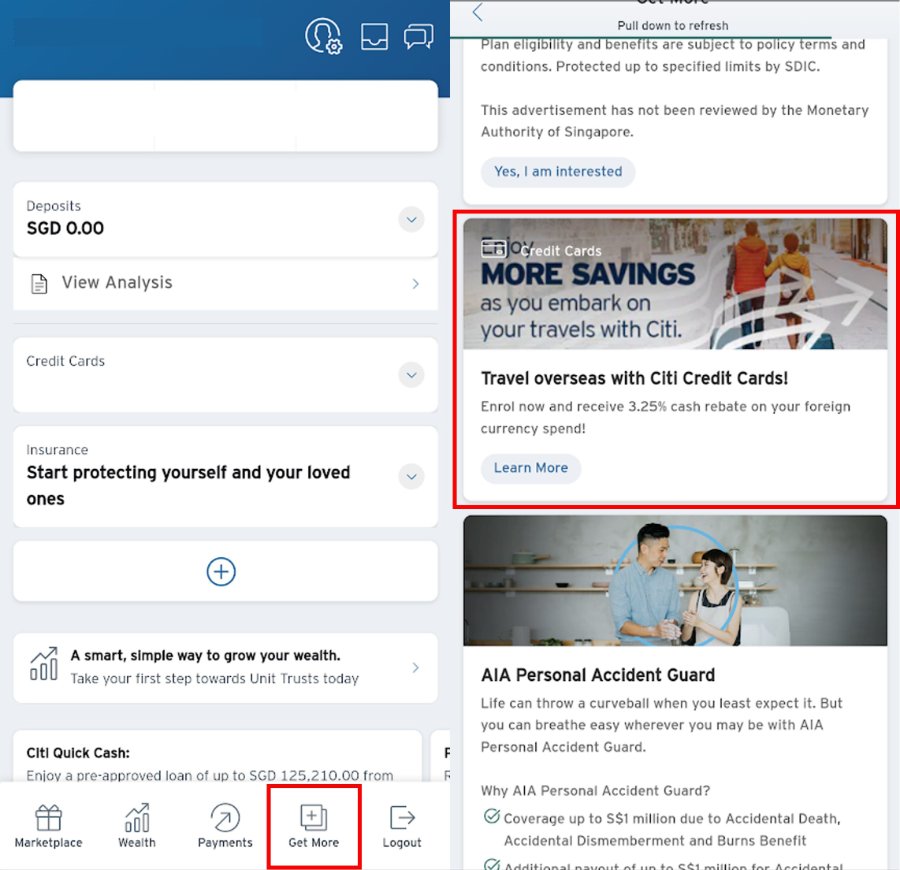

Registering for this offer

This offer is targeted, and requires registration. To see if you’re eligible, login to the Citi Mobile App and tap on “Get More” at the bottom. Scroll down and you’ll see the following banner.

Tap on the banner and complete your registration. You’ll receive a push notification confirmation.

Terms & Conditions

The T&Cs for the FCY spend promotion can be found here.

Do note that the standard rewards exclusions are featured, so there’ll be no points awarded for transactions like education, government institutions, insurance, charitable donations and prepaid top-ups, regardless of what currency they’re charged in.

Is the offer worth it?

As a reminder, here’s how much it normally costs to use your Citi PremierMiles and Citi Rewards Card overseas, based on the regular FCY earn rate and fee.

| FCY Earn Rate | FCY Fee | CPM | |

Citi PremierMiles Citi PremierMiles |

2.0 | 3.25% | 1.63 |

Citi Rewards Citi Rewards |

4.0* | 3.25% | 0.81 |

| *On online transactions (except travel) and offline shopping transactions only, otherwise 0.4 mpd | |||

For example, you earn 2 mpd on all FCY spend on the Citi PremierMiles Card with a 3.25% fee, so you’re basically paying 1.63 cents per mile (ignoring the spread charged by Mastercard/Visa, which tends to be ~0.3%).

The question the is whether you should continue using the Amaze with your Citi cards overseas, or just use the Citi card directly.

If you have a Citi PremierMiles Card, you’re choosing between:

- Use Amaze: 1.2 mpd with Amaze spreads, no min. spend or cap

- Use card direct: 2 mpd with a 3.25% rebate, min. spend S$5,000 and a cap of S$8,000

If I knew I could hit the minimum spend, I’d lean towards using the card directly in order to enjoy the higher earn rate. Remember, Amaze converts all transactions into SGD, so you only enjoy the local 1.2 mpd earn rate when you pair it with the Citi PremierMiles Card.

If you have a Citi Rewards Card, the situation is slightly more complicated. First, we need to remember that only certain transactions qualify for 4 mpd when using the card directly.

Second, the cash rebate promotion runs till 31 January 2023, which means you have at best three statement periods to hit S$5,000 spend. This implies a minimum spend of S$1,667 per period, which means at least S$667 of your spend will earn a measly 0.4 mpd (since 4 mpd is capped at S$1,000 per statement period).

Therefore, I’m inclined to stick to Amaze + Citi Rewards Card, which avoids the issue of the minimum spend and converts all offline transactions to online.

Conclusion

Citi PremierMiles and Citi Rewards Cardholders should check their Citi Mobile App and see if they’re targeted for this cash rebate offer. Earning a 3.25% rebate on all FCY spend is great, provided the S$5,000 minimum spend isn’t a barrier.

Take a moment to register now, just in case.

(HT: Justin)

The T&C say that eligible spend are “retail transactions” – does that include FX transactions where you are not physically abroad (eg Amazon US)?

Looking at the cardmember’s agreement:

“retail purchase” means a purchase of any goods or services by the use of the card and may, at our reasonable discretion and with reasonable notice, include or exclude any card transaction as may be determined by us; “local retail purchase” means a retail purchase denominated in S$; “overseas retail purchase” means a retail purchase denominated in a currency other than S$;

There is no distinction between card-present and online FX transactions.

In your illustration 2, total spend is SGD $4.4k. Does it still trigger the offer as the total spend is less than 5k?

that is really interesting. no, it shouldn’t. and yet that’s exactly the illustration given in the T&Cs. looks like someone at citi goofed up…

i’ll just remove it for now.

Actually, you could max out the 4mpd earn on the Citi Rewards card if you have both the Mastercard & Visa versions.

Good point. Yes in that case you could consider using both cards for 10x categories instead of crmc + amaze

I struggle to see the benefit with this. Correct me if my calculations are wrong. Lets say you make a EUR1000 purchase and the mid rate is EUR/SGD1.45. Using Amaze it will cost you SGD1450. You will get a 1% rebate so net is SGD$1435.50. Even if you have maxed out the 4mpd on Citi Rewards already, just pairing with, say, UOB MC would get you 1.4 miles. This is1450*1.4=2030 miles. Valuing miles at $15/1000 gives miles worth $30.45. So your net cost is $1435.50-30.45=SGD$1405.05. Now, if you use this offer the EUR1000 would cost the same $1450 (as the… Read more »

Amaze doesn’t give you mid mkt rate. Closer to 2-2.5% above mid mkt nowadays; wonky on weekends; wonky in Japan.

If you can hit 5k, I would most definitely go with Citi.

I never said Amaze gave the mid-rate. If you read what I actually wrote, I noted that BOTH Citi AND Amaze will charge a spread on top of the mid-rate – and as I noted I believed that spread was the same for both the Citi card and the Amaze card – so given the spread is about the same, including it makes no difference to the above calculations. By all means go with Citi if you can hit the $5k, but as I have shown, you will be no better off than just continuing to use Amaze – and… Read more »