Back in November 2022, American Express announced that the AMEX Platinum Charge’s S$800 travel credits would be discontinued, and replaced by S$1,204 of statement credits in early 2023:

- S$200 dining credits at participating local restaurants

- S$200 dining credits at participating overseas restaurants

- S$400 lifestyle credits at participating retail partners

- S$204 entertainment credits for news or music streaming services

- S$200 airline credits for Singapore Airlines or Scoot

Details were scarce at first, but now that registration has opened, we have the full T&Cs.

Registering your card

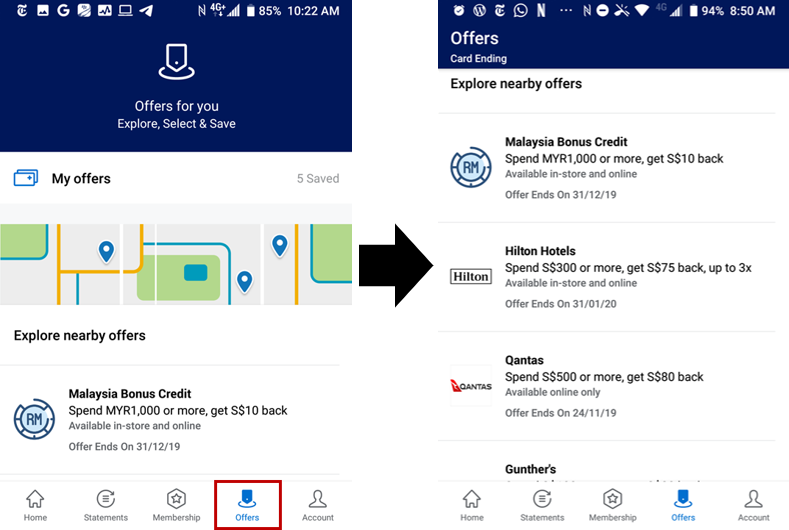

AMEX Platinum Charge cardholders need to register for their new statement credits via the AMEX Offers portal, either on the mobile app or desktop browser.

| ❓ What are AMEX Offers? |

|

AMEX Offers are opportunities to earn bonus miles, Membership Rewards points, or discounts in the form of statement credits. They can be found in the “Offers” section of the AMEX app or web portal. Registration is required, and some offers may be targeted. These are not applicable to DBS, Citi or UOB AMEX cardholders. |

Registration will remain in effect till 31 December 2024. In other words, if you register in 2023, there’s no need to re-register come 1 January 2024.

Statement credits will generally appear on your billing statement within 30 days from the date of transaction, but in practice often appear much sooner.

How are the new statement credits different from the old ones?

Here’s a quick overview of how the new credits are different from the old ones.

| New Credits | Old Credits | |

| Total Amount | S$1,204 | S$800 |

| Allowance | Calendar Year | Membership Year |

| Min. Spend | Applies to certain categories | N/A |

| Availability | Principal cardholder only |

|

Total Amount

The most obvious difference between the new and old credits is the quantum: S$1,204 is a 50% increase from S$800.

However, you can’t blindly compare the headline figures since:

- The new credits may be more or less useful to you, depending on your personal spending patterns

- Some of the new credits come with minimum spend requirements

Allowance

The old credits were issued once every membership year, while the new credits are issued once every calendar year.

What this means is that a new AMEX Platinum Charge Cardholder who gets approved from February to December 2023 would enjoy:

- one set of statement credits for 2023

- one set of statement credits for 2024 (but do remember the entertainment credit is awarded on a monthly basis)

This is regardless of whether he/she chooses to renew. There will be no clawback of statement credits even if the cardholder subsequently decides to terminate his/her card in 2024.

This brings the Singapore American Express cards in line with what we see in the USA, where credits are awarded based on the calendar year (effectively providing a boost to value in the first year of membership).

Minimum Spend

While the old credits did not have a minimum spend requirement, some of the new credits require a minimum spend of S$600.

Availability

As before, credits are only available to principal cardholders. Supplementary cardholders are not eligible to receive them, nor will their spending trigger the credits.

S$200 local dining credits

|

|

| Local Dining Credit | |

| Awarded | Per calendar year |

| Minimum Spend | None |

AMEX Platinum Charge cardholders receive a S$200 local dining credit every calendar year that can be used at any of the following restaurants in Singapore. No minimum spend is required.

| 🍽️ Participating Restaurants (Singapore) | |

|

|

The list is pretty much what we expected, based on a similar promotion that American Express ran in 2021.

You may remember that AMEX Platinum Charge cardholders already receive vouchers for some of the abovementioned restaurants (e.g. Basque Kitchen, Mikuni), as part of their yearly renewal pack. You can stack these vouchers with the statement credits; all that matters is the nett amount charged to your card.

Likewise, Love Dining discounts at Si Chuan Dou Hua can be used in conjunction with the credits.

I’m happy to take these credits at face value, since they include some restaurants I like and others I’ve been wanting to try.

S$200 overseas dining credits

|

|

| Overseas Dining Credit | |

| Awarded | Per calendar year |

| Minimum Spend | None |

AMEX Platinum Charge cardholders receive a S$200 overseas dining credit every calendar year that can be used at any participating restaurant worldwide. No minimum spend is required.

The credit can be used at over 1,400 restaurants in the following countries:

| 🍽️ Platinum Global Dining Countries | |

|

|

The credit is only valid for dine-in services and excludes purchases of gift cards and vouchers, transactions made towards deposits charged upfront by the participating restaurants, cancellation and no-show charges, take away or dine-at-home services.

Do note that if you want to book restaurants in Japan, you must go via the Pocket Concierge service and make a prepaid reservation.

Again, I have no big issue with these credits since I imagine my travels will bring me to at least one of the cities featured.

S$400 Lifestyle Credit

|

|

| Lifestyle Credit | |

| Awarded | Per calendar year |

| Minimum Spend | S$600 |

AMEX Platinum Charge cardholders receive a S$400 lifestyle credit every calendar year that can be used at the following merchants, with a minimum spend of S$600 in a single transaction.

- Adeva Spa

- Follicle at Adeva

- Spa Rael

- The Ultimate

- The Spa by The Ultimate

- Grand Cru Wine Concierge

I personally would ignore the spa options, since I’m not in the mood to go and get hard sold on a package. I mean, have you even seen the crazy rates these places charge?

That leaves Grand Cru. I was initially concerned that the special website for Platinum cardholders would force you to buy packages featuring wines you might not be keen on, but credit where it’s due, you can mix and match what you like.

Don’t forget, you need to spend it all in a single transaction!

S$204 entertainment credits

|

|

| Entertainment Credit | |

| Awarded | Per calendar month |

| Minimum Spend | None |

AMEX Platinum Charge cardholders receive a S$17 entertainment credit every calendar month that can be used at the following merchants. No minimum spend is required.

- Audible

- Eventbrite

- Disney+

- Netflix Singapore

- SPH Media (Straits Times, Business Times, Lianhe Zaobao, Shin Min Daily News, Berita Harian, Tamil Murasu)

- Ticketmaster

The initial list was somewhat disappointing, but Disney+ was belatedly added. This gives me hope we might see a wider range of periodicals like the New York Times or Economist, plus other streaming services like Apple TV, HBO Max, Spotify or Viu.

At S$17 per month, this credit would just about cover a Standard Netflix plan (S$17.48), or could be used to offset a Basic Netflix plan (S$12.98) plus Digital Straits Times subscription (S$9.90- yes, people actually subscribe to The Straits Times)

Despite the limited merchant list, I could certainly manage to max out this perk, though I should highlight that because the credit is awarded every month and January is already over, the actual value in 2023 is S$187, not S$204.

S$200 Airline Credit

|

|

| SIA Credit | |

| Awarded | Per calendar year |

| Minimum Spend | S$600 |

AMEX Platinum Charge cardholders receive a S$200 airline credit every calendar year that can be used at Singapore Airlines or Scoot, with a minimum spend of S$600 in one or more transactions.

The following terms apply:

- Tickets must be purchased in-app or online at the Singapore Airlines or Scoot websites

- Tickets must be purchased in Singapore Dollars for flights departing from Singapore

- Transactions on KrisShop, Kris+ and any purchase of trip add-ons or purchases via phone, email, or other payment links do not count

I find this credit a lot more restrictive than the previous S$400 air travel credit, because:

- You can only spend it with Singapore Airlines or Scoot

- You must buy the ticket from the Singapore Airlines (or Scoot) website, and therefore can’t take advantage of IAP rates

While it’s not said explicitly, I’m fairly confident that the credit will be triggered when paying for taxes and surcharges on an award ticket with your AMEX Platinum Charge (provided you do so via the Singapore Airlines website, and not over the phone with an agent). If so, then I should be able to easily earn the full S$200 over the course of a year, minimum spend restriction notwithstanding.

As a side note, the opportunity cost involved with using the AMEX Platinum Charge for Singapore Airlines/Scoot transactions isn’t quite as bad as other categories, since you earn 1.95 mpd. Moreover, you will also trigger the rather comprehensive travel insurance coverage by using your AMEX Platinum Charge to pay (even if it’s an award ticket).

My thoughts on the new credits

| Note: The section below was written before the Grand Cru website for Platinum cardholders launched. Now that I’ve seen the options, I personally feel a lot better about the lifestyle credit, seeing as how I can get value from buying S$600 worth of wines (that I actually like) for S$200. |

On the surface, the new statement credits are a positive for AMEX Platinum Charge cardholders since the quantum is increasing by 50% while the annual fee is staying the same (OK fine, a 1% GST increase if you want to be technical about it).

However, I’m far from impressed. For me personally, the maximum I’ll get out of this is S$787 in 2023 (S$804 minus the S$17 lost for January’s entertainment credit), since I have absolutely no use for the lifestyle credit in its current form.

I suppose that if you were expecting something much worse to happen, then the new statement credits will be a relief. Apart from the lifestyle credit, none of them are abjectly bad, they just require a lot more hassle to manage.

All the same, I’m going to repeat the same caveats I mentioned back when the changes were first announced.

The new credits will obviously see more breakage, because we’re going from two categories to five. While the mere fact you’re reading this website suggests you’re probably on top of these things, the average cardholder is a lot less meticulous, and may have difficulty keeping track.

Moreover, it was relatively straightforward to spend the airline and hotel credits, since they were valid for any airline or any hotel available through the AMEX Travel Portal. In contrast, the new credits are notably more restrictive– dining, lifestyle and entertainment credits are only valid at specific merchants, and if those aren’t part of your regular repertoire, the credit may go to waste.

Then there’s the opportunity cost involved in using your AMEX Platinum Charge for these transactions. Normally, you might be using other 4 mpd cards for these purchases, but instead you’ll be using the AMEX Platinum Charge with a much lower 0.78 mpd earn rate.

Simply put: with different credits at different merchants with different T&Cs, the cognitive load on the cardholder increases exponentially. There’s more legwork to be done, more things to remember, and it won’t surprise me if some cardholders end up getting less value than before due to forgetfulness or laziness.

The potential upside has been increased, but you’re going to have to work for it. It’s a “coupon book” model that some some people won’t mind and others will absolutely detest, though the ability to get two sets of credits in the first year of membership will surely be a plus if nothing else.

Conclusion

American Express has debuted its new S$1,204 statement credits for the AMEX Platinum Charge, which replace the old S$800 airline and hotel travel credits. While there is no cap on registrations, you should obviously register your card as soon as you can- the priority would be to use the entertainment credit, since that lapses every month.

If you ask me, there’s very little to get excited about here.

What do you make of the new AMEX Platinum Charge credits?

I had been holding the Charge Card since 2017 but will not be renewing this year when the time comes. Vouchers are more and more useless, and now this. Also – the International Airline Program used to throw up good discounts on SQ fares. Now, I frequently find this so-called program offering more expensive fares in J than on SQ’s own website (and yes – in the same Saver or Flexi class so comparing apples to apples). AMEX customer service also seems gutted ever since COVID. The AMEX travel email seems to be dead – no replies when messages sent.… Read more »

Perfect summary of my feelings about the downward trajectory of this card. Such a shame

If the $17 is given monthly, you will get the 12th month benefit come Jan 2024.

Then feb to dec 2024 is 11 mths. Isn’t it the same?

Majority will have downside, me included. No Disney+ or Spotify (?). Amex Plat Charge value proposition has significantly declined over the years.

And the travel benefits incl lounge access? Most of us hv zero or much reduced biz travels due to cost cutting & corporate sustainability efforts. For personal travel, the +1 guest into airport lounge is rolling back meaning kiddos no more free entry into lounge (?)

See what happens when I decline renewal this year.

You can get your partner a free supplementary card, which is also entitled to a Priority Pass, this can resolve the kids’ access issue unless you have more than 2. 🙂

No business travel for wifey either.

Although no change currently for Singapore issued Amex Plat, US issued Amex Platinum no longer has +1 free guest access as of 1 Feb 2023. If u got kids, that’s bad.

Might be a sign of things to come…..

I have a feeling the answer will be “no”, but asking just in case. My membership annual fee is usually charged in January (5 Jan, in case it’s relevant).

Since the new vouchers are credited by calendar year, does that mean I’ll get to double dip even if I choose not to renew in 2024?

The example given in the article was for a cardholder who gets approved from February to December 2023, but wondering if the same logic would apply in January too.

FYI, noted expiry date is in 31/12/24 for some of the credits

I’m also underwhelmed with the whole package recently- I booked W hotel using the statement credit through Amex travel and when I arrived it had been booked through Expedia so I didn’t get any credit to Bonvoy- I thought the whole point of Amex fhr was to get the status benefits as well. I booked flights to Koh Samui to use the flight credit and the flights were $80 more than the Bangkok air website- but I had to use the voucher so just did it. The only reason to hold was the priority pass plus guest but on balance… Read more »

Citi prestige offers the priority pass + guest at a fraction of the cost

Signed up last year due to welcome offer. Will be cancelling this year after claiming my miles and milking it. Goodbye!

The whole proposition has become a joke. The guys at Amex have lost the plot on what makes the card worth it for a majority of its base. The reduction in benefits along with a miserable decline in the quality of the concierge and call centre services will mean that I will only be renewing by SIA business card and not the the Plat Charge in June unless something changes drastically!

I moved to AU lately and just obtained my AU version of the card. Cheaper annual fee (A$1450), similar benefits, and I will list down the difference: 1) The dining voucher is $200 domestic + $200 overseas, this is the same as what SG program converts to. Of course domestic here means Australia, but the restaurant lists are the same. Previously I planned to use $200 overseas mainly in Singapore when I go back, now that SG also has $200 local voucher, guess I will use it in other countries. Now I have $200 SG, $200 AU, and $400 for… Read more »

A couple of things about your Aus Plat Card: 1. Amex Aus also has some benefits for professional groups (used to be much broader, they narrowed down their partners a few years back now) where the Plat annual fee comes down to A$1200. Example of one who still has affiliation with Amex is CPA Aus. 2. Aus Plat Card has (in my opinion) a larger range of insurance & assistance benefits that I know a lot of Plat cardholders in Aus aren’t fully across. Eg roadside assistance, emergency home assistance. I also feel that the Aus travel insurance is a… Read more »

Thanks a lot for the info. Agreed in full about the insurance coverage. As for Virgin lounge access, since I have KF Gold, it’s already covered for now, but good to have it as I may lose gold status after 2024…

to make the analysis simpler, if you are not using the lifestyle credit, 400 dollar for the spa, which I agree is a joke, then it sets back the benefit to 807 SGD assuming you max all the other benefits. So yea.. definitely a downgrade.

My renewal date was in January, so rather than wait and see and hope what the new benefits were I cancelled as soon as annual fee was charged. I’m glad I did that, the change in credits would have been a huge value loss for me. The lifestyle credits are a joke with that huge minimum spend requirement, the entertainment credit valueless to me as my Netflix account is US billed, and the SQ credit no use to me as a OneWorld status maintainer who doesn’t ever fly SQ. Restuarant credits have some value, but has anyone else noticed that… Read more »

My renewal is in oct this year…. am hoping that amex have already had a mass exodus by then and they increase the value proposition. Otherwise i am out too.

Great unbiased post!

Plat in SG is underwhelming. They should do more for the market with the highest annual fee in the world. At least open a Centurion lounge in Changi LOL.

Even the previous 800 SGD credits couldn’t be taken at 100% face value, but it came closer.

Sticking to Citi Prestige. Their annual fee > return value ratio is arguably even better with the 25K miles + world elite and other benefits. Not to forget their Priority Pass still allows non-lounge airport experiences/restaurants, for 2 even.

thought they wanted to make this card mass market, yet they are nerfing the perks

You are not the target audience #hardtruths

Biggest joke of a card ever. The amex platinum charge card fee is incredibly high with little value or no return. Poor earn rates, wasting paper on the coupon voucher book which i dont think ive used one yet to date. Poor rates for hotel/airline booking through their site. Significant hotels / restaurants have opt out with amex. All these restaurants are expensive to eat at routinely and probably for the occaisional affair. Now with 8% gst and 9% gst next year the membership fee goes up even more. The travel customer service is extremely poor with mistakes being made… Read more »

It’s also my final year with Amex

Sadly, it is a further downgrade. The card ised to be great once upon a time.

Question @the community:

For the hotel free night voucher, I never figured out, do u need to state, that a voucher will be redeemed? This time, wanted to book Banyantree Hangzhou. Told them as usual voucher will be redeemed and they rejected. Pathetic customer service. What do you guys recommend?

would like to confirm that those of us holding BOTH the plat charge and the plat reserve DO NOT need to pay annual fees for the plat reserve if we have applied for it a few yrs ago already? cos the plat reserve benefits are pretty decent and help to justify plat charge annual fee

https://milelion.com/2022/10/22/nerfed-no-more-free-amex-platinum-reserve-for-platinum-charge-members/

It’s 4.30pm on 6 Feb and the Grand Cru’s website (clicked via link above) isn’t even active. That’s a real embarrassment for this supposed premium brand

It seems there are a grand total of 16 wines available for purchase on the ‘special’ website.

Definite downside for me. I called in the hope of receiving some MR points to incentivise my continued subscription but no go. Was also very surprised that if you cancel your card there is no pro rata refund of the fee hence if you don’t call before your renewal you’re stuck for another year. Compared to my amex cards in UK and US this is by far the worst deal.