Citibank has launched a new offer for overseas spending on the Citi PremierMiles Card, which runs from now till 30 June 2023.

Registered cardholders can earn 4 mpd on overseas spending on up to S$5,000 spend per month. However, it only applies to in-person transactions, meaning you’ll have to be physically overseas to benefit.

A minimum spend of S$5,000 also applies, although it can be met through local and overseas spending, including no-fee Citi PayAll transactions!

| ⚠️ Update: From 2 May 2023, no-fee Citi PayAll transaction no longer count towards qualifying spend for sign-up offers. Citi has not updated me whether this change also affects this promotion, so proceed at your own risk! |

Citi PremierMiles Card offering 4 mpd on overseas spending

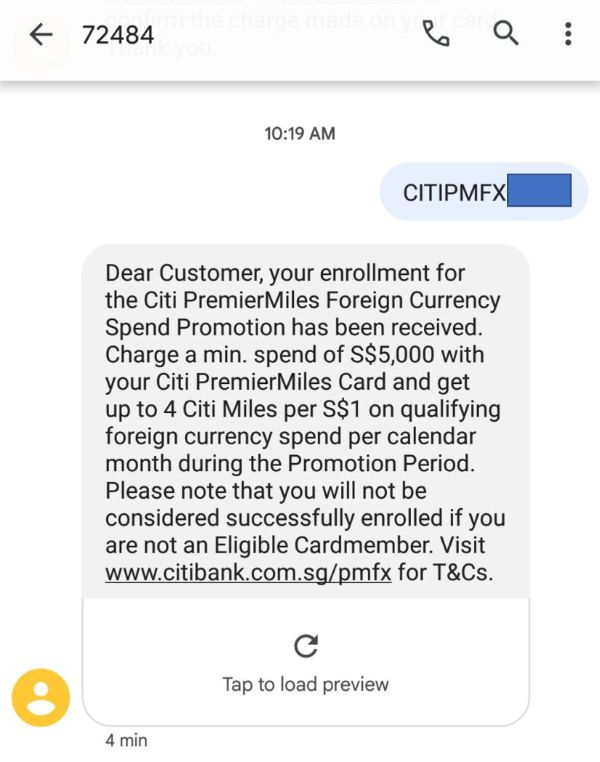

Registration is required for this offer, and can be done by sending the following SMS from your mobile number registered with Citi.

| 📱 SMS to 72484 |

| CITIPMFX<space>Last 4 digits of the eligible card number e.g. CITIPMFX 1234 |

This is a public offer open to all cardholders, and there is no cap on the maximum number of eligible registrations.

Take a moment now to register, because any spending prior to the month of enrolment will not be eligible. For example, if you register on 15 April 2023, then only qualifying spending from 1 April to 30 June 2023 will be entitled to bonus miles; all spending from 1-31 March 2023 will not qualify.

You will receive a confirmation SMS from Citibank once your registration is received.

Registered cardholders will earn up to 4 mpd on all in-person overseas transactions made between 1 March and 30 June 2023 as follows:

| Base | Bonus | Total | |

| Overseas Spend (point-of-sale purchases of goods or services in person at a physical store) |

2 mpd | 2 mpd | 4 mpd |

This comprises the usual 2 mpd for overseas spending, plus a bonus 2 mpd award under this campaign.

A minimum spend of S$5,000 per calendar month is required to trigger the bonus award. This can be met by any eligible retail spend, whether local or overseas, in-person or online.

This is a relatively high threshold, but remember: Citi recently confirmed that Citi PayAll transactions, even those under the no-fee option, will count towards the minimum spend required for card-related benefits.

|

All Citi PayAll transactions can be included in the minimum spend required to qualify for card-related benefits, such as Citi Prestige’s complimentary airport limousine rides and welcome offers on other Citi cards. This includes Citi PayAll transactions, with or without service fees included. Citi PayAll transactions made with zero service fees paid, however, will not qualify for any other rewards, such as base points, bonus points or miles. In line with industry practices, we reserve the rights to review and modify the relevant terms and conditions related to Citi cards as required. |

The maximum bonus you can earn each calendar month is capped at 10,000 miles, or S$5,000 qualifying spend.

It is not necessary to meet the minimum spend in every month of the promotion period, only the months you wish to participate. For example, you could choose to spend S$5,000 in May and June only, to earn the bonus just for those two months.

Both minimum spend and qualifying spend will be determined by transaction date based on Singapore timing (GMT+8), so be careful with those time zones, especially for spending on the last day of the calendar month.

What counts as qualifying spend?

Qualifying spend refers to foreign currency transactions made at overseas point-of-sale, i.e. purchases of goods or services in-person at a physical store.

The standard exclusions apply, such as:

- Payments to education institutions

- Payments to government institutions and services

- Payments to insurance companies

- Payments to financial institutions

- Payments to non-profit organisations

- Any top-ups of prepaid accounts

- Transit-related transactions

Do note in particular that transit-related transactions are excluded, so using your credit card to pay for fares (in countries where that sort of thing is supported) will not earn any bonuses (or base miles for that matter- this is a general exclusion for Citi).

For avoidance of doubt, while online foreign currency transactions will not count as eligible transactions (to earn the bonus 2 mpd), they will count as part of minimum spend (to hit the minimum S$5,000 necessary to earn the bonus 2 mpd).

| ⚠️ It won’t work with Amaze |

| Amaze converts all FCY transactions into SGD, so you will not earn the bonus on Amaze transactions charged to your Citi PremierMiles Card. |

Supplementary cardholder spending will be added to the main cardholder’s qualifying spend.

When will bonus miles be credited?

Citi PremierMiles Cardholders will earn the usual base rate of 2 mpd for overseas spending , awarded when the transaction posts.

The bonus 2 mpd for this promotion will be credited up to four months after the transaction, per the table below.

| Qualifying spending period | Bonus miles credited |

| 1-31 March 2023 | 1-30 June 2023 |

| 1-30 April 2023 | 1-31 July 2023 |

| 1-31 May 2023 | 1-31 August 2023 |

| 1-30 June 2023 | 1-30 September 2023 |

Terms & Conditions

The full T&Cs for the Citi PremierMiles Card overseas spending promotion can be found here.

What can you do with Citi Miles?

Citi PremierMiles Cardholders get access to 10 different frequent flyer programs and one hotel partner, the widest selection of any bank in Singapore.

Points can be transferred to miles in blocks of 10,000 Citi Miles (10,000 miles). There are some great sweet spots with programmes like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles. You may even find Qatar Privilege Club to be useful, assuming you dont mind the sneakily reintroduced award segment fees.

| Partner | Transfer Ratio (Citi Miles: Partner) |

|

1:1 |

| 1:1 | |

| 1:1 | |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

|

1:1 |

| 1:1 |

A S$27 conversion fee applies for every transfer, and do note that Thank You points earned on the Citi Prestige/Citi Rewards cards do not pool with Citi Miles, so you’ll have to redeem them separately.

Citi Miles do not expire.

Citi PremierMiles Card sign-up offer

|

| Apply |

As a reminder, Citi is currently offering a 30,000 miles sign-up bonus for the Citi PremierMiles Card, available to new-to-bank customers.

Applicants who spend at least S$800 within 2 months of approval and pay the S$194.40 annual fee will receive a total of 30,000 bonus miles, an effective cost of 0.65 cents per mile.

Should they not wish to pay the annual fee, a smaller bonus of 8,000 miles is available with the same S$800 minimum spend.

This offer is currently set to run till 31 March 2023, though further extensions are possible.

Conclusion

Citi PremierMiles Cardholders can now earn 4 mpd on overseas spending all the way till 30 June 2023, with a minimum spend of S$5,000 per month. This is capped at 10,000 bonus miles per month- not a bad haul by any means.

Don’t forget to register via SMS, because any spending prior to the calendar month of registration won’t be eligible for the bonus.

At the same time they have devalued Citi Payall from 1.3 mpd to 1.2mpd !

citi payall continues to earn whatever your regular card earn rate is, be it 1.2/1.3/1.6.

edit: i’m aware the landing page shows 1.2 mpd without any context, it’s confusing, but the earn rates are unaffected.

Oh I see. Thank you!

I am new to the miles collection game. Over the last 3 months I have scoured the net for whatever info I can get. And you are the best out there – by miles! 🙂 You’ve become my first reference point whenever I want to learn about credit cards/miles/krisflyer programme. Thank you for sharing all your knowledge with us.

The Prestige product manager gets bullied again.

Citi Prestige is losing its prestige…if the product manager doesn’t get their act together soon, I’ll be looking to cut this card up when it’s next up for renewal

Sorry Aaron, I’m confused. So I am traveling this month, if the min spend is $5k but it’s capped at 10k miles bonus while I can earn 4mpd. Would I not hit the 10k miles bonus just by spending $2.5k in person overseas? However to qualify for the promo, I have to spend another $2.5k which will only earn me 2mpd? Making it a total of 15k max bonus miles I can earn in Mar?

It’s stated that the maximum bonus you can earn each calendar month is capped at 10,000 miles, or S$5,000 qualifying spend. The ‘bonus’ element is the additional 2mpd on top of the base of 2mpd, which you’ll anyways earn for overseas spend. I.e. if you spend $5k overseas, you can earn a max bonus of 5k x 2mpd = 10k miles. You’ll anyways earn the base rate of 5k x 2mpd = 10k miles

looks like only some people are eligible. my message keeps not getting delivered

One step at a time…

Looking forward to the 8mpd days

🥳🥳🥳

Any idea how to send the sms/register if currently outside SG?

i’m on the same situation. tried to SMS +6596572484 as I can find that number from Citi website, but I never received any acknowledgement at all

Thanks for replying. I did that too but no acknowledgment. Probably not worth the risk of charging 5k to find out it didnt work months later 🙁

Wasted cos I was in Europe last 2 weeks and had maxed out all the available 4MPD cards my with the spouse crazy luxury goods spending

Trust with no fcy fee or this?

Depends on what you value?

Hi Aaron, the exclusions you mentioned (eg insurance, govt instititions etc) relate to the spend for awarding of bonus miles. What about the calculation for the 5k minimum? Do the exclusions still apply? I’m not too sure how to read it (aside from the PayAll clarification which is clear)

Can I use instarem with this?

Forgive me, but what exactly are “transit-related transactions”, please? Do they mean train tickets, ferry tickets, Uber rides, and the like? Is there a definition somewhere?

So I called Citi this morning to ask, and the CS agent said “whenever you tap-in or tap-out” with something, like going on the subway. She also said that intercity train tickets and car rentals should not fall under this category. I am still not 100% sure whether this is correct, but I guess I will just have to try it out and see…

yup that’s right- mainly for public transport. buying intercity train tix comes under another MCC

Do mobile contactless payments (in-person) count?

Hi, does retail spend include eg payment for accommodation at hotels?