| The following is a sponsored post by Citi. The opinions remain those of The MileLion. |

With travel restrictions lifted and borders now reopened, there’s never been a better time to get back on the road.

And if you’re a Citi PremierMiles Cardholder, here’s a few deals that will help you rack up extra miles, score great deals on flights, hotels, and attractions, as well as put you in the running to win a S$10,000 travel voucher to bankroll your trips.

If you don’t have a Citi Credit Card yet, read on to the end for a Citi PremierMiles Card sign-up offer of up to 30,000 bonus Citi Miles (T&Cs), with a low minimum qualifying spend of just S$800 within two months after card approval.

Earn up to 4 Citi Miles per dollar on qualifying foreign currency spend

|

|

| What’s on offer? | 4 Citi Miles per S$1 on qualifying foreign currency spend |

| To do | Enrol your card by SMS |

From 1 March to 30 June 2023, Citi PremierMiles Cardholders can earn up to 4 Citi Miles per S$1 (mpd) on qualifying foreign currency spend.

This comprises the usual 2 mpd for foreign currency spending, plus a bonus award of 2 mpd.

| Base | Bonus | Total | |

| Foreign Currency Spend (point-of-sale purchases of goods or services in person at a physical store) |

2 mpd | 2 mpd | 4 mpd |

Registration is required, and can be done by sending the following SMS from your mobile number registered with Citi.

| 📱 SMS to 72484 |

| CITIPMFX<space>Last 4 digits of the eligible card number e.g. CITIPMFX 1234 |

Do register as soon as possible, because any spending prior to the month of enrolment will not be eligible. For example, if you register on 15 April 2023, then only qualifying spending from 1 April to 30 June 2023 will be entitled to bonus miles; all spending from 1-31 March 2023 will not qualify.

A minimum spend of S$5,000 per calendar month is required to trigger the bonus miles. This can be met by any eligible retail spend, whether local (including Citi PayAll transactions) or overseas, in-person or online.

The maximum bonus miles cardholders can earn each calendar month is capped at 10,000 miles, or S$5,000 qualifying spend in foreign currency.

Qualifying spend

Qualifying spend refers to foreign currency transactions made at overseas point-of-sale, i.e. purchases of goods or services in-person at a physical store.

Some exclusions apply, such as:

- Payments to education institutions

- Payments to government institutions and services

- Payments to insurance companies

- Payments to financial institutions

- Payments to non-profit organisations

- Any top-ups of prepaid accounts

- Transit-related transactions

The full list of excluded transactions can be found in the T&Cs (see below).

As a reminder, you must be charged in foreign currency to qualify for the bonus miles. If the merchant asks whether you wish to pay in SGD or foreign currency, always opt for the latter!

Crediting of bonus Citi Miles

Citi PremierMiles Cardholders will earn the usual base rate of 2 mpd for foreign currency spending, awarded when the transaction posts. The bonus 2 mpd for this promotion will be credited up to four months after the transaction, per the table below.

| Qualifying spending period | Bonus miles credited |

| 1-31 March 2023 | 1-30 June 2023 |

| 1-30 April 2023 | 1-31 July 2023 |

| 1-31 May 2023 | 1-31 August 2023 |

| 1-30 June 2023 | 1-30 September 2023 |

Terms & Conditions

The full T&Cs for the Citi PremierMiles Card overseas spending promotion can be found here.

What can you do with Citi Miles?

Citi Miles do not expire, and are one of the most flexible rewards currencies on the market with 11 different airline and hotel loyalty programmes.

| Airline/Hotel Loyalty Programme | Transfer Ratio (Citi Miles: Partner) |

| Singapore Airlines KrisFlyer | 10,000 : 10,000 |

| Cathay Pacific Asia Miles | 10,000 : 10,000 |

| British Airways Executive Club | 10,000 : 10,000 |

| Etihad Guest | 10,000 : 10,000 |

| EVA Air | 10,000 : 10,000 |

| FlyingBlue | 10,000 : 10,000 |

| IHG Rewards Club | 10,000 : 10,000 |

| Qantas Frequent Flyer | 10,000 : 10,000 |

| Qatar Privilege Club | 10,000 : 10,000 |

| THAI Royal Orchid Plus | 10,000 : 10,000 |

| Turkish Airlines Miles&Smiles | 10,000 : 10,000 |

A S$27 conversion fee applies for every transfer, regardless of the number of Citi Miles converted.

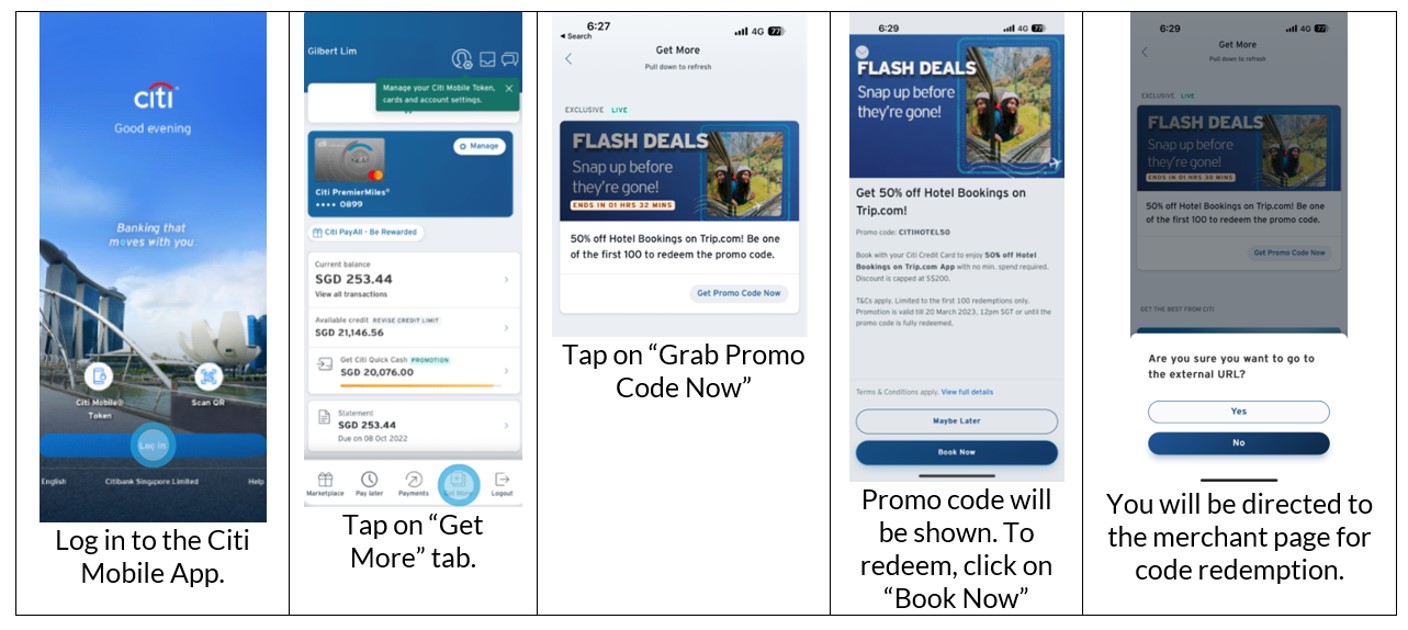

Enjoy up to 50% off travel flash deals with Citi Credit Cards

|

|

| What’s on offer? | Up to 50% off travel and hotel deals with your Citi Credit Card |

| To do | Visit the Citi Mobile App at 12 p.m on the 1st and 15th of every month from now to 1 June 2023 |

Flights and hotel prices have recovered from their COVID-era slumps, and in some cases, can be even more expensive than before!

To take some of the sting out of this, from now to 1 June 2023 Citi is offering special flash deals with up to 50% off flights, hotels and attractions with Klook, Trip.com and Expedia.

Promo codes are in very limited quantity (first 100 redemptions), and go live at 12 p.m on the 1st and 15th of every month.

Be sure to login to your Citi Mobile App and camp out in advance to secure your codes.

Citi Great Giveaways

|

|

| What’s on offer? | Win a S$10,000 Trip.com travel voucher |

| To do | Register via the Citi Mobile App |

In addition to earning Citi Miles, your spending on the Citi PremierMiles Card (or any other Citi Credit Card for that matter) can turn out to be doubly rewarding.

From 15 February to 31 May 2023, Citi is running a Great Giveaways contest with S$10,000 worth of travel vouchers up for grabs to five lucky winners.

To participate, all you need to do is register and spend clock at least S$2,000 qualifying spend on your Citi Credit Cards during the campaign period. Your spending can be combined across multiple Citi Credit Cards if you so wish.

To register, login to the Citi Mobile App and tap on “Get More” at the bottom. Scroll until you see the Great Giveaways banner, and tap to enrol.

The Trip.com travel vouchers is valid for one year from date of issuance. Winners will be announced within seven days of the draw date, which is set for 28 June 2023.

Qualifying spend

Qualifying spend refers to any retail transactions (including online purchases) which

do not arise from:

- any Equal Payment Plan (EPP) purchases;

- refunded/disputed/unauthorised/fraudulent retail purchases;

- Quick Cash and other instalment loans;

- Citi PayLite/Citi Flexibill/cash advance/quasi-cash transactions/balance transfers/annual card membership fees/interest/goods and services taxes

- bill payments made using the Eligible Card as a source of funds;

- late payment fees; or

- any other form of service/ miscellaneous fees

Terms & Conditions

The full T&Cs for the Great Giveaways contest can be found here.

Earn up to 30,000 bonus Citi Miles with a new Citi PremierMiles Card

|

| Apply |

| T&Cs |

If you don’t already have a Citi Credit Card, sign up for a Citi PremierMiles Card and enjoy a welcome gift of up to 30,000 bonus Citi Miles when you spend at least S$800 within two months of card approval, and pay the first year’s S$194.40 annual fee (inclusive of 8% GST).

Alternatively, cardholders can choose to receive a first year fee waiver and enjoy 8,000 bonus Citi Miles with S$800 spent within two months of card approval.

Both offers are valid for applications received by 30 June 2023, and are for new-to-bank customers only. These are defined as individuals who do not currently hold a principal Citi credit card, and have not cancelled one in the past 12 months.

Conclusion

Citi PremierMiles Cardholders can look forward to bonus miles, flash deals and a lucky draw as they set out on their travels over the next few months.

Here’s the checklist once more:

- Register your Citi PremierMiles Card via SMS for the 4 Citi Miles per S$1 on in-person overseas spending offer (valid till 30 June 2023)

- Register yourself for the Citi Great Giveaways contest via the Citi Mobile App (valid till 31 May 2023)

- Mark 12p.m on 15 April, 1 May, 15 May and 1 June in your calendar to jump onto the Citi Mobile App and grab your promo codes

And if you don’t have a Citi PremierMiles Card yet, be sure to take advantage of the sign-up offer with up to 30,000 bonus Citi Miles, available with a minimum spend of just S$800.

Does this applied if we apply via singsaver and moneysmart?

The 30k bonus is only available for direct applications via Citibank. Singsaver and money smart have their own gifts

Are there any bonus miles if we apply via Singsaver? besides the gifts. That requires only $500 spend, so thinking if we should spend using this card or others after $500

singsaver offer cannot be stacked with this offer

Any issues using the citi premiermiles card through amaze (for overseas in-store spend)? are the bonus miles still awarded? thanks

Not FCY if goes through Amaze right

5000! Crazy.

pssst: https://milelion.com/2023/02/23/surprise-citi-payall-no-fee-option-qualifies-for-prestige-limo-rides-and-sign-up-bonuses/

@Aaron – could you pleaseee ask Citi for a way to register for the 4mpd promotion if overseas and can not send the sms to this phone number? Is there any international number you could text instead? thank you in advance