A lot of strange things are going on with Standard Chartered’s 360° Rewards Programme at the moment.

First, the bank launched its new rewards portal, an almighty mess which removed the ability to pool points between Visa Infinite and non-Visa Infinite cards.

Then, the bank launched its new mobile app, a complete dumpster fire which removed a whole load of functionality including the ability to view or transfer points. This led some to (mistakenly) conclude that Standard Chartered had eliminated all its non-KrisFlyer transfer partners.

But the bad news keeps coming, as Standard Chartered has increased its minimum conversion blocks for KrisFlyer transfers from 1,000 miles to 10,000 miles.

Standard Chartered increases minimum conversion blocks

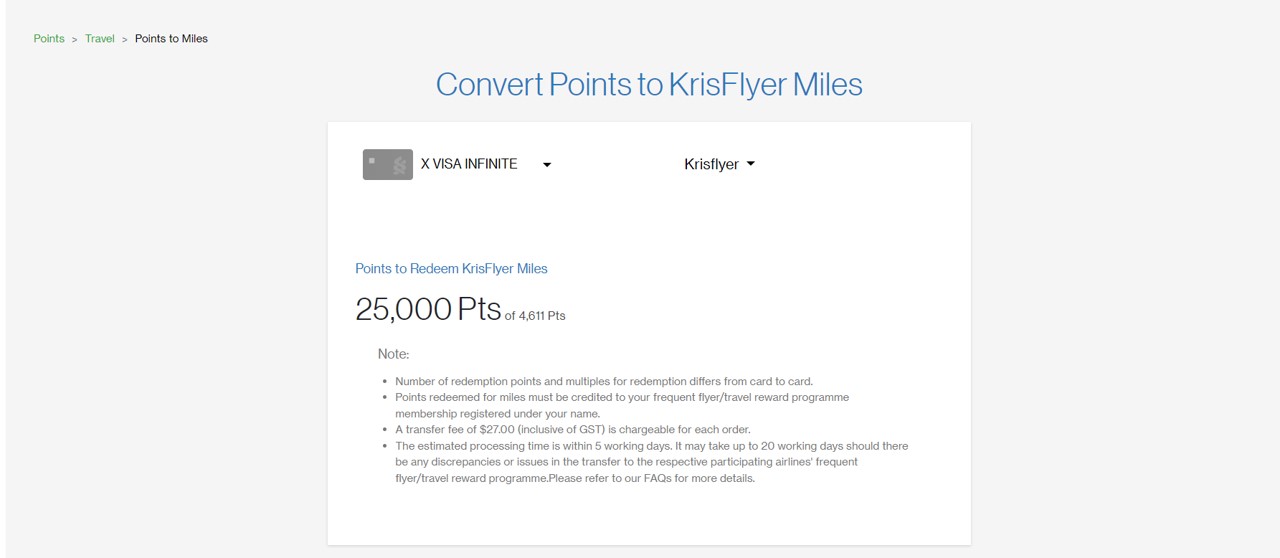

Effectively immediately, Standard Chartered’s minimum conversion blocks for KrisFlyer miles have increased as follows:

| ✈️ KrisFlyer Miles Conversions |

||

| Card | Old Block | New Block |

Visa Infinite Cards Visa Infinite Cards |

2,500 points = 1,000 miles | 25,000 points = 10,000 miles |

Non-Visa Infinite Cards Non-Visa Infinite Cards |

3,500 points = 1,015 miles | 34,500 points = 10,000 miles |

For Visa Infinite cards like the StanChart X Card and StanChart Visa Infinite, the minimum conversion block has increased from 1,000 miles to 10,000 miles.

For non-Visa Infinite cards like the StanChart Smart Card and StanChart Rewards+ Card, the minimum conversion block has increased from 1,015 miles to 10,000 miles.

In case you’re new here, yes, Standard Chartered has a very confusing rewards system that applies different conversion rates for Visa Infinite and non-Visa Infinite cards. Why they do this is a puzzlement; it’s fine if you want to reward Visa Infinite cardholders more, but couldn’t you have built that into the earn rate?

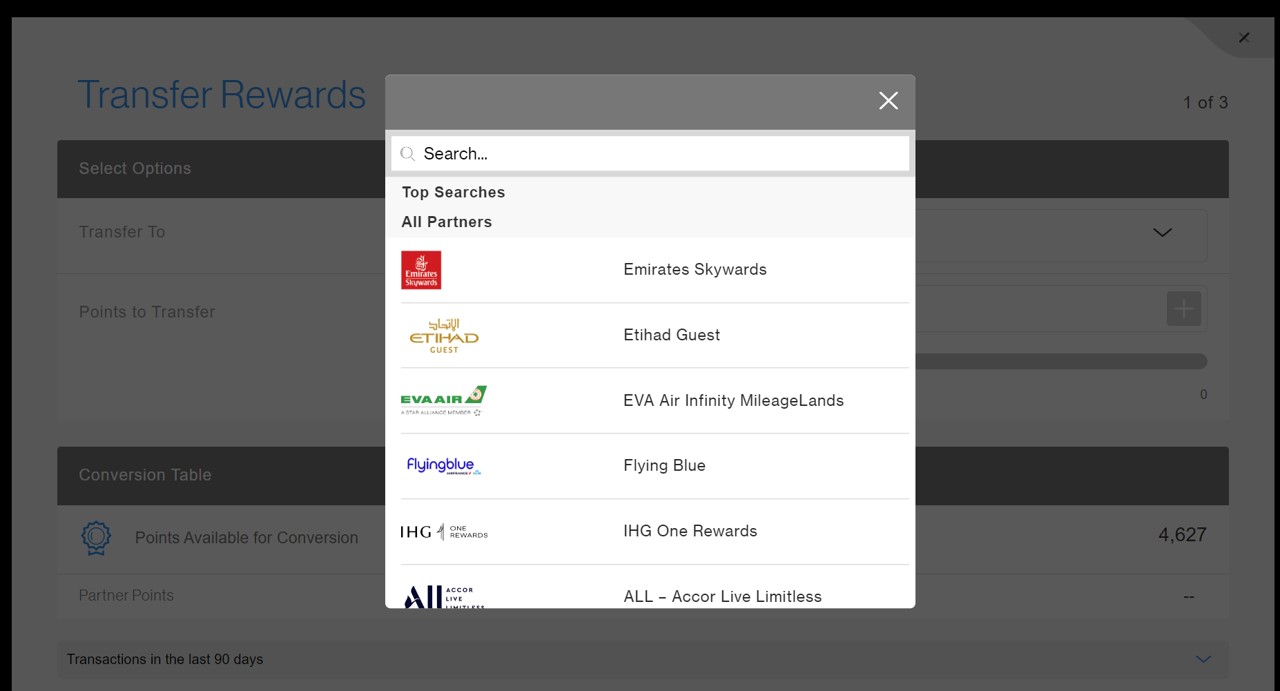

If it’s any consolation, the minimum blocks for Standard Chartered’s nine other transfers partners remain the same.

| Frequent Flyer Programme | Conversion Blocks (360° Rewards Points: Partner) |

| 2,500: 1,000 |

|

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 3,000: 1,000 | |

| 3,500: 1,000 | |

| 3,500: 1,000 | |

|

3,500: 1,000 |

| 5,000: 1,000 |

Now, I’ve received countless messages from people who believe that:

- Standard Chartered has removed all transfer partners except KrisFlyer, or

- Standard Chartered has removed KrisFlyer transfers

The confusion is understandable. Standard Chartered’s UX is plain awful, with the bank seemingly determined to make things as unintuitive as possible.

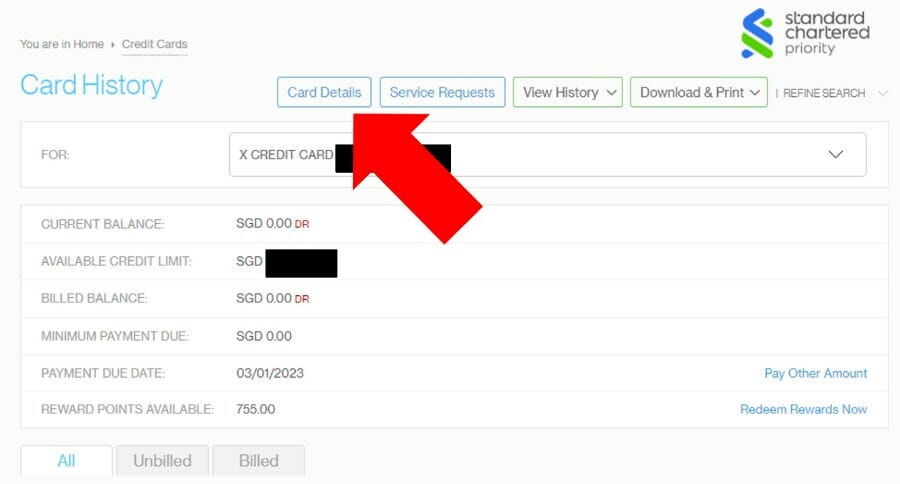

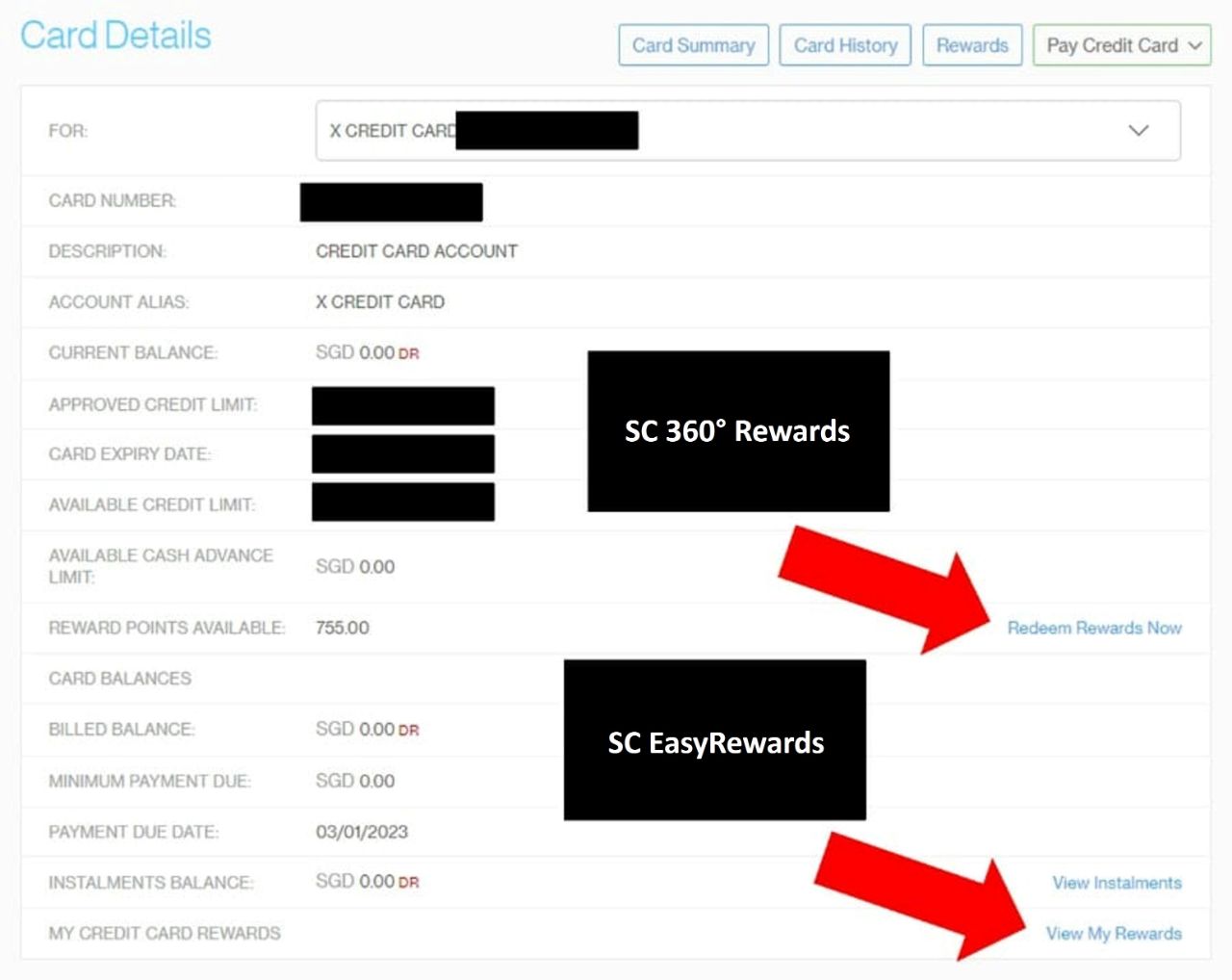

The reality is that both KrisFlyer and non-KrisFlyer transfer options remain. Login to Standard Chartered internet banking on your desktop and navigate to your credit card account. Click on “card details”.

You’ll then see two options:

- Redeem Rewards Now

- View My Rewards

Redeem Rewards Now sends you to SC 360° Rewards, which features KrisFlyer transfers.

View My Rewards sends you to SC EasyRewards, where you can redeem points for Standard Chartered’s nine other rewards partners.

Conclusion

Standard Chartered has increased the minimum transfer block for KrisFlyer to 10,000 miles, a 10X increase from the previous 1,000 miles. This means that StanChart points transfers are no longer a good option for making a small top-up to your KrisFlyer account, although there’s still other ways like Kris+ or Linkpoints.

Frankly, the increase in minimum block doesn’t bother me so much as their utterly confusing and unintuitive UX, not to mention new-and-deproved (if Standard Chartered is fine with committing crimes against UX, I’m fine with committing crimes against English) app.

It’s no wonder people go away thinking this…

(HT: PTT)

Hi Aaron, do you still personally use SC cards to earn miles then?

nope. retaining the X card out of some morbid fascination of “what comes next”

I’ve not used SCB cards to earn miles for years. But the ‘refreshed/updated’ SCB mobile app truly sucks.

Frankly don’t understand what the fuss about 10k miles is all about – the larger the number, the better because they’ve standardised the fee at $25/transfer. Also, SC pays out 3mpd for foreign spends. without caps. Sure there are cards out there which can give you more than 3mpd, but based on directed vendor spends or quantity caps of sorts. I have reasonable volume of FX spends every year, and after reviewing numerous cards, the SC Infinite comes out still way better – been able to generate typically about 200k-300k KF miles per year – since 10+ years now –… Read more »

Most people are using the Standard Chartered Smart Card here (which offers around 5.5mpd on Bus/MRT and Fast food/Ya Kun coffee etc). These are low spends that make it very hard to hit 10k miles as a block, more so given that you have to cash in all points at the same time (they all expire at the same time unless you’re using infinite card or sth). That’s where the frustration comes from I think but to be fully objective about it, it was always marketed by StanChart as a 6% rebates by points card so using it for miles… Read more »

Yes totally agree with this comment! 6% cashback is as good as you can get for these niche categories anyway so not all is lost in that aspect I guess..

Good value to exchange to accor points?