If you’re a heavy GrabPay user, it’s only a matter of time before you come up against the S$30,000 annual transaction limit.

This isn’t a Grab-specific restriction. Rather, it’s imposed by the MAS under its Payment Services Act, and applies to all other Singapore e-wallets as well, such as Revolut and YouTrip. The limit resets every calendar year (i.e. on 1 January), and additional restrictions on single, daily and monthly transactions apply.

| 💳 GrabPay Card Limits | |

| Maximum | |

| Single trxn. limit | S$5,000 |

| Daily trxn. limit | S$5,000 |

| Monthly trxn. limit (based on calendar month) |

S$10,000 |

| Annual trxn. limit (based on calendar year) |

S$30,000 |

| Daily trxn. count | 20 |

| Daily ATM withdrawal limit | S$1,500 |

| Monthly ATM withdrawal limit | S$5,000 |

In this post, we’ll take a closer look at the annual transaction limit, since it’s the ultimate ceiling. Why does it matter, how does it work, and what happens when you hit it?

Why is the GrabPay limit important?

Given the anaemic GrabRewards programme (which somehow manages to get worse all the time), why would anyone spend anything close to S$30,000 via GrabPay in the first place?

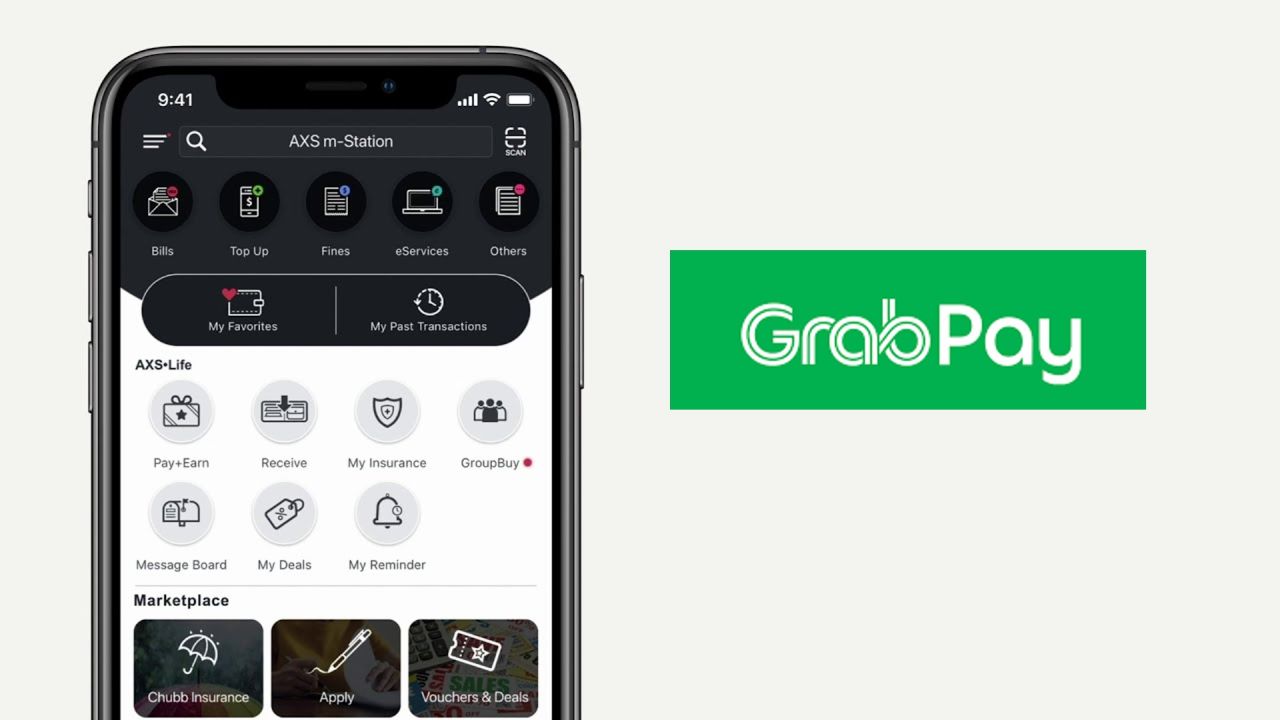

Simple answer: GrabPay allows you to earn credit card rewards on transactions which would normally not qualify, like insurance premiums and income tax. Instead of paying a fee to use a platform like CardUp or Citi PayAll, you could top up your GrabPay balance and use it to pay bills on AXS.

|

|

| 💸 AXS- Supported Payments | |

|

|

This, of course, is contingent on earning rewards on the GrabPay top-up itself. While the vast majority of cards have nerfed GrabPay top-ups, there’s still three options left for miles or cashback.

| 💳 Cards for GrabPay Top-Ups | ||

| Card | Earn Rate | Remarks |

AMEX HighFlyer Card AMEX HighFlyer CardApply |

1.8 mpd | Only for owners of SMEs |

AMEX True Cashback Card AMEX True Cashback CardApply |

1.5% cashback | No cap |

UOB Absolute Cashback Card UOB Absolute Cashback CardApply |

1.7% cashback | No cap |

In other words, you can earn up to 1.7% cashback or 1.8 mpd on your bills, with no fee.

AXS transactions don’t earn GrabRewards points, but that was never the point. The whole idea is to use GrabPay as a conduit for turning S$30,000 of ineligible spend into points-earning transactions. That’s why the annual limit matters.

What counts towards the annual limit?

The following transactions will count towards the GrabPay Wallet’s S$30,000 annual transaction limit:

- Using the GrabPay Wallet balance to make payments

- All GrabPay Card transactions

- All fund transfers from your GrabPay Wallet to another GrabPay Wallet, e-wallet or bank account (except fund transfers made to your bank account via a PayNow number linked to your Grab account)

How do I know when I’m approaching the limit?

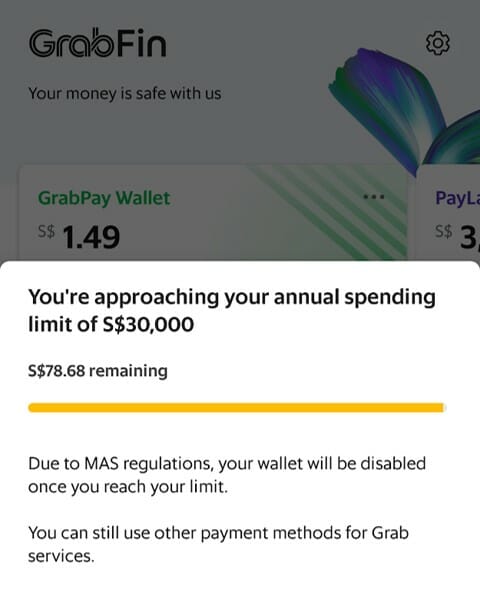

An in-app tracker will appear once you’ve exceeded 75% of your GrabPay annual limit, i.e. S$22,500.

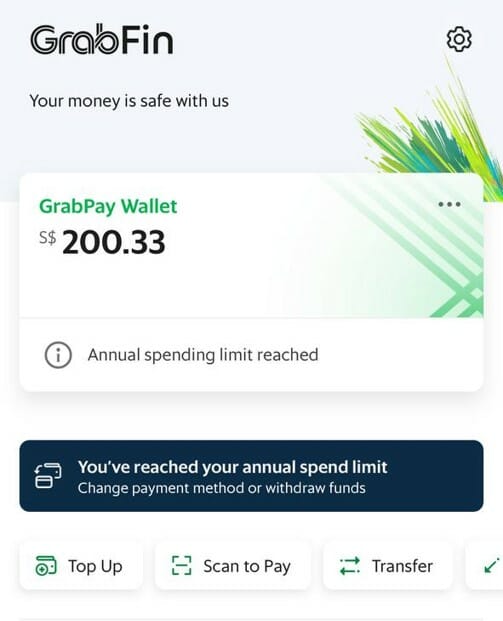

Once you’ve hit the limit, the following message will be displayed.

What happens once you hit the $30,000 limit?

Once the annual GrabPay limit is hit, you can still top-up your GrabPay balance, but cannot make any further transactions using your GrabPay Wallet, PayLater or GrabPay Card.

You will still be able to transfer any GrabPay balance to your bank account via PayNow, provided it’s a transferrable balance.

| 💰 GrabPay Balances |

||

| Non-Transferable Balance | Transferable Balance | |

| Source of Balance |

|

|

| Use For |

|

|

Do note that top-ups from credit cards are non-transferrable balances. This means you should pay close attention to your GrabPay annual limit; for example, if you’re S$100 shy of the limit and top-up S$1,000, S$900 will be unusable until the start of the next calendar year.

What about PayLater?

If you use PayLater, you’ll know that the standard procedure each month is for the consolidated amount to be deducted from your GrabPay balance. If your GrabPay balance is insufficient, an automatic top-up will be triggered before the bill is deducted.

But what if you’ve exceeded your S$30,000 annual limit?

Here’s where it gets complicated. Grab told me (via a spokesperson) that in this case, the linked credit or debit card would be automatically debited with the GrabPay wallet as a passthrough. In other words- no topping up required.

At the end of the month, transactions will be consolidated into a single bill so that consumers can settle the bill using their linked credit / debit card.

Consumer can choose to fix default wallet as passthrough, which charge directly to credit/debit card added to the GrabPay wallet. Hence if you pass the 30K cap on GrabPay transactions, this methods allow you to pay with the linked credit/debit card instead.

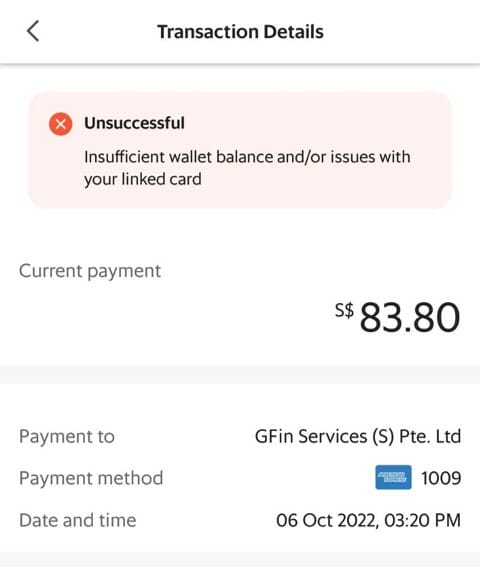

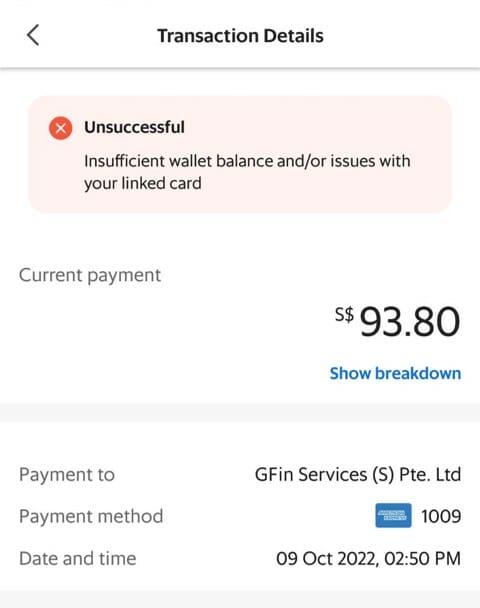

But that’s not what happened for me. When my PayLater bill came due, the automatic credit card deduction failed (there was nothing wrong with the card itself), my PayLater account was suspended, and I was billed an admin fee.

In fact, even after paying the balance manually via bank transfer, the system was still trying to charge me the outstanding amount, plus the S$10 admin fee!

Grab later contacted me to explain that American Express cards are currently not supported as a passthrough payment, hence the failed deduction. If you ask me, they need to make that a lot more clear in the app- especially when all three remaining miles/cashback-awarding cards belong to the AMEX network!

I will be very annoyed if this has any impact on my credit score…

What if a transaction is refunded?

A refunded transaction will not restore your annual limit. For example, if you make a S$2,000 payment via GrabPay which is subsequently refunded, your remaining annual limit will still be S$28,000.

Conclusion

GrabPay has a S$30,000 annual transaction limit which, if used judiciously, could be an opportunity to earn 54,000 miles or S$510 cashback on transactions which would otherwise not qualify.

If you’ve reached the limit on your GrabPay account, one workaround is to use your points/cashback-earning credit card to top-up the account of a family member, then use the family member’s GrabPay account to transact.

Your annual limit is precious. Save it for transactions that don’t normally earn rewards!

Was in the same situation where I got charged the admin fee. How did it got resolved for you?

i got a callback saying they’d waive the fee.

If it is any consolation, BNPL services currently don’t report to CBS.

Tan ku ku if you expect Grab to notify you of anything, scummy company as it is.

Those screen shots showing you are approaching your limit, and later the message when you have reach your limit are interesting. My GRAB does NOT show these messages. I had looked everywhere to see whether there is anywhere that tells you how much of the $30k you have spent. Gave up looking. My wife’s GRAB is the same! Had another look just now to see if I could see the screen shots you have above, but no luck. Why you get those messages and we don’t I wonder?

It only appears as you are approaching your limit, like >75%.

I have hit the limit. Did not show approaching. Does not show now I have hit the limit.

Those only show after you’ve hit 75% of the 30k annual limit.

Nope. Did not show after I got to 75%. And does not show now I have hit the limit either.

Spend more and they’ll show up.

Never showed up approaching the limit. Never showed up after I hit the limit.

The notification box will appear on the Finance page when you reach 80% or 85% utilization.

The messages showed in my grab app but what I’m peeved is that amounts I transferred to grab for its challenges and subsequently transferred back to my bank account are counted in the 30k limit. I didn’t spend those transfers at all.

You already benefitted from the cash moving around yet want to kpkb for more. Jin entitled lewl.

The amount is not counted only if the bank transfer is towards a bank linked to your phone number u used for your grab account.

Then under the tranfer, u need to choose “transfer to paynow account”. Below that option, it should write what number that account is linked to, and it should be the number u used for grab account.

Grab a prepaid, link to another g-acct so no need SMS login in future and viola, another 30k TL !

Need to verify the account otherwise just 5k annual limit. And you need to use Singpass/submit IC photo to verify.

Grab a prepaid, link to another g-acct so no need SMS login in future and viola, another 30k TL !