Back in June 2022, the DBS Vantage Card launched with an 80,000 miles sign-up offer, marking DBS’s entry into the $120K card segment. That offer only lasted for a mere five days before it was cut to 60,000 miles, where it’s stood ever since.

DBS has now launched a new flash deal that runs till 17 March 2023, which brings back the original launch offer of up to 80,000 miles for new-to-bank customer. Existing DBS cardholders can enjoy a smaller bonus of 50,000 miles instead.

DBS Vantage Flash Deal

DBS Vantage Card DBS Vantage Card |

||

| Apply |

||

| Card T&Cs | ||

| Flash Deal T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$120,000 |

S$594 | 3.25% |

| Local Earn | FCY Earn | Miles with AF |

| 1.5 mpd |

2.2 mpd | 25,000 miles |

From 13-17 March 2023, new DBS Vantage Cardholders who spend S$8,000 within 60 days of approval and pay the first year’s S$594 annual fee will receive the following:

| New-to-bank | Existing Cardholders | |

| Pay S$594 annual fee | 25,000 miles | 25,000 miles |

| Spend S$8,000 within 60 days | 55,000 miles | 25,000 miles |

| Total | 80,000 miles | 50,000 miles |

| Must apply with promo code VTGFLASH |

||

| ❓ “New-to-bank” Definition | ||

|

New-to-bank customers are defined as those who:

|

||

New-to-bank cardholders will receive 80,000 miles, while those who already hold other DBS cards will receive 50,000 miles.

This bonus is on top of whatever base miles you normally earn with the DBS Vantage, so you’re looking at at least 92,000 miles (new) or 62,000 miles (existing) in total, based on S$8,000 spent locally at 1.5 mpd.

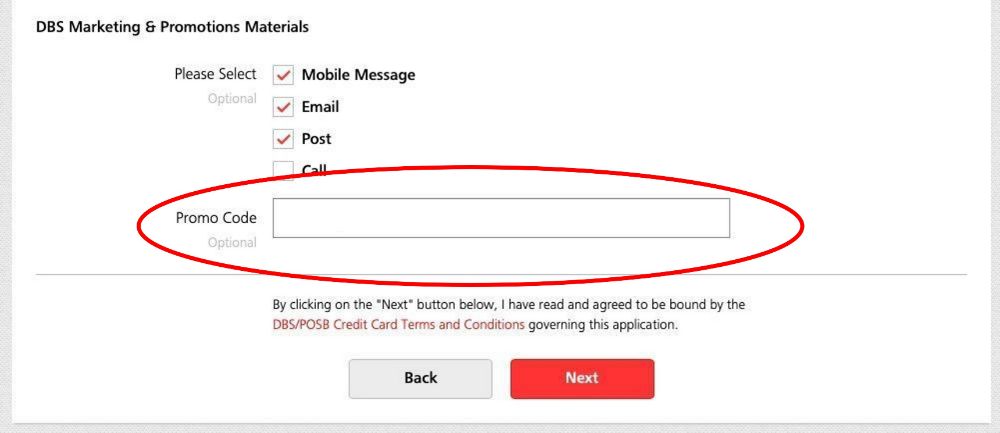

You must enter the promo code VTGFLASH when applying, and all applications must be approved by 31 March 2023. The promo code field can be found towards the bottom of the application page, under the “DBS Marketing & Promotions Materials” section.

If you forget to enter the code, you can do so via this link (currently not working- so you may need to contact customer service).

Given the annual fee of S$594, the cost per mile is:

- New customer: 0.74 cents (S$594/80,000 miles)

- Existing customer: 1.19 cents (S$594/50,000 miles)

Is this a good deal?

If you’re an existing DBS cardholder, then this is as good as it gets, since DBS is not running any other Vantage sign-up offers.

However, if you’re a new-to-bank customer, you should be aware that there’s an alternative offer that runs until 30 June 2023, where you can get 60,000 miles with S$4,000 spend in 30 days.

While this is a smaller number of miles, it does represent a better return on a spend to miles basis.

| Spend | Miles | Miles per S$1 | |

| VANMILES | S$4K in 30 days | 60,000 | 15 |

| VTGFLASH | S$8K in 60 days | 80,000 | 10 |

If you’re interested in the alternate offer, then enter the code VANMILES during the application process.

What counts as qualifying spend?

Cardholders are required to spend at least S$8,000 within 60 days of approval.

Qualifying spend includes both local and foreign retail sales and posted recurring bill payments, excluding the following:

| ⚠️ Excluded transactions |

| a. posted 0% Interest Instalment Payment Plan monthly transactions; b. posted My Preferred Payment Plan monthly transactions; c. interest, finance charges, cash withdrawal, balance transfer, smart cash, AXS payments, SAM online bill payments, bill payments via internet banking and all fees charged by DBS; d. payments to educational institutions; e. payments to financial institutions (including banks, online trading platforms and brokerages); f. payments to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here); g. payments to hospitals; h. payments to insurance companies (sales, underwriting and premiums); i. payments to non-profit organisations; j. payments to utility bill companies; k. payments to professional service providers (including but not limited to accounting, auditing, bookkeeping services, advertising services, funeral service and legal services and attorneys); i. any top-ups or payment of funds to payment service providers, any prepaid accounts or purchase of prepaid cards/credits (including but not limited to EZ-Link, GrabPay, NETS FlashPay, Transit Link, Razer Pay, ShopeePay, Singtel Dash, AMAZE*); m. any betting transactions (including levy payments to local casinos, lottery tickets, casino gaming chips, off-track betting and wagers); n. any transactions related to crypto currencies; o. payments made to CardUp, FavePay, iPaymy and SmoovPay are also subject to the exclusions listed in Clauses 9 (a) to 9 (o) above; and p. any other transactions determined by DBS from time to time |

DBS has previously clarified that only rental transactions made via CardUp will count towards the sign-up bonus; all other payments will not count (though they will still earn the base rate of 1.5 mpd).

For the avoidance of doubt, supplementary and principal cardholder spending will pool when calculating whether the minimum qualifying spend has been met.

When will the miles be credited?

The 25,000 miles for paying the S$594 annual fee will be awarded immediately (in the form of 12,500 DBS points) when the annual fee is charged.

The bonus of 25,000 miles (existing) or 55,000 miles (new) will be credited within 120-150 days from the date of fulfilling the qualifying spend (in the form of 12,500/27,500 DBS points).

What can you do with DBS Points?

DBS Points earned on the DBS Vantage expire in three years, and can be converted to any of the following frequent flyer programmes with a S$27 admin fee.

| Frequent Flyer Programme | Conversion Ratio (DBS Points: Miles) |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

| 5,000: 10,000 | |

|

500: 1,500 |

Terms & Conditions

The full T&Cs for this flash deal can be found here.

Overview: DBS Vantage Card

Apply Here Apply Here |

|||

| Income Req. | S$120,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$594 |

Min. Transfer |

5,000 DBS Points (10,000 miles) |

| Miles with Annual Fee |

25,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$27 |

| Local Earn | 1.5 mpd | Points Pool? | Yes |

| FCY Earn | 2.2 mpd | Lounge Access? | Yes: 10x Priority Pass |

| Special Earn | 6 mpd on Expedia | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The DBS Vantage Card offers 1.5 mpd on local spend and 2.2 mpd on FCY spend. Unfortunately, the DBS Vantage Card no longer offers 4 mpd on dining and petrol spend, ever since 1 January 2023.

Cardholders enjoy benefits such as:

- A Priority Pass membership with 10 free lounge visits per year

- Accor Plus Explorer membership with Accor Silver status, up to 50% off dining and one complimentary hotel night at selected Asia Pacific hotels

- Dining discounts via Dining City

- 6 mpd on Expedia flight and hotel bookings

While the card’s annual fee cannot be waived in the first year, it will be waived subsequently when you spend at least S$60,000 in a membership year. Should the fee be waived, you will not receive the 25,000 miles, though you will receive the rest of the benefits like the Accor Plus membership and lounge passes.

Conclusion

The DBS Vantage Card has brought back its launch offer of up to 80,000 miles with S$8,000 spend in 60 days, valid for applications submitted by 17 March 2023 and approved by 31 March 2023 with the code VTGFLASH.

However, if you’re not confident of hitting the S$8,000 minimum spend, you should consider applying for the alternative offer of 60,000 miles with S$4,000 spend in 30 days, valid for applications submitted by 30 June 2023 and approved by 14 July 2023 with the code VANMILES.

Aaron, maybe you can have an article discussing whether its worth to renew. The value proposition don’t seem strong …

Too soon! June not here yet

Depends whether you managed to make the most of free hotel night benefit. If can’t book at least a Sofitel or Banyan Tree, then to me no point renew. But it’s up to each individual.

Anyone can suggest how to incur $4k or $8k of retail spend when you don’t have big home or tech or travel expense in next few months?

Don’t

Dont spend money if you don’t have to. 3rd US bank crash today. 80k miles with fees and spend wont take you far.

Do we still get the accor membership even if we have an existing one from AMEX highflyer? Thanks

I have a POSB everyday card already, so won’t be eligible for this promo right?

Does AXS Pay+Earn qualifies as eligible spend?

Just checked with DBS and was informed that payment scheduled via CardUp (eg reno expense) should count as qualifying spend so long as they are not of the nature specifically excluded in (a)-(n). Perhaps we can confirm your understanding?

Just nice I’m doing home renovation and have large items to buy to reach the 8k spend. Existing dbs card holder though so only qualify for the lower bonus.

Been charging my renovation costs to my citi premiermiles so far.

Going forward, will likely continue with my citi pm as I doubt I’ll utilize the benefits of the dbs vantage much.

Is it worth it to apply for the card, get the bonus miles then cancel it soon after?

Depends on whether you value the other perks like the hotel and lounge. If low value, then cancel so you can apply again if ever such promo arises

In general if apply and cancel cards will affect credit score?

Just spoke to DBS and they said CardUp MCC 7399 is EXCLUDED. Only 6513 can count towards promo. Doesn’t that mean that rental on card up does not qualify?

was it over the phone or online chat? The article says rental qualifies, wondering whats the final consensus here?

I have applied and just gotten the card. How do I check if I have successfully taken part in the signup promo?

I’d strongly advise checking and double checking if y’all gonna hit the qualifying spend with a healthy buffer before you apply. I didn’t have my physical card with me when in Turkey and the hotels didn’t accept ApplePay, so I thought to make up for it when some Points dot com purchase, since I use those regularly. I just learned that those spend count as “Professional Services” and are excluded from the Qualifying Spend. Apparently the MCC is decided by the processing bank (not DBS), but a good reminder for everyone!!