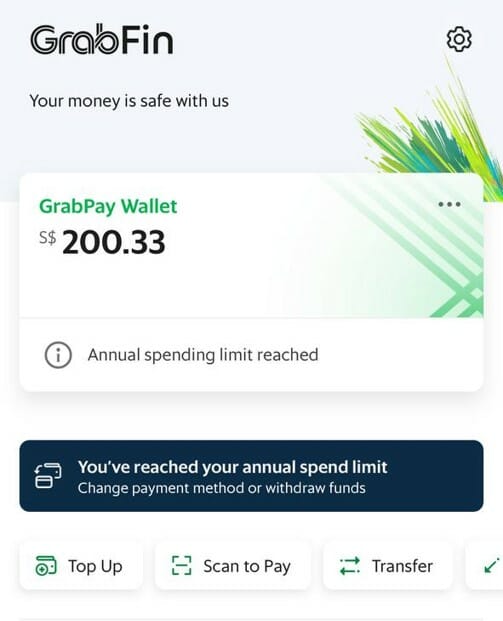

Heavy GrabPay users will be all-too-familiar with the S$30,000 annual transaction limit. This ceiling, imposed by the MAS under the Payment Services Act, effectively limits the miles or cashback you can earn from paying bills via AXS.

But that could soon be changing.

Back in October 2022, the MAS published a consultation paper called “Proposed Amendments to Restrictions on Personal Payment Accounts that Contain E-Money”. While the title may be bureaucrat’s dry dream (bureaucrats have dry dreams, right?), the contents are rather titillating indeed.

tl;dr: the annual GrabPay transaction limit (and all other e-wallets for that matter) could soon be increased to S$100,000.

Proposed updates to MAS e-wallet regulations

For context, MAS currently sets a stock and flow cap on e-wallets:

- Stock: The maximum funds that can be held in an e-wallet at any given time is S$5,000

- Flow: The maximum total outflow from an e-wallet over a 12-month period is capped at S$30,000

These caps explain why your GrabPay Wallet can’t hold more than S$5,000 at any time, and why you can’t spend more than S$30,000 in a calendar year through the GrabPay Card (the cap is technically based on a rolling 12-month period, but I guess it’s easier to implement based on calendar year).

| ⚠️ Exceptions |

The MAS has carved out two exceptions to the stock and flow rule:

|

MAS is now studying a proposal to raise the stock and flow cap on e-wallets as follows:

- Stock: The maximum funds that can be held in an e-wallet at any given time will be increased to S$20,000

- Flow: The maximum total outflow over a rolling 12-month period will be increased to S$100,000

No timeline has been provided for implementation, but the public consultation period has concluded. MAS says the responses “will be published soon, and any relevant amendments to its regulations will be made in due course”.

For what it’s worth, I believe it’s more likely than not we’ll see the changes made. E-wallet operators like Wise and YouTrip are pushing hard for it, and there’s obvious benefits for the consumer as well.

Why higher e-wallet limits would be beneficial

I’m sure by now you know the drill for GrabPay: top it up with a rewards-earning card, pay your bills via AXS, and earn miles or cashback indirectly.

| 💳 Cards for GrabPay Top-Ups | ||

| Card | Earn Rate | Remarks |

AMEX HighFlyer Card AMEX HighFlyer Card

|

1.8 mpd | Only for owners of SMEs |

AMEX True Cashback Card AMEX True Cashback Card

|

1.5% cashback | No cap |

UOB Absolute Cashback Card UOB Absolute Cashback Card

|

1.7% cashback | No cap |

|

|

| ✔️ AXS- Supported Payments | |

|

|

| Visit AXS e-station, enter your bill details, then select Credit Card > Other Banks on the payment screen (notwithstanding the fact the GrabPay Card is technically a debit card) | |

S$30,000 a year may sound like a high cap, but trust me, when you’re using GrabPay for income tax, insurance premiums, MCST fees and what not, that disappears very quickly.

I busted my cap in September this year, which makes my GrabPay account a paperweight until 1 January 2023 (I can still use it for cashing out Amaze cashback, to be fair).

A revised annual limit of S$100,000 would mean an opportunity to earn up to 180,000 miles or S$1,700 cashback a year basically free, insofar as you needed to make those payments anyway.

| ⚠️ AMEX HighFlyer Card caps |

| One drawback of the AMEX HighFlyer Card is that it limits you to transferring 150,000 miles per year (30,000 miles to five KrisFlyer accounts), but put it another way: it’s the only way you’d be able to earn free miles on bill payments in the first place.

In a pinch, HighFlyer points can also be used to pay for cash tickets at a rate of 1,050 points= S$10, which would make 1.8 points per S$1 roughly equivalent to a 1.7% cashback card- albeit slightly more restricted. |

But even leaving aside the rewards angle, a higher annual cap would make it easier to save on big-ticket overseas transactions.

Consider the case of someone who needs to pay overseas school fees. That will likely be well in excess of the current e-wallet limits, forcing them to make payment via bank transfer with the associated fees and less-than-competitive rates.

Or consider someone who wants to buy an expensive handbag or watch overseas. If your e-wallet can only store a maximum of S$5,000, you may end up having to use a credit card with its foreign currency transaction fee and spreads.

Increasing the stock and flow cap would allow Revolut and YouTrip to compete for share of wallet with such transactions, resulting in more reasonable rates all round.

Conclusion

MAS is currently studying a proposal to increase the maximum funds in an e-wallet from S$5,000 to S$20,000, and the maximum flow through an e-wallet from S$30,000 to S$100,000 per year.

This would be great news for anyone using GrabPay, or really any e-wallet for that matter. The main concern cited is the potential for greater losses through e-wallet scams, although that’s always going to be an existential concern any way you look at it.

Let’s hope for some good news soon.

Hi Aaron, how do we check how much of the $30k cap we have left for the calendar year on grab? thank u.

You can now check under Grab app. Go to wallet under “Spend and Balance Limits”.

thank you! 🙂

Now that the loophole of topping up wallets has been closed, the grab limit is inconsequential for most people, like 99%.

I hopw they could also i crease to have 12 months mode of payment instead of the current 4 monthd

Grab indeed increased the limit to $100k in early 2025 but somehow rolled it back on 26 April 2025. Talk about bait-and-switch.