AMEX Platinum Charge cardholders will be well-versed with “The S$1,712 Question”, which shoots to the top of the agenda every 12 months.

Simply put: do you commit to another year with what’s probably the most expensive card you’ll ever own, or call it quits and return to a world where annual fee waivers are just a phone call away?

It’s no small decision, and it’ll only get bigger once the impending GST hike takes it to S$1,728 in 2023 and S$1,744 in 2024. And since no one gets the AMEX Platinum Charge for its miles-earning potential (unless perhaps you’re a big spender at 10Xcelerator merchants), the only way the math works is if you can fully utilise all the benefits it has to offer. That was tough in 2020 and 2021 with lockdowns and border closures, but 2022 has thankfully been much better in that regard.

Since my renewal decision is not my own — The MileLioness and I have a rule that we consult each other on any purchase greater than S$500 — I do a little exercise each year to estimate how much I got out of the card.

AMEX Platinum Charge 2021/22 Summary

Below is a summary of how much value I got out of my AMEX Platinum Charge for the 2021/22 membership year (which in my case runs from October to September).

AMEX Platinum Charge: 2021/22 Analysis AMEX Platinum Charge: 2021/22 Analysis |

|

| Perk | Value |

| Hotel & Airline Travel Credit | S$800 |

| 1-Night Hotel Stay | S$650 |

| Love Dining & Chillax | S$550 |

| Lounge Access | S$300 |

| Dining Vouchers | S$280 |

| Hilton Gold Benefits | S$250 |

| Retention Offer (20K points) | S$188 |

| 2-nights Frasers Hospitality voucher | S$180 |

| Wine Vouchers | S$140 |

| Total | S$3,338 |

Three points to note.

First, the above calculations are from the perspective of an existing AMEX Platinum Charge cardholder.

If you’re reading this as someone who doesn’t hold the card yet, your first year will be richer because of the value of the sign-up bonus. American Express is currently running the following offer:

|

||

| Apply Here |

||

| New | Existing | |

| Pay S$1,712 Annual Fee | 80K | 65K |

| MileLion Bonus | 20K | N/A |

| Spend S$3,000 (Months 1-3) |

N/A | 5K |

| Spend S$20,000 (Months 1-6) |

75K | 75K |

| Base Points from S$20,000 (@ 2 pts/S$1.60) |

25K | 25K |

| Total Spend | S$20K | S$20K |

| Total Points | 200K | 170K |

| ❓ Definitions | ||

|

New cardholders: New cardholders are defined as those who do not currently hold a principal American Express credit card (excluding the AMEX HighFlyer Card and AMEX cards issued by DBS/UOB), and have not cancelled an AMEX Platinum Charge in the past 24 months. Existing cardholders: Existing cardholders are defined as those who currently hold a principal American Express credit card and have not cancelled an AMEX Platinum Charge in the past 24 months. |

||

Ignoring the base points, you’re looking at 175,000/145,000 MR points for new/existing customers, or 109,375/90,625 miles. That’s worth a further S$1,640 or S$1,360, based on a value of 1.5 cents per mile.

Second, the above calculations include benefits from the AMEX Platinum Reserve and maxing out the AMEX Platinum Charge supplementary card allowance (first 2 free).

Really, there’s no reason why you shouldn’t do this. The AMEX Platinum Reserve (free for AMEX Platinum Charge members) comes with additional perks like a 2-night stay at selected Frasers properties and a S$100 Tower Club voucher, and AMEX Platinum Charge supplementary cards enjoy benefits like lounge access, hotel elite status and Love Dining.

Third, valuation is inherently subjective, and will be based on your individual preferences and lifestyle. For example, a teetotaller wouldn’t find much value in Chillax or the wine vouchers, and someone who always flies First or Business Class may not need a lounge pass.

In other words, the last thing you should be doing is taking my figures wholesale. Make adjustments as needed!

Hotel & Airline Travel Credit: S$800

AMEX Platinum Charge cardholders receive an annual S$400 hotel credit, which is fairly easy to use especially since American Express now allows stacking with Fine Hotels & Resorts and The Hotel Collection rates.

I used my 2021/22 credit at the Best Western Plus Santa Barbara, during my trip to the USA with my dad in March. “Best Western” doesn’t scream aspirational, but this was a charming little place that offered a sprawling two-bedroom suite at a reasonable price- I only topped up S$40 or so after the credit.

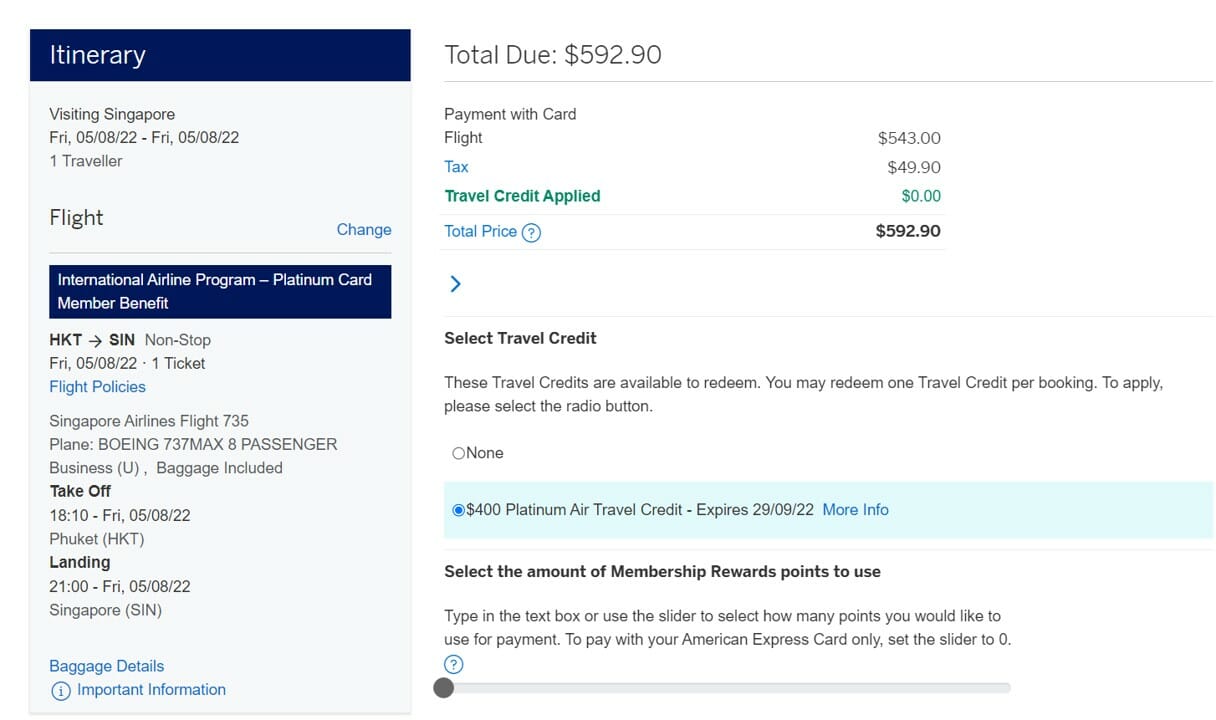

I’ve historically had more issues using the annual S$400 airline credit, especially with COVID wreaking havoc with overseas travel. While American Express did introduce on-ground alternatives, they were very poor value (unless perhaps you wanted to buy the latest iPhone).

It’s for that reason I took a 50% haircut on the value last year, though ironically I ended up getting the full S$400. The speculative flight I booked was cancelled, and the AMEX concierge refund me the full amount instead of reinstating the air credit!

This year, I’ve been able to properly utilise the air credit during my recent trip to Phuket. I booked a one-way Business Class fare which cost S$193 after applying the credit. This booking was made through the International Airline Programme (IAP), which saved me about 8% off the cost on Singapore Airlines’ official website.

1-Night Hotel Stay: S$650

AMEX Platinum Charge members receive a voucher for a complimentary hotel night each year, currently valid for stays at 24 different properties worldwide (seven are in China, however, and practically unavailable).

|

|

I redeemed my voucher this year at the Banyan Tree Lang Co, as part of a trip to Da Nang.

While I can’t say I’m a fan of the Banyan Tree brand in general (it’s a little too rustic for my tastes), Banyan Tree Lang Co was a solid enough experience, helped by excellent service and a daily champagne breakfast. It’s just a pity there isn’t a lot to do or see in Lang Co, and I don’t think I’d go back.

Based on the revenue rates for a breakfast-included rate, I saved roughly S$650.

Love Dining & Chillax: S$550

It’s debatable whether you should include the value of Love Dining benefits, since it’s possible to enjoy them for free if you’re eligible for a first-year fee waiver on the AMEX Platinum Credit Card. I’m not, so I’m going to include this nonetheless.

2022 has seen numerous departures from the Love Dining programme. On the hotels side, we lost The Fullerton Hotel, Fullerton Bay Hotel and Conrad Centennial. On the restaurant side, Hutong, Indocafe, RENNthai, Fremantle Seafood Market, FYR, Paulaner Brauhaus, Praelum Wine Bistro, and Le Fusion are gone.

While I can’t say all were of equal quality, the fact remains they’ve not been replaced. This means that the current Love Dining list is leaner than it’s ever been in recent years.

| Love Dining Hotels | Love Dining Restaurants* | |

| February 2018 | 8 | 24 |

| August 2019 | 6 | 22 |

| September 2020 | 8 | 21 |

| October 2021 | 10 | 26 |

| October 2022 | 7 | 19 |

| *Different branches of the same restaurant are counted as one | ||

True, there are some solid restaurants still on the list (SKIRT is a personal favourite of mine), but I’d really like to see a rejuvenation of Love Dining, and soon.

Based on my statements, I’ve saved about S$550 through dining discounts and complimentary drinks over the past 12 months.

Lounge access: S$300

While I try and redeem Business Class tickets as much as possible, there’s always some trips where that’s not possible or simply doesn’t make sense (e.g. Kuala Lumpur to Singapore).

In those cases, I rely on my AMEX Platinum Charge for lounge access. Cardholders can visit the following lounges

- Centurion Lounges (+2 guests)

- Delta SkyClubs

- International American Express Lounges (+2 guests)

- Priority Pass (+1 guest)

- Plaza Premium Lounges (+1 guest)

I didn’t assign a value to lounge access in last year’s review, because it was published just as the borders reopened under the VTLs, and I only had the opportunity to visit one lounge the whole membership year.

The past 12 months have been much busier, as I began exploring the world once again.

In that time, I’ve used the AMEX lounge benefits at:

- Centurion Lounge San Francisco (and left after five minutes since I couldn’t find a place to sit)

- CIP Orchid Lounge Da Nang

- Coral Executive Lounge Phuket

- LuxxLounge Frankfurt

- Oman Air Lounge Bangkok

- Plaza Premium Lounge Kuala Lumpur

- Saphire Plaza Premium Lounge Jakarta

My personal favourite is the Oman Air Lounge in Bangkok. It’s one of the few Priority Pass lounges to offer champagne, and usually quiet because few people know it participates in the programme. But really, any time you can visit a lounge instead of hanging out in the terminal is a good thing, especially if you have a ton of work to clear.

By my estimates, my supplementary cardholders and I have made ~20 lounge visits over the past year, and I’m going to give each visit a value of S$15 (the retail cost of admission is higher, but I’m taking a haircut since I probably wouldn’t have been willing to pay that) for a total of S$300.

Dining vouchers: S$280

Unfortunately, dining vouchers are one aspect of the AMEX Platinum Charge that has been steadily devalued over the years.

- Cardholders originally received 4x S$50 St. Regis dining vouchers, with no minimum spend. This was even stackable with Love Dining!

- This was replaced by 2x S$50 Jaan and 2x S$50 Violet Oon vouchers, with a minimum of two diners and a cap of one voucher per visit

- Now we have 2x S$50 Jaan and 2x S$50 Basque Kitchen, with a minimum of two diners and a cap of one voucher per visit

It’s disappointing, to say the least. The Jaan vouchers are practically useless to me, since S$50 won’t even begin to put a dent in the cost of a meal for two. Ditto Basque Kitchen, and I’m not assigning any value to either.

If it’s any consolation, the 2x S$100 Tower Club vouchers (one from Platinum Charge, one from Platinum Reserve) are still intact, and come with no such conditions. My advice is to book dim sum at Ba Xian (Saturdays only), or oyster night at Straits Bar (Wednesdays and Fridays from 5 p.m). Non-members need to pay a 10% surcharge, so I’ve adjusted the value accordingly to S$180.

The AMEX Platinum Charge and AMEX Platinum Reserve each have a S$50 dining voucher for Marriott Tang Plaza, valid with a minimum spend of S$100.

This cannot be stacked with Love Dining, but can be useful for solo diners or groups of three (since S$50 off S$100 is better than the 15%/35% you’d save in those scenarios). I used this for a couple of meals at Wan Hao and thought it was very decent indeed, so I’m adding it to the valuation.

This brings me to a total value of S$280.

Hilton Gold status: S$250

AMEX Platinum Charge members receive complimentary status with several programmes including Marriott Bonvoy and Radisson Rewards, but the truly useful one is Hilton Gold.

Why? Because it comes with free breakfast. That can easily save S$100 or more per couple per day at high cost locations. Over the past year, I’ve stayed at numerous Hilton properties including Hilton Munich City, Conrad Bali, Hilton Singapore Orchard, Hilton Da Nang and the Conrad Koh Samui. Breakfast at Conrad Koh Samui alone would have cost 2,800 THB++ (S$128) per couple, so that’s already S$640 of savings for a five night stay right there!

I won’t assign any value to this for myself because I’m already a Hilton Diamond member, so the Gold status from AMEX doesn’t represent any incremental benefit. However, my supplementary cardholders have been enjoying the benefits on their travels, and I’ll give an estimated value of S$250 to the benefits they’ve received so far.

Retention Offer: S$188

If you plan to renew your AMEX Platinum Charge, make it a point to call up and ask about your retention offer (do it after your annual fee has been billed; the CSO won’t be able to assist you before that).

American Express usually offers bonus Membership Rewards (MR) points upon renewal, but they’re not automatically awarded; if you don’t ask, you don’t get. I’ve received 20,000 MR points (12,500 miles) for each year of renewal, based on my annual spend of S$15-25K. At 1.5 cents per mile, this is worth ~S$188.

Bigger spenders have reported receiving up to 40,000 MR points (25,000 miles), so it’s really a YMMV situation.

2-night Fraser Hospitality voucher: S$180

A 2-night Fraser Hospitality voucher is included with the AMEX Platinum Reserve, which AMEX Platinum Charge members can get free of charge. This voucher can be redeemed at more than 40 properties worldwide, and my choice this year was the Moderna by Fraser Bangkok.

I can’t say it has the best location, but it still saved me the points/cash I’d have otherwise shelled out for a hotel. The cost of a two-night stay was S$180.

Wine Vouchers: S$140

AMEX Platinum Charge cardholders receive a total of seven wine vouchers (most of them come from the AMEX Platinum Reserve, so that’s another reason to get the card!), redeemable for seven bottles of wine at the following outlets:

| From | Voucher | Conditions |

AMEX Plat. Charge AMEX Plat. Charge |

2x vouchers for wine (or cake) at Fairmont Hotel & Swissotel The Stamford | At least 1 dine-in item, max 2 vouchers per visit |

AMEX Plat. Reserve AMEX Plat. Reserve |

2x vouchers for wine (or cake) at Fairmont Hotel & Swissotel The Stamford | At least 1 dine-in item, max 2 vouchers per visit |

| 2x vouchers for Grand Cru Wines | N/A | |

| 1x voucher for Napoleon | N/A |

The Grand Cru Wines and Napoleon vouchers are absolute no-brainers. No minimum spend is required; just show up and collect your bottles. Don’t feel bad, you’re not the first to do this.

The Fairmont Hotel & Swissotel The Stamford vouchers require a minimum order of one dine-in item. Most people simply have a coffee or dessert and redeem two wine vouchers each time. The wine need not be drank at the restaurant; you can take it in sealed bottles to go.

How good are the wines? Don’t expect any Robert Parker 90 points stuff. These are best described as “table wines”, and I may or may not have used them for cooking.

Depending on available stock, you may receive any of the following:

- La Minga Sauvignon Blanc 2022

- Mâcon Uchizy 2015

- Triennes Merlot 2014

- L’Autantique Sauvignon 2020

- Karku Nocturno Sauvignon Blanc 2020

- Karku Nocturno Merlot 2020

- Famille Perrin Ventoux 2019

I’m going to give a S$20 value to each bottle, for a total of S$140.

Other perks

I’ve not given a value to any of the perks below, but thought I’d mention them for completeness’ sake.

AMEX Fine Hotels & Resorts

AMEX Platinum Charge members can book Fine Hotels & Resorts (FHR) rates, which include perks like room upgrades, daily breakfast, a US$100 hotel credit and guaranteed late check-out. These price the same as the hotel’s best flexible rate, and you’ll still earn hotel points and elite status credits where applicable.

Over the past year, I’ve booked two FHR stays:

On both occasions I got multi-category upgrades (Ocean Deluxe Pool Villa at Six Senses Yao Noi, Deluxe Suite at Waldorf Astoria Bangkok), some very nice breakfasts (Waldorf Astoria’s is one to remember), as well as the opportunity to try restaurants and spa treatments with the hotel credits.

However, I’m not including this in the valuation because you can book similar luxury agent rates through a free platform like HoteLux.

Platinum af’FAIR 2021

After experimenting with a virtual Platinum af’FAIR in 2020, AMEX decided to revert to analogue in 2021. COVID restrictions ruled out large-scale events, so an own-time-own-target picnic was the next best thing.

For 20,000 MR points, members could redeem:

- Exclusively-designed and curated picnic set for two, including four appetisers, two mains and a dessert platter

- Bottle of 2015 La Fleur de Bourd, two bottles of craft beer, two bottles of cold-pressed juice, two bottles of cold-brew coffee & tea, Evian water

- Limited-edition Platinum mementos

- Livestream concert by an international artiste and exclusive access to mobile games with exciting prizes to be won

Food was catered by Masons and Hopscotch, and sure-win game prizes included Challenger, Takashimaya and GrabFood vouchers.

I’m really hopeful 2022 sees the return of a big blowout- we’re all overdue one!

Spa vouchers

AMEX Platinum Charge members receive the following spa vouchers:

- S$100 credit at Aveda Spa (min. S$180 spend)

- S$100 credit at Spa Rael (min. S$180 spend)

- S$130 credit at The Ultimate Spa (min. S$180 spend)

I might have given these a token value back when the treatments were completely free, but now that they have minimum spends I just ignore them.

Summing it up

2021/22 was a year that really allowed the AMEX Platinum Charge to play to its strengths once again. The lifting of restrictions meant more opportunities to use perks like air credits, lounge access, hotel vouchers and Love Dining, and it’s unsurprising my total value this year comes out higher than before (it’s probably also why we saw fewer surprise and delight moments from AMEX, such as the dining and supermarket credits of previous years).

To be sure, the overall value proposition is weaker than 2019. Dining and spa vouchers have been nerfed, Love Dining has been parred down, and Platinum VIBES/NOOK are no more. But even so, someone who’s frequently on the road and enjoys dining out should more than be able to make it work.

So it’s another year with the AMEX Platinum Charge for me, but once again, don’t take my word for it. Have a long hard think about your plans for the year ahead, and how many benefits you’ll be able to use. Look at your historical patterns: how many vouchers have you actually redeemed, how many benefits did your supplementary cardholders make use of? Also consider whether a $120K card (with annual fees around S$500-600) could work just as well for your needs.

Otherwise, I’ll see you in 12 months’ time, where we’ll tackle The S$1,728 Question.

Curious – why don’t you attribute any value to the Towers Club membership? Does this not function at least as a free gym in central?

You don’t get a gym membership, only a $100 voucher

>Complimentary Access Into Tower Club

This excludes the gym?

This is his valuation according to his use case. In the same way a teetotaller might value chillax at $0, someone who doesn’t go to the gym in central would value the free gym at $0

because i dont gym.

like i said, value is subjective. someone who does would place a value on that.

I just cancelled it yesterday, and I didn’t have to think. To me it’s more like buying a 1.7k package. Without this card I would have spent my money elsewhere that I may enjoy more. I would say most vouchers are worthless. They are more like ads than benefits to me. I wouldn’t go to tower club to spend $400 and use a $100 voucher when I can just go to a better restaurant for the same food for less than $200. In addition to that, carrying and paying with voucher is just stupid and doesn’t go with the “luxurious”… Read more »

Agree it’s just an over-hyped card, especially with vouchers getting worse this year. And even to use those vouchers are a headache dealing with T&C and exclusions.It’s becoming a homework or dreaded chores to use them which I do not need in my life.

I like the “sneaky” rule that “we consult each other on any purchase greater than S$500”.

I can imagine almost everything a woman touches would easily exceed $500 – shoes/bags/makeup/hair-nail-facial-massage packages etc. And since Aaron redeems most of his flights with miles and shares hotel stays with his wife, it’s obviously a win-lose situation.

Good one, Aaron! Too bad I can’t apply it to my wife.

Shhhh. She reads the comments.

Nothing to see here, move on

Interesting to see your take on the SG Platinum card. It really has turned into a bit of a coupon book hasn’t it… Especially those almost useless coupons with minimum spend. I can feel your frustration, especially with Jaan. I have the Aus version, they just enhanced it with $400 dining credits ($200 in Aus, $200 overseas) – that plus the $850 travel credit and the free Accor Plus with one night stay easily covers my $1200 AF at first glance. I would say you are being generous on the Plat 1 night and Plat Res 2 night stays by… Read more »

regarding valuation of rooms- i agree that you should normally take a haircut if you wouldn’t have spent that money anyway, but in the case of banyan tree i already had purchased a 2 night voucher elsewhere and wanted to add a third night, so this saved me from having to pay the quoted rate. re: bangkok, I’d probably spend more than that amount if I went to book my own hotel.

the coupon book comparison isn’t entirely without merit though.

He needs to keep this card for any future referral from the new readers.

This is a common ad hominem that gets brought up every time the year in review is published, so thanks for the opportunity to address it again!

I have an affiliate agreement with American express, as I do with numerous other banks. This means I could earn referrals from new members whether or not I hold the card. It has no bearing on the matter.

I’ve found that all the airfares are often more expensive through the Amex portal. I ended up booking Bangkok air to Samui just to use the voucher but the flights were $80pp more than on the Bangkok website for the exact same flight, so for the 2 of us I only really saved $240. I’ve emailed Amex to see what reason they will give…

Not sure about Bangkok air, but when I book via portal I look at IAP rates which come out around 5% cheaper or more for Sia at least

Could you do a case for those to switch from Amex reserve to Amex plat charge?

If you got the plat reserve free as part of your plat charge membership, do annual fees kick in the moment you cancel your charge card?

If no, would it make sense to only subscribe for the reserve card just 1-2 months before you cancel your charge card?

If you pay a 10% surcharge at Tower Club (for non-members) – the value of a 200$ voucher is 181.82$, not 180$. Small detail 😉

round numbers easier to deal with!

Hi, I am interested in the card.

but have some questions:

1. Does the first 2 sub card members enjoy the three hotel loyalty programme benefits: Marriott, Radisson Blu and Hilton Gold?

2. Does the first 2 sub card members enjoy complementary lounge access to centurion lounge, delta, Amex and plaza premium lounge? Noted that only principal and 1st sub card enjoy priority pass + 1 guest.

Yes to both.

Any feedback in what are the typical MR points given to cardholders who renew ?