| The following is a sponsored post by UOB. The opinions remain those of The MileLion |

The UOB Lady’s Cards have received a major enhancement, allowing cardholders to enjoy 15X UNI$ (equivalent to 6 miles per dollar) on up to two rewards categories, up from the previous 10X UNI$ (equivalent to 4 mpd).

With rewards categories spanning beauty & wellness, dining, entertainment, family, fashion, transport and travel, this is practically an essential card for any (female) miles chaser, letting them rack up the airline miles faster than anything else on the market.

In this post, we’ll look at how you can get the most out of your UOB Lady’s Card.

Earn 6 mpd with the UOB Lady’s Card

|

| Apply here |

| Learn more |

From 8 March 2023 to 29 February 2024, UOB has enhanced the UOB Lady’s Cards earn rates as follows:

- UOB Lady’s Cardholders earn 15X UNI$ (6 mpd) on their choice of one rewards category, capped at 2,800 bonus UNI$ (S$1,000) per calendar month

- UOB Lady’s Solitaire & Lady’s Solitaire Metal Cardholders earn 15X UNI$ (6 mpd) on their choice of two rewards categories, capped at 8,400 bonus UNI$ (S$3,000) per calendar month

| ❓ How do we get from UNI$ to miles? |

| UOB Lady’s Cardholders earn 15X UNI$ per S$5 spent, and 1 UNI$ is equivalent to 2 airline miles. Therefore 15X UNI$= 30 miles per S$5 spent, an earn rate of 6 mpd (30 miles/S$5) |

As before, bonus UNI$ will be credited to your card account on a monthly basis, and reflected in the next statement cycle. You can check the crediting via the UOB TMRW app.

These changes mean that a UOB Lady’s Cardholder can earn an additional 24,000 miles per year, and a UOB Lady’s Solitaire Cardholder an additional 72,000 miles per year, from the same amount of spending as before.

These are now the highest earn rates offered by any rewards card in Singapore on an ongoing basis- other rewards cards max out at 4 mpd.

Rotate your rewards category(ies) to maximise miles

|

| Choose rewards category(ies) |

One unique feature of the UOB Lady’s Card is that it allows you to rotate your preferred rewards category(ies) every calendar quarter.

- UOB Lady’s Cardholders can pick one rewards category

- UOB Lady’s Solitaire Cardholders can pick two rewards categories.

A total of seven different rewards categories can be chosen:

| Category | MCCs | Description |

| (1) Beauty & Wellness | 5912, 5977, 7230, 7231, 7298, 7297 | Discount, Mass and Drug Stores, Cosmetics Stores, Barber and Beauty Shops, Health and Beauty Spa, Massage Parlors |

| (2) Dining | 5811, 5812, 5814, 5499 | Caterers, Eating places and Restaurants, Fast food restaurants and food deliveries |

| (3) Entertainment | 5813, 7832, 7922 | Bars, Taverns, Lounges and Nightclubs, Motion Picture Theatres, Theatrical Producers and Ticket Agencies |

| (4) Family | 5411, 5641 | Grocery stores, Children and Infants wear store |

| (5) Fashion | 5311, 5611, 5621, 5631, 5651, 5655, 5661, 5691, 5699, 5948 | Department Stores, Men’s and Boy’s Clothing and Accessories Store, Women’s Ready-to-wear Stores, Women’s Access and Specialty, Family Clothing Stores, Sports and Riding Apparel Stores, Shoes Stores, Men’s and Women’s Clothing Stores, Miscellaneous Apparel and Accessories Shops, Luggage and Leather Stores |

| (6) Transport | 4111, 4121, 4789, 5541, 5542 | Local Commuter Transport, Taxi, Cabs, Limousines and Travel Service, Service Stations and Automatic Gas Dispensers |

| (7) Travel | Credit card retail transactions made at major airlines and/or hotels with their main business activity classified as flights and/or hotels only | |

Do note that bonus UNI$ crediting depends on the Merchant Category Code (MCC), which is not within UOB’s control.

The ability to change your rewards category(ies) every quarter means the card can be different things to you at different times.

Consider the following example of a UOB Lady’s Cardholder:

- In Q1, she chooses Beauty& Wellness to earn bonus UNI$ on the purchase of a massage package

- In Q2, she goes for an overseas trip and chooses Travel to earn bonus UNI$ on airline and hotel bookings

- In Q3, she stays mostly in Singapore and chooses Transport to earn bonus UNI$ on Grab rides, taxis and public transport

- In Q4, she does a lot of festive dining and chooses Dining to earn bonus UNI$ on catering, restaurants and cafes

Under the new earning scheme, she would earn up to 72,000 miles per year, enough for a round-trip Business Class ticket to Taiwan, or a round-trip Economy Class ticket to New Zealand.

Or consider the following example of a UOB Lady’s Solitaire Cardholder:

- In Q1, she prepares for CNY by selecting Fashion and Dining to earn bonus UNI$ on new clothes for CNY and CNY meals

- In Q2, she goes overseas for a holiday, keeping Dining for restaurants and adding Travel for bonus UNI$ on hotel and airline bookings

- In Q3, she switches to Entertainment and Transport as she spends time in Singapore, earning bonus UNI$ on nightlife, petrol, Grab rides, and public transportation

- In Q4, she switches to Family and Shopping to earn bonus UNI$ as she prepares for Christmas by stocking up on festive groceries, and buying gifts online and in department stores

Under the new earning scheme, she would earn up to 216,000 miles per year, enough for a round-trip Business Class ticket to Europe, or to fly a family of four in Economy Class to Japan/South Korea and back.

Simply put: rotating your rewards category(ies) is how you unlock maximum value from your UOB Lady’s Card. Don’t “fire and forget” here; some forward thinking can earn you a lot of bonus miles!

Other cardholder perks

Complimentary travel medical insurance & travel benefits

UOB Lady’s Solitaire Cardholders enjoy complimentary travel medical insurance when they charge the entire cost of their common carrier ticket (any land, sea or air travel arrangement) to their card and register here prior to their trip.

| Maximum Benefit* (UOB Lady’s Solitaire Card) |

|

| Medical Expenses | Up to US$100,000 |

| Emergency Medical Evacuation & Return of Mortal Remains | Up to US$100,000 |

| Daily In-Hospital Cash Benefit | US$100 per day (min. 3 days, max. 15 days) |

| Overseas Quarantine Allowance | US$100 per day (max. 14 days) |

| *Subject to terms, conditions and exclusions in the policy wording for UOB Lady’s Solitaire Card | |

Complimentary travel insurance & travel benefits

UOB Lady’s Solitaire Metal Cardholders enjoy complimentary travel insurance when they charge the entire cost of their common carrier tickets (any land, sea or air travel arrangement) to their card. No registration is required.

| Maximum Benefit^ (UOB Lady’s Solitaire Metal Card) |

|

| Travel Accident & Medical Insurance | |

| Travel Accident | US$500,000 |

| Medical Expenses | US$500,000 |

| Emergency Medical Evacuation and Repatriation | US$500,000 |

| Hospital Daily Indemnity | US$100 per day (max. 30 days) |

| Overseas Quarantine Allowance | Up to US$100 per day (max. 14 days) |

| Travel Inconvenience and Cancellation Insurance | |

| Loss of baggage | Up to US$3,000 |

| Baggage delays over 4 hours | Up to US$500 |

| Trip cancellation | Up to US$7,500 |

| Trip curtailment | Up to US$7,500 |

| Trip postponement | Up to US$7,500 |

| Personal Liability Abroad | Up to US$500,000 |

| Trip Delays over 4 hours | Up to US$500 |

| Missed connections | Up to US$500 |

| ^Subject to terms, conditions and exclusions in the policy wording for UOB Lady’s Solitaire Metal Card | |

Where award tickets are concerned, coverage will apply if entire cost of ticket is redeemed with airline mileage program associated with the card and the card is used to pay the taxes and surcharge component.

The policy also provides coverage for COVID-19, for extra peace of mind. Do refer to the terms, conditions and exclusions in the policy wording for full details:

Furthermore, UOB Lady’s Solitaire Metal Cardholders enjoy additional travel perks, including:

- One complimentary airport transfer per year, valid in Singapore and overseas

- Six complimentary lounge visits a year, redeemable at over 1,300 lounges worldwide, offered through Mastercard Airport Experiences provided by LoungeKey

Bonus interest on the UOB One Account

One great feature of the UOB Lady’s Cards is that card spending qualifies you to earn bonus interest on the UOB One Account.

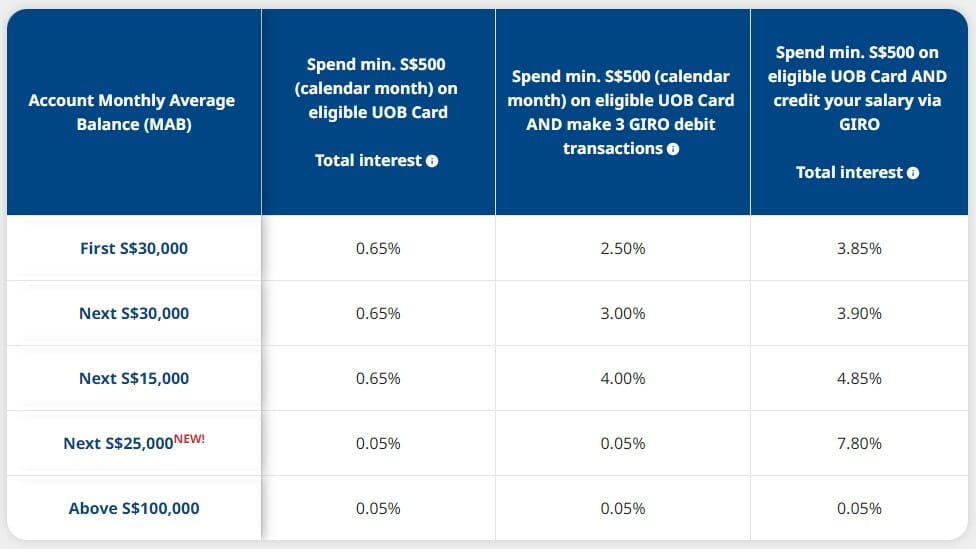

For example, a cardholder who spends at least S$500 in a calendar month and makes three GIRO debit transactions (e.g. paying utilities bills, insurance premiums, credit card bills) will earn 3% p.a. effective interest rate on the first S$75,000 in her UOB One Account.

A cardholder who spends at least S$500 in a calendar month and credits her salary of at least S$1,600 (with the transaction reference “SALA”/”PAYNOW SALA”) will earn 5% p.a. effective interest rate on the first S$100,000 in her UOB One Account.

Unlike some other high-yielding bank accounts , the UOB One Account does not require you to purchase insurance or investment products in order to unlock its highest interest tier, which is perfect for those who have existing plans/policies elsewhere.

Pooling with other UOB cards

UOB UNI$ are pooled for the purposes of redemption, which means that UOB Lady’s Cardholders can make use of other UOB cards as well, combining the UNI$ earned for miles or other reward redemptions.

| Card | Earn Rate | Remarks |

UOB PRVI Miles Card UOB PRVI Miles CardApply |

1.4 mpd (Local) 2.4 mpd (FCY) |

No min. spend, no cap |

UOB Pref. Plat. Visa UOB Pref. Plat. VisaApply |

4 mpd | Max S$1.1K per c. month, must use mobile payments |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd | S$1K-2K per s. month on overseas spending, contactless & petrol |

For example, you could use the UOB Preferred Platinum Visa and UOB Visa Signature to earn 10X UNI$ (4 mpd) on contactless payments, stacking it with the 15X UNI$ (6 mpd) earned from the UOB Lady’s Card. With an earn rate of 4/6 mpd on most of your spending, you’ll be jetting off on your next vacation in no time.

In Summary

|

| Apply here |

| Choose rewards category(ies) |

The UOB Lady’s Cards are now bigger and better, earning up to 6 mpd on your choice of one or two rewards categories every quarter.

The key to maximising rewards is to rotate your rewards category(ies) as needed, so if you’re an existing cardholder, be sure to do so via this link. Rewards category(ies) can be changed up till 11.59 p.m before the first calendar date of the following quarter.

Get your card, choose your rewards category(ies), and start spending to earn your way to your next vacation faster!

Thanks. Do OTA like Expedia and Agoda… fall under category “travel” or are they excluded?

I saw Expedia on the list under Travel at UOB’s website.

GetGo, BlueSg belong to which category?

Hope posting about a lady’s only 6mpd card finally makes you more than 50% successful in “help people travel better for less and impress chiobu” 😉

Hi, i think this may have been discussed previously. Do payments to AIRBNB code as travel? Thank you!

Keep the qns coming! Will be compiling and sending to uob

Thank you Aaron for this post.

i want to find out the category for optical shops fall under, is it under family? Thank you

Can you tell your UOB contact to stop this gender discrimination?

What about car rental overseas? And petrol for the rental car?

I’ve paired my Lady’s Solitaire card with Amaze and was advised by UOB CSO that UOB cannot detect the MCC as it reflects as Amaze so bonus points were not credited… I wonder why as I was under the impression that Amaze does not change the MCC so it seems to contradict…

Why is it that the UOB Lady’s is the only card that is eligible for earning bonus interest on the One account, on top of being such a good miles earning card?

It is wholly unfair for men and is extremely sexist.

Can you clarify if this upsize miles is only for 1 year? You have stated ending in Feb 2024

Is the insurance applicable to only the cardholder or also the trips booked using card for your family members?

What is the expiry of the miles?

What is the earn rate for transactions not in the chosen category?

In my mind, your sponsored post lacks many other details to the detriment of your readers.

best card ever.

Is there a deadline to submit the category change? Ie. March 31 for 2nd quarter (Apr-Jun)? What if multiple changes are submitted? Does UOB take the last or first form submitted in the previous quarter?

The most recent one is effective. Submit by end of the previous calendar quarter

Can I ask, if my billing cycle is say until the 20th March, for the remaining of the calendar month (21-31 Mar), does it reflect as the same category as the original or it jumps to the new category?

Does spend have to be in SGD? Assuming your category is dining, if you use it overseas, do you still get the bonus miles?

Does optical fall under fashion category? And health check under wellness?